Johan Palmberg

Senior Quantitative Analyst World Gold CouncilLet's Tally the Rally

Delaying our Gold Market Commentary until after the possibly volatility-inducing US election, we instead take stock of some interesting statistics regarding October's and the year-to-date stellar run-up in gold prices.

Ray Jia

Head of Research (Asia Pacific, ex-India) and Deputy Head of Trade Engagement (China) World Gold CouncilMarissa Salim

Senior Research Lead, APAC World Gold CouncilAsset allocation implications in today’s chaotic world

Geopolitical risks have been elevated in recent years. And our analysis shows that spikes in geopolitical risk usually lead to equity market sell offs. While risk assets suffer during these periods, gold has delivered robust returns as an effective portfolio risk diversifier. And we believe gold can continue to benefit investors’ portfolios in today’s world as a geopolitical risk hedge and return enhancer following its stunning performance y-t-d.

Juan Carlos Artigas

Regional CEO (Americas) and Global Head of Research World Gold CouncilGold among top 2023 performers

Gold finished the year on a high, literally and metaphorically, as the LBMA Gold Price PM reached a new historical record of US$2,078.40/oz on 28 December – the final afternoon auction of 2023.

Adam Perlaky

Former Senior Analyst, Americas World Gold CouncilDrivers behind the recent gold rally

Gold rallied nearly 4% in December, mainly in the second half of the month, and recently moved to an intraday high of US$1,613/oz as the US-Iran confrontation unfolded. We believe there are a few likely reasons for the move...John Reade

Senior Market Strategist World Gold Council2019 Outlook: Will Gold Shine Amidst Murky Markets?

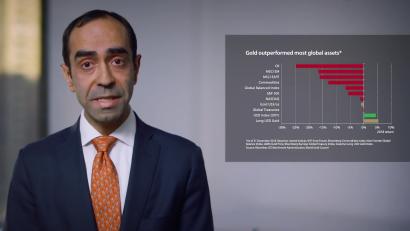

Against the backdrop of turbulent markets, geopolitical risk and Fed rates hikes, gold closed 2018 on a strong note, outperforming most global asset classes. World Gold Council’s Joe Cavatoni and John Reade discuss 2018 trends and explore key dynamics likely to influence gold performance in 2019.