Gold rallied nearly 4% in December, mainly in the second half of the month, and recently moved to an intraday high of US$1,613/oz as the US-Iran confrontation unfolded. We believe there are a few likely reasons for the move:

- A technical breakout

- Bullish positioning in derivatives markets

- Light trading volumes

- Portfolio rebalancing at the end of 2019 especially as investors hedged risk asset allocations

- Federal Reserve (Fed) repo activity

- Increased geopolitical risk

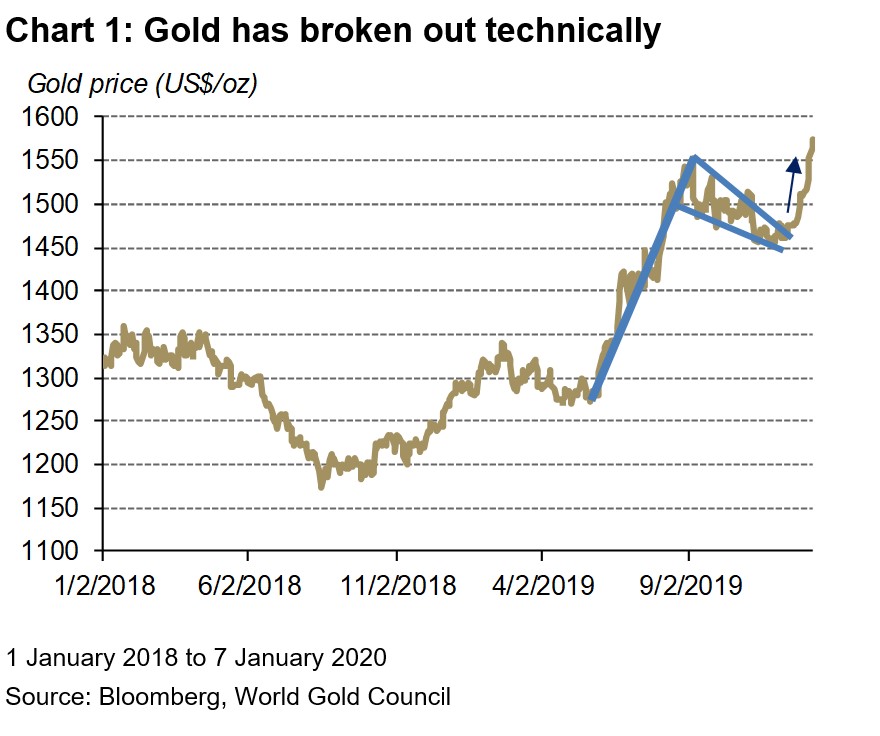

A technical breakout

The gold price was at a pivotal level in early December, near the top of the 50-day moving average as well as a bullish pennant1 formation (Chart 1). As gold moved above US$1,500/oz and the moving average the breakout was confirmed, suggesting the price would move to the top of the pennant around US$1,575/oz – effectively where it topped out.

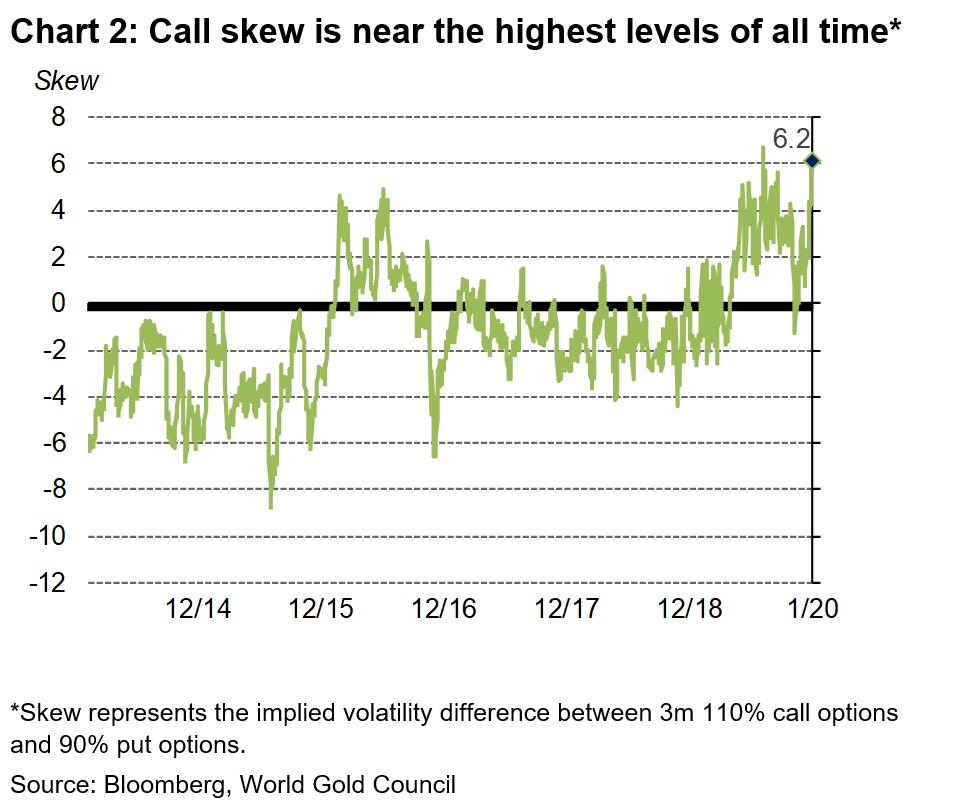

Bullish positioning in derivatives markets

Investors were actively buying upside call options in gold during December. In particular, the purchases were significantly out of the money (OTM), as a long volatility position. This type of positioning typically requires dealers who are selling volatility to the investor to hedge their trade by buying gold, potentially pushing the price higher. This bullish positioning was also reflected by the options volatility skew2 that reached an all-time high in Q4 2019 (Chart 2). This positioning often signals that market participants expect a higher likelihood of a price increase.

Light trading volumes

Gold trading volumes moved sharply higher in November, reaching US$170bn a day – well above the 2019 average of US$145bn. However, this reversed significantly in December, falling 26% to US$126bn a day. The lower volume may have reflected fewer willing sellers toward the end of the year, providing support for a larger move to the upside.

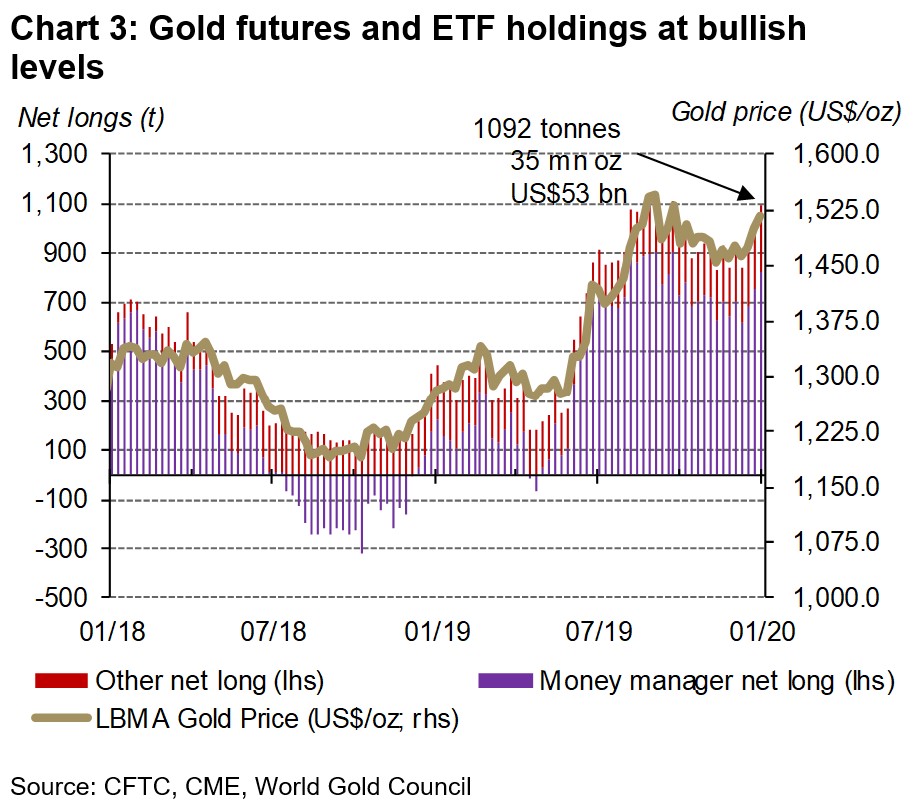

Rebalancing ahead of 2020

We saw a pullback in investor demand for gold in November, as demonstrated by outflows in gold-backed ETFs and a reduction in COMEX net longs. This reversed in December, with net longs moving back near all-time highs and gold-backed ETF holdings reaching all-time highs (Chart 3).

Anecdotal evidence suggests that investors may be inclined to maintain exposure to risk-on assets such as stocks, but not without hedging their portfolios in preparation for potential pullbacks – especially given the high level of geopolitical and geo-economic risks that have been carried over from 2019. And data suggests that gold may be a recipient of some of this activity.

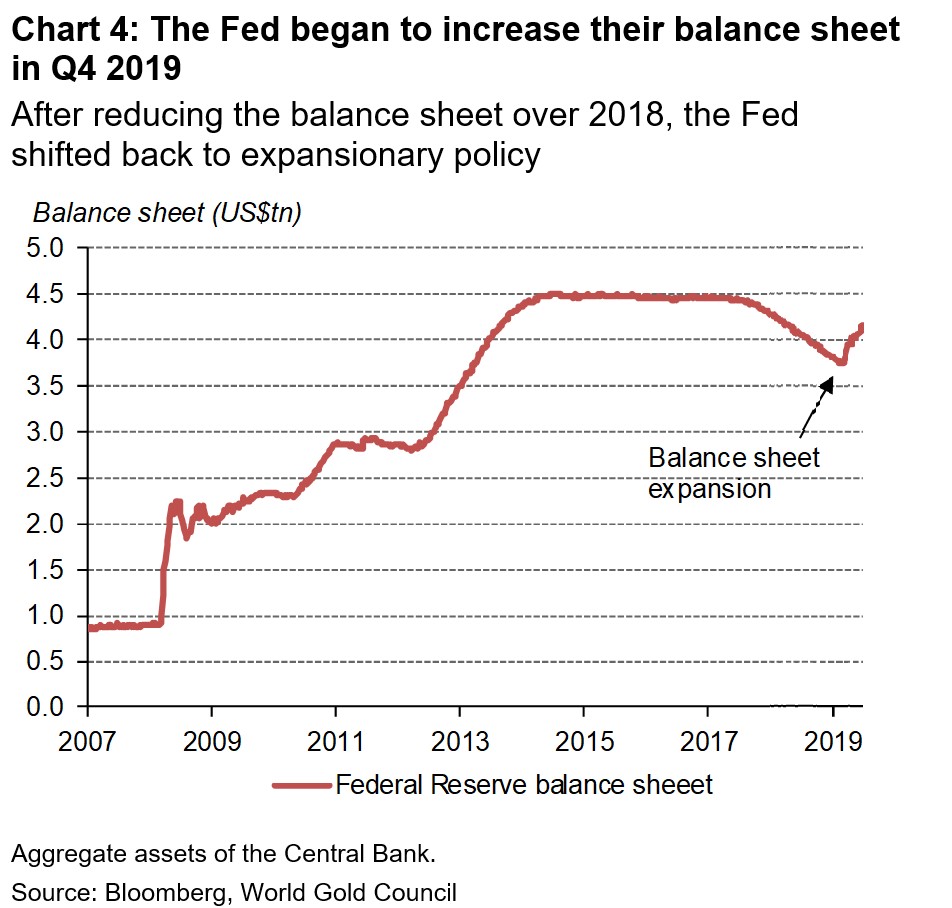

Fed repo activity

The Fed began reducing their balance sheet in 2018, but reversed this decision in the second half of 2019 (Chart 4). In particular, they began regular repurchase (repo) market injections totaling nearly US$500bn in the fourth quarter. This activity has continued into 2020 and has been described by some market participants simply as another form of quantitative easing (QE) – often dubbed “QE light” – and causing some investors to worry about liquidity in the Treasury market as a whole. And, historically, expansions of QE have led to increases in the gold price.

Increased geopolitical risk

Tensions in the Middle East, driven by the US-Iran confrontation, supported safe-haven flows, pushing the gold price to a six-year high. While a more conciliatory tone by President Trump has recently eased concerns and pushed the price down to the US$1,550/oz level, gold remains up by approx. 2.4% as of 9 January 2020.

Footnotes

1 Pennants are continuation patterns where a period of consolidation is followed by a breakout: https://www.investopedia.com/terms/p/pennant.asp.

2 The skew, computed as the difference in premia paid between puts and calls at equivalent strikes, implies that market participants were willing to pay a significant premium for upside versus downside exposure.