- Chinese gold prices rose modestly in July

- Au(T+D)’s trading volume in July extended its June surge

- The local gold premium saw a much lower volatility

- Imports registered another decline, dropping to 55t in July, the lowest since 2017

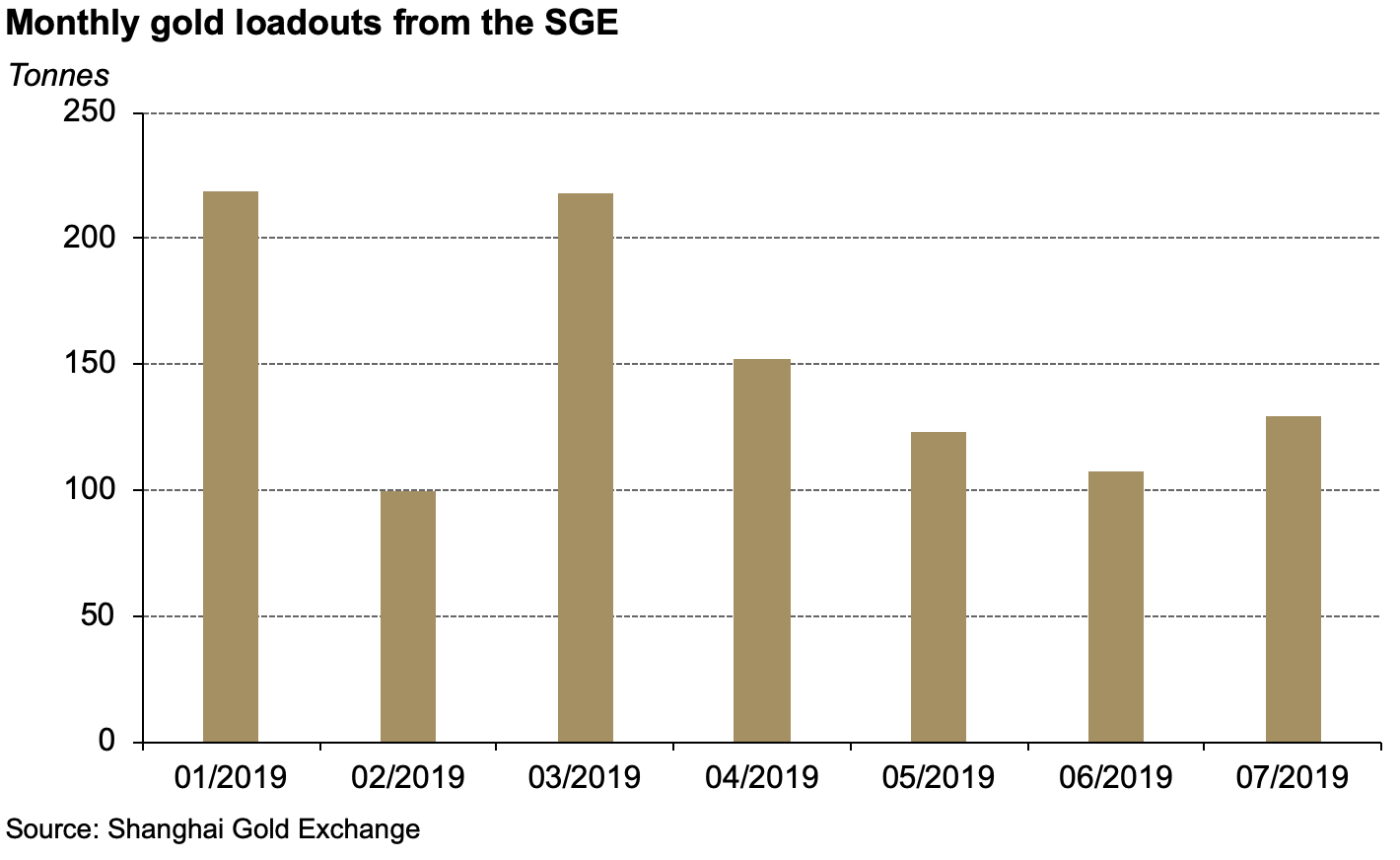

- Gold withdrawals from Shanghai Gold Exchange (SGE) experienced the first rise in four months

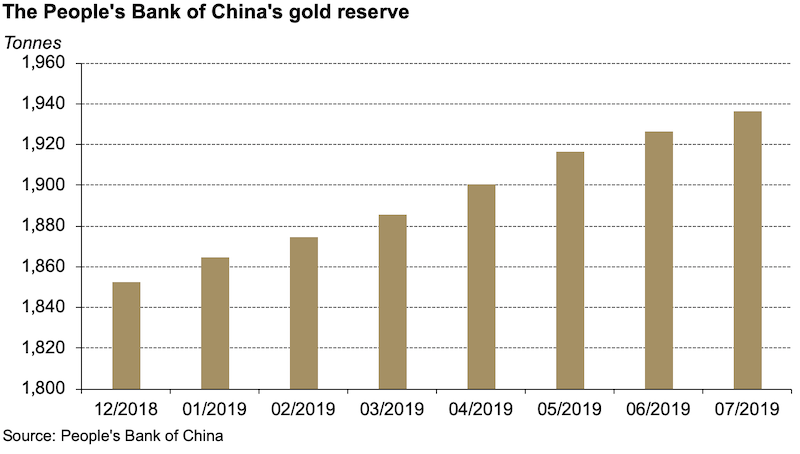

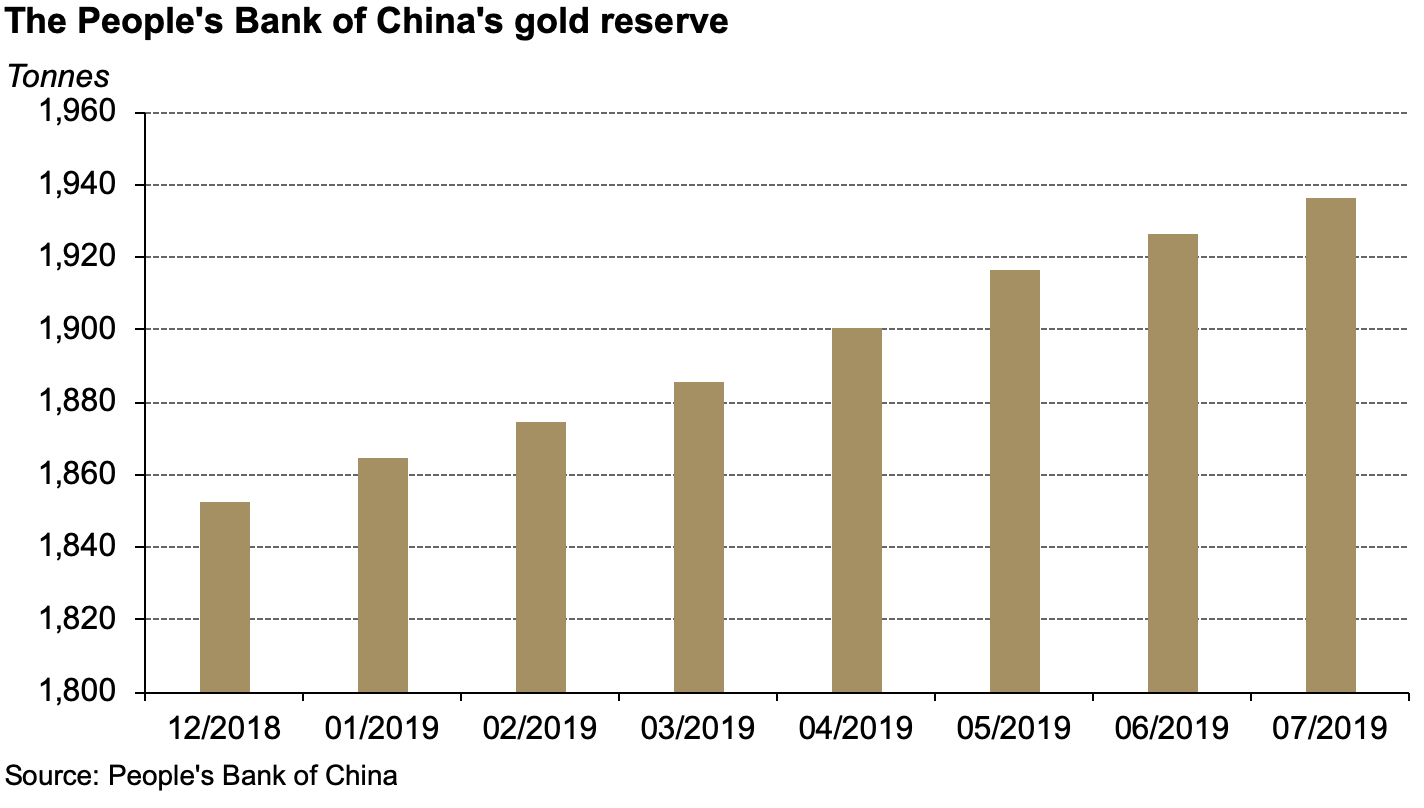

- The People’s Bank of China (PBoC) added another 10t to its gold reserves

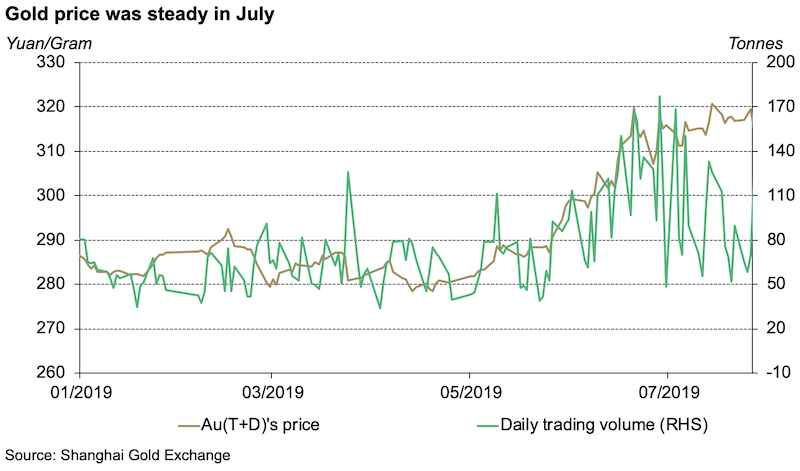

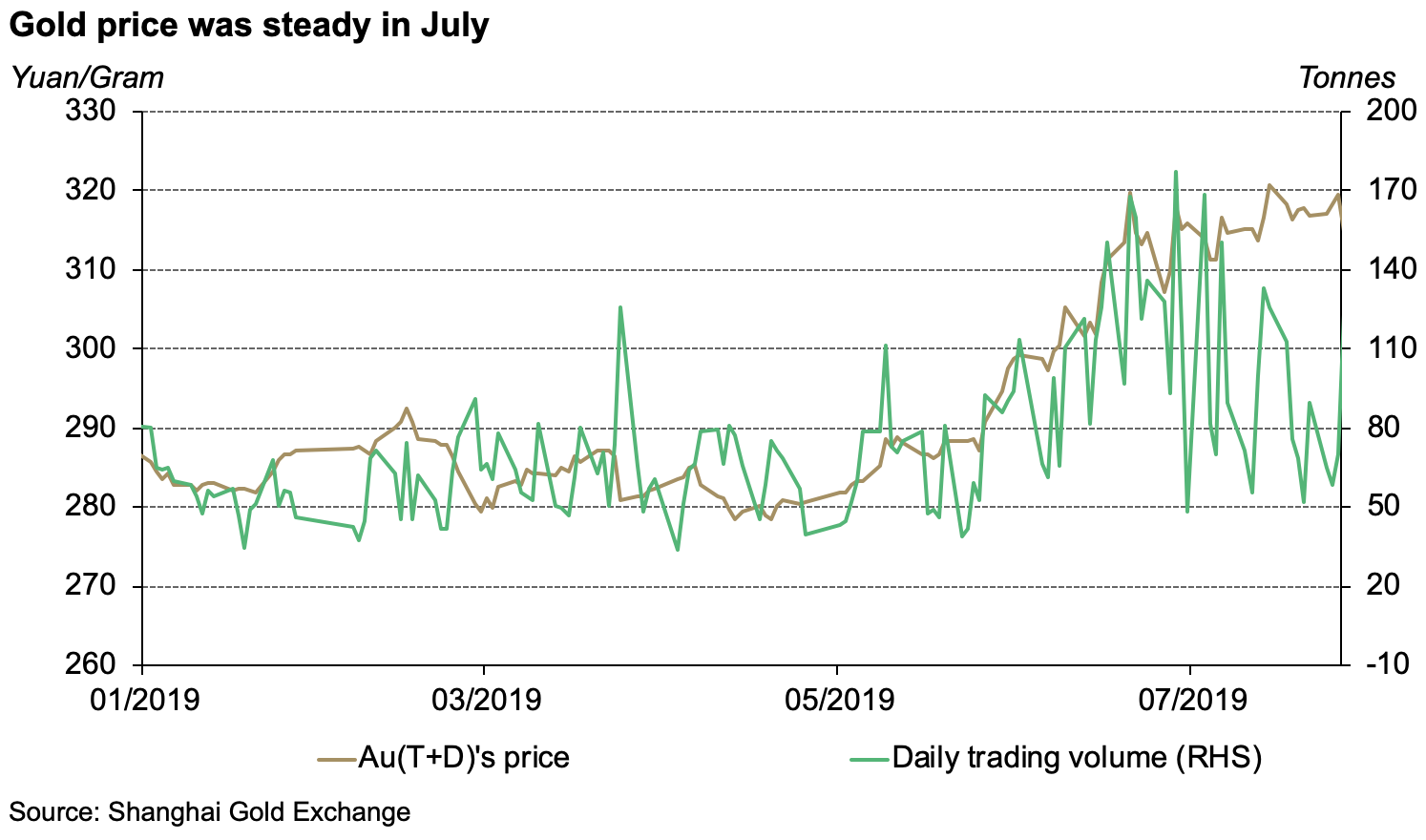

The Chinese gold price gradually rose in July. The price of the Au(T+D) contract gained 1.5% during the month, while the Shanghai Gold Benchmark price (PM) rose 1.3% – hitting a record high on 19th July. While geopolitical concerns and easing monetary policies expectations remained supportive, a stronger US dollar in July exerted pressure.

China’s economic performance in July continued to remain weak: growth in key indicators such as retail sales and fixed asset investment decelerated further. And inflation again rose above expectation – the fourth time this year. Investor worries over the slowing Chinese economy continued to support local gold price in July.

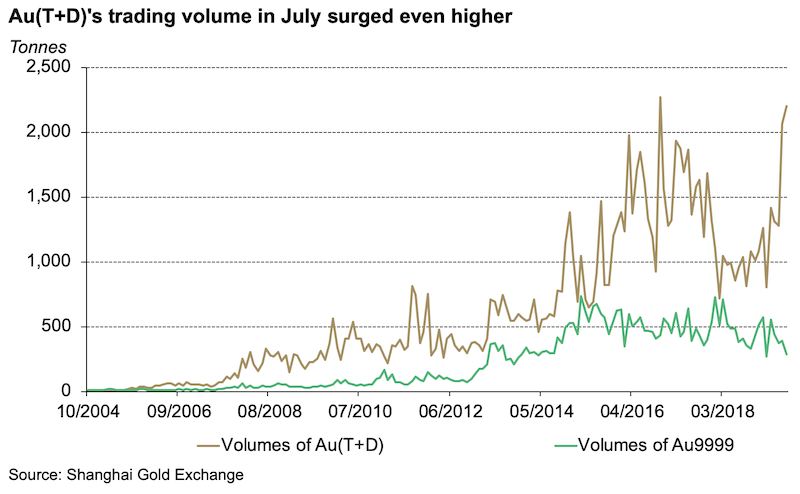

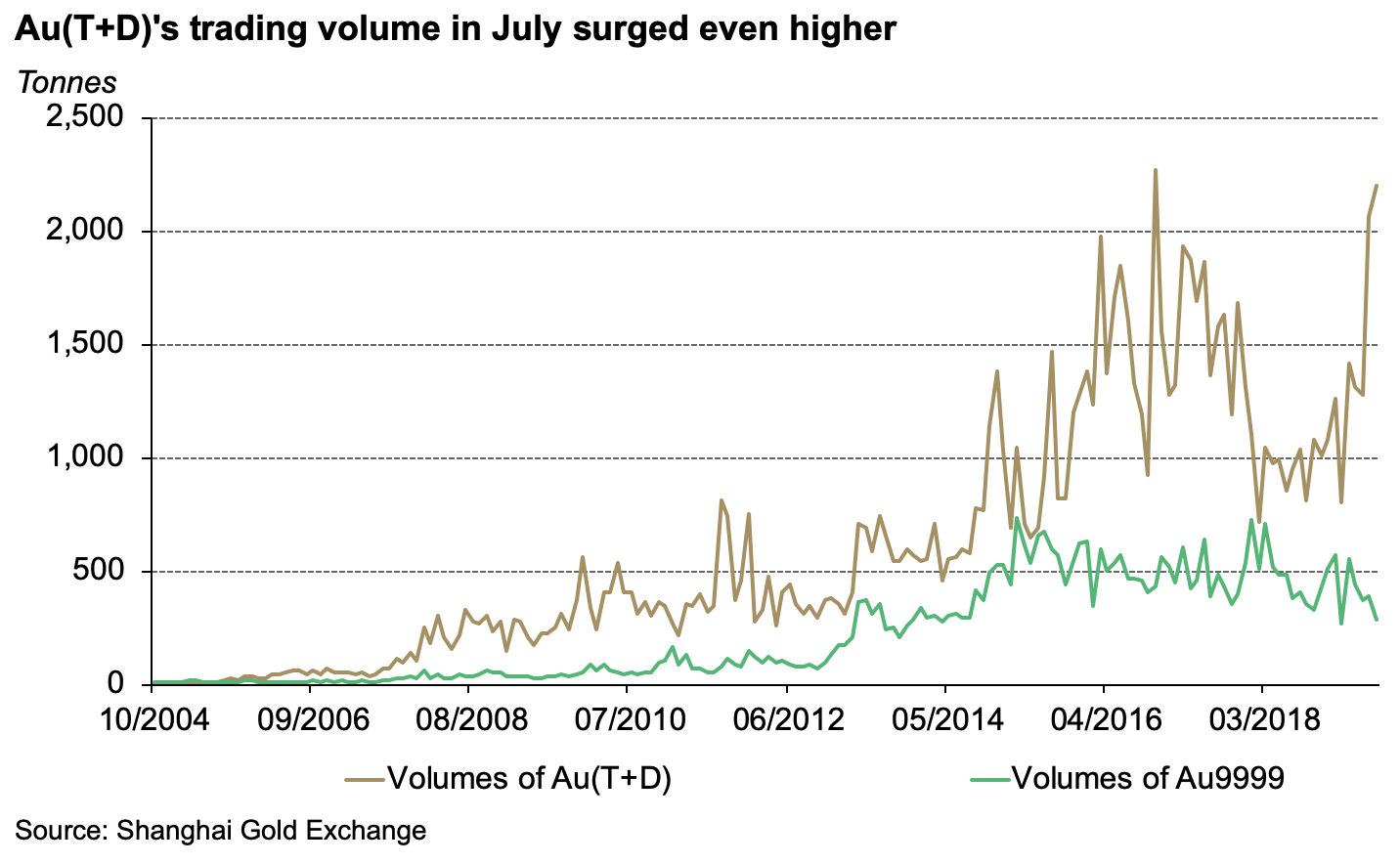

July saw an even higher trading volumes of Au(T+D). After reaching the 2nd highest level in history in June, Au(T+D)’s trading volume in July rose 139t to 2,201t - only 66t shy of the record high. Speculators’ enthusiasm towards gold remained red hot in July, but physical demand weakened further – Au9999’s trading volume in July dropped 101t m-o-m1.

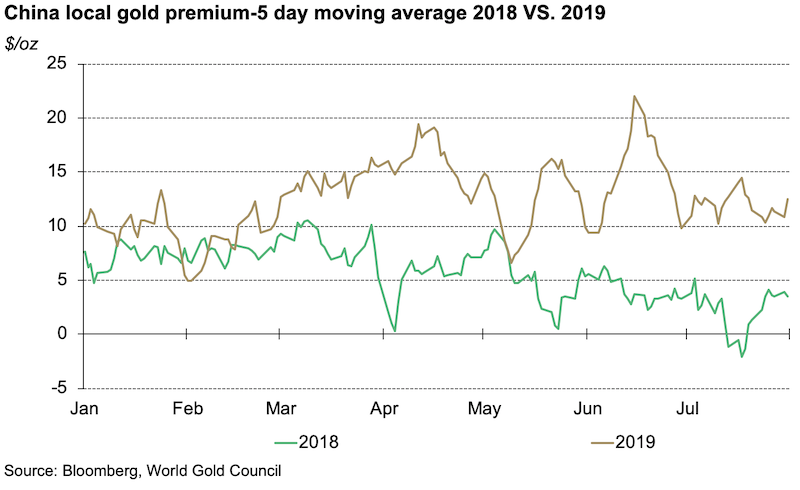

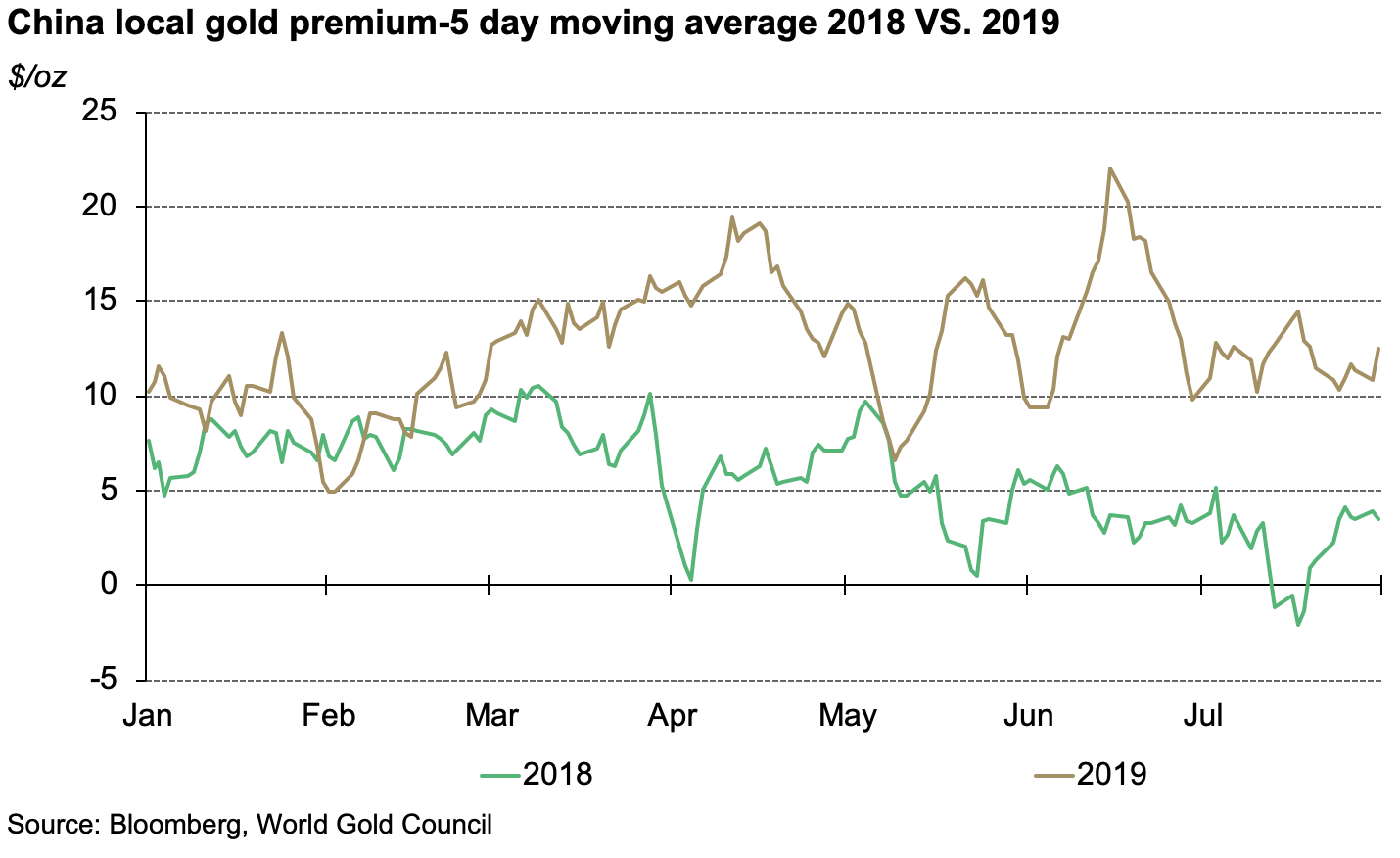

In July, the average local gold premium in China slipped to US$11.54/oz, 24% lower m-o-m. As the local gold price rally ended, and the CNY remained stable during the month, the local gold premium fell. Another reason could be the weaker physical demand for seasonal reasons and retailers’ hesitation to replenish inventories due to the quick hike in the gold price. But the high season is expected to come in September and October.

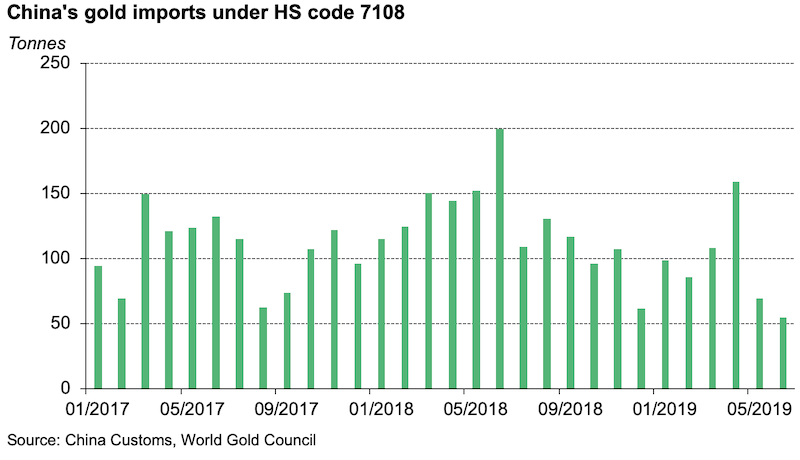

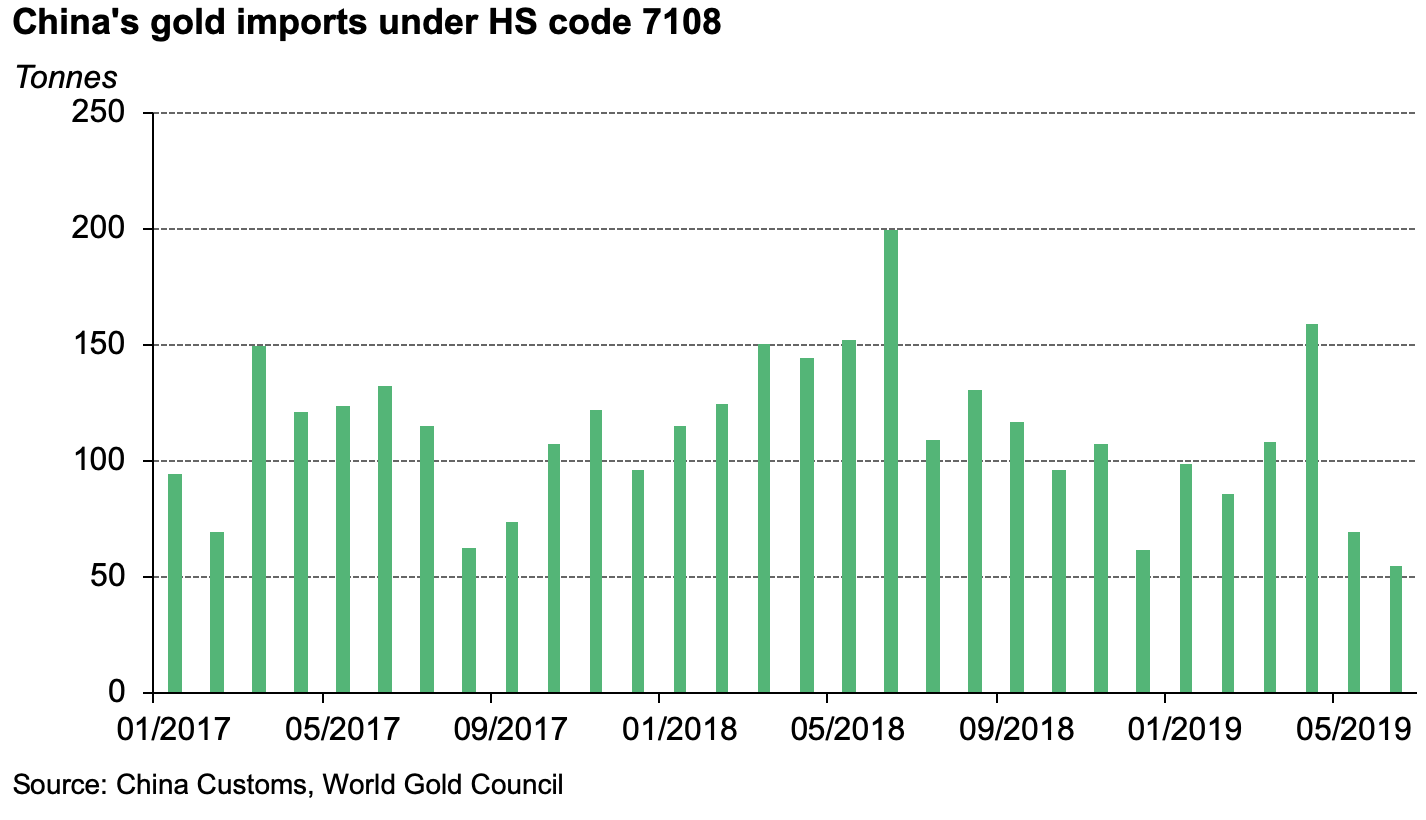

However, the premium was generally much higher than last year as shown below. Much lower gold imports in 2019 could be the key reason pushing this year’s local premium up: 575t in 2019 Vs. 884t in 2018 during the first half.

China’s gold imports under the HS code 7108 registered a further drop in June2. A total of 55t of gold was imported in June, declining 14t m-o-m. Gold imports kept decreasing since early 2019 as the authority might have controlled gold import quotas in the face of uncertainties the economy and the trade dispute brought.

Gold withdrawals from the SGE saw a 22t rise in July after 3 consecutive declines. The combination of falling gold imports and declining withdrawals from the SGE led to tighter supply conditions in Q2, pushing July’s loadouts up as a result3. However, this does not necessarily indicate a recovery in physical demand.

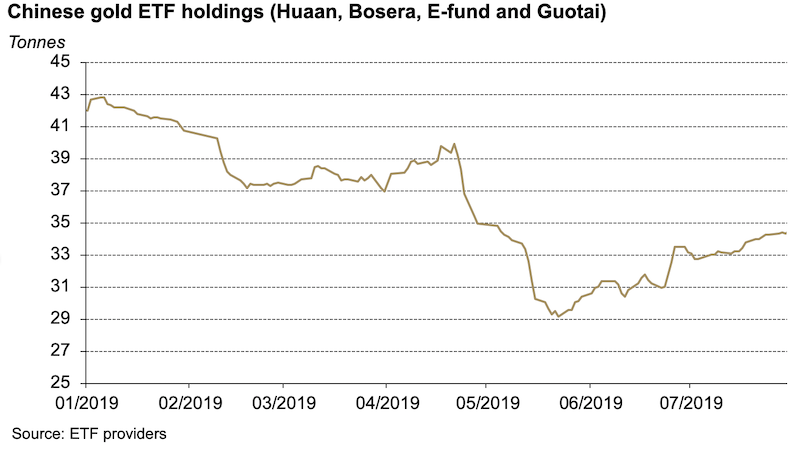

Chinese gold ETFs holdings, on the other hand, have been on the rise since mid-May. The four major gold ETFs in China totalled 34.3t at the end of July, 1t higher m-o-m. While the price surge in June continues to draw investors in, innovations also played a supportive role.

Investors are now able to convert their gold ETF shares from Huaan, Bosera and E-fund – representing 96% of the total gold ETF holdings in China – into physical gold bars, coins and jewelleries. This is possible via Ant Wealth – Alipay’s wealth management platform which boasts over 60 million fund investors in 2018. This might be one of the factors boosting the popularity of gold ETFs in recent months.

The PBoC kept a steady pace of adding gold to its reserves: another 10t of gold was purchased in July. After eight consecutive purchases, the PBoC’s gold reserves now totalled 1,937t at the end of the month.

Outlook

The trade dispute – which is unlikely to be resolved anytime soon – plus a weaker economy and currency could boost safe-haven demand even higher in the short term. And China’s inflation also continues to pick up steam, making gold – as an inflation hedge – more attractive.

And as we pointed out in our gold mid-year outlook 2019, financial uncertainties and accommodative monetary policy – which have been witnessed in the past few months – will provide mid-to-long term boosts to gold’s investment demand.

Footnotes

1 For the differences in the demand the two contracts represent, please click here

2 HS code 7108 includes gold (Including Gold Plated With Platinum), unwrought or In semi-manufactured forms, or In powder form

3 Loadouts: the amount of gold leaving Shanghai Gold Exchange’s vault