You asked, we answered: Gold's optimal portfolio weight in a higher correlated environment?

23 May, 2025

Highlights

- Investors need to be cautious of the risks of relying too heavily on historic correlations that are prone to change

- When the bond-equity correlation flips from negative to positive, a larger allocation to gold is required to retain the initial level of portfolio risk.

Reasons and consequences of a spike in bond-equity correlation

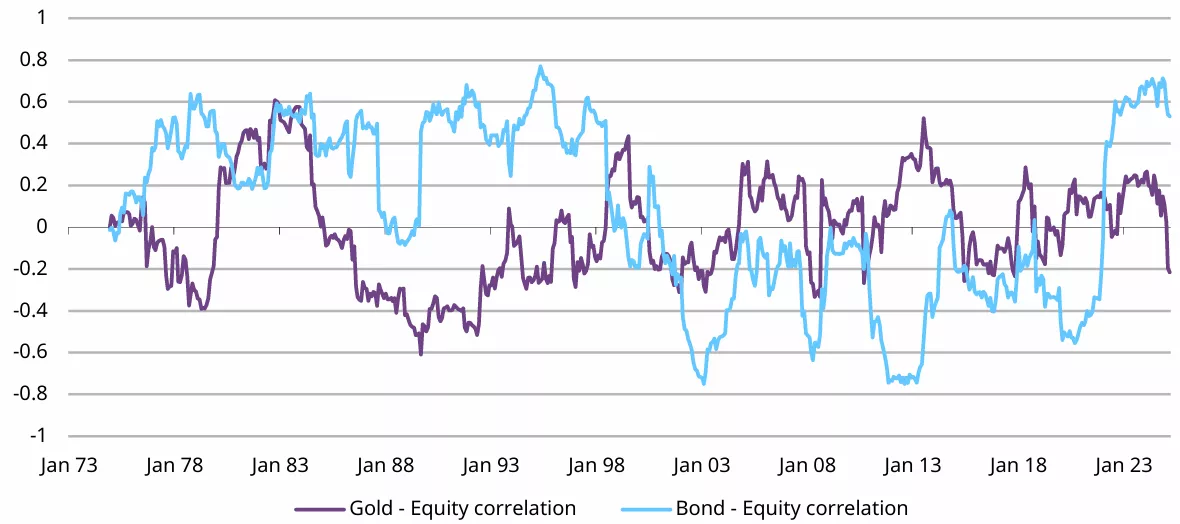

Diversification across assets is important in the construction of resilient portfolios. And for many multi-asset investors, high-quality government bonds have been a reliable diversifier for equity risk - the two assets typically reacting differently to similar economic conditions. But this relationship appears to have broken down of late. In other words, the two asset classes are now the most correlated they have been since the mid-1990s (Chart 1).

Chart 1: Gold to the rescue in a positive bond-equity correlation environment

Bond-equity & Gold-equity rolling 24-month correlations*

*Correlations are computed using monthly returns in US dollars between 31 January 1973 and 30 April 2025. Indices used: MSCI USA Index, Bloomberg US Treasury Bond Index and LBMA Gold Price PM.

Source: Bloomberg, World Gold Council

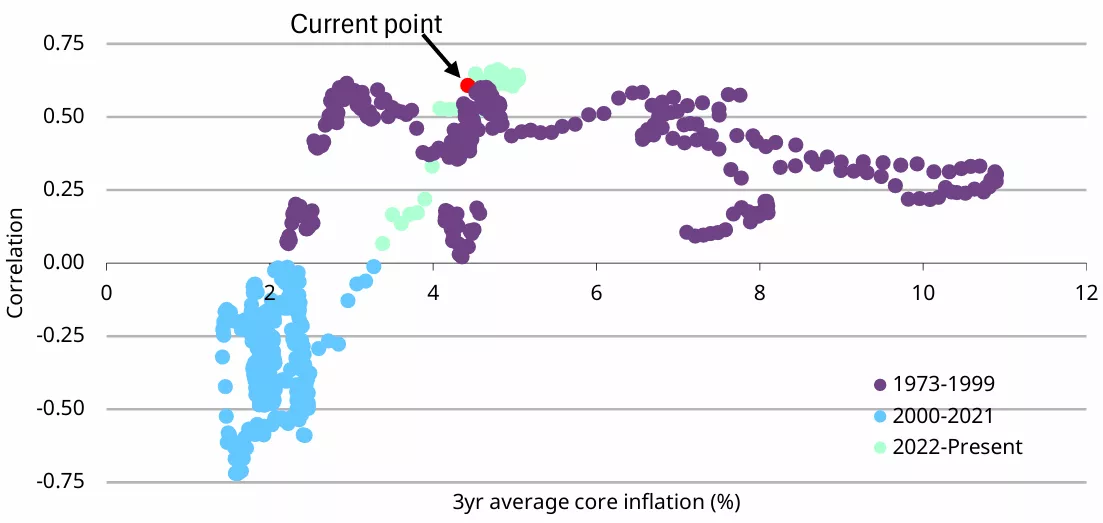

It is the higher inflation environment which has, to a large extent, weakened the appeal of government bonds as a diversifier. At core inflation levels below 2.5%, the correlation between US equities and US treasuries has been, by and large, negative, providing diversification. At levels above 2.5%, this relationship has historically started to break down (Chart 2).

Chart 2: Bond-equity correlation shifts as inflation rises

Rolling 3yr correlation of US equity and US treasury returns vs. 3yr average core inflation*

*Correlations are computed using monthly returns of MSCI USA Index and Bloomberg US Treasury Bond Index from 31 January 1973 to 30 April 2025.

Source: Bloomberg, World Gold Council

The lessons here are twofold:

- Investors need to be cautious of the risks of relying too heavily on historic correlations that are prone to change.

- The current positive correlation between bonds and equities undermines fixed income’s value proposition as a portfolio diversifier.

What is gold’s optimal weight in a positive bond/equity correlation environment?

The shift in the bond-equity correlation has presented many investors with a fundamental challenge around how to approach diversification and portfolio construction. In fact, amidst this rapidly evolving market backdrop, maintaining a diversified portfolio can feel like chasing a moving target.

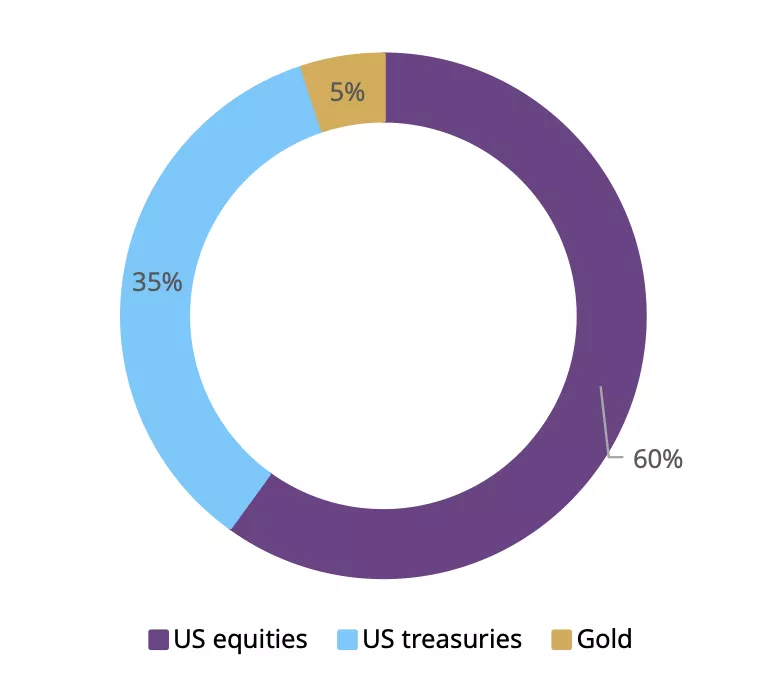

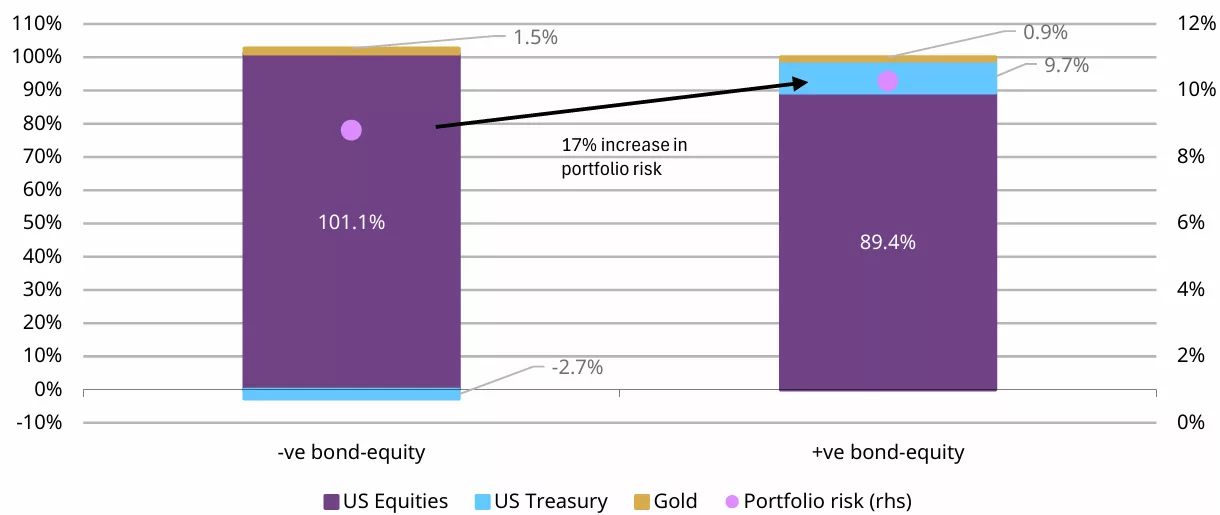

Let us now illustrate how this change in correlation results in increased portfolio risk and how, in order to retain the same level of portfolio risk, the optimal allocation to gold needs to rise. Chart 3 outlines a simple hypothetical portfolio made up of three asset classes. Using just three asset classes helps us isolate the impact from the change in correlations.1

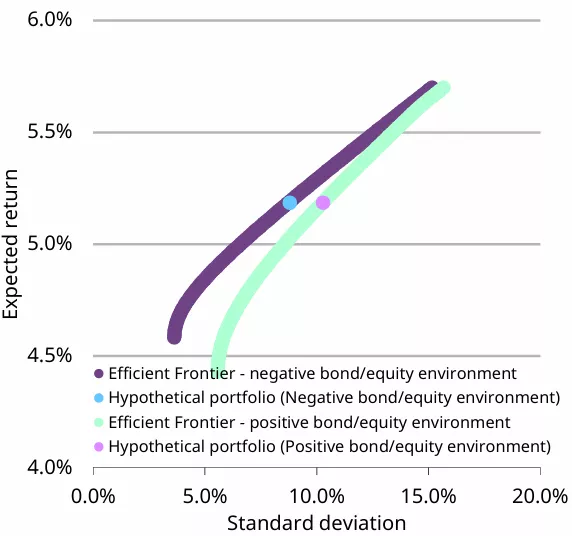

A mean variance optimisation analysis suggests that, generally speaking, a change in the bond-equity correlation environment from negative to positive results in a deterioration to the risk-adjusted returns by shifting the efficient frontier downwards (Chart 4).

Chart 3: Hypothetical optimal portfolio in a negative bond-equity correlation environment

Asset allocation: 60% US stocks, 35% US treasuries, and 5% gold*

*Based on an optimised portfolio as outlined in “Gold as a strategic asset: 2025 edition.

Source: World Gold Council

Chart 4: A positive bond-equity correlation reduces portfolio returns across various levels of risk

Efficient frontier in a negative and positive bond-equity correlation environment*

*The efficient frontiers are based on monthly data for the specified assets from 31 January 1973 to 30 April 2025

Source: Bloomberg, Portfolio Visualizer, World Gold Council

In other words, all else equal, a portfolio’s risk profile rises as the correlation flips from negative to positive. Moreover, bonds become a meaningful contributor to total portfolio risk in such an environment (Chart 5).

Chart 5: Bond’s contribution to portfolio risk rises in a positive bond-equity correlation environment

Risk contribution and total portfolio risk in different correlation environment*

*Risk metrics based on data from January 1973 to April 2025

Source: Bloomberg, Portfolio Visualizer, World Gold Council

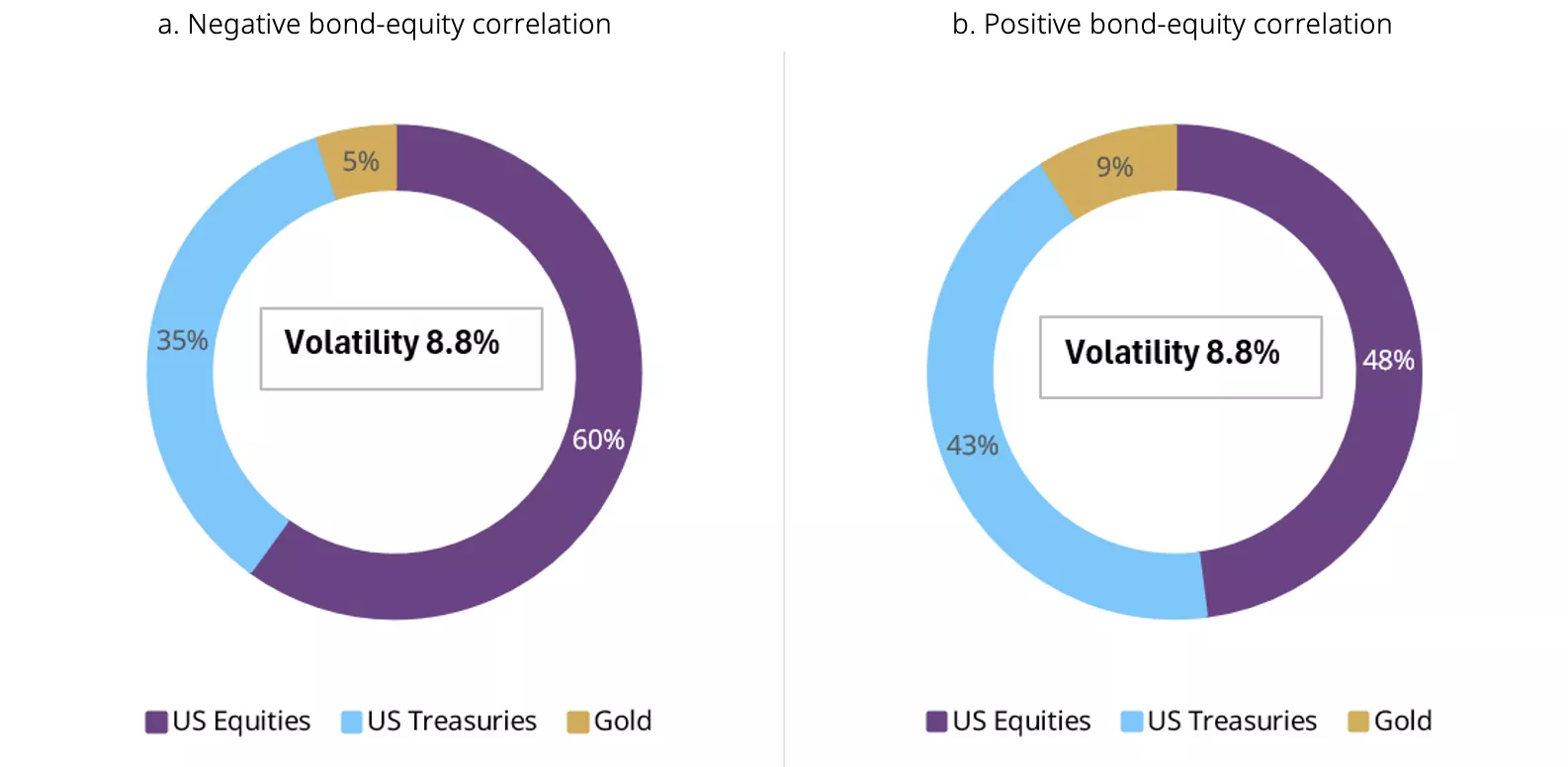

And assuming that an investor’s risk tolerance remains the same, when the correlation flips from negative to positive, the optimal asset allocation should shift too, so as to remain in the pre-defined risk budget.

In fact, the ‘optimal’ amount of gold varies according to the bond-equity correlation environment. Broadly speaking, the analysis suggests that in a positive bond-equity correlation scenario, a larger allocation to gold is required to retain the initial level of portfolio risk (Chart 6).

Chart 6: More gold is required in a positive bond-equity correlation environment to maintain the same level of volatility

Hypothetical portfolios weights in a:

*Optimal weights based on a mean-variance optimisation using monthly data for the specified assets from 31 January 1973 to 30 April 2025.

Source: Bloomberg, Portfolio Visualizer, World Gold Council

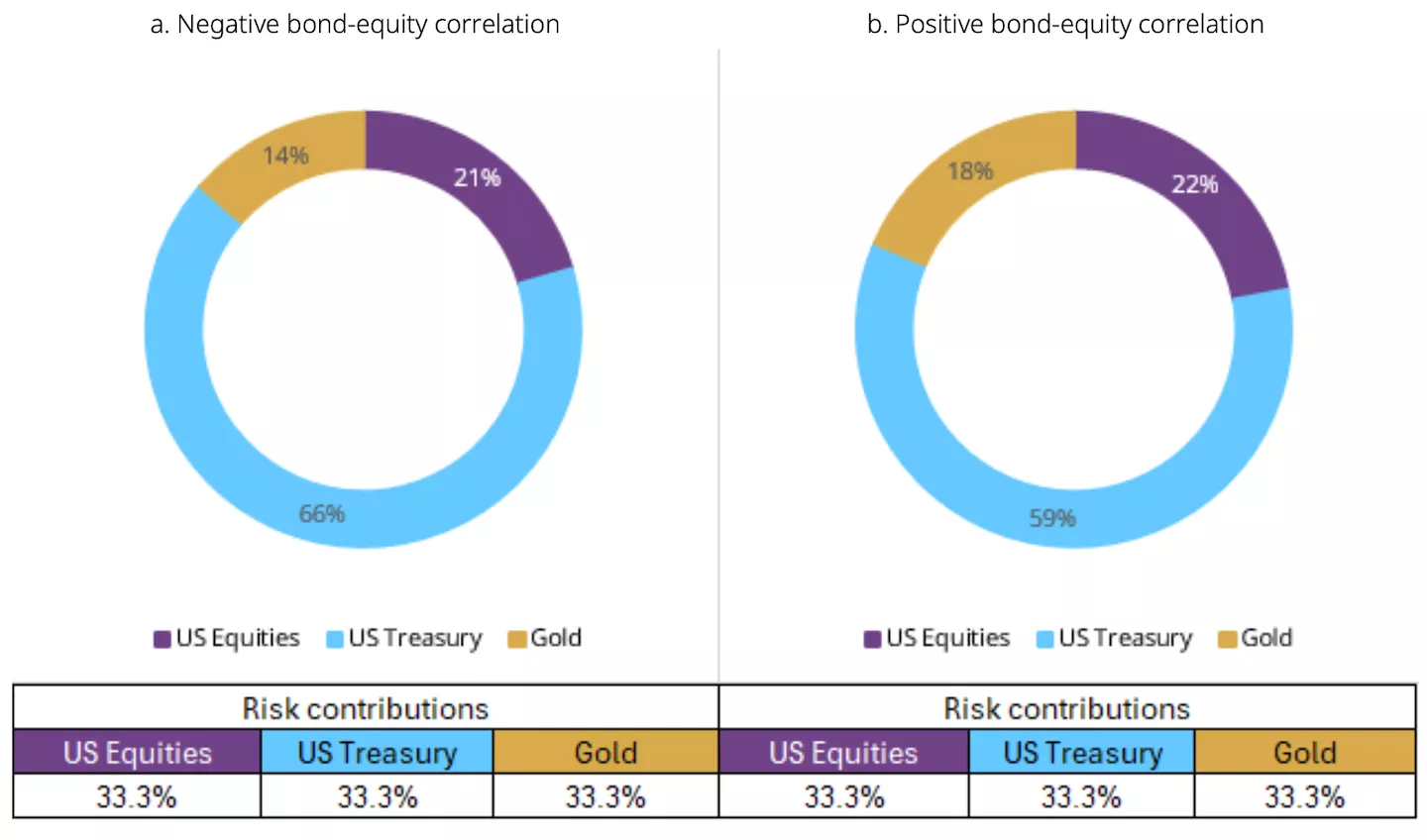

Another way of looking at this is through the lens of a risk parity optimisation which seeks to achieve equal contributions to risk across various asset classes. As the correlation between bonds and equities rises so does their contribution to portfolio risk. In this scenario the optimal amount of gold again needs to rise to redistribute the risks equally (Chart 7).

Chart 7: More gold is required in a positive bond-equity correlation environment to equalise the risk contributions of portfolio assets

Hypothetical portfolios weights in a:

*Optimal weights based on a risk parity optimisation using monthly data for the specified assets from 31 January 1973 to 30 April 2025

Source: Bloomberg, World Gold Council

Conclusion

The negative correlation between returns from stocks and from bonds – once the cornerstone of a balanced portfolio is in a state of flux due to the volatile inflation backdrop. In terms of the implications for diversifying investor portfolios, it remains unclear where the equity-bond correlation will settle. But recent changes in the macroeconomic landscape call for a cautious approach. For those investors that don’t hold gold, this might prompt them to broaden their sources of diversification. For those investors that already hold gold, it might mean increasing their allocation. Especially if approaching geopolitical risks materialise and bring stagflationary concerns to the fore once again.

Footnotes

1While further analysis is required to determine the extent of gold’s increase in a broader portfolio, our previous research would suggest that is would result in a higher allocation due to gold’s effective diversification benefits across different environments.