Summary

- The Shanghai Gold Benchmark Price PM (SHAUPM) (RMB) and the LBMA Gold Price AM (USD) rose by 5.6% and 7% respectively in May1

- With the Producer Price Index (PPI) surging in May, the short-term inflationary pressure in China is increasing

- In general, investment demand for gold in China remained subdued in May:

- despite m-o-m rebounds, trading volumes of Au(T+D) on the Shanghai Gold Exchange (SGE) and gold futures on the Shanghai Futures Exchange (SHFE) remained low

- collective holdings in Chinese gold ETFs declined by 3.7t (US$7.9mn, RMB348mn) in the month

- Gold withdrawals from the SGE were seasonally lower in May

- The Shanghai-London gold price spread saw a gentle rise last month, averaging US$11.3/oz2

- Gold held by the People’s Bank of China (PBoC) remained at 1,948t at the end of May, accounting for 3.3% of total reserves; the Chinese central bank has kept its gold reserves unchanged since September 2019

- China’s gold imports in April surged3

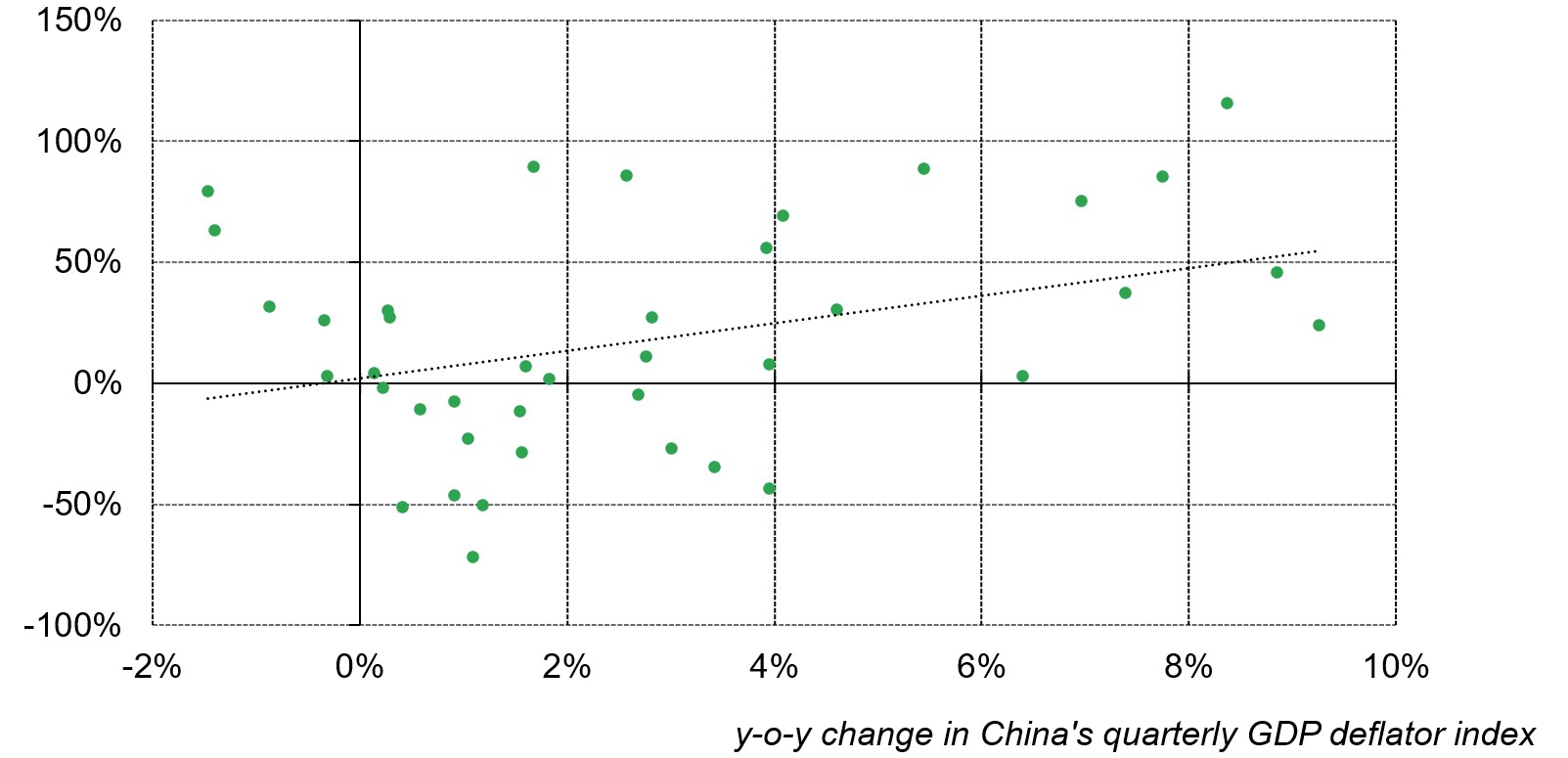

- Inflationary concerns could be supportive of future investment demand for gold in China.

International gold prices continued to rise in May. While the nominal yield remained stable, the 10-year treasury inflation-protected securities – a proxy of the real rate – fell further last month as investors’ inflation expectations continued to intensify. Coupled with a weak dollar, local gold prices saw sizable rises in the month, leading to relatively flat year-to-date performances. A strong local currency– the CNY appreciated by 1.7% against the USD – contributed to a weaker performance in the RMB gold price than the USD gold price.4

Gold prices continued to rise in May

Source: Shanghai Gold Exchange, ICE Benchmark Administration, World Gold Council

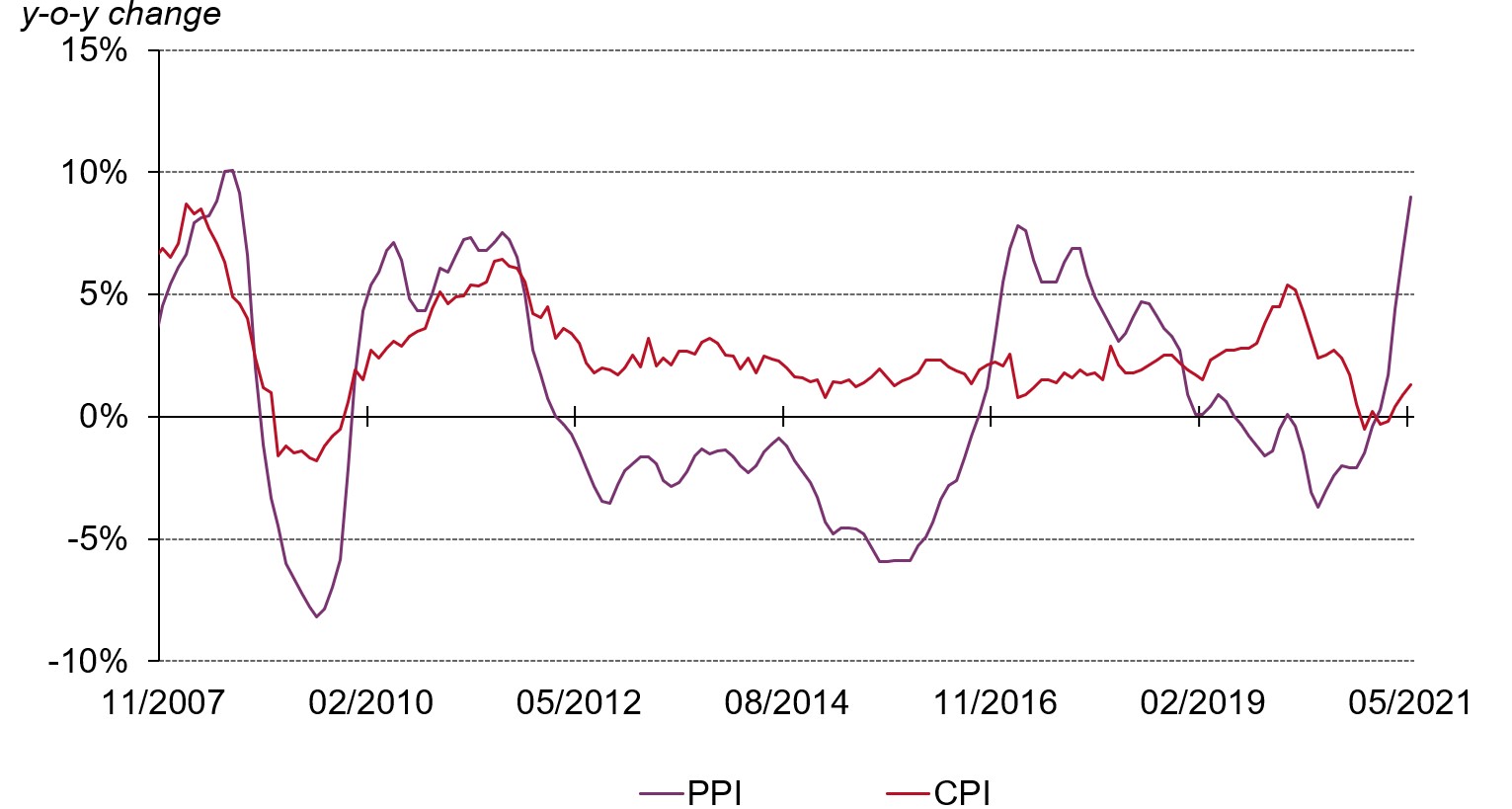

Short-term inflationary pressure is gradually building in China. Despite rises in recent months, the y-o-y change in China’s Consumer Price Index (CPI) has been mild so far in 2021, landing at 1.3% in May, significantly lower than the 2020 and 2019 averages of 2.5% and 2.9% respectively. In contrast, rising input costs have fuelled producer inflation; y-o-y growth in PPI surged to 9% last month – the highest since September 2008.

While the PPI was surging, China's inflation remained mild

Source: National Bureau of Statistics, World Gold Council

With commodity prices remaining stubbornly high and downstream industries suffering margin squeezes, consumers could face higher retail product prices soon, leading to higher inflation in China.5 Against such a backdrop, gold, as a strategic inflation hedge, is likely to gain local investors’ interest, potentially lifting demand for gold ETFs, bars and coins in China.

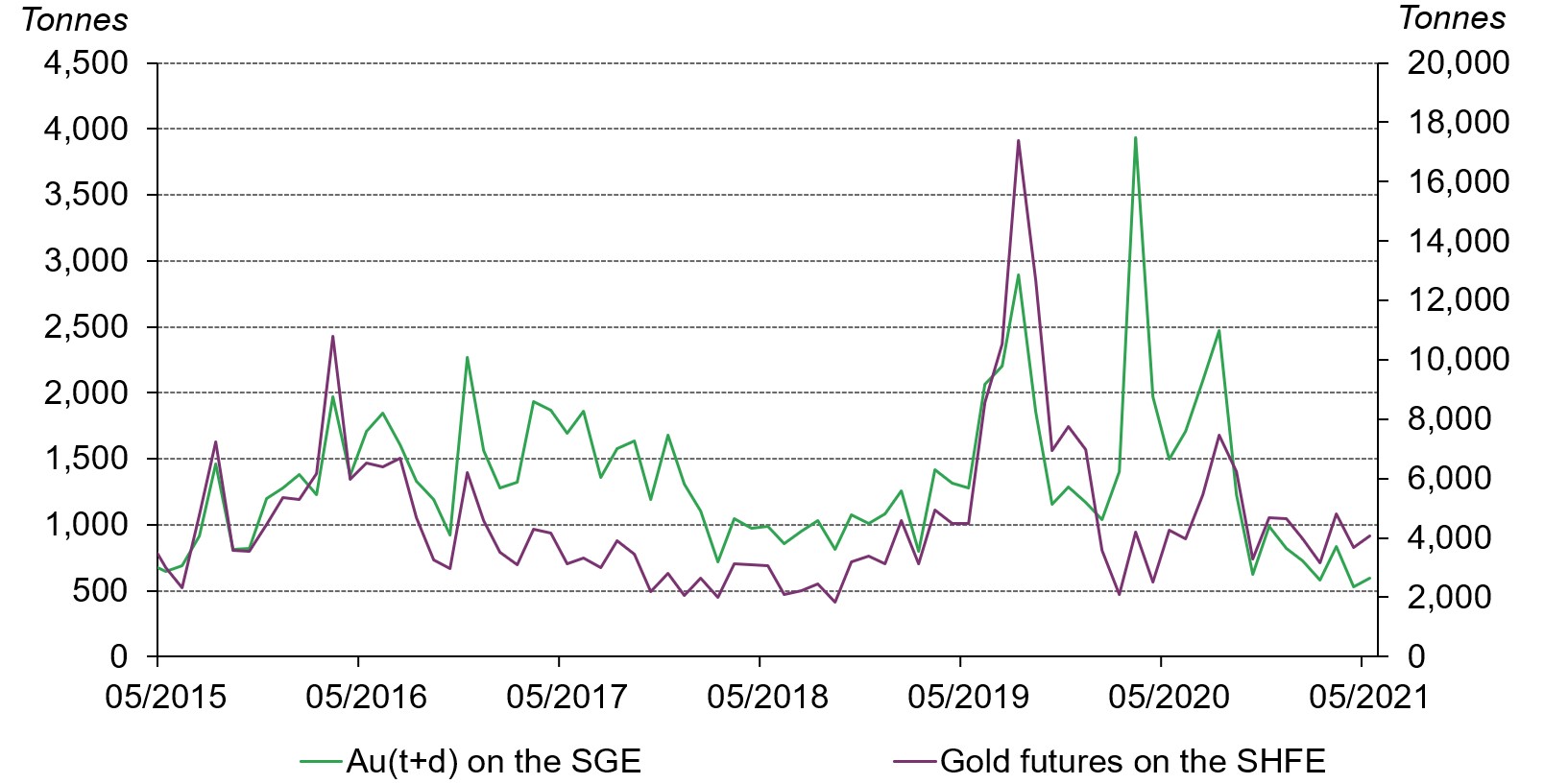

Local investors’ interest in short-term gold trading saw a slight m-o-m rebound. Trading volumes of Au(T+D) on the SGE and gold futures on the SHFE increased by 12% and 10% m-o-m respectively. While this m-o-m rebound reflected the increasing attractiveness of a relatively bullish local gold price last month, trading volumes were lower than their 2020 averages.

Local investors’ higher risk tolerance amid a strong RMB and stock market – the CSI300 stock index increased by more than 4% – in May was the main factor limiting their interest in gold, leading to these contracts’ trading volumes remaining low.

Investors' interest in Au(T+D) and gold futures rebounded in May

Monthly trading volumes of the most liquid margin-traded gold contract on the SGE and gold futures on the SHFE*

Source: Shanghai Gold Exchange, Shanghai Futures Exchange, World Gold Council

*Trading volumes of the SGE and SHFE gold contracts count both sides.

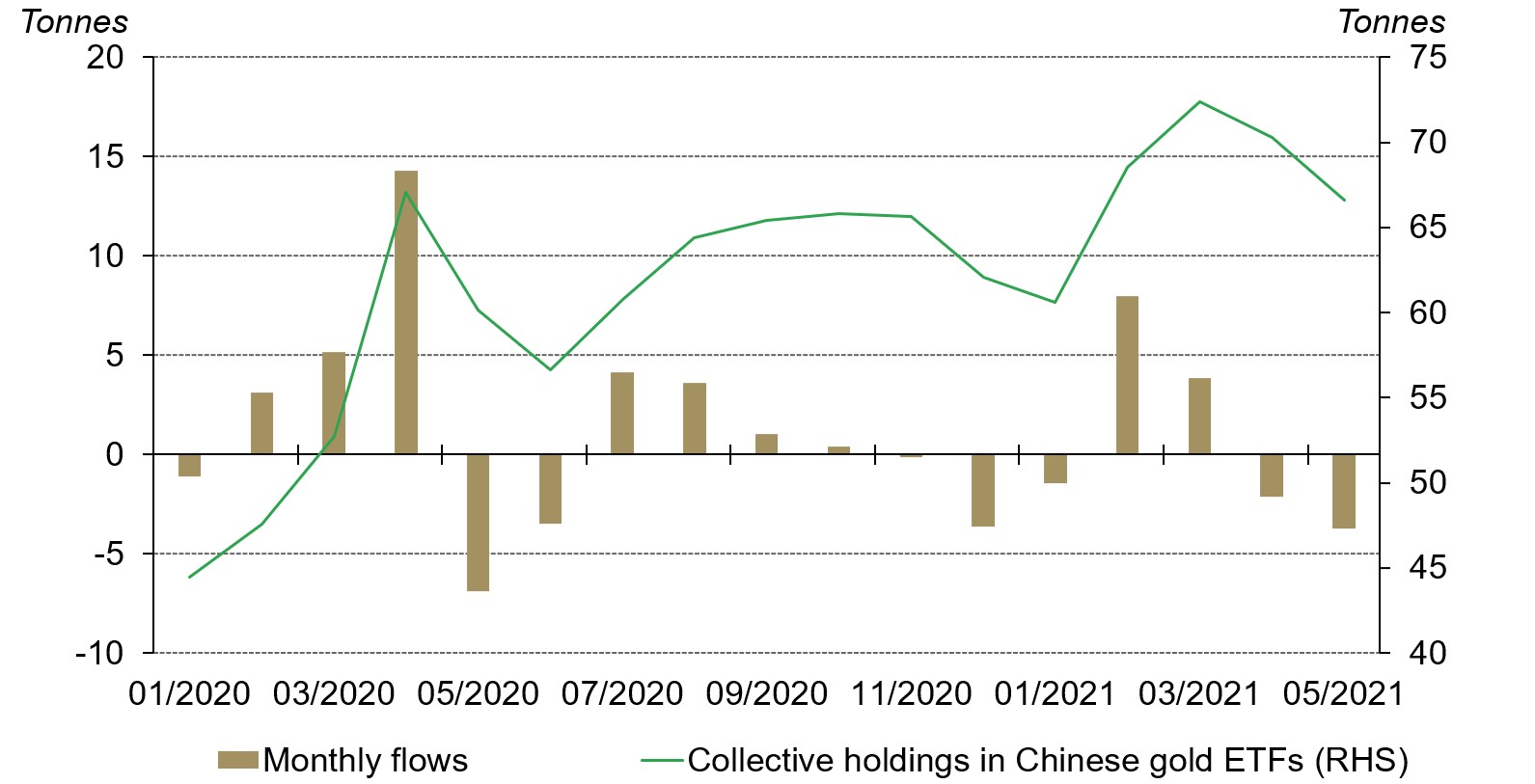

Chinese gold ETF holdings totalled 66.6t (US$4.1bn, RMB25.6bn) as of May, 3.7t (US$7.9mn, RMB348mn) lower m-o-m. Investors’ rising risk appetite and profit-taking amid a higher local gold price might have driven the outflow from Chinese gold ETFs last month.

Chinese gold ETFs saw outflows in May

Source: ETF providers, World Gold Council

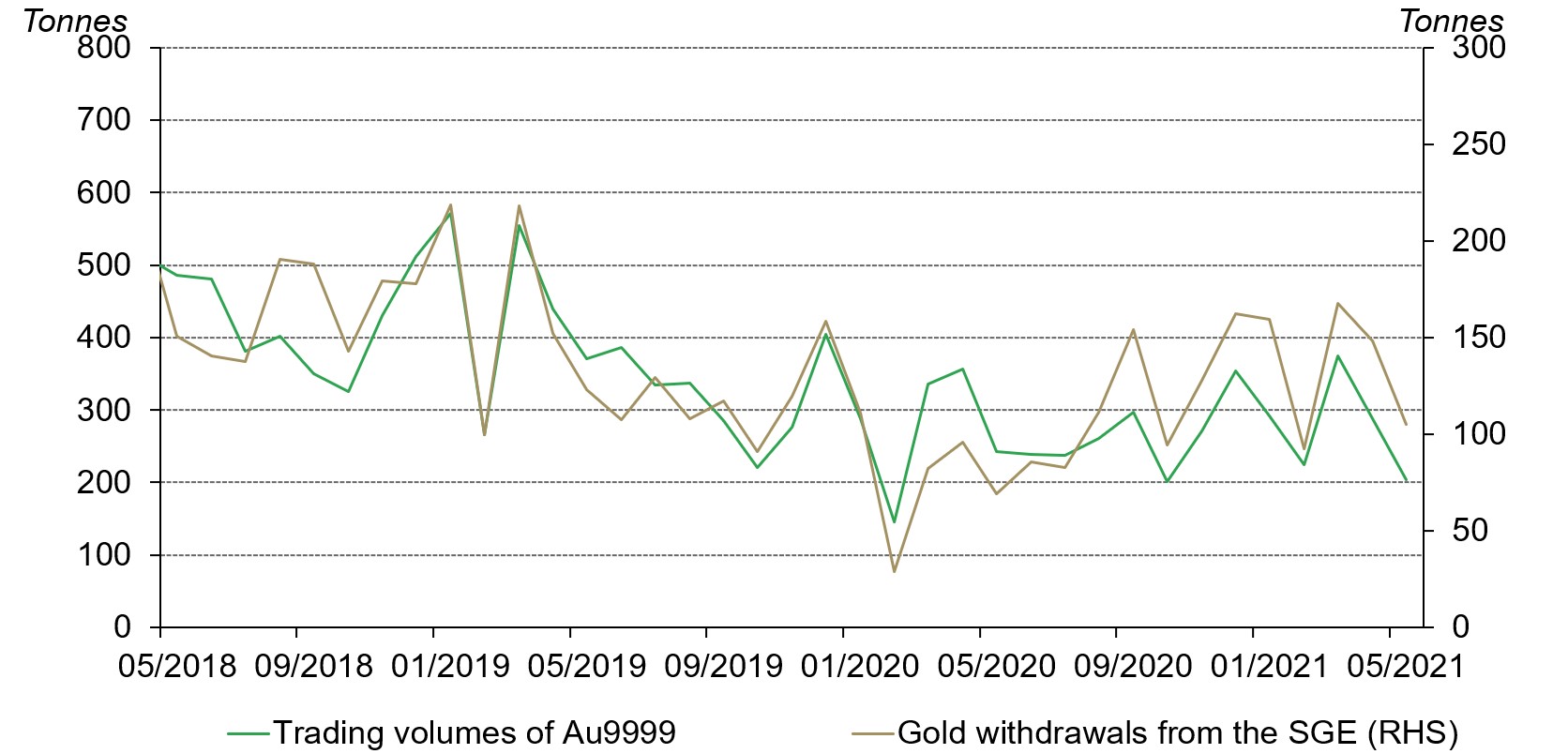

Gold withdrawals from the SGE were 105.1t in May, 43.3t lower m-o-m. Chinese manufacturers’ wholesale demand for gold usually drops in Q2 as it is typically the low season for China’s gold consumption. In fact, gold withdrawals from the SGE have seen m-o-m drops in May every year in the past five years, averaging a decline of 34t between 2016 and 2020.

China's wholesale physical gold demand fell further in May

Source: Shanghai Gold Exchange, World Gold Council

In contrast to changes in wholesale demand, retail gold, silver, jade, and gem jewellery consumption – according to the Bureau of Statistics – rose by 31.5% y-o-y and 19% compared to 2019 in May. The 2021 National Consumption Promotion Month kicked off on 1 May, the first day of the five-day International Labour Day holiday in China. Retailers, teaming up with local governments, ramped up their promotional efforts to attract consumers. According to Shanghai Gold Jewellery Association, retail jewellery sales in Shanghai between 1 May and 5 May totalled RMB 621mn, 45% higher y-o-y.6

As the CCTV Financial News reported, their interviews showed robust retail gold sales in Shanghai during the Labour Day Holiday. And main drivers include:7

- discounts offered by gold retailers were attractive

- the local gold price was trending up

- gifting and wedding demand

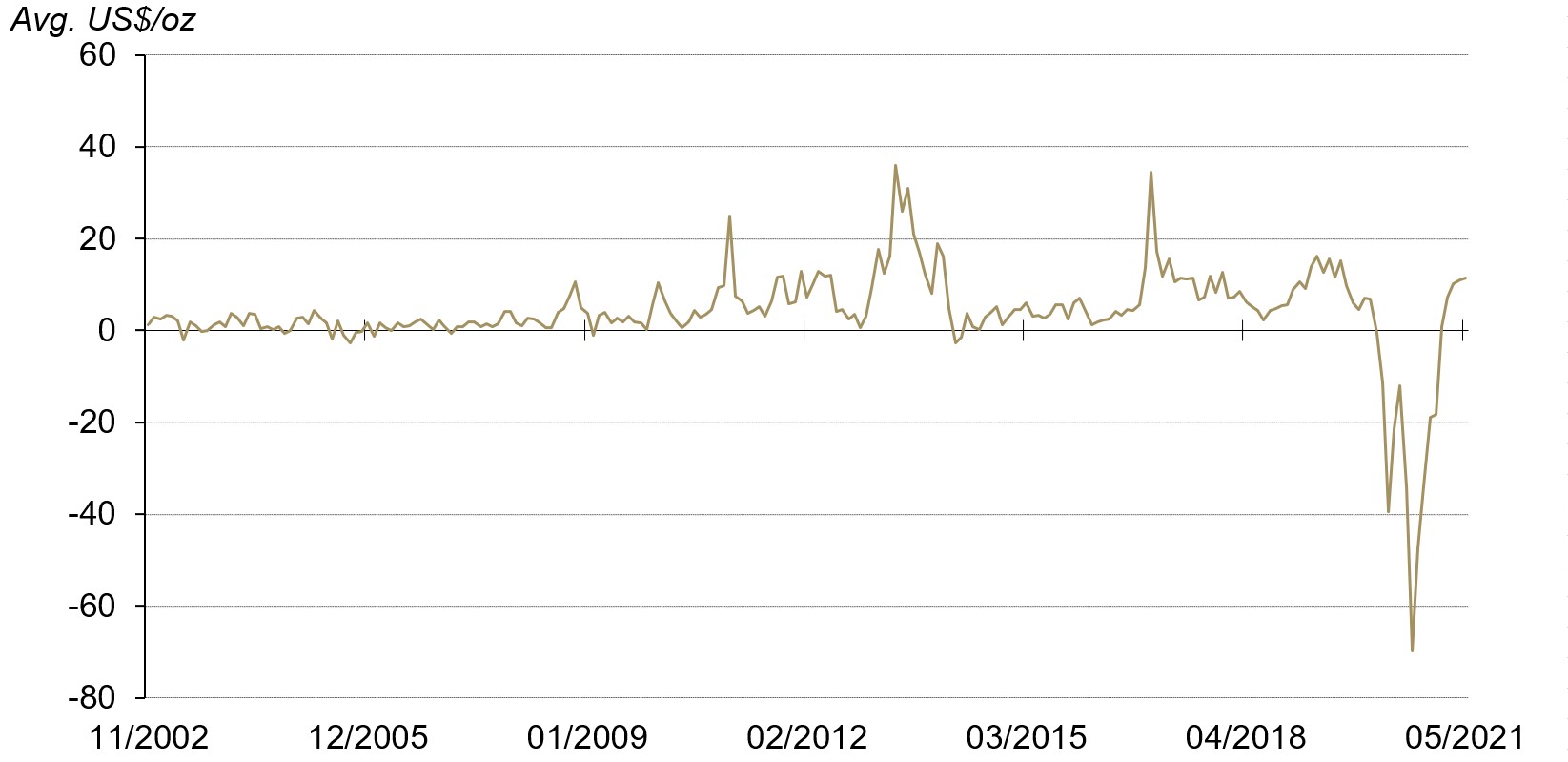

As China’s retail gold consumption in May remained strong, the average Shanghai-London gold price spread edged higher in May, reaching US$11.3/oz, just above its 2019 average of US$11/oz.

The Shanghai-London gold price spread edged higher last month

Source: Bloomberg, Shanghai Gold Exchange, World Gold Council

*SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used. Click here for more.

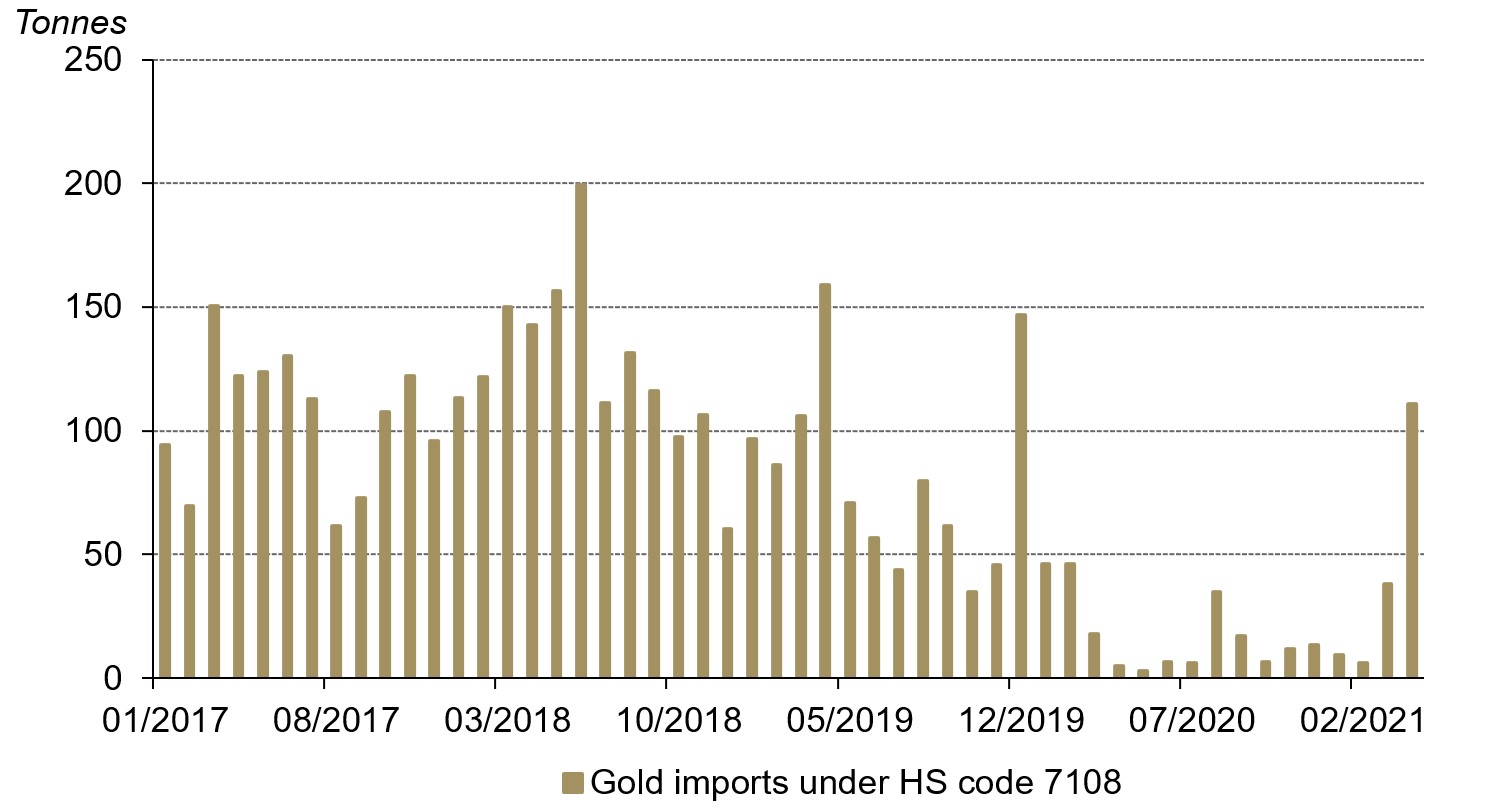

China imported 111t of gold in April, 73t higher m-o-m and 106t higher y-o-y. Impacted by the COVID-19 pandemic and the PBoC’s import quota control, China’s gold imports were significantly lower in 2020 and remained subdued in Q1 2021. At the same time, China’s gold consumption was rapidly recovering, leading to a deficit in China’s gold supply and creating the need for higher gold imports as local gold production continued to decline.8

Gold imports jumped in April

Source: China Customs, World Gold Council

The outlook for China’s gold demand in coming months is mixed. On the one hand, as inflationary pressure intensifies, we expect Chinese investors’ interest in gold to pick up in the short- to mid-term. On the other hand, as we approach summer, Chinese consumers’ preference for light-weight jewellery items might increase in coming months, weighing on China’s gold jewellery demand in tonnage terms.

Usually, higher inflation leads to higher gold bar and coin demand*

y-o-y change in China's bar and coin quarterly demand

Source: Metals Focus, National Bureau of Statistics, World Gold Council

*Based on China’s gold bar and coin demand and the GDP deflator index between Q1 2009 and Q4 2019, excluding outliers in 2013. We chose the GDP deflator index because it is a more comprehensive measure of inflation. For a definition of GDP deflator, please visit: GDP Price Deflator Definition (investopedia.com).