Summary

- The Shanghai Gold Benchmark Price PM (SHAUPM) (RMB) rose 3.8% and the LBMA Gold Price AM (USD) was up by 5%1

- In view of the imbalanced economic recovery, Chinese policy makers will continue to prioritise the stimulation of domestic demand

- Investment demand in gold fell amid lower safe-haven needs:

- trading volumes of Au(T+D) on the Shanghai Gold Exchange (SGE) and gold futures on the Shanghai Futures Exchange (SHFE) both dropped on a m-o-m basis

- collective holdings in Chinese gold ETFs saw a 2t (US$81mn, RMB268mn) outflow in the month

- Gold withdrawals from the SGE were seasonally lower m-o-m but higher than the 10-year average of April loadouts

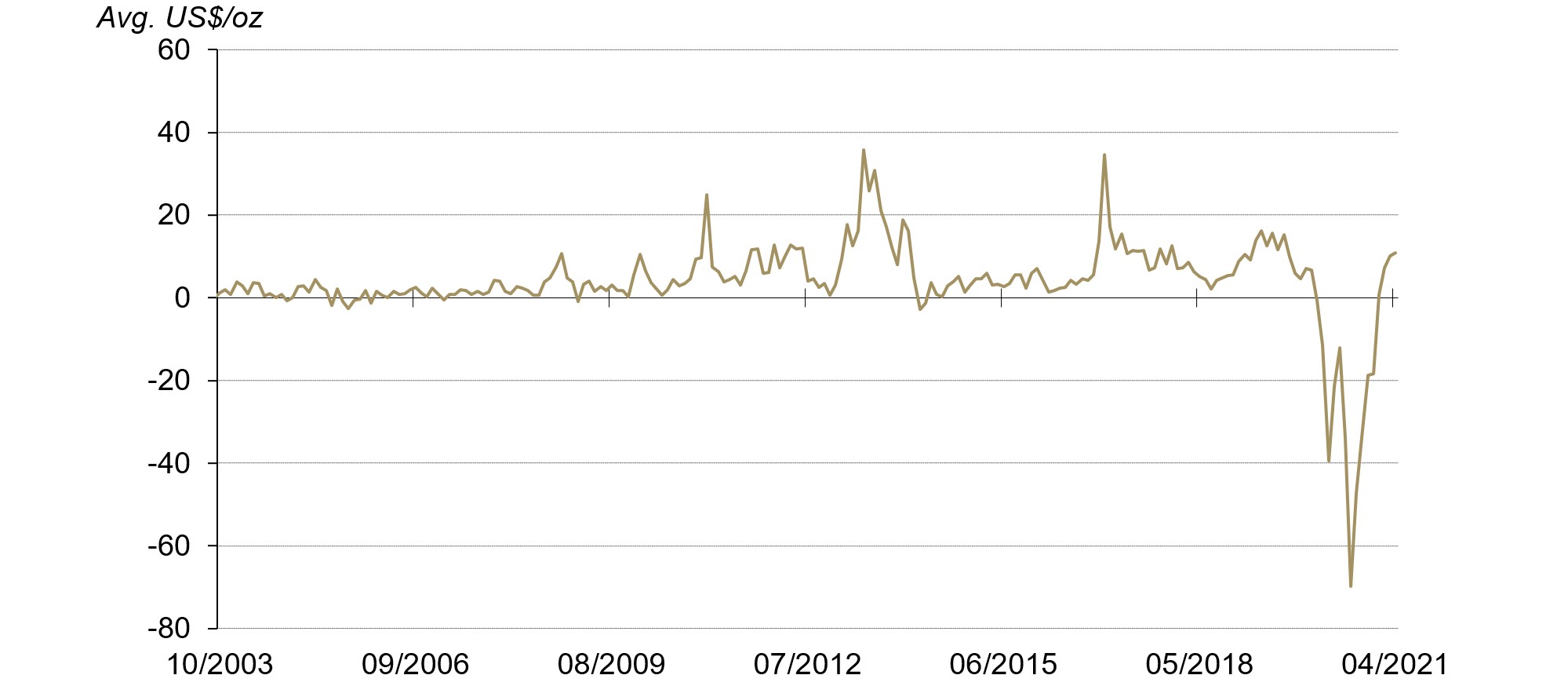

- The Shanghai-London gold price spread saw a slight m-o-m rise in April, averaging US$11/oz2

- The People’s Bank of China gold reserves remained at 1,948t at the end of April, accounting for 3.3% of its total reserves; the Chinese central bank has kept its gold reserves unchanged since September 2019

- China’s gold imports in March rebounded significantly both m-o-m and y-o-y3

- We are likely to see strong retail gold consumption in May.

International gold prices rebounded in April. Primarily, the sharp fall in real yields across key regions, along with the weakening dollar amid the Federal Reserve’s dovish policy stance, lifted the USD gold price.4 In addition, inflation expectations continued to intensify during the month, contributing to the rebound in gold prices.

Within China, however, relatively stable government bond yields, lower inflationary concerns and a strong currency limited upside potential for the local gold price – the SHAUPM had a smaller price increase than its US dollar peer.

Gold prices rebounded in April

Source: Shanghai Gold Exchange, ICE Benchmark Administration, World Gold Council

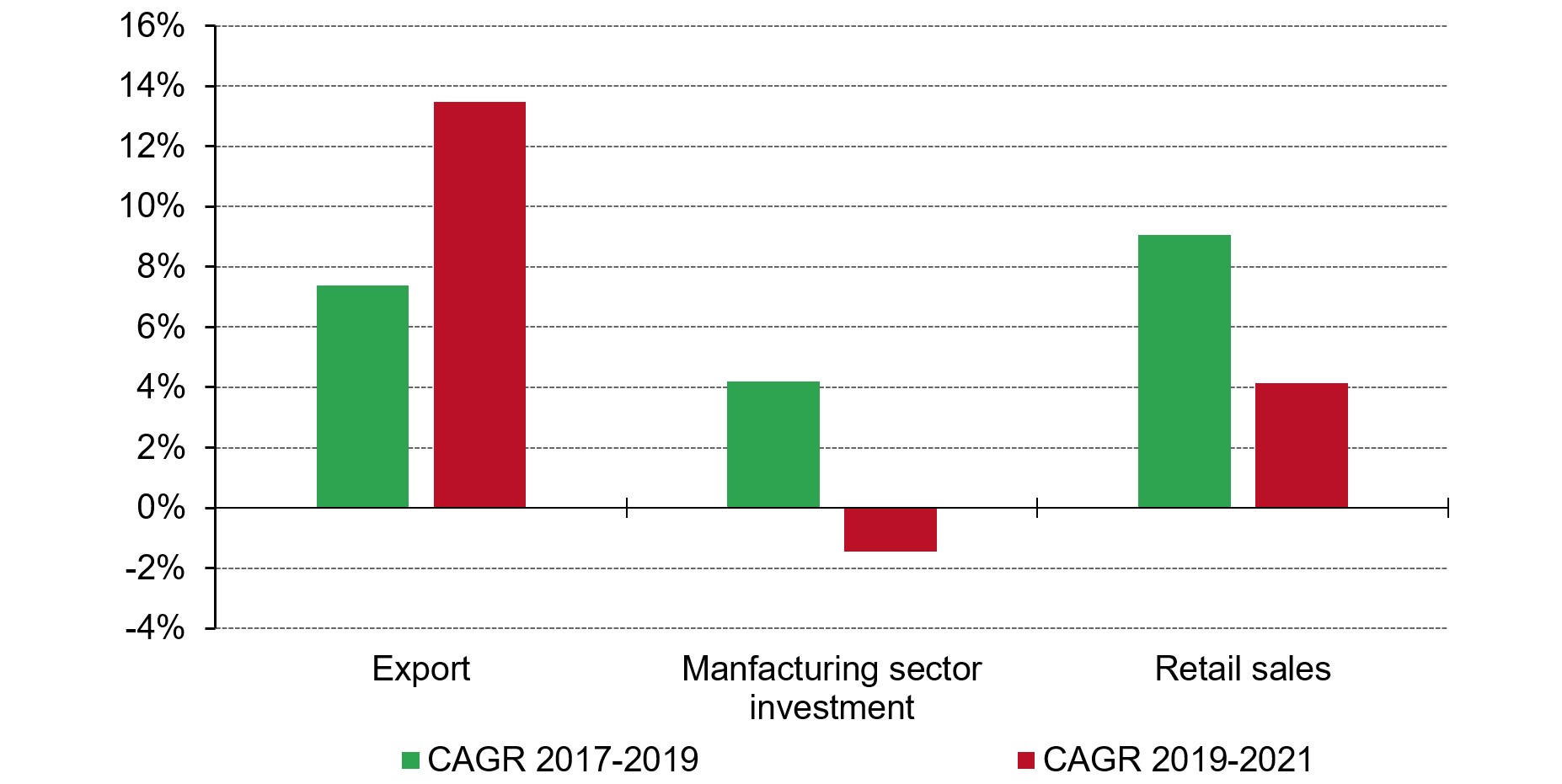

China will continue to prioritise domestic consumption stimulation. At the Political Bureau meeting of the CPC Central Committee at the end of April, Chinese policy makers addressed issues surrounding the strong economic recovery in Q1. In the main, these include: - a complicated and austere external environment - the local economy’s high dependence on exports - a slower recovery in manufacturing investment and consumption than in other sectors.

China's economic recovery has been relying on external demand so far

2019-2021 CAGR vs 2017-2019 CAGR

Source: National Bureau of Statistics, World Gold Council

The meeting concluded that domestic consumption stimulation must remain a key focus in order to reduce the economy’s dependence on exports, which could encounter challenges given the current geopolitical conditions. The prioritisation of domestic consumption stimulation in the wake of the pandemic has supported local gold demand throughout 2020 and the first quarter of 2021. These stimuli are likely to remain in place during 2021, potentially further supporting China’s gold consumption this year.

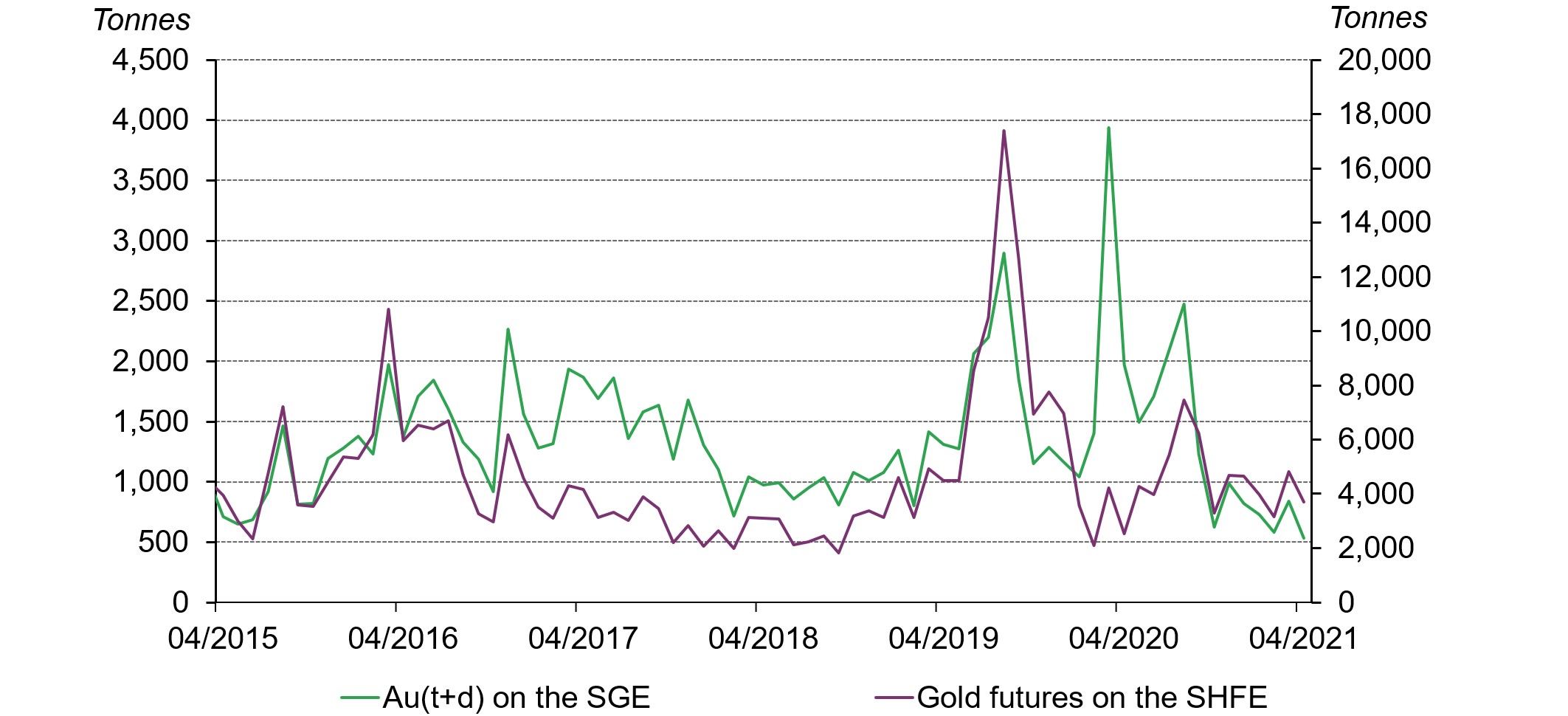

Interest in short-term gold trading declined last month. On a m-o-m basis, monthly trading volumes on the SGE of Au(T+D) – the most liquid margin-traded gold contract – and gold futures on the SHFE dropped by 36% and 23% respectively in April. A stable stock market and lower volatility in the local gold price compared to March have lowered interest in short-term gold trading, weighing on trading volumes in these contracts.5

Investors' interest in short-term gold trading declined

Monthly trading volumes of Au(T+D) on the SGE and gold futures on the SHFE

Source: Shanghai Gold Exchange, Shanghai Futures Exchange, World Gold Council

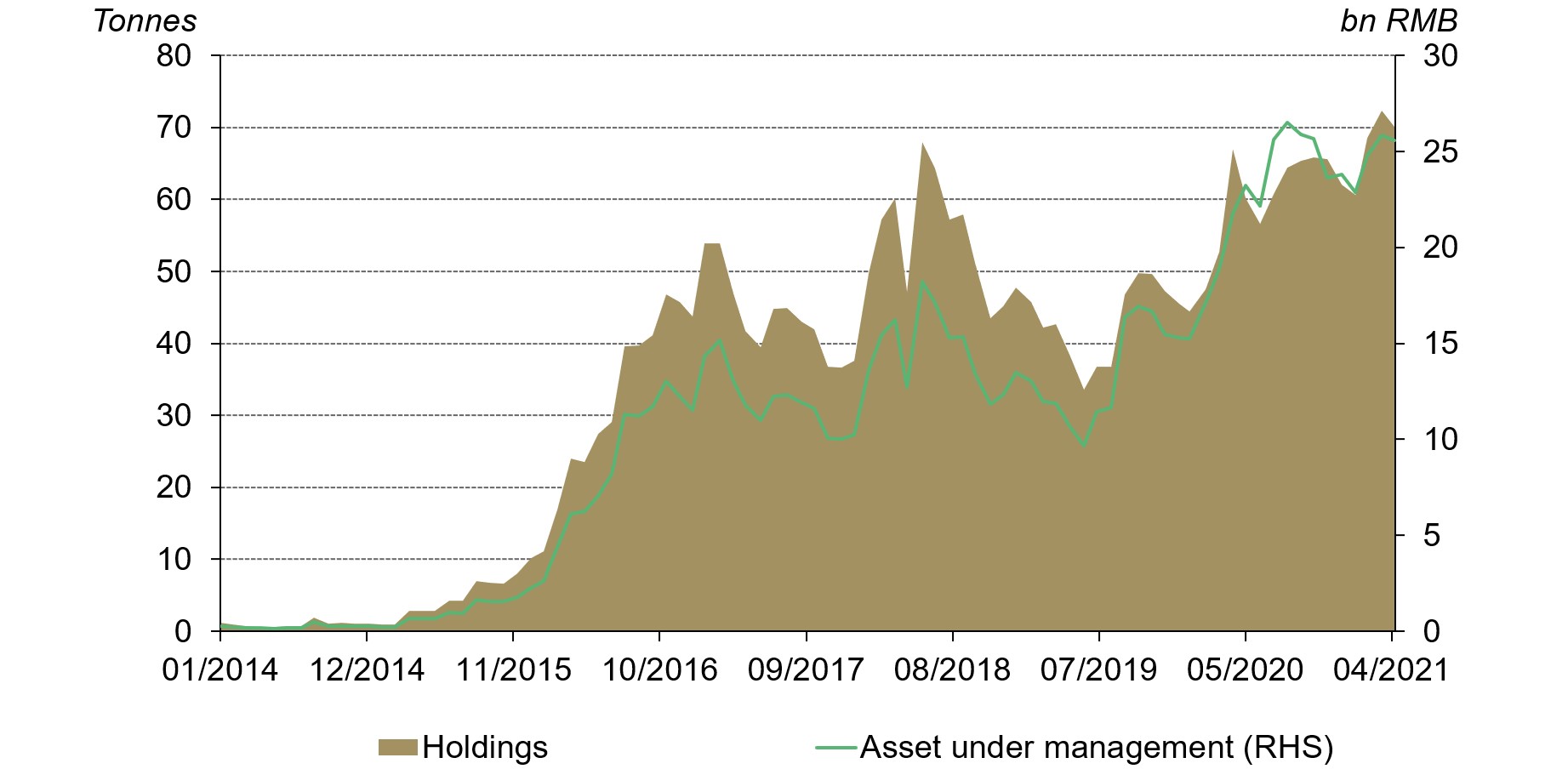

Chinese gold ETF holdings totalled 70.4t (US$4bn, RMB25.1bn) as of April, representing a 2t (US$81mn, RMB268mn) outflow in the month. Lower safe haven demand amid the stabilising stock market in China reduced the attractiveness of gold ETFs for local investors. Nonetheless, collective holdings in Chinese gold ETFs – both in tonnage and value terms – remained near historical highs.

Chinese gold ETF holdings remained near record levels

Source: ETF providers, World Gold Council

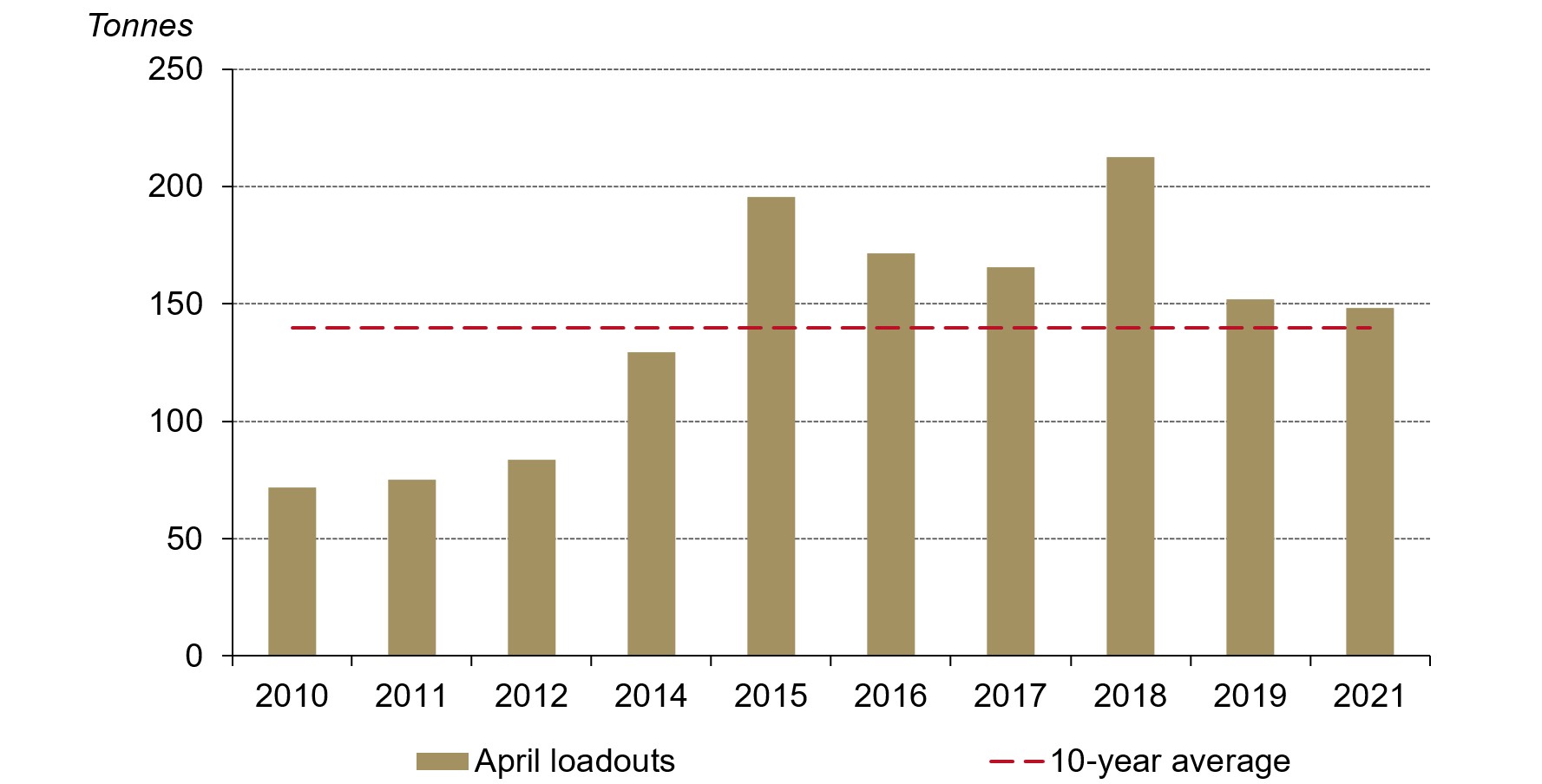

Gold withdrawals from the SGE in April were 148.4t, 19.3t lower m-o-m. In last month’s blog we highlighted that there might a drop in local wholesale physical demand due to Q2 typically being seasonally weaker for gold. This is backed by historical data: in the past decade, on average, gold withdrawals in April have been 19.6t lower than March.6

China's wholesale physical gold demand saw a marginal m-o-m fall in April

Source: Shanghai Gold Exchange, World Gold Council

Nevertheless, China’s wholesale gold demand in April held near its 2019 level and above its 10-year April average of 140t. With the economy continuing to improve, many manufacturers were optimistic that future gold demand would return to at least pre-pandemic levels, leading to active replenishing.

Also, with a longer Labour Day holiday than in pre-pandemic years and with more effective containment of COVID-19 than 2020, many industry participants expect better-than-average gold consumption in May.7 Various consumption stimuli from local governments has further boosted the industry’s confidence, resulting in higher-than-average gold withdrawals from the SGE in April.8

2021 April withdrawals higher than the 10-year average

Gold loadouts from the SGE in April compared to the 10-year average*

Source: Shanghai Gold Exchange, World Gold Council

*10-year average based on April gold withdrawals from the SGE between 2010 and 2020, excluding 2013 and 2020 as seasonality patterns were distorted. For more information, please visit our past Gold Demand Trends reports.

The Shanghai-London gold price spread averaged US$11/oz in April, US$0.7/oz higher m-o-m and on a par with the 2019 average. Higher-than-average wholesale gold demand in April and the expectation of strong retail gold consumption in May lifted the Chinese gold price premium.

The Shanghai-London gold price spread remained elevated

Source: Bloomberg, Shanghai Gold Exchange, World Gold Council

*SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used. Click here for more.

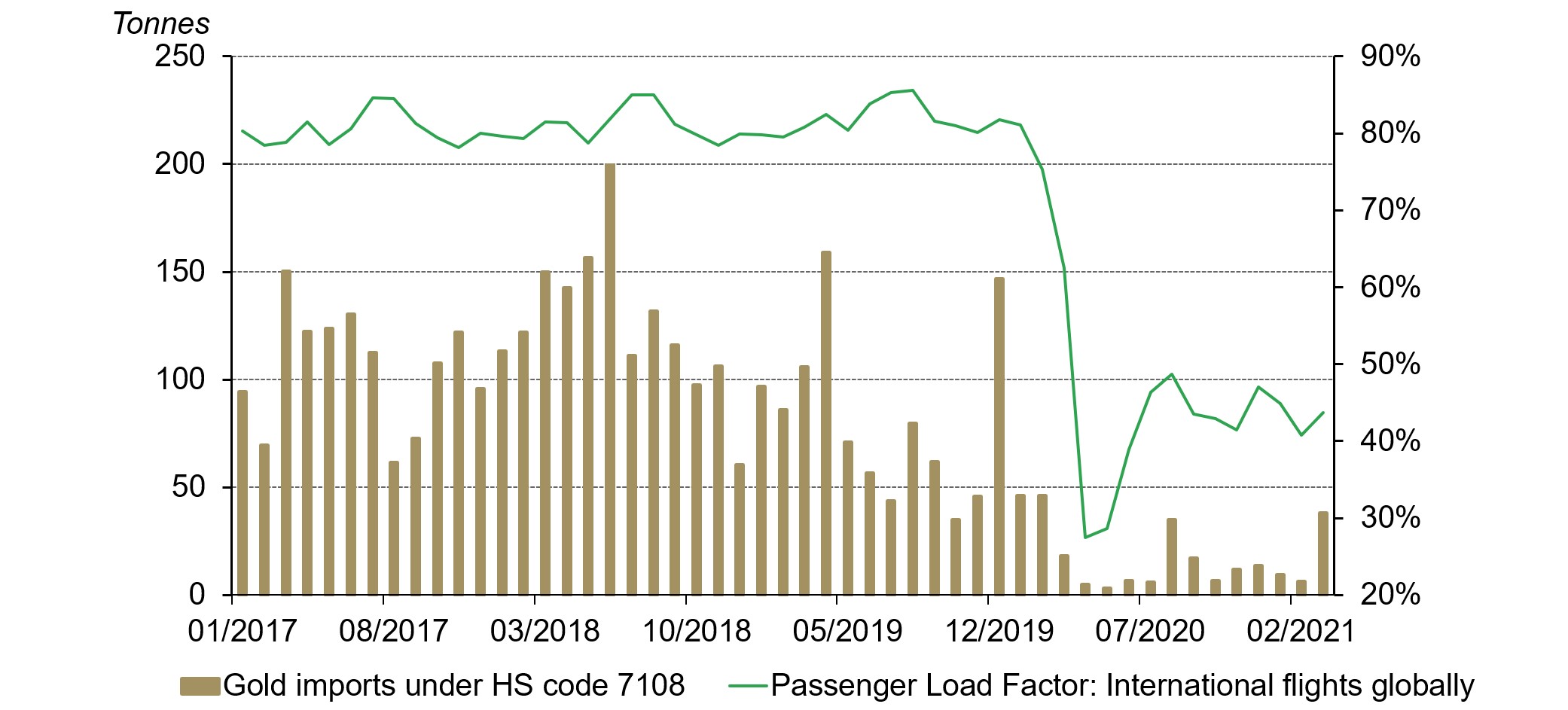

China imported 38t of gold in March, 20t higher y-o-y and 32t higher m-o-m. Two factors account for such substantial increases:

However, imports are still well below the average of 82t in 2019 - the pre-pandemic level. We believe the reduction in international flights globally and strict boarder controls in China amid the COVID-19 containment could be key factor weighing on gold flows into China.

Gold imports started to rebound in March

Source: China Customs, IATA, World Gold Council

Even though Q2 is usually an off season for gold demand in China, we expect to see stronger-than-average local gold consumption in May. And such optimism stands on four legs:

- an improving economy

- proper containment of the pandemic

- consumption stimuli from local governments in major cities to encourage spending9

- promotional efforts by gold retailers focusing on May shopping occasions such as the extended International Labour Day holiday and Mother’s Day.

Footnotes

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange.

For more information about premium calculation, please visit our local gold price premium/discount page.

There is a lag in gold imports data due to the China Customs schedule of data release.

For more information about the Fed’s dovish stance, please visit: FOREX-Dollar hits 4-week low as Fed's dovish message gains sway; rouble sinks | Nasdaq and FOREX-Dollar left defenceless by dovish Fed, euro muscles higher | Nasdaq.

In April, the CSI300 stock index rose by 1.5% and the annualised local gold price volatility was 11%, 2% lower than March.

Based on gold withdrawals from the SGE in April and March between 2010 and 2020, excluding 2013 and 2020 due to distorted seasonality patterns in those years. For more information, please visit our past Gold Demand Trends reports.

In 2020 and 2021, the International Labour Day holiday ran from 1 May to 5 May, two days longer than previous years.

For more information please visit: Consumption month launched nationwide to encourage spending (sh.gov.cn).

For more information, please visit: Consumption month launched nationwide to encourage spending (sh.gov.cn)