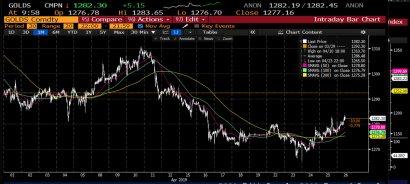

China gold market update: November demand feels the VAT reform

The recent VAT reform weighed on China’s gold jewellery demand in November, denting gold withdrawals from the Shanghai Gold Exchange despite robust investment buying. Gold ETFs in China continued to attract notable inflows in the month and the PBoC reported gold purchases 13 months in a row.