Weekly Markets Monitor

Weekly Markets Monitor: Crisis hedge

Weekly Markets Monitor

Weekly Markets Monitor: A silver lining playbook?

Weekly Markets Monitor

Weekly Markets Monitor: The tail is wagging

Unearthed Podcast

World Gold CouncilUnearthed: Gold Price Surge and What It Means for Investors

Weekly Markets Monitor

Weekly Markets Monitor: yen does a 180° at 160

Last week was all about geopolitical tension over Greenland, which eased post Davos negotiations. US economic data signaled a healthy backdrop despite elevated inflation. Europe saw steady activity, Japan held rates but with a tightening bias, China’s recovery remained uneven.

Weekly Markets Monitor

Weekly Markets Monitor: Leaving the leaders

Last week, global markets were shaped by steady US inflation, resilient consumer demand, and fresh tariff threats. Europe saw economic recovery; China’s GDP grew at 5% in 2025, matching its pre-set target; Japan called a snap election, and India saw inflation tick up and trade deficit widen.

Taylor Burnette

Research Lead, Americas World Gold CouncilJeremy De Pessemier

Asset Allocation Strategist World Gold CouncilYou asked, we answered: Is gold’s appeal fading on rising vol?

Unearthed Podcast

World Gold CouncilUnearthed: Gold's Breakout Year & Outlook for 2026

Unearthed Podcast

World Gold CouncilUnearthed: Navigating gold prices - What lies ahead?

In this episode of Unearthed, hosts John Reade and Joseph Cavatoni, Senior Market Strategists at the World Gold Council, discuss the recent developments in the gold market, including price movements, the impact of political events in Washington, and predictions for the end of 2025.

Weekly Markets Monitor

Weekly Markets Monitor: Return of the Mac(ro)

Last week marked the end of the longest US government shutdown, while economic updates from major economies painted a mixed picture. Meanwhile, expectations for further Fed rate cuts waned after hawkish comments from officials.

Weekly Markets Monitor

Weekly Markets Monitor: Open the spigots

Last week’s economic updates highlighted uneven global momentum. US consumer sentiment dipped close to record lows, and European central banks kept rates steady. China’s exports fell and Japan’s manufacturing slowed, whereas India’s manufacturing gained pace.

World Gold Council

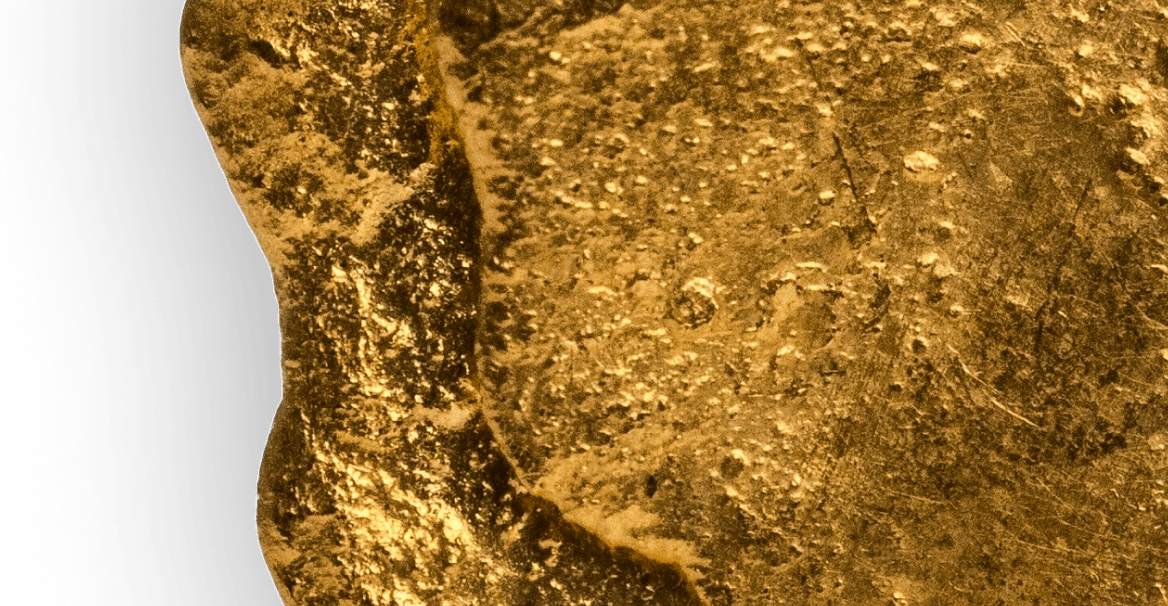

The experts on goldGold hits US$4,000/oz - trend or turning point?

Gold reached another historic milestone on 8 October 2025 as it broke through US$4,000/oz. And while it finished the week below the record high, it’s en route to mark its strongest performance in a calendar year since 1979.