Key highlights:

- While the LBMA Gold Price AM in USD declined by 0.6% in August, the Shanghai Gold Benchmark PM (SHAUPM) in RMB rose by 1.8% amid Chinese currency weakness, resulting in a sizable 13% return y-t-d and outperforming most assets

- The industry withdrew 161t of gold from the Shanghai Gold Exchange (SGE), a notable pick-up from June amid rising replenishment needs for Chinese Valentine’s Day and various jewellery fairs in September1

- August’s average Shanghai-London gold price premium surged to a record high, possibly due to the continued tightening in local demand and supply conditions

- Chinese gold ETFs saw the third consecutive monthly inflow, adding RMB2bn (+US$293mn) in August and pushing their total assets under management (AUM) to RMB26bn (US$4bn)

- The People’s Bank of China (PBoC) announced a 29t gold purchase in August, pushing total gold reserves to 2,165t and extending the buying streak to 10 months.

Looking ahead:

- Despite challenges, an improved outlook for China’s economy could provide some support for local gold demand. Also, various jewellery fairs and industry events may spur both manufacturers’ and retailers’ replenishing demand. Furthermore, with the National Day Holiday and Mid-Autumn Festival approaching, retailers’ inventory restocking is likely to continue

- Anecdotal evidence suggests, however, that the record-level RMB gold price has been, and may continue to be, a key deterrent to local gold consumption.

The RMB gold price rose further while its USD peer fell

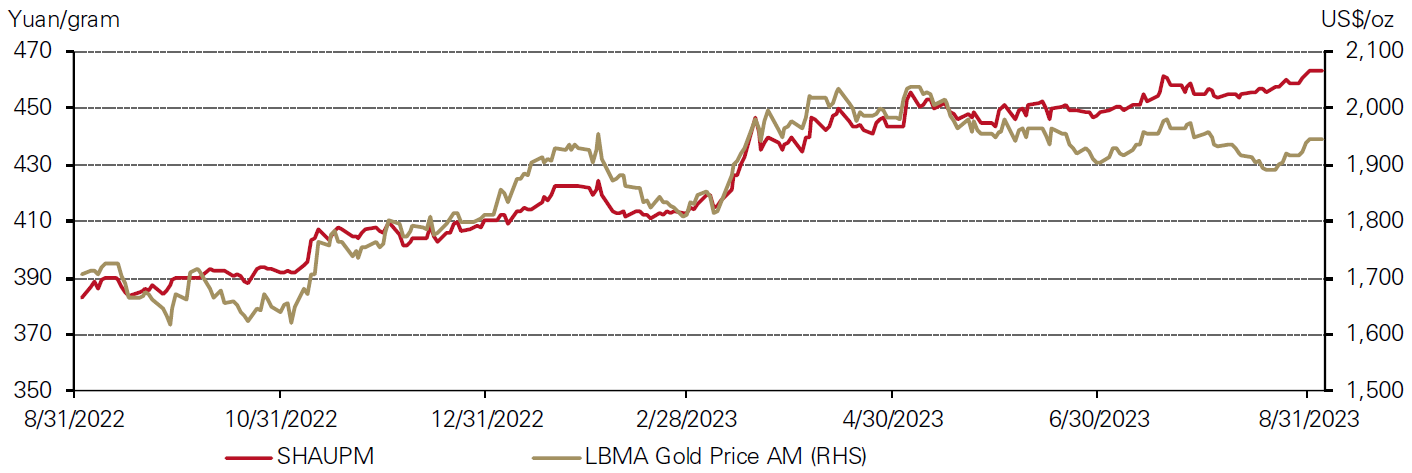

Gold prices quoted in USD and RMB headed in different directions in August (Chart 1). Major factors including rising US Treasury yields and a strong dollar weighed on the international gold price in USD. But the Chinese currency weakness, which depreciated by 2% against the dollar in the month, led to a mild increase in the RMB gold price.

Chart 1: The RMB gold price sustained its strength

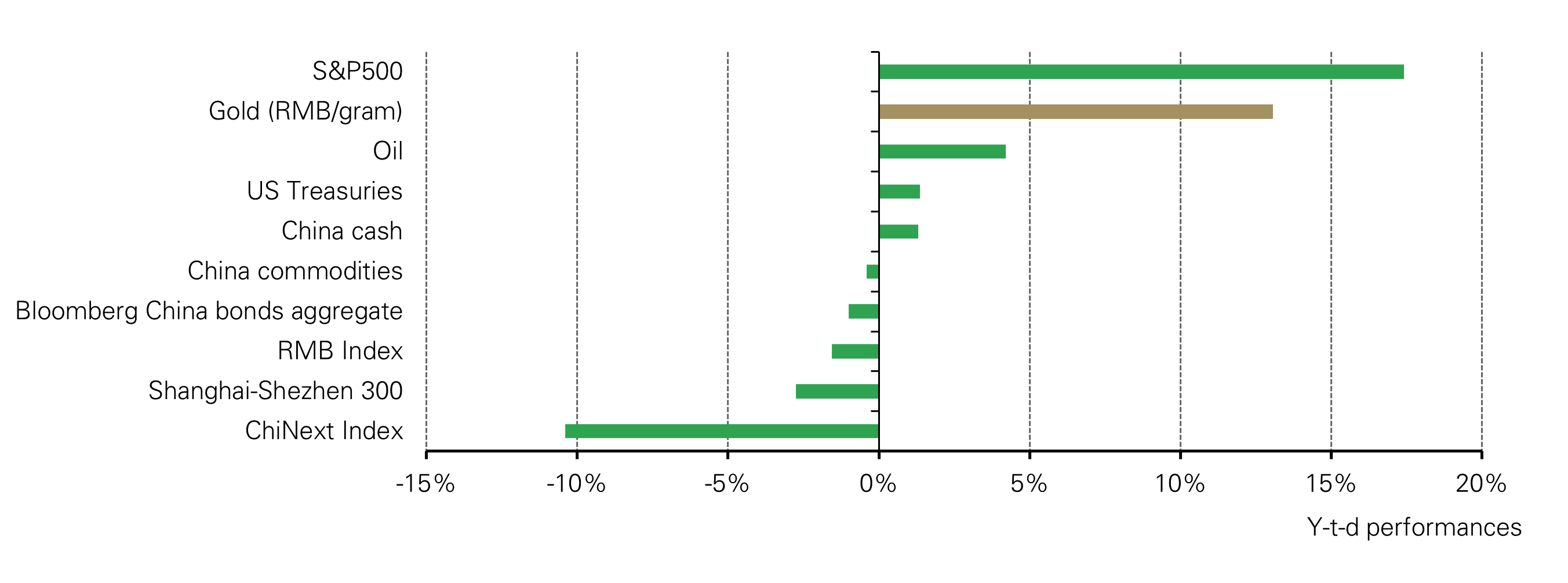

August pushed the month’s average SHAUPM to RMB457/gram, a fresh record high and the seventh consecutive monthly rise. Y-t-d, the SHAUPM soared by 13%, outperforming most assets (Chart 2).

Chart 2: Gold in RMB has outperformed most assets so far in 2023

Major assets’ performances during the first eight months of 2023*

Wholesale demand saw a notable rebound in August

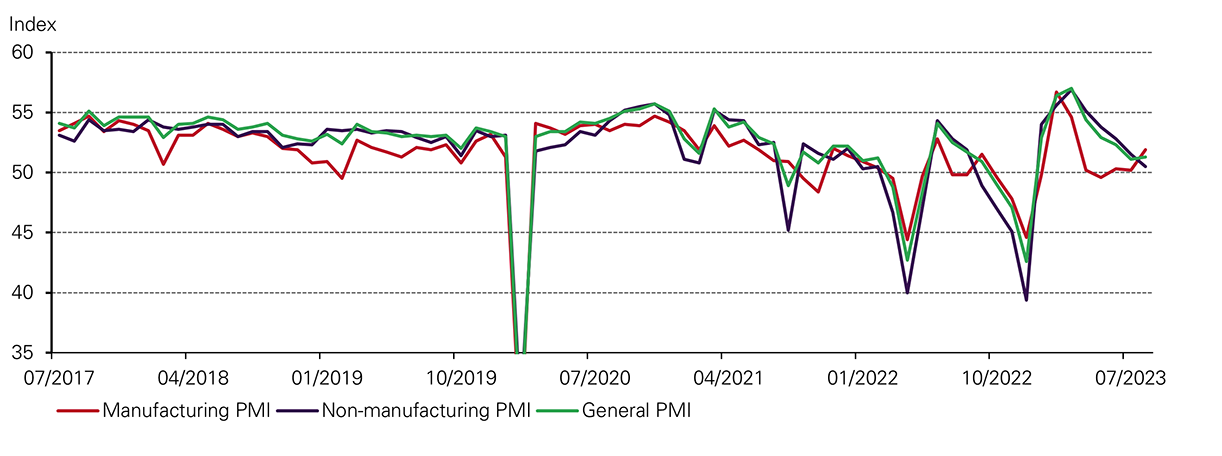

China’s economic recovery faces continued challenges. In August, non-manufacturing and service Purchasing Managers’ Indexes (PMIs) slipped further amid poor demand and extreme weather conditions, reminding the market that clouds over the recovery remain.2

However, there are also signs that conditions are improving. The official manufacturing PMI rose for the fourth month straight and exceeded expectations. Also, credit growth in total social financing and new yuan loans surprised to the upside. Meanwhile, policy makers rolled out various stimuli to support the property market including lowering the downpayment and mortgage rates for home buyers.3

Chart 3: Manufacturing activities continued to rebound while other sectors stayed tepid

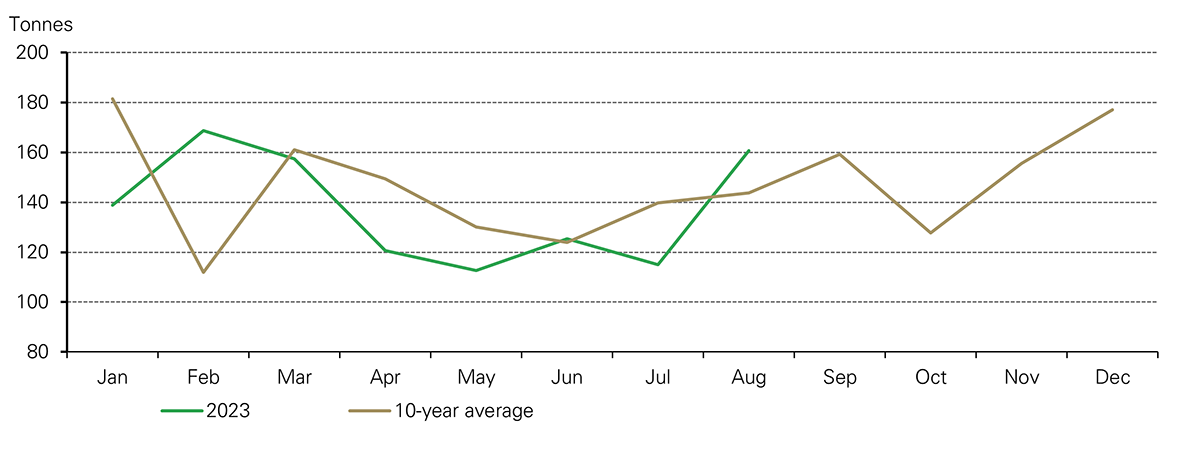

Gold withdrawals from the SGE totalled 161t in August, a 46t m/m rise (Chart 4). Higher replenishment activities by both retailers and manufacturers provided support amid:

- Chinese Valentine’s Day, a key shopping occasion emerging in recent year

- various jewellery exhibitions in Shenzhen and Hong Kong during September, without mobility restrictions for the first time in three years.

But compared to August 2022, there was a 5t decline. The mild y/y drop was mainly due to 2022’s distorted seasonality amid COVID-related restrictions and a lower local gold price.

Chart 4: Gold withdrawals rebounded sizably in August

Local premium surged

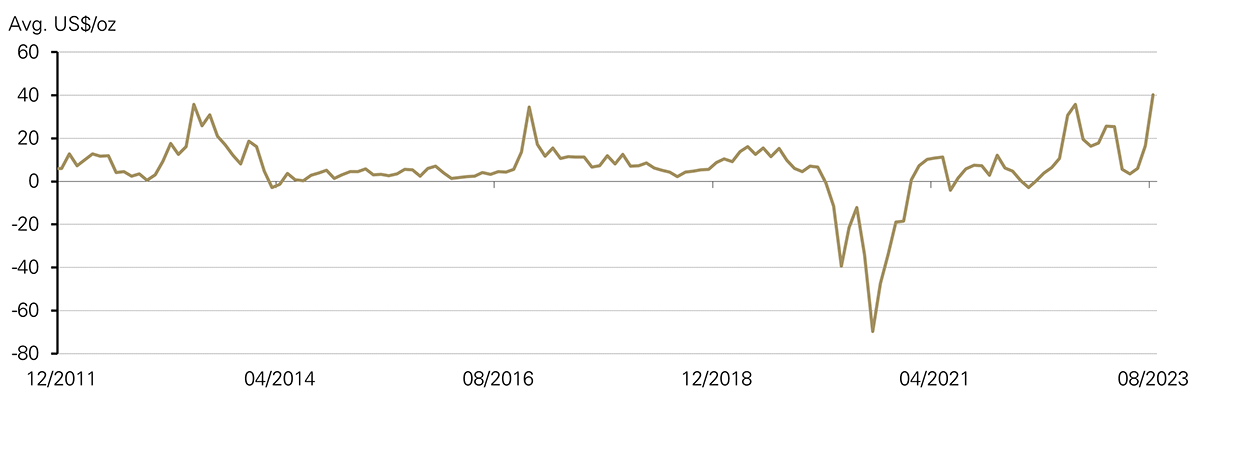

The Shanghai-London gold price spread averaged US$40/oz in August, a fresh record high and US$23/oz higher m/m (Chart 5). We believe improving gold demand and relatively tepid imports in recent months may have led to local demand and supply conditions tightening, pushing up the local gold price premium.

Chart 5: Average premium in August rose to a record high

The monthly average spread between SHAUPM and LBMA Gold Price AM in US$/oz*

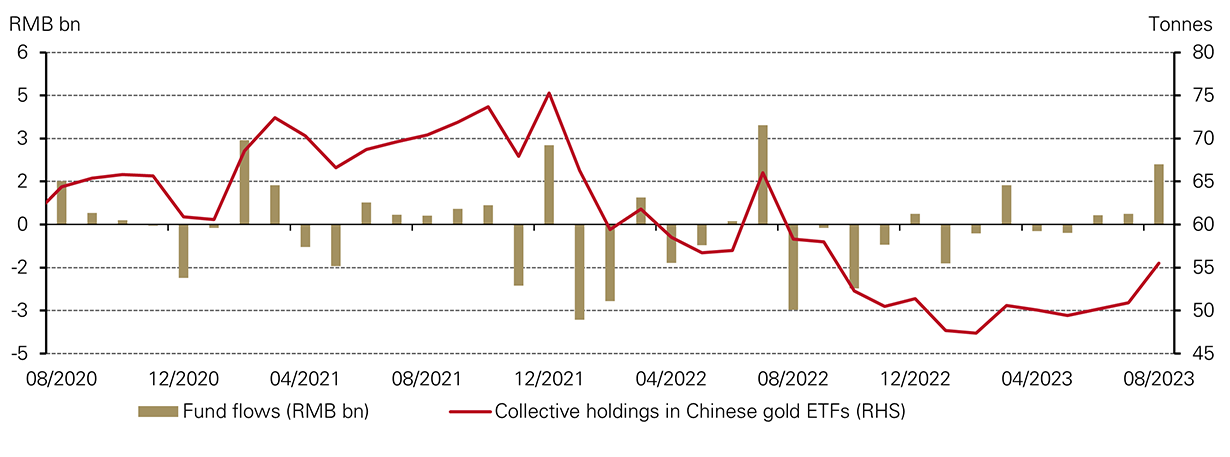

Chinese gold ETFs saw sizable inflows in August

Inflows into Chinese gold ETFs continued for the third consecutive month, amounting to RMB2.1bn (+US$293mn, +4.6t), the strongest since July 2022. During the month, poor equity market performance (CSI300: -6%) and continued local currency weakness drove many to safe-haven assets such as gold, which has delivered attractive returns so far in 2023. Additionally, ETF providers’ increasing promotional efforts in their products’ retail campaign also helped attract attention.

Following August’s inflows, local gold ETFs’ total AUM rose to RMB26bn (US$3.6bn), the highest since end-2021 in RMB terms, while holdings reached 56t. And y-t-d, their inflows accumulated to RMB2bn (+US$270mn, +4t). And while their collective holdings were 8% higher y-t-d, total AUM surged by 22% amid the strong RMB gold price performance.

Chart 6: Gold ETF demand improved significantly

Monthly fund flows and Chinese gold ETF holdings

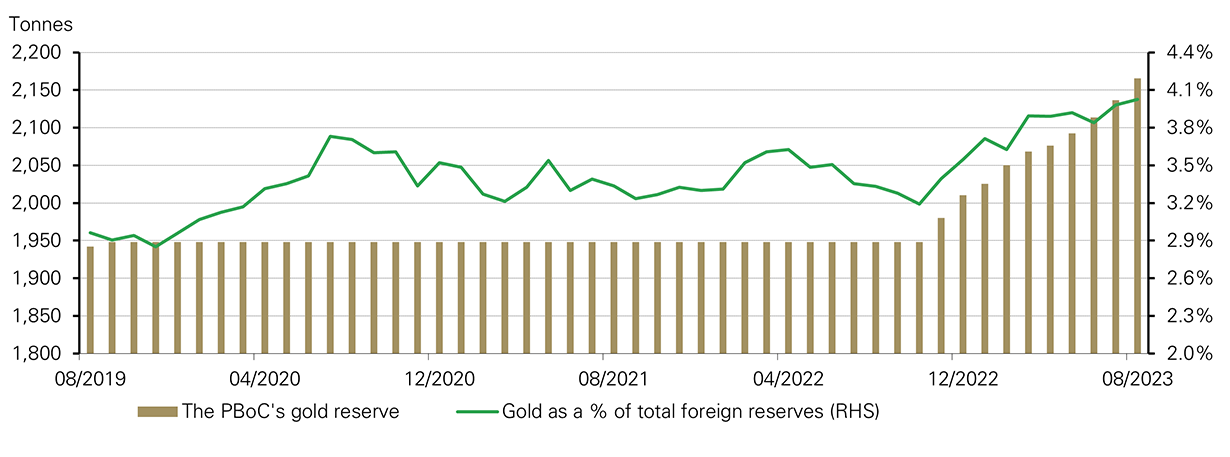

The PBoC’s gold reserves rose further

The PBoC announced its tenth consecutive gold purchase in August, amounting to 29t and pushing total gold reserves to 2,165t. (Chart 7). Currently, gold accounts for 4.03% of China’s total foreign exchange reserves in USD terms, the highest on record. So far in 2023, China has reported a 155t addition to its gold reserves.

Chart 7: The PBoC announced gold purchases 10 months in a row

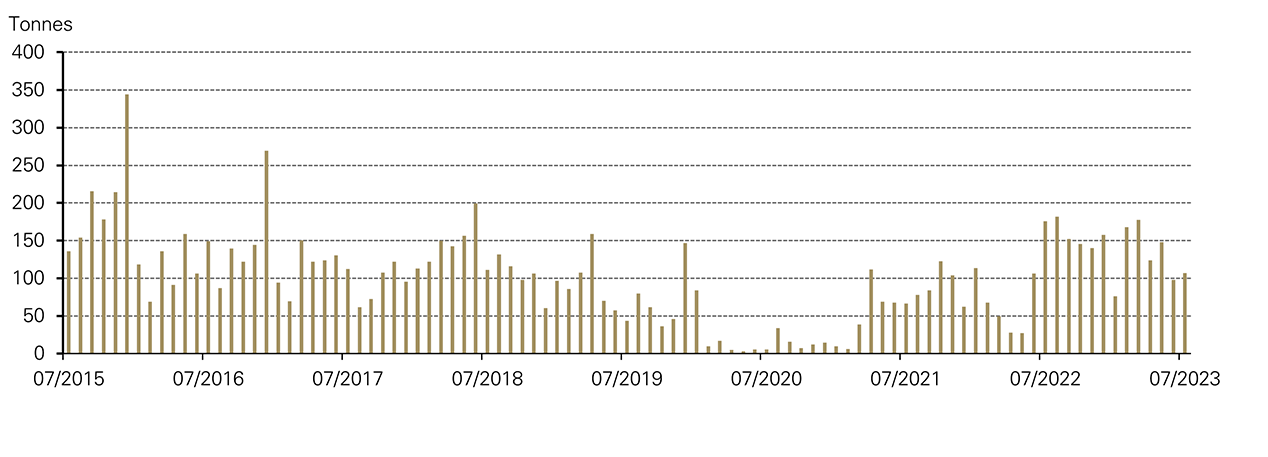

July’s imports saw little change compared to June

China imported 107t of gold in July, based on the most recent data release from China Customs. July’s imports were 9t higher m/m, a slight change from the previous month amid off-season demand patterns. Compared to July 2022, there was a 69t fall, which was also a reflection of the y/y demand weakness as we previously noted.

Chart 8: July’s imports remained stable

Footnotes

2023’s Chinese Valentine’s Day occurred on 22 August. In recent years, it has become a key shopping occasion among the young generation. Jewellers usually restock in advance to prepare for various events during the Shenzhen Jewellery Fair and Hong Kong Jewellery Fair in September.

For more, see: Xi'an: Heavy rains bring deadly flash flood and landslide to northwest China | CNN

For more, see: China cuts down payments, mortgage rates, aiming to further boost sector’s sustainable development - Global Times