- Inflation is on the rise in China, reaching 2.8% in August 2019, the highest in 18 months; leading economists expect it to rise further by the end of the year

- African swine flu has wiped out a third of China’s pig livestock since last August, contributing substantially to the rising inflation

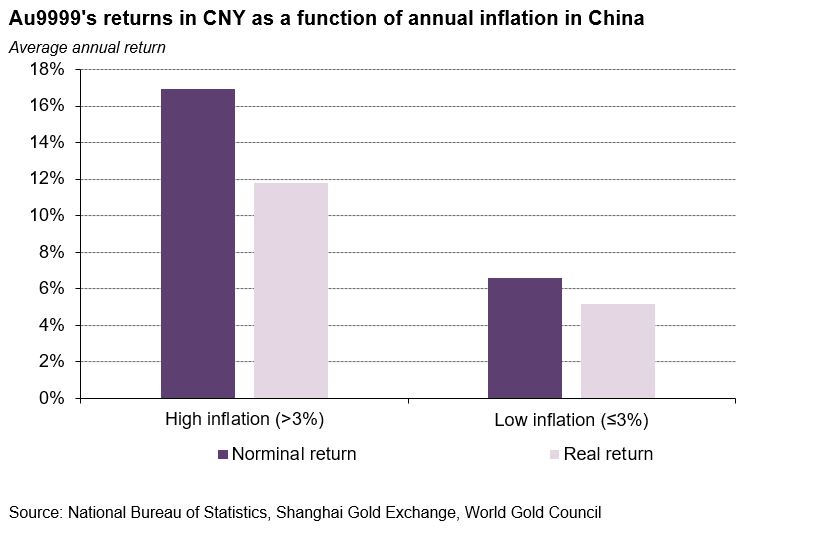

- Looking back at history, when inflation rose above 3% the nominal return of the local gold price has averaged 17%

Gold and inflation in China

Gold is well known for its inflation hedging properties. During periods of higher inflation – higher than 3% – the gold price has risen in both the US and the UK, by an average of 15% and 12% respectively.1

And it’s the same story in China. During the past 17 years, the annual nominal return of Au9999 – the physical gold contract traded on Shanghai Gold Exchange since 2002 – averaged 17% during years when inflation rose above 3%.2

Based on y-o-y changes of Au9999 gold price and China’s CPI between 2002 and 2018. For each year on the sample, real return = (1+nominal return)/(1+inflation)-1.

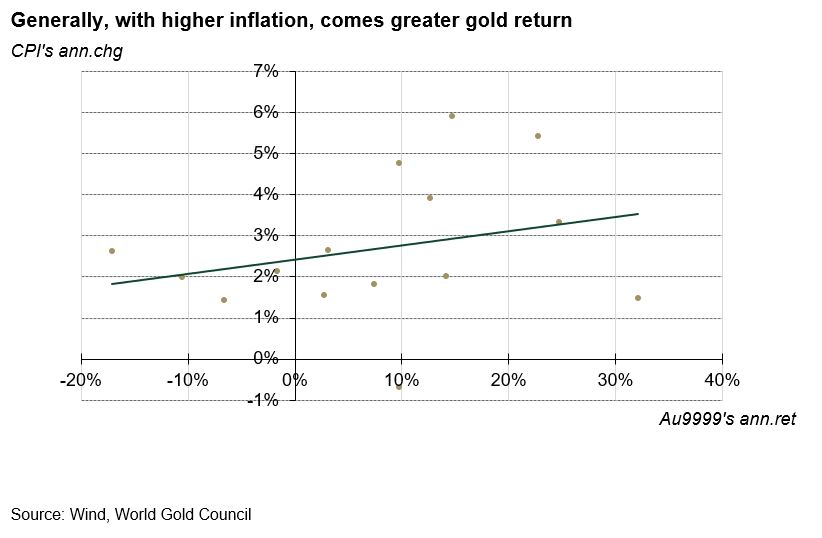

Looking at the scatter chart between gold and inflation in China, it becomes more obvious: gold has provided greater returns when inflation has been higher during most of the years since 2002.

Based on y-o-y changes of Au9999 gold price and China’s CPI between 2002 and 2018.

Inflation on the rise

Inflation has been on the rise in China since the start of 2019. The Consumer Price Index (CPI) rose by 2.8% y-o-y in August, the highest in 18 months. And leading economists think this trend may continue. Dr. Lu Zhenwei, Chief Economist at China Industry Banking Group, and Dr. Li Chao, Chief Macro-Economist at Huatai Securities both expect inflation to edge higher by the end of the year.

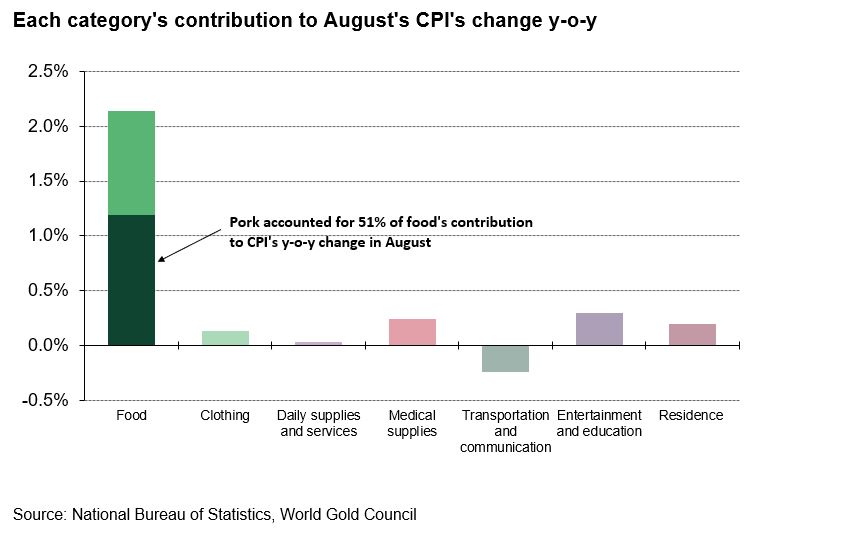

Rising prices for staples, especially pork and fruits, have been the main contributor for the overall rise in CPI. While the weather’s negative impact on major fruit supplies - the main reason pushing fruits’ prices up - is diminishing, pork remains the most important factor pushing CPI higher. To understand the reason behind this, we first need to take a look at the components of China’s CPI.

Despite accounting for just 2.3% of the CPI basket, nearly 40% of August’s CPI y-o-y increase came from the rapid rise in pork prices. Furthermore, pork accounted for 89% of August’s 0.7% m-o-m rise in CPI. This was the result of the swift climb in pork prices seen in the past few months due to a sliding supply. And there is no real substitution for pork in Chinese diets.

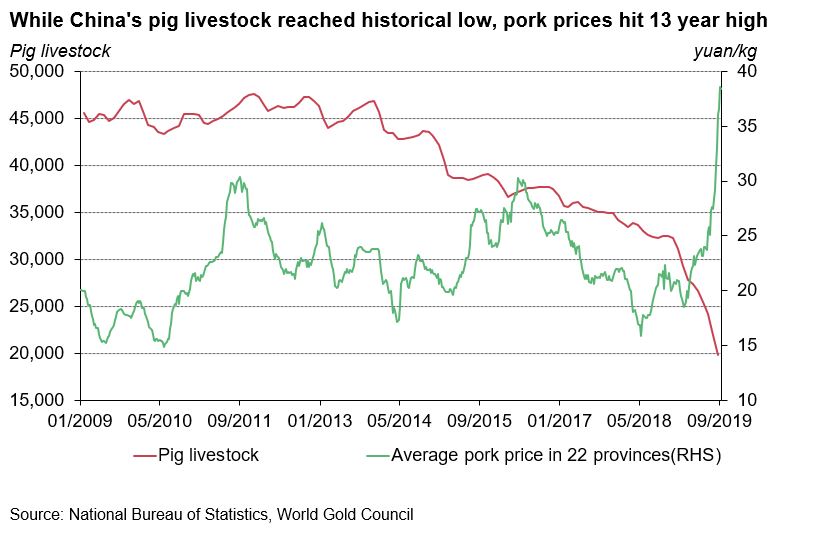

African Swine Fever (ASF), a highly contagious virus harmless to humans but fatal to pigs, has been devastating China’s pork supplies since August 2018. With no effective vaccine or cure, ASF has been reported in 31 provinces with over 150 outbreaks as of July 2019. Pig livestock in July 2019 fell to 219 million, 32% lower y-o-y and the lowest level in ten years. This has led to a 6% drop in China’s pork supply to consumers during the first half of 2019, biggest drop in ten years. Consequently, the average weekly retail pork price in 22 major provinces rose by 76% y-o-y as August ended, to its highest level for 13 years.

Outlook

As inflation picked up steam, real yields on China’s 5-year treasury notes have also dropped – from 1.03% last August to 0.13% this August on average.3 Real rates could drop further as People’s Bank of China lowered reserve requirement rates for banks earlier this month and the PBoC also made moves in cutting the loan prime rate recently. While falling real rates are making treasuries less attractive, the opportunity cost of holding gold is significantly lowered.

Although measures have been taken to stabilise pork supplies and imports have increased significantly, the recovery from a loss this severe will be a slow process – concerns for even higher pork prices are unlikely to fade any time soon.4

As such, gold’s inflation hedging role couldn’t be more relevant in China. And as shown above, during periods of higher inflation – we’re not there yet, but close – gold’s performance has been meaningfully higher than other years. Coupled with falling real rates, China’s gold’s investment demand could be further supported in the short-to-medium term.

Footnotes

1 For more details, please see: www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset-2019.

2 It is meaningful to compare local gold price with local inflation, and local gold contract Au9999 only started trading on the SGE 17 years ago.

3 Real rates refer to 5-year treasury’s average monthly nominal return minus inflation.

4 Pork imports only accounted for 3% of total pork consumption in 2018 and it will take time for these measures to take effect.