Gold finished the year on a high, literally and metaphorically, as the LBMA Gold Price PM reached a new historical record of US$2,078.40/oz on 28 December – the final afternoon auction of 2023.1

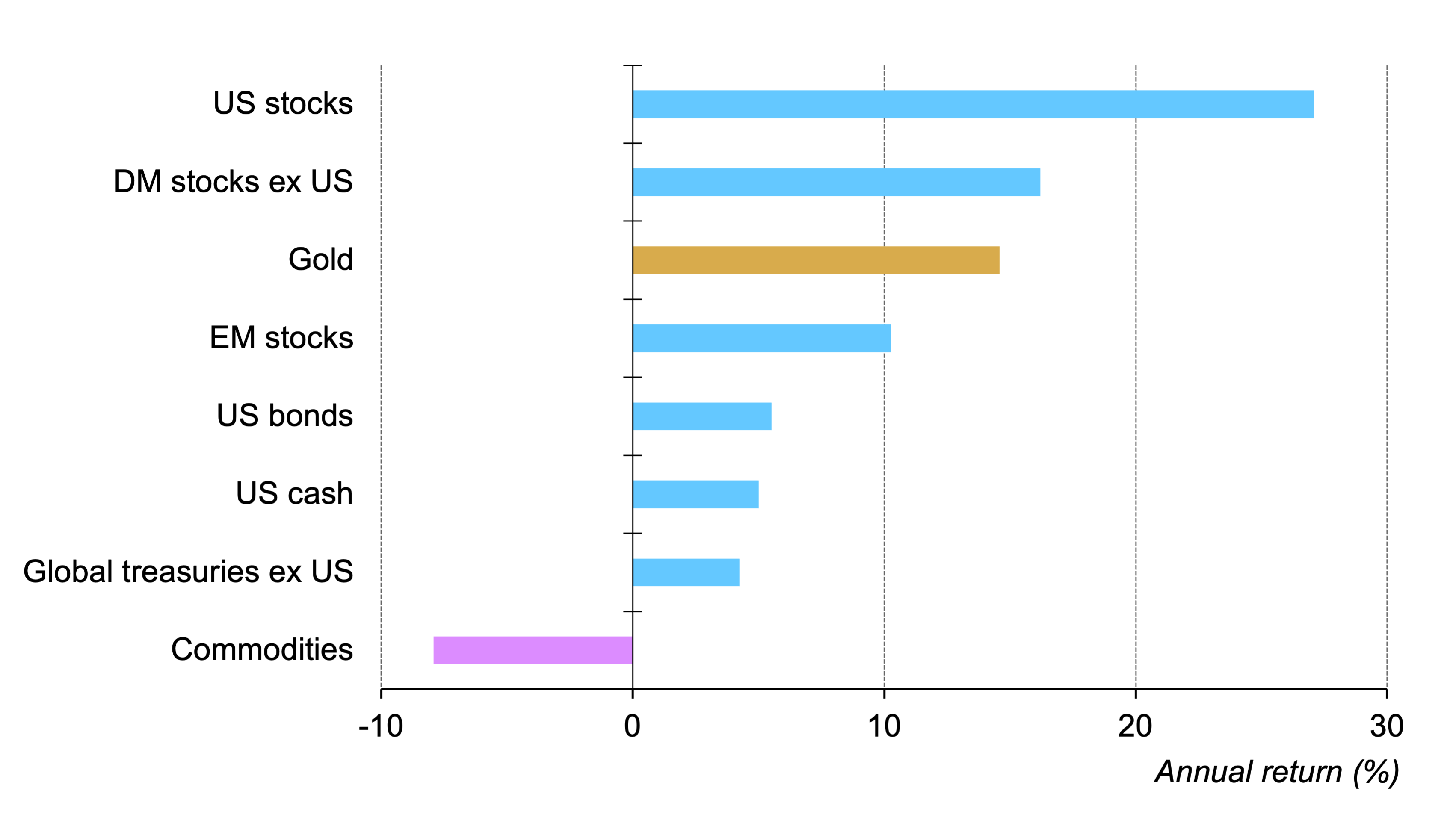

Gold rose 14.6% on the year, defying expectations amid a high interest rate environment and outpacing commodities, bonds and emerging market stocks.

Gold’s positive performance was linked to a combination of factors:

- Strong central bank demand

- Robust retail demand in key markets

- And increased geopolitical risk, especially in the last part of the year.

Stay tuned for our upcoming Gold Market Commentary, scheduled for 9 January, for a deeper dive into the factors behind gold’s feat and our near-term expectations.

In the meantime, you can read our Gold Outlook 2024, where we explore three likely economic scenarios for this year and their impact on gold.