Key highlights:

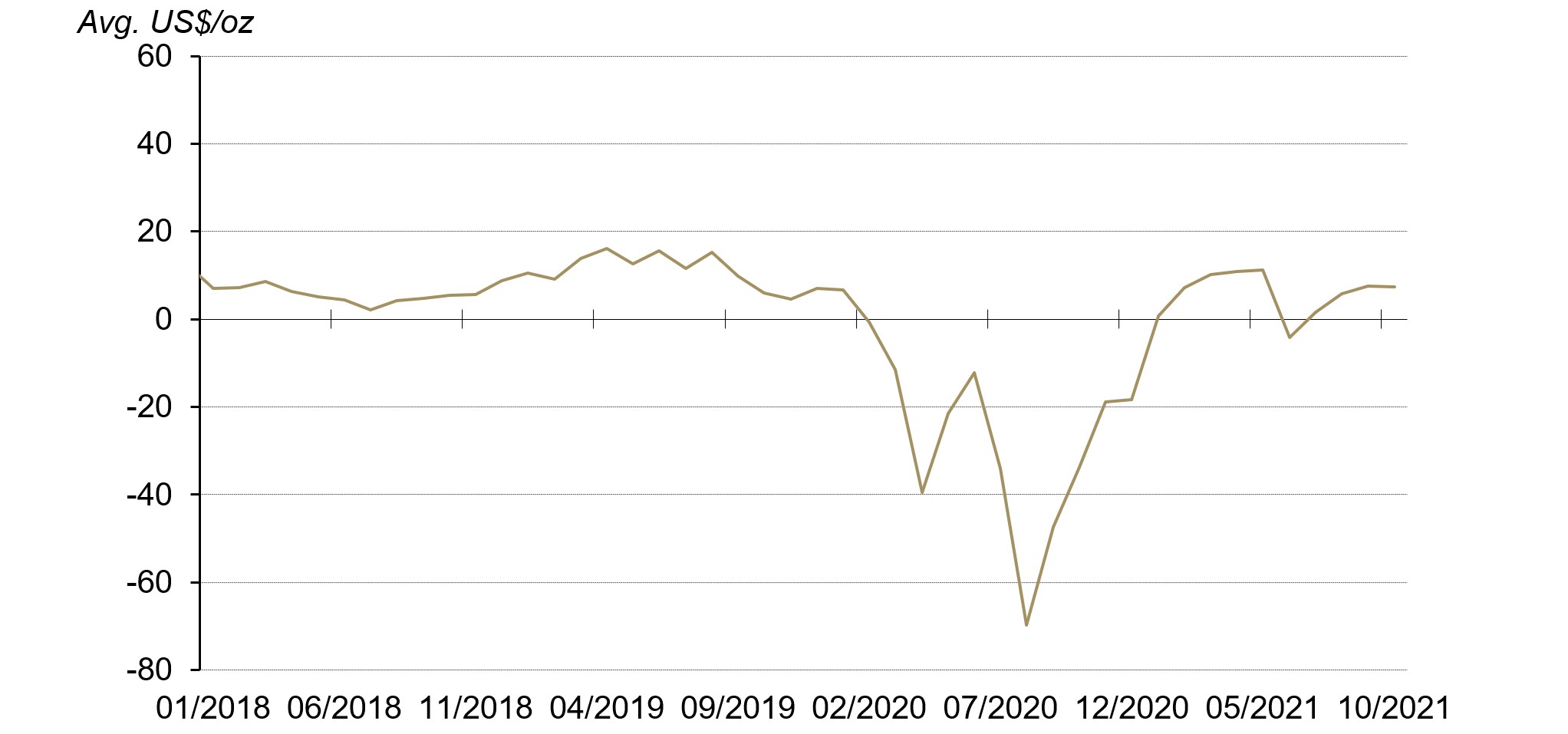

- Gold prices rose in October1. And the average local gold price premium stabilised at US$7.4/oz in the month as China’s physical gold demand remained steady2

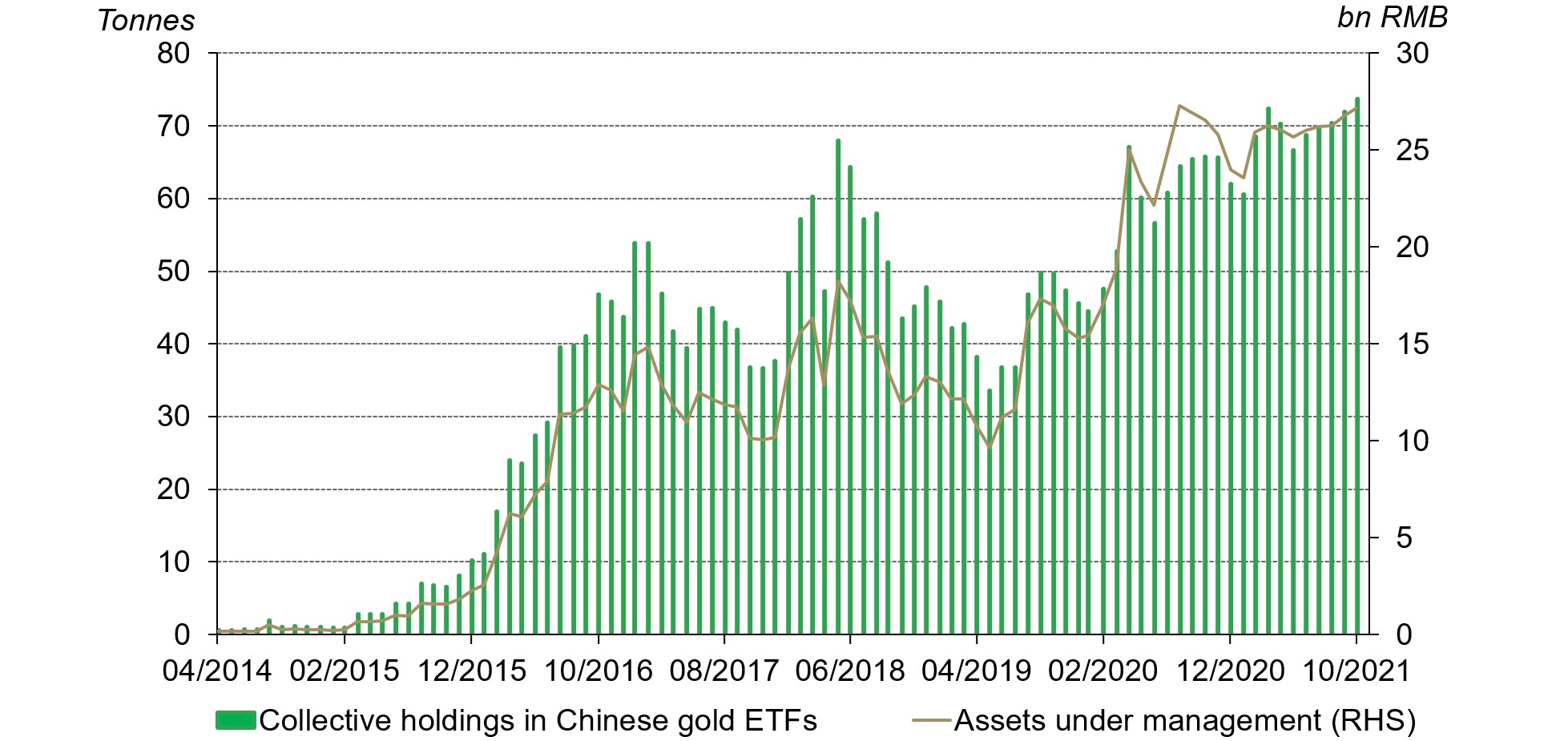

- After five consecutive monthly inflows, collective holdings in Chinese gold ETFs reached 74t (US$4bn, RMB27bn) at the end of October, the highest AUM on record in tonnage terms3

- Wholesale physical gold demand was robust: gold withdrawals from the Shanghai Gold Exchange (SGE) in October were higher than previous years while the latest data shows gold imports rose further in September.

Looking ahead:

- Economic uncertainties and a shift in local commercial bank sales from other products to physical gold bar and coin could provide support for China’s retail gold investment demand

- Seasonal strength in Chinese retail gold jewellery sales in coming months might be challenged by slowing economic growth and uncertainties caused by Delta variant outbreaks.

Gold prices rebounded and Shanghai-London spread stabilised

Gold prices rebounded in October mainly thanks to surging inflation expectations, rising net longs at the COMEX, and a weakening dollar in the month. The LBMA Gold Price AM in USD and the Shanghai Gold Benchmark Price (PM) in Chinese Yuan (CNY) rose 3.8% and 2.3% respectively. The appreciating CNY against the dollar might be the key driver of the weaker gold price performance in RMB relative to it.

The local gold price premium averaged US$7.4/oz in October, virtually unchanged m-o-m. As the seasonally strong quarter for China’s gold consumption unfolds, local physical gold demand remains elevated on the back of a robust Q3, supporting the Shanghai-London gold price spread.

Chinese gold ETF tonnage holdings set a new record

Collective holdings in China’s gold ETFs amounted to 74t (US$4bn, RMB27bn) at the end of October following five consecutive monthly inflows, the highest AUM on record in tonnage terms. Year-to-date inflows into Chinese gold ETFs reached 12t. The 2t inflow into Chinese gold ETFs during October drew support from two main factors:

- the steady rising gold price might have attracted trend-following local investors

- disappointing economic growth weighed on the risk appetite of local investors, leading to a 0.6% decline in the Shanghai Stock Exchange Composite Index and a 35% m-o-m drop in its daily trading volumes in the month.

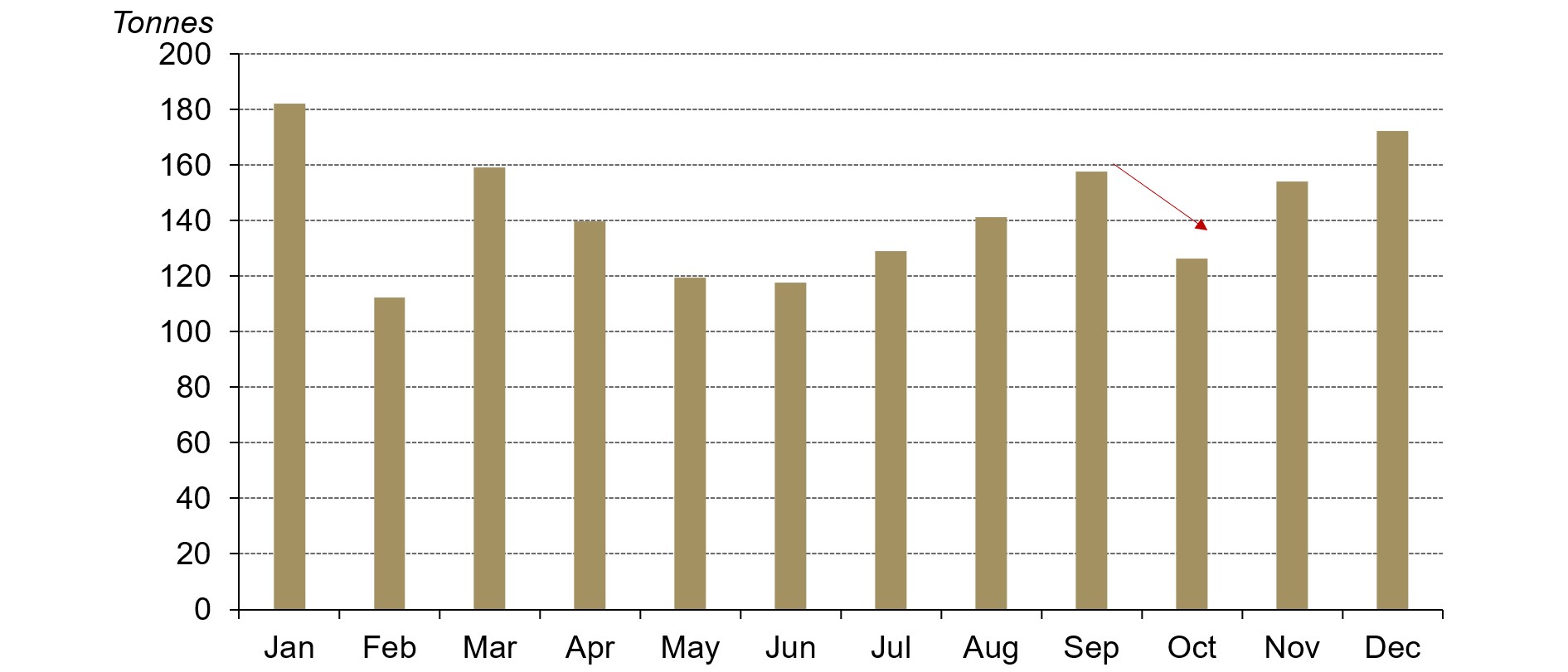

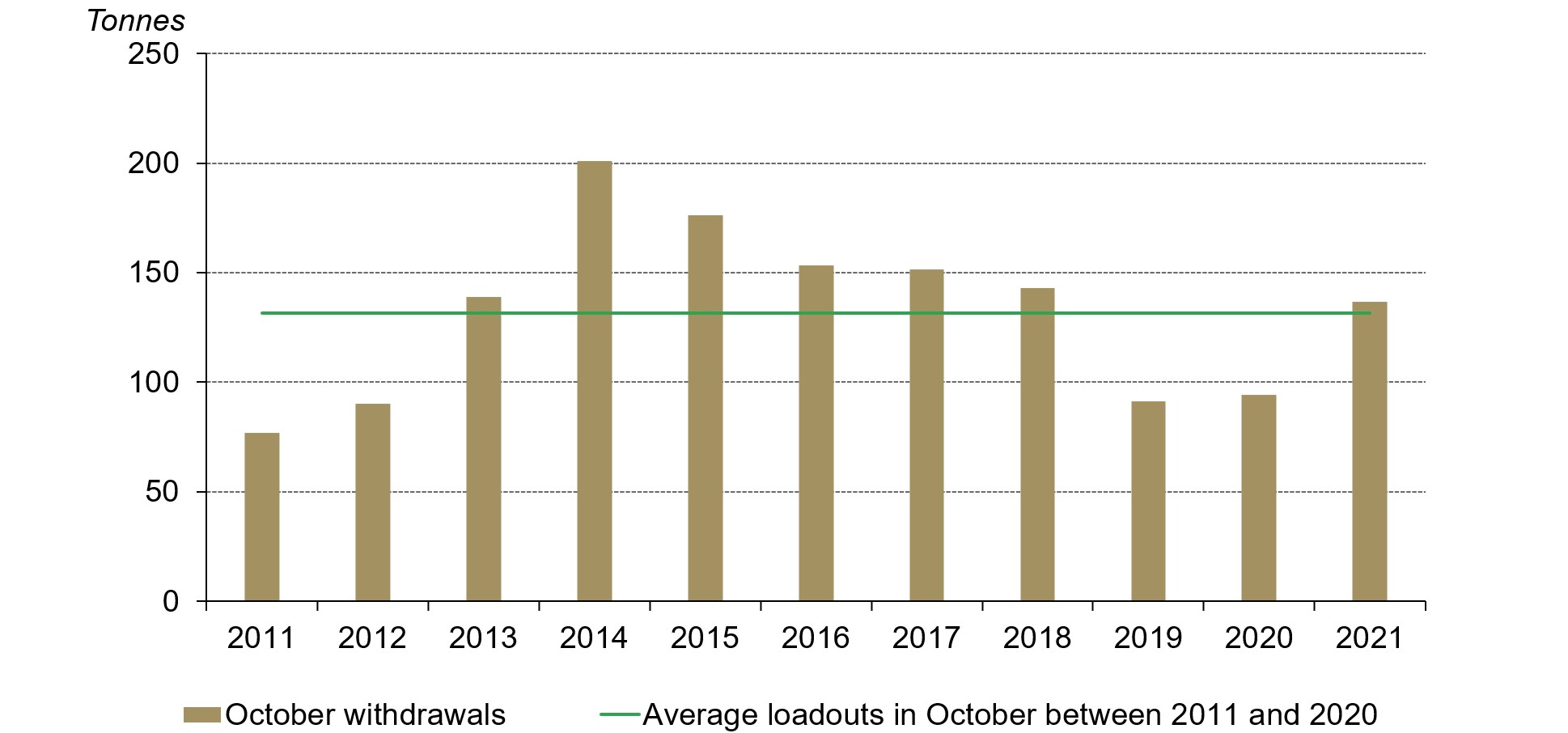

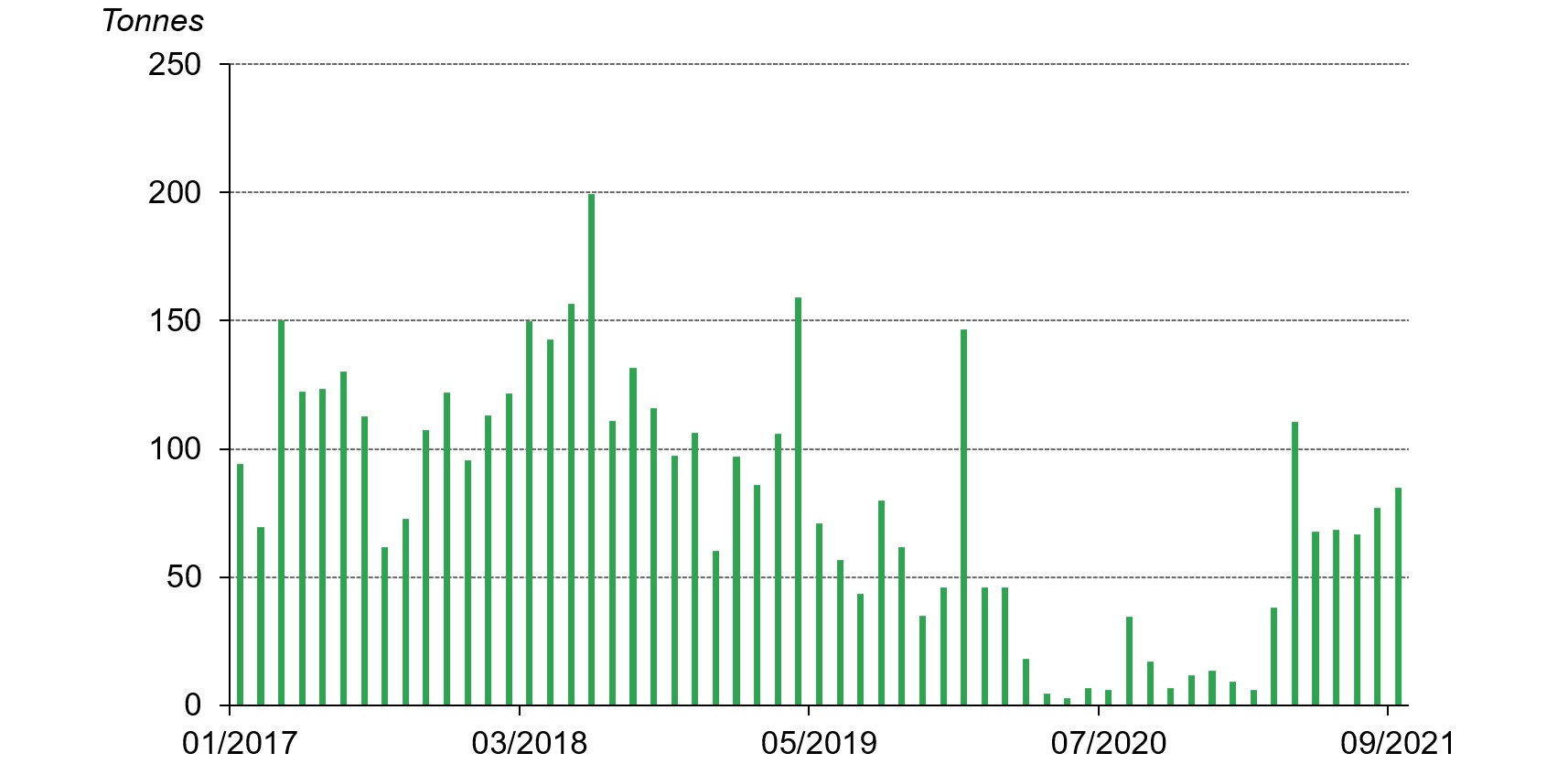

October’s wholesale physical gold demand is stronger than previous years, gold imports rose further in September

Gold withdrawals from the SGE totalled 137t in October, 28% lower m-o-m. This m-o-m decline is seasonal: physical wholesale gold demand in China tends to be lower in October as manufacturers’ stocks remain ample following their active replenishing in September. Also, fewer trading days in the month, due to the seven-day National Day Holiday between 1 October and 7 October, constitutes another key reason for the decline over the previous month.

Chinese wholesale gold demand tends to fall in October

Nonetheless, this October’s gold loadouts from the SGE were 45% higher y-o-y and 50% stronger than the pre-pandemic level in 2019 mainly due to:

- A combination of stronger gold consumption in Q3 compared to the same quarters in 2020 and 2019,

- Heritage gold jewellery’s popularity among young consumers has raised the industry’s expectation for Q44

- Local jewellers are including more products of heavier weight in their inventories as their adoption of the per-gram pricing model increases: chunkier products lead to higher profits using this method.5

As the latest data from China Customs shows, China imported 85t gold in September, 8t higher m-o-m. Similar to factors that drove up gold withdrawals in September, the appetite for gold imports usually rises prior to Q4 – which is the peak season for gold consumption in China.

This brings China’s total gold imports in the third quarter to 228t, 171t higher y-o-y and 43t higher than Q3 2019. There were two key drivers for this:

- China’s gold consumption in the third quarter was higher than both 2020 and 2019 during the same period, resulting in higher import needs

- China’s mined gold production has continued to fall over recent quarters and this, together with the significant curtailing of imports amid the COVID-19 related restrictions in 2020, meant that it was essential to replenish the nation’s gold inventory, especially in the face of robust demand.

You can find more details of China’s gold demand and supply in our recently published 2021 Q3 Gold Demand Trends report.

Looking ahead

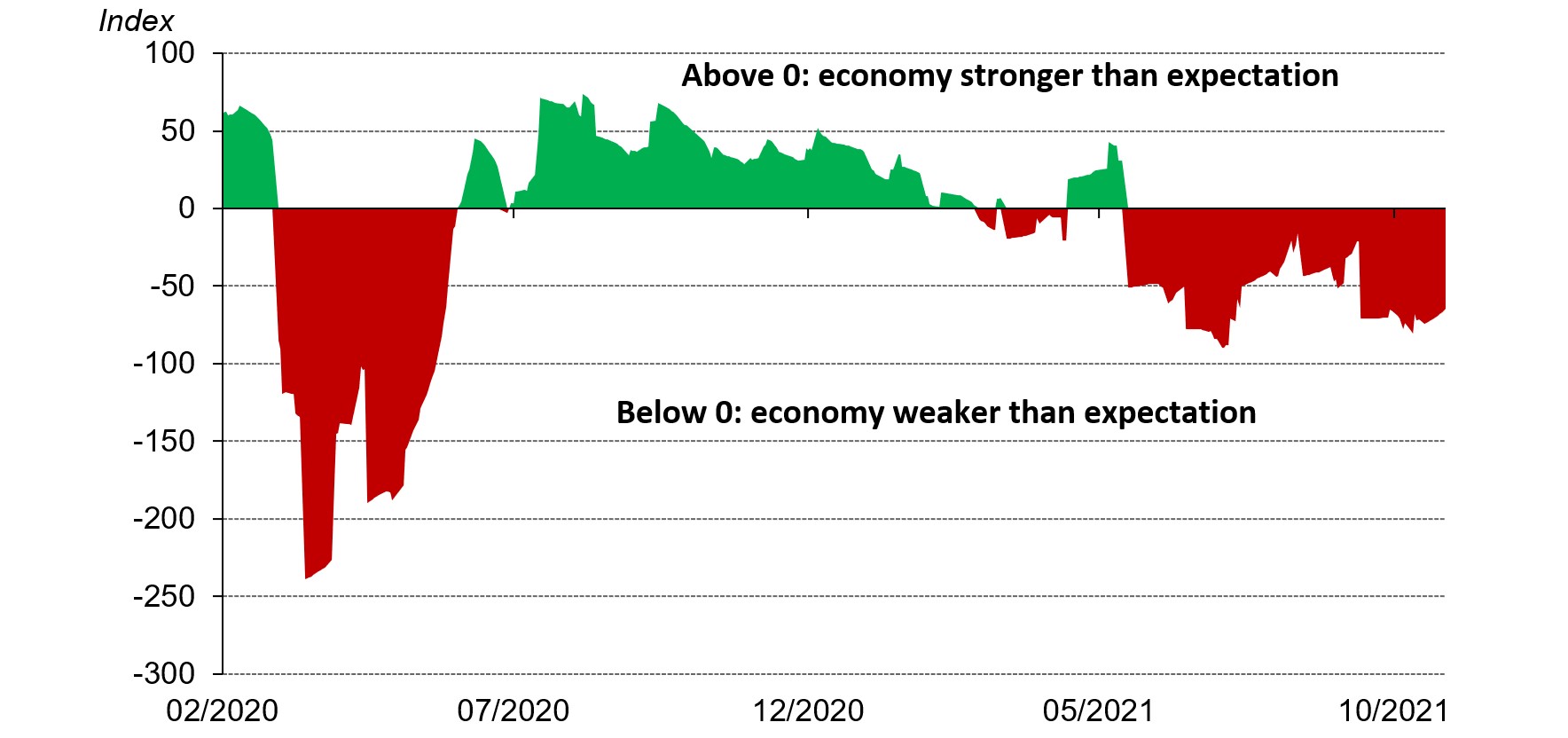

Economic growth uncertainties might bode well for China’s retail gold investment demand

As Q3 GDP growth slowed, concerns around future Chinese economic performance intensified. Factors such as sporadic COVID-19 outbreaks and the rising stagflationary-like pressure could cause local investor risk appetite to fall, leading to higher demand for safe-haven investments such as gold ETFs or other physical gold products.

Chinese economy has been disappointing investors lately

In addition, the shift in focus towards sales of physical gold products at local commercial banks – a key driver of China’s Q3 retail gold investment – could further support local demand for gold bars and coins.

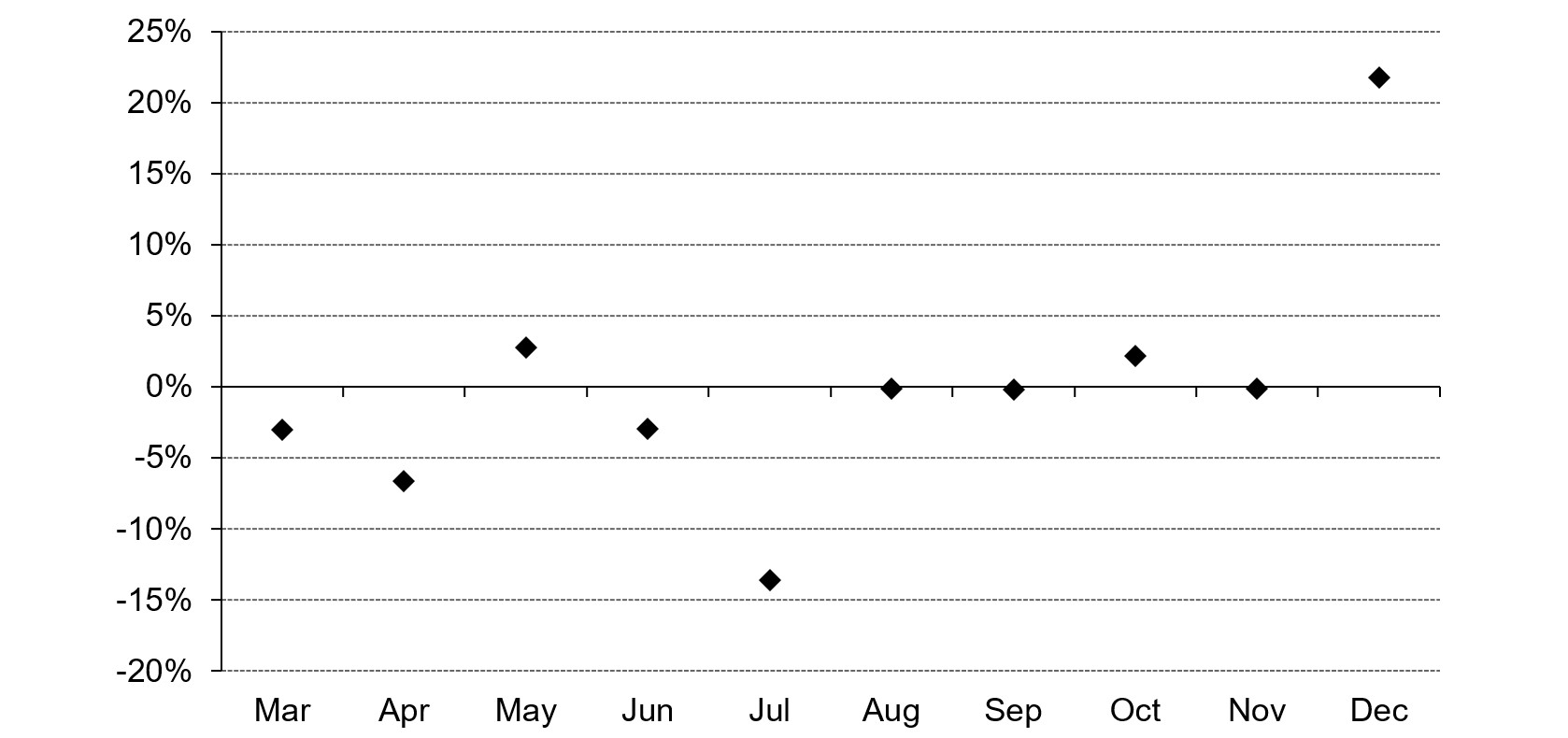

Seasonal strength in gold jewellery consumption might encounter some challenges

Looking ahead to the coming months the following factors should benefit local gold jewellery sales: historical patterns; the popularity of Heritage gold jewellery among young consumers; and the increasing efforts of local retailers to sell chunkier products – a result of the gradual shift in the gold jewellery pricing model as previously mentioned.

Even as the traditional peak season for gold jewellery sales unfolds, risks remain. Primarily, uncertainties around China’s economic growth could become a key challenge for China’s gold jewellery consumption as it is highly correlated with consumers’ disposable income. Alongside this, recent sporadic Delta outbreaks might cloud the outlook for gold jewellery retail sales. As such, we remain cautiously optimistic about China’s gold jewellery sales in coming months.

Q4's jewellery retail sales in China tend to be stronger

Footnotes

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange.

For more information about premium calculation, please visit our local gold price premium/discount page. The y-t-d average refers to the average daily local gold price spread between January and July.

Please note that the inflow/outflow value term calculation is based on the end of period Au9999 prices in RMB and the USD/CNY rate.

For more details, please visit: Gold Demand Trends Q3 2021 | World Gold Council.

For more information, please visit: Jewellery | World Gold Council.