Summary

- The Shanghai Gold Benchmark price fell slightly in October as the appreciating USDCNY offset the rise in US dollar-denominated gold price. This pushed the local gold price to a discount, the first in 12 months

- Impacted by the weak performances of CNY-denominated gold prices, speculative demand dropped further. Trading volume of Au9999 continued its decline during the month on weaker physical gold demand

- During the first ten months of 2019, China’s gold imports dropped by 41% y-o-y

- Three new gold-backed ETFs were approved in October, raising the total number of gold-backed ETF products in China to seven

- The People’s Bank of China (PBoC) didn’t purchase any gold in October, leaving its gold reserves at 1,948t.

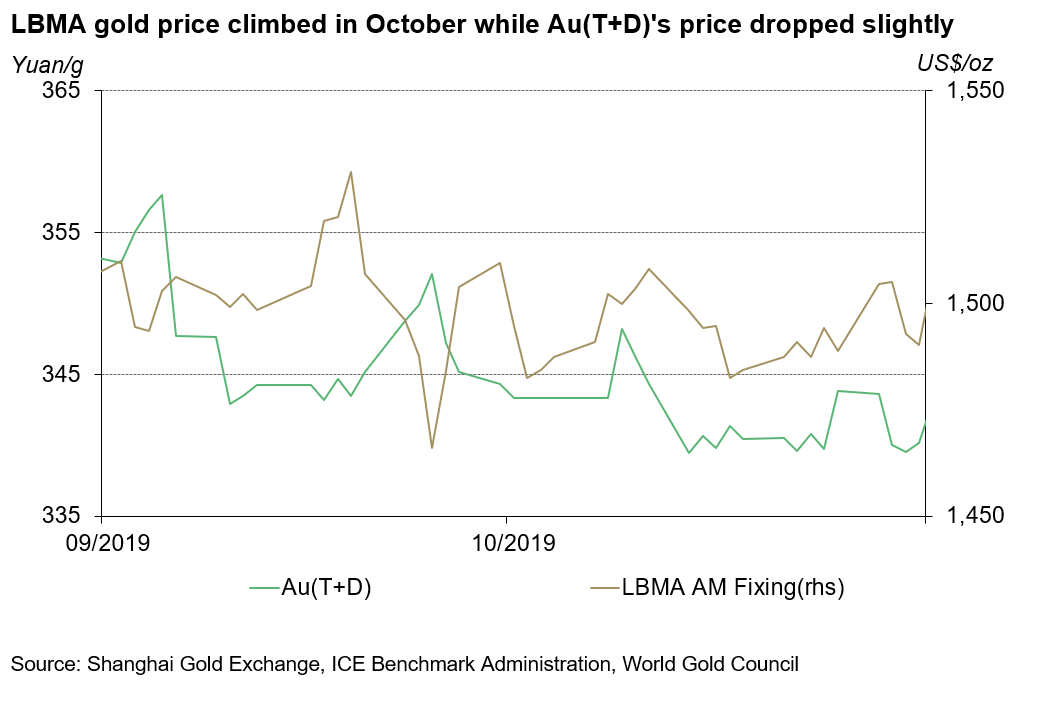

While US dollar gold prices climbed in October, CNY-denominated gold prices saw fractional declines. The LBMA Gold fixing AM rose by 2.8% in October. In contrast, the Shanghai Gold Benchmark (PM) and Au(T+D)’s prices fell by 0.8% and 1% respectively in October. The USDCNY’s appreciation of 1.4% and the US dollar’s depreciation of 2.1% during the month were the major reason behind this difference in prices.

China’s economic slowdown continued in October. Growth in key economic indicators such as social financing, retail sales, industry-added value and PPI continued their decline in October. And driven by the surge in the pork price, October’s CPI jumped by 3.8% y-o-y, the highest in seven years. As mentioned in our most recent Gold Demand Trends, the slowdown in China’s economy and the rising inflation have squeezed consumers’ budgets, hampering China’s physical gold demand as a result.

Au(T+D)’s trading volume fell to 1,153t in October, extending its decline since August when the volume reached record high of 2,894t. While this 38% m-o-m drop can be partially be attributed to fewer trading days last month due to the National Day holiday, the weak CNY-gold price performance also discouraged some speculators1. And the latter has been reflected in the 31% m-o-m decrease in the contract’s average daily trading volume in October.

The trading volume of Au9999 totaled 221t in October, 22% lower m-o-m. Y-t-d, the total trading volume of the physical contract in 2019 has fallen by 23% y-o-y2. This was a result of a weaker physical demand: as our Gold Demand Trends discussed, both jewellery and physical investment demand witnessed sizable contraction in China this year.

The local gold premium turned negative during October for the first time in one year. As discussed above, the appreciating CNY and the depreciating US dollar were responsible for this significant drop in local gold price premium. Driven by positive signs after another round of China-US trade negotiation in mid-October, USDCNY appreciated by 1.44% during the month, weakening CNY-denominated gold prices as a result.

China’s gold imports fell to 35t in October, 27t lower m-o-m3. China has imported 795t of gold as of October in 2019, 41% lower y-o-y.

Gold withdrawals from the SGE in October totalled 91t, 26t lower than September. After the increase in gold loadouts from the SGE in September, the amount dropped in October. Ahead of the 7-day National Day holiday early October, jewellery manufacturers withdrew enough gold from the SGE in September to ensure ample supplies to jewellers. This stock load-up in advance led to a fall in the SGE’s gold withdrawals in October.

But Chinese jewellers didn’t see any sales boost during the long National Day Holiday as expected this year. As we mentioned in our Gold Demand Trends Full year and Q4 2018, the relevance of the golden week holiday as a shopping occasion has been fading as consumers prefer experiential purchases now. As a result of this increasingly visible trend and a weaker physical demand overall, gold withdrawals from the SGE dropped by 45% and 52% y-o-y in September and October respectively.

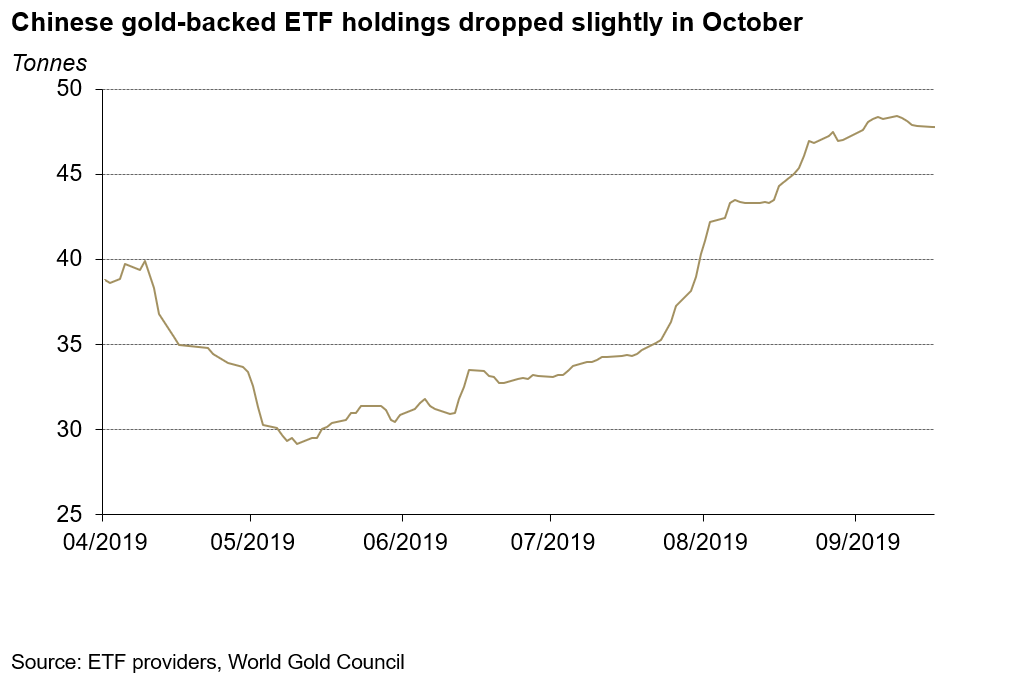

The four Chinese gold-backed ETFs’ holdings totalled 49.7t as of 30 October, a marginal 0.1t decrease m-o-m. And after reaching a new record in September, Chinese gold ETFs’ total asset under management (AUM) in yuan came off slightly by the end of October. Profit taking could be the major reason behind this slight drop.

Chinese investors will have a wider range of gold-backed ETF products soon. The China Securities Regulatory Commission (CSRC) approved three new gold-backed exchange-traded funds late October, raising the number of Chinese gold-backed ETFs to seven. These new ETFs, fully backed by physical gold, will be provided by ICBC Credit Suisse Asset Management, China Asset Management and the First Seafront Fund Management and listed within the next nine months4.

The PBoC’s gold didn’t purchase any gold in October. After the ninth consecutive monthly gold purchase in September, the PBoC’s gold reserves remained during October, standing at 1,948t (2% of total reserves). China has added 95.8t of gold to its reserves so far in 2019.

Footnotes

1 Chinese markets were closed during the National Day holiday from 1 Oct. to 8 Oct.

2 For the differences in the demand the two contracts represent, please visit:

https://www.gold.org/goldhub/gold-focus/2019/06/tale-two-contracts-speculative-investment-physical-demand-down

3 Please refer to gold imports under HS code 7108 which includes gold (Including Gold Plated with Platinum), unwrought or In semi-manufactured forms, or In powder form

4 According to the CSRC, these fund companies have no more than nine months between the approval and the products’ listing.