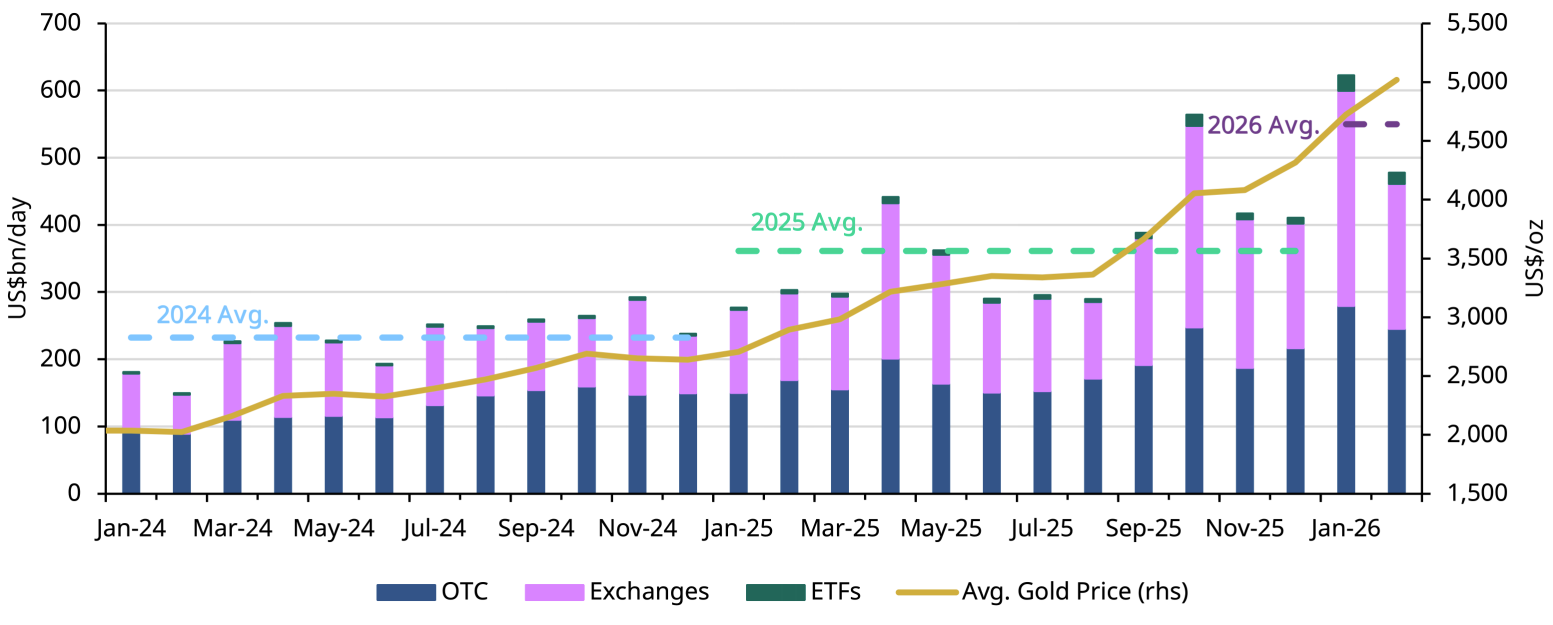

Volumes fall but remain elevated

Global gold market trading volumes7 eased from January’s record high, averaging US$478bn/day in February. Despite the pullback, activity remained robust – 32% above the 2025 average.8 The month‑on‑month decline largely reflected profit‑taking, lighter Asian participation during the Lunar New Year holiday, and gold trading sideways after recovering most of its early‑month drop (Chart 2).

Over‑the‑counter (OTC) volumes fell 12% m/m to US$245bn/day, driven by softer LBMA spot trading but still elevated by historical standards. Derivatives activity on major exchanges also moderated: after averaging US$336bn/day in the first week of February, volumes trended lower and ended the month near US$151bn/day. A similar pattern emerged in global gold ETFs, with trading averaging US$28bn/day early in the month before dropping by more than half to around US$12bn/day by month‑end.

Tonnage‑based volume reflected the broader slowdown, averaging 2,969t/day in February – down 26% m/m and below the 2025 average of 3,247t/day. Exchange trading accounted for most of the decline, falling 34% m/m to 1,345t/day.

Positioning data showed a reduction in total COMEX net longs, which fell 21% during the month to 504t.9 There was a modest build in the week ending 20 February, but the delayed release of the COT report means data for the final week – during which gold rallied amid heightened tensions between the US and Iran – is still unavailable. Money manager net longs decreased 18% to 311t, while Other net longs declined 27% to 194t.

Chart 2: Gold volumes pull back but remain elevated relative to 2025 levels

Average daily trading volumes by segment*

*Data as of 28 February 2026. Gold price based on the monthly average LBMA gold price PM USD.

For more information on trading volumes please visit our Trading Volumes page on Goldhub: Gold Trading Volume | Gold Daily Volume | World Gold Council.

Source: Bloomberg, Nasdaq, COMEX, ICE Benchmark Administration, Shanghai Gold Exchange, Shanghai Futures Exchange, ETF providers, Multi Commodity Exchange of India, Dubai Gold & Commodities Exchange, Japan Exchange Group, Thailand Futures Exchange, Borsa Istanbul, Bursa Malaysia, Korea Exchange, World Gold Council