You asked, we answered: Does gold qualify as an HQLA under Basel III?

2 June, 2025

Please note: this blog post was updated 6th June, 2025.

Highlights

- Gold is not currently classified as a High Quality Liquid Asset (HQLA) under Basel III…

- …but its performance during times of crisis rivals that of intermediate and long-term Treasuries

- In this context, our analysis shows that gold is an HQLA in all but name.

Gold’s role in Basel III

The Basel III requirements were first published in 2010 but its implementation has been years in the making. Most provisions have been in place since 2019, but its most recent iteration, dubbed Basel III Endgame (or Basel 3.1), was due to take effect in July 2025. While it now seems that Endgame will be delayed,1 there has been renewed interest in the rules and implications of its framework. The role of gold within Basel III was no exception. But, not surprisingly, there were also a fair number of misconceptions.

In a recent article, Norton Rose Fulbright reviewed the Basel Framework and regulatory status of gold, covering gold’s treatment under Basel III through the perspective of: 1) regulatory capital; 2) capital requirements; 3) collateral requirements – for credit mitigation as well as clearing counterparties and derivatives; and 4) liquidity requirements.2

The LBMA also set out to correct misleading information circulating online, highlighting that while gold carries a 0% risk weight for purposes of capital requirements under the Risk Weighted Asset rules,3 and can be used as collateral with a 20% haircut, it is not currently defined as an HQLA for purposes of the Liquidity Coverage Ratio (LCR) and with an 85% Required Stable Funding (RSF) under the Net Stable Funding Ratio (NSFR).4

What’s in a name? A practical perspective of HQLAs

Despite not being officially recognised as an HQLA, gold surely behaves like one. Over the years, we have collaborated with academics and the LBMA in multiple studies that have shown that gold meets many of the criteria that determine HQLAs.

These characteristics, as defined in the Basel Framework, are divided into two categories: fundamental and market related.

Fundamental characteristics include:

- Low risk – gold is an asset that does not hold credit risk

- Ease and certainty of valuation – while gold does not fit common valuation models used for bonds or some stocks, its behaviour is determined by market equilibrium with readily available market prices

- Low correlation with risky assets – gold is an effective diversifier that performs well in periods of crisis.

Market related characteristics include:

- Active and sizable market – the gold market is large and liquid, trading more than US$120bn per day on average on the over-the-counter market alone

- Low volatility – gold’s volatility is at par with that of 30-year US Treasuries and below of individual stocks

- Flight to quality – gold tends to be the recipient of investment flows during periods of risk, also seen through its negative correlation to the stock market.

Most recently, in their February 2025 paper Is Gold a High-Quality Liquid Asset? Baur et al. show that gold is among the most liquid assets across a sample of top tier government bonds, and that its performance does resemble that of an HQLA.5

Given that one of the key attributes of an HQLA is its behaviour – and usefulness – in periods of heightened risk, we have used the principles established by Baur et al. and analysed gold’s market characteristics over the past six months. This period has been marked by high levels of uncertainty and volatility, as well as a less-than-stellar performance by US Treasuries…the epitomes of HQLAs.

Our report Gold: an HQLA in all but name finds that over the past six months gold has shown characteristics associated with HQLAs, including:

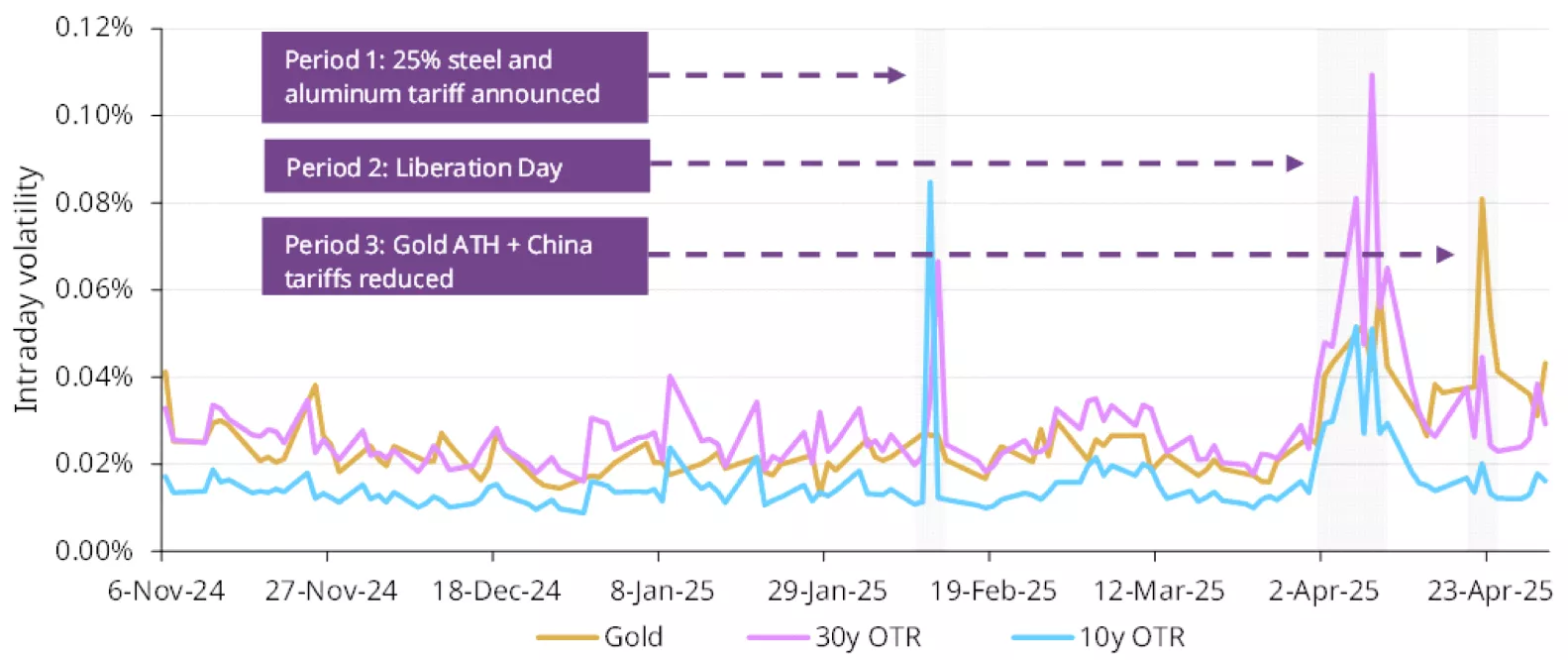

- Volatility: gold demonstrated comparable or superior stability to intermediate and long-term US Treasuries during recent market shocks, highlighting its lower-than-assumed volatility profile

- Spreads: gold’s bid-ask spreads remained narrow – or normalised quickly – during periods of market stress, rivalling those seen in 10- and 30-year US Treasuries

- Volume: gold’s robust daily trading volumes rival those of 10-year US Treasuries, reinforcing its status as a deep and actively traded market.

The report also contrasts gold’s behaviour with that of equities, some of which may technically qualify as Level 2B assets under Basel III. Yet, gold outperforms them in virtually every metric.

In sum

While gold is not currently classified as an HQLA under Basel III and there are no announcements of prospective changes, there’s also overwhelming evidence that gold does behave like one. Whenever the rules are revised, we believe regulatory authorities should revisit their initial decision and reconsider gold’s standing.

Chart 1: Gold’s volatility factor is in line with, if not more favourable than, US Treasuries during periods of turmoil

Level 1 HQLAs (10-year and 30-year US Treasuries) and gold intraday volatility*

*Daily volatility computed using returns on 1-minute data increments from 6 November 2024 to 30 April 2025. Gold based on spot price (XAU) in US$/oz. US Treasuries based on “on-the-run” (OTR) 10-year and 30-year notes, respectively.

Source: Bloomberg, World Gold Council

Footnotes

1Basel III endgame: The specter of global regulatory fragmentation, Atlantic Council, 13 May 2025.

2The Basel Framework and regulatory status of gold: Clarifying the status-quo, Norton Rose Fulbright, May 2025.

3Wording amended to avoid confusion between regulatory capital and gold’s treatment as a zero-weight asset as explained by Norton Rose Fulbright (see footnote 2).

4Gold and HQLA: Correcting Misleading Online Information, LBMA, 14 May 2025.

5Is Gold a High-Quality Liquid Asset? Baur, Gornall, Hoang, Palmberg, 12 February 2025.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.