Key highlights:

- In July the Shanghai Gold Price Benchmark PM (SHAUPM) in RMB and LBMA Gold Price AM in USD fell by 1.9% and 3%, respectively

- The average Shanghai-London gold price spread in July rose further, reflecting stronger demand in the month 1

- Total holdings in Chinese gold ETFs saw the largest monthly inflow (9t, US$431mn, RMB3bn) since April 20202

- In a traditionally quiet season for gold demand, gold withdrawals from the Shanghai Gold Exchange (SGE) kept rising, registering the strongest July since 2015.

Looking ahead:

- While the gold price dip may have provided a short-term boost for local gold demand, we believe a sustained recovery requires reviving economic and income growth, fewer disruptions from coronavirus and more weddings. We will keep a close eye on indicators of future demand in our monthly blogs.

Gold prices fell but the local gold price premium kept rebounding

Gold prices experienced another month of weakness in July. Momentum amid global ETF outflows, softer inflation expectations and a strong dollar were main contributors to the weakening gold price. Similar to previous months, the depreciating local currency resulted in a stronger RMB gold price relative to its USD benchmark.

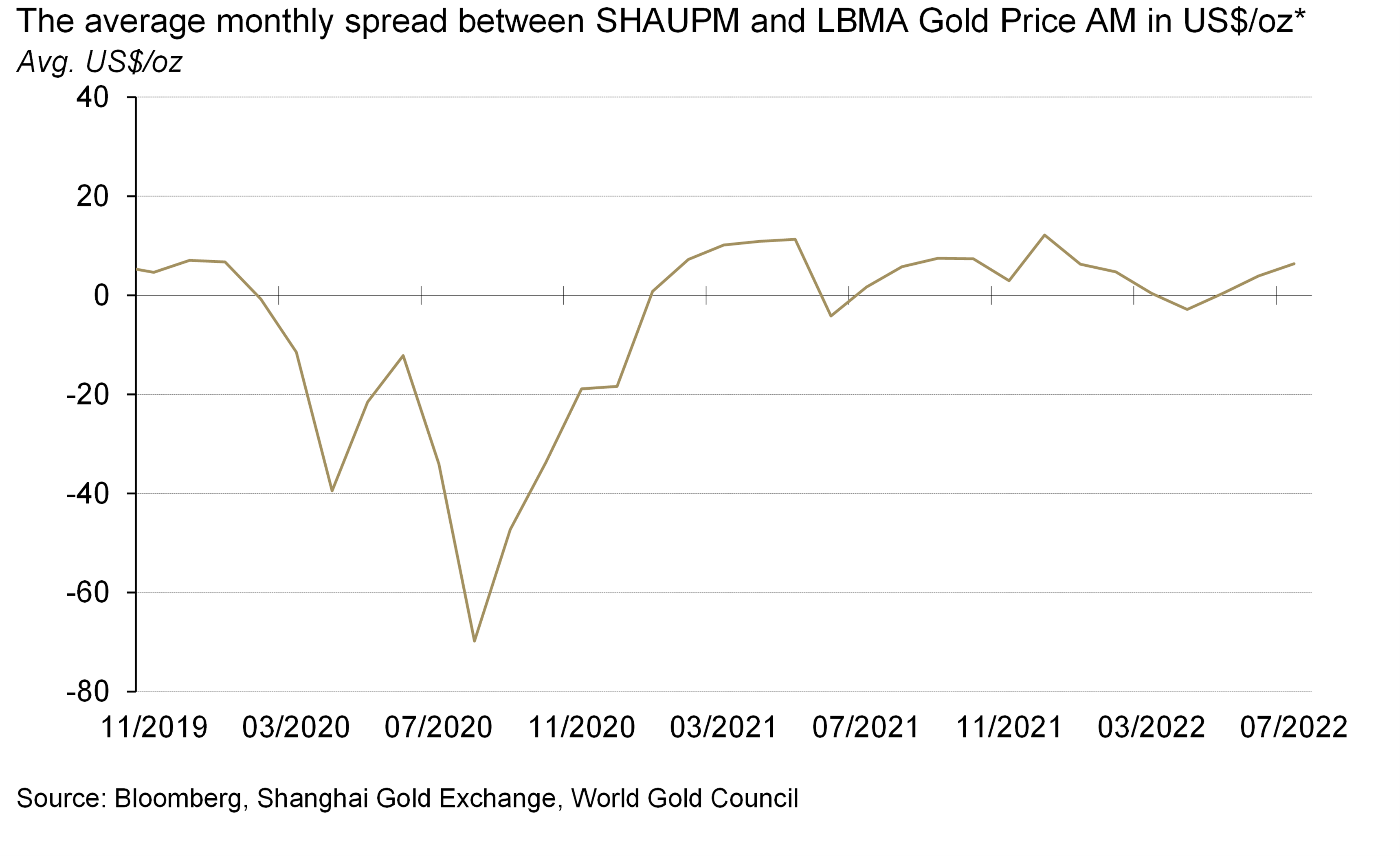

The Shanghai-London gold price spread rose further in July – averaging US$6.4/oz, a US$2.4/oz rise m-o-m – climbing above the 2021 average of US$6.1/oz. The lower price in the month seemed to have spurred interest in gold products from local consumers and investors, driving the local gold price spread higher.

Chart 1: The local gold price spread rose further in July

Chinese gold ETFs saw a sizeable inflow

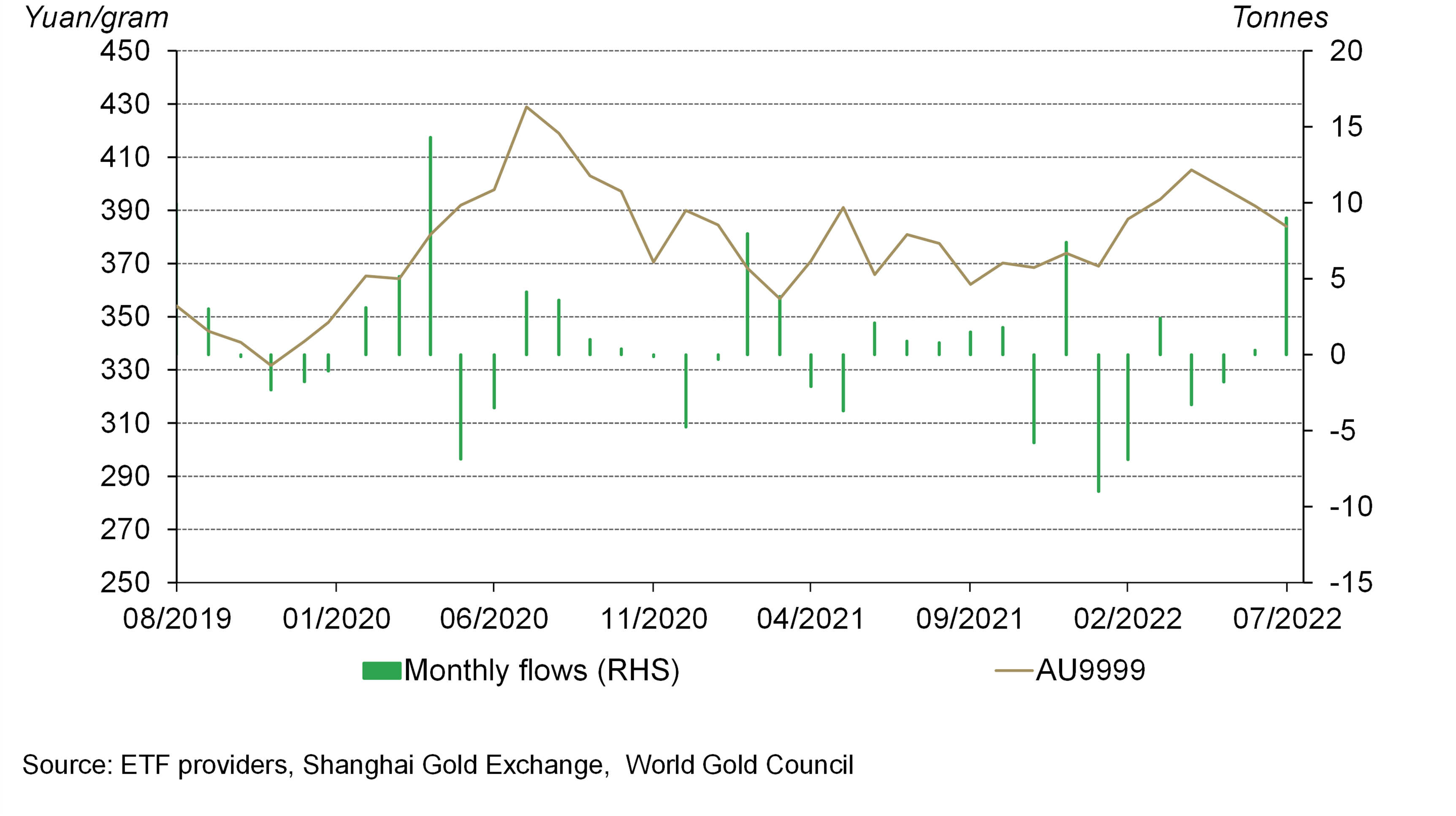

Holdings of Chinese gold ETFs stood at 66t (US$3.8bn, RMB25.3bn) by the end of July, a 9t (US$431mn, RMB3bn) inflow during the month. The combination of opportunistic buying amid a lower gold price and investors’ lower risk appetite possibly due to the 7% fall in the CSI300 stock index were main drivers of the strongest monthly inflow since April 2020.

Chart 2: July saw the largest Chinese gold ETF inflow since April 2020

Wholesale physical gold demand continued to improve

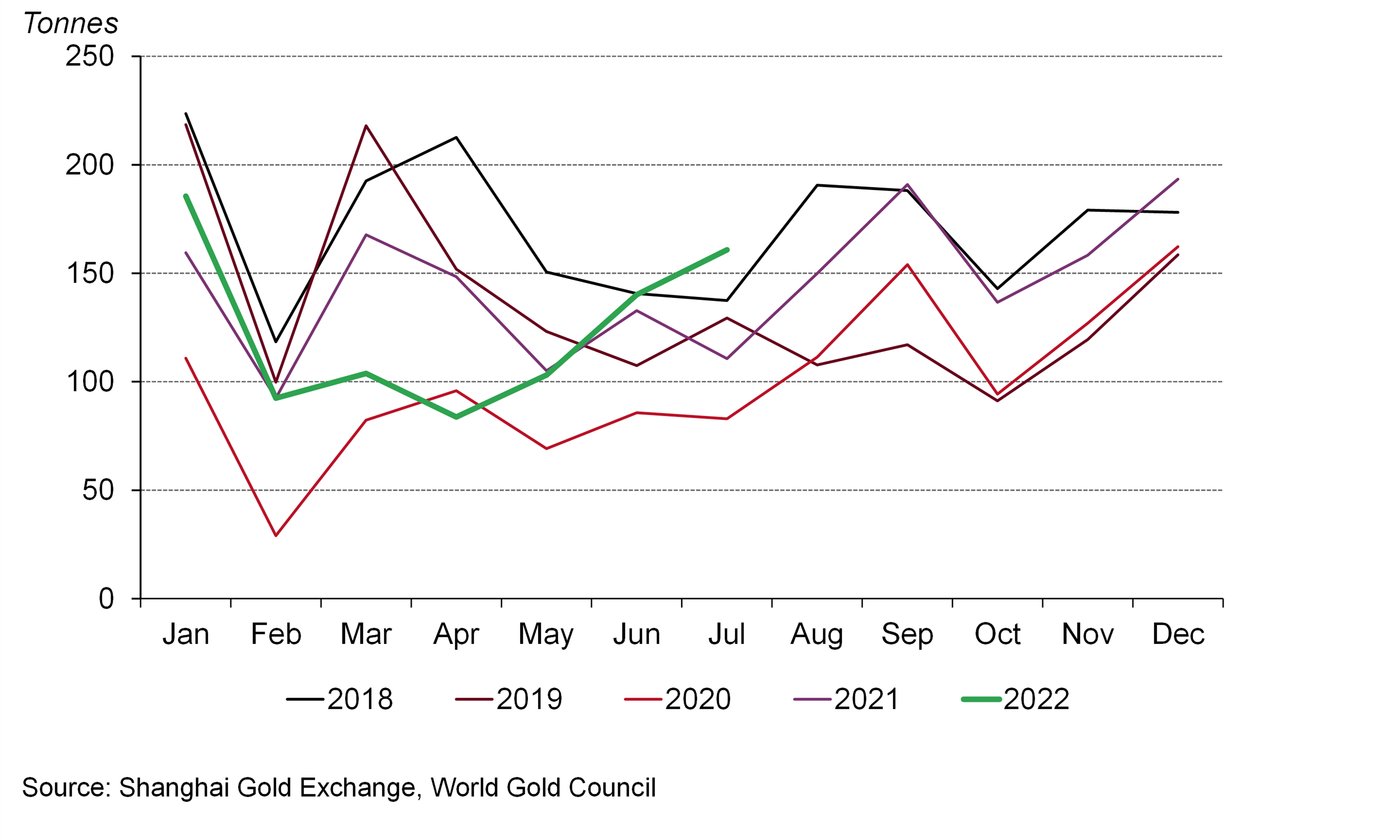

Local manufacturers and banks withdrew 161t of gold from the SGE in July, up by 15% m-o-m and by 45% y-o-y. Recent conversations with our trade partners in the industry suggest that a lower local gold price has supported both wholesale and retail demand for gold. Proper containment of the COVID-19 pandemic and improved economic activities also contributed.

The higher replenishment of stocks by manufacturers amid COVID-related lockdowns in previous months, an improved outlook for future gold consumption and a lower gold price are, we believe, contributory factors to the highest SGE gold withdrawals in July – a traditionally quiet month for Chinese gold demand – since 2015.

Chart 3: Wholesale gold demand saw the strongest July since 2015

Gold imports jumped in June

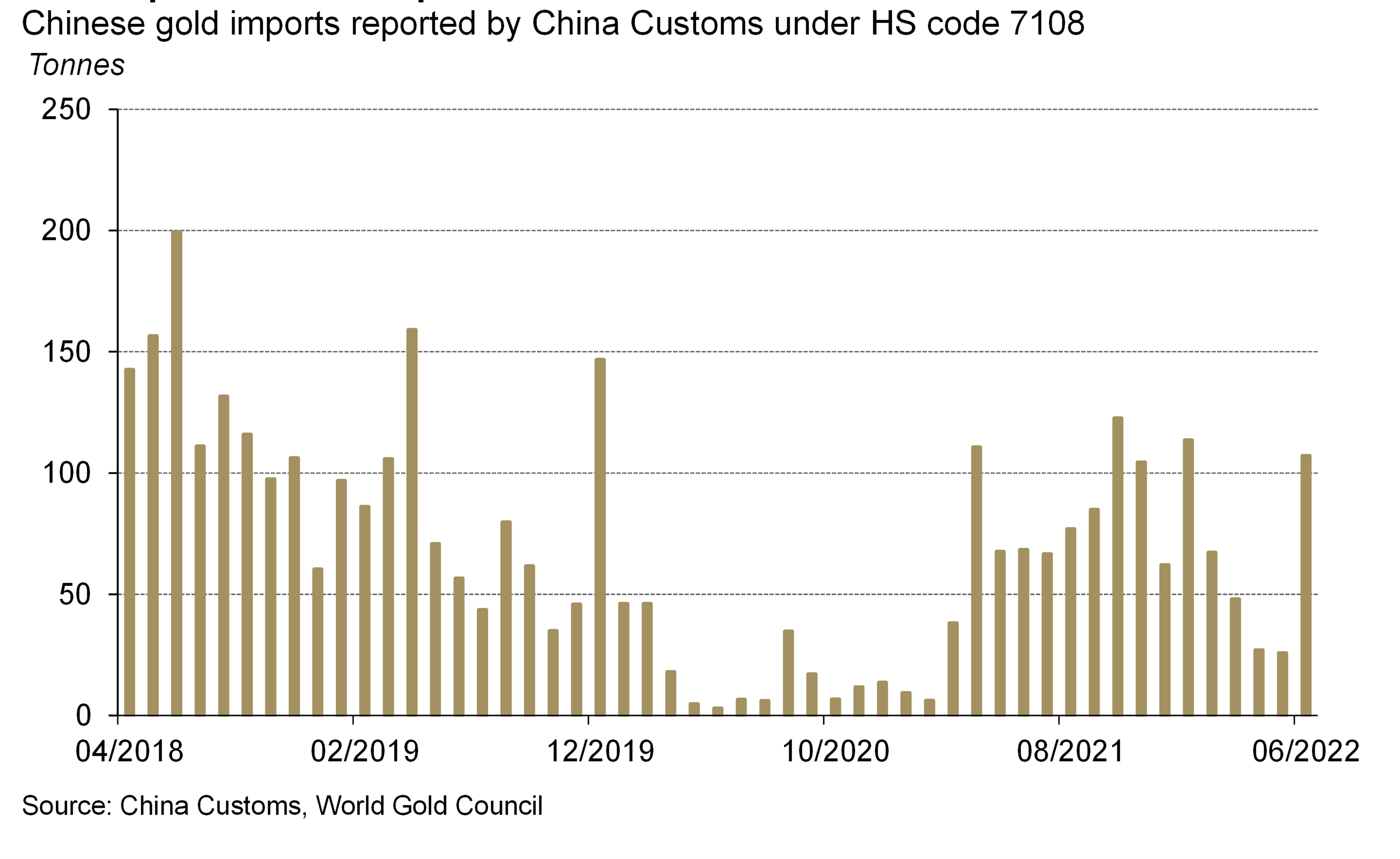

China imported 107t gold in June, the highest in five months and significantly above the 2019 pre-pandemic level. The 81t m-o-m increase was a reflection of the strong rebound in local gold demand that followed the easing of COVID-related restrictions, as we have previously noted.

Chart 4: Gold imports saw a sharp increase in June