Summary

- Shanghai Gold Benchmark price hit 319.2 yuan/gram – highest level since its introduction in April 2016

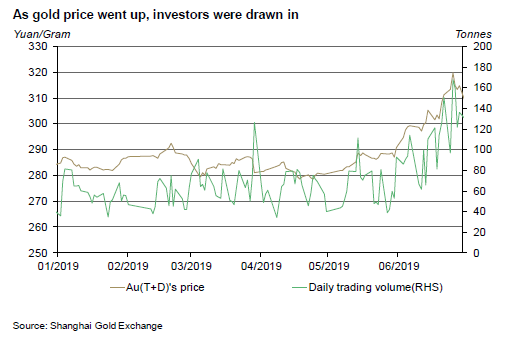

- Au(T+D)’s trading volume in June reached second highest level on record – 2,062t

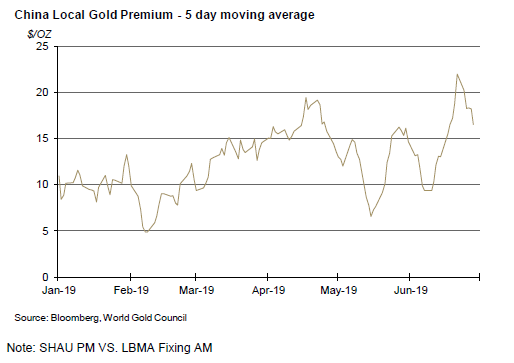

- The local gold premium rose sharply

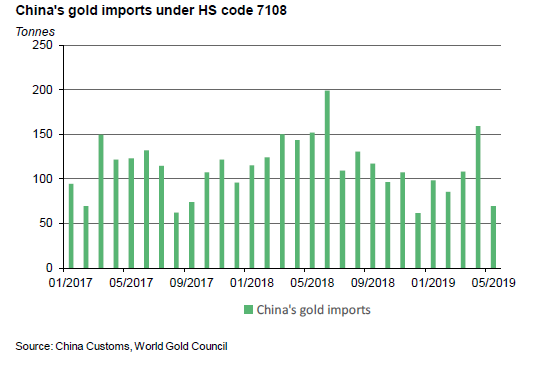

- Imports continued to slide in May, dropping to 69t

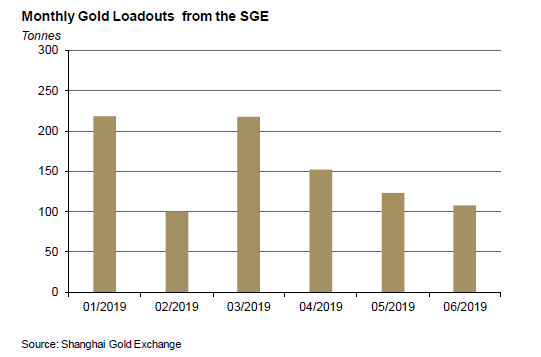

- Gold withdrawals from Shanghai Gold Exchange (SGE) fell again last month

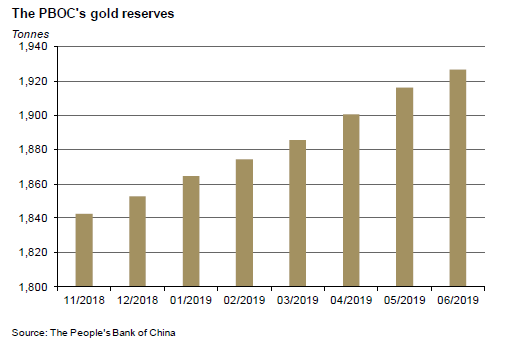

- PBOC added a further 10t to its reserves in June

Gold was already on fire at the beginning of summer: Au(T+D) soared 8.7% in June and the Shanghai Gold Benchmark price (PM) peaked at 319.2 yuan/gram – the highest level since its introduction in April 2016.1 And this happened even though CNY and Chinese stock markets were relatively stable. The main drivers of this rally included expectations for easing monetary policies globally, to combat a potential recession, and geopolitical tensions in the Middle East.

Also, the Chinese economy continued to show signs of slowdown with manufacturing/service/composite PMIs and the growth rate of PPI all registered further declines in June. Economic concerns have played a big part in the rise of safe-haven demand for gold in China.

Driven by above-mentioned factors and momentum, gold’s speculative interest in China surged. The trading volume of Au(T+D), the margin-traded and the most liquid gold contract at Shanghai Gold Exchange, reached 2,062t in June, the second highest level in its history.

The local gold premium in China jumped in June, averaging US$15/oz, 20% higher m-o-m. This could be the result of the booming investment demand coupled with decreasing gold imports.

China’s gold imports under the HS code 7108 in May dropped to only 69t, the lowest level in 2019, representing a 90t decrease m-o-m.2

Gold withdrawals from the SGE continued to drop in June, falling to 107t. This represents another 16t decline m-o-m after the 29t decline witnessed in May. As we stated in VAT in China, tax incentives before the VAT cut in April drove the loadouts considerably higher in March. As a result, a large industry inventory was built up early, reducing physical demand afterwards.3

But while local gold price was trending up in June, Chinese ETF investors were exiting the market. In tonnage terms, the four exchange-listed gold ETFs in China lost 4.24t combined last month.4 Profit taking might be the key reason for this move.

The People’s Bank of China (PBOC) add another 10t of gold to its reserves in June, making it 1,927t in total. This was the 7th consecutive monthly gold purchased made by the PBOC.

Outlook

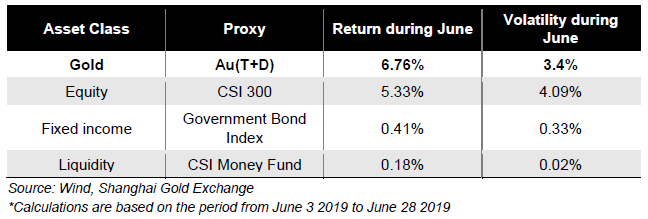

Compared to other major RMB assets, gold provided a higher return while producing a lower volatility (than equities) in June. Characteristics such as these made gold a valuable asset.

And since it seems geopolitical tensions and easing monetary policy expectations won’t fade away anytime soon, investment demand for gold could be supported further.

1The monthly price increase was based on figures between June 3 and June 28. Shanghai Gold Benchmark was introduced on April 19, 2016. The peak of Shanghai Gold Benchmark price (PM) was on June 25.

2HS code 7108 includes gold (Including Gold Plated With Platinum), unwrought or In semi-manufactured forms, or In powder form

3Loadouts: the amount of gold left Shanghai Gold Exchange’s vault

4The data is based on the flows of the four gold ETFs include Huaan Yifu Gold ETF, Guotai Gold ETF, E-Fund Gold ETF and Bosera Gold ETF (excluding its I & D shares which are not listed in exchanges) as of June 30, 2019 from their daily reports.