At the end of January, the new head of the European Central Bank (ECB), Christine Lagarde, announced the launch of a year-long strategic review of the bank’s monetary policy strategy.1 Stemming from this, there has been much discussion recently about the ECB’s existing “below but close to 2%” inflation target, and whether this needs to be made more specific, both in aim and measurement.2 Especially as the bank has failed to meet this target since 2013.

ECB review signals little change in short-term

18 February, 2020

The ECB – like many other central banks around the world – has already taken unprecedented steps to try and take control of the situation.3 Last year, the ECB restarted its quantitative easing program, buying €20bn of bonds each month, in order to ensure the cost of borrowing remains low.

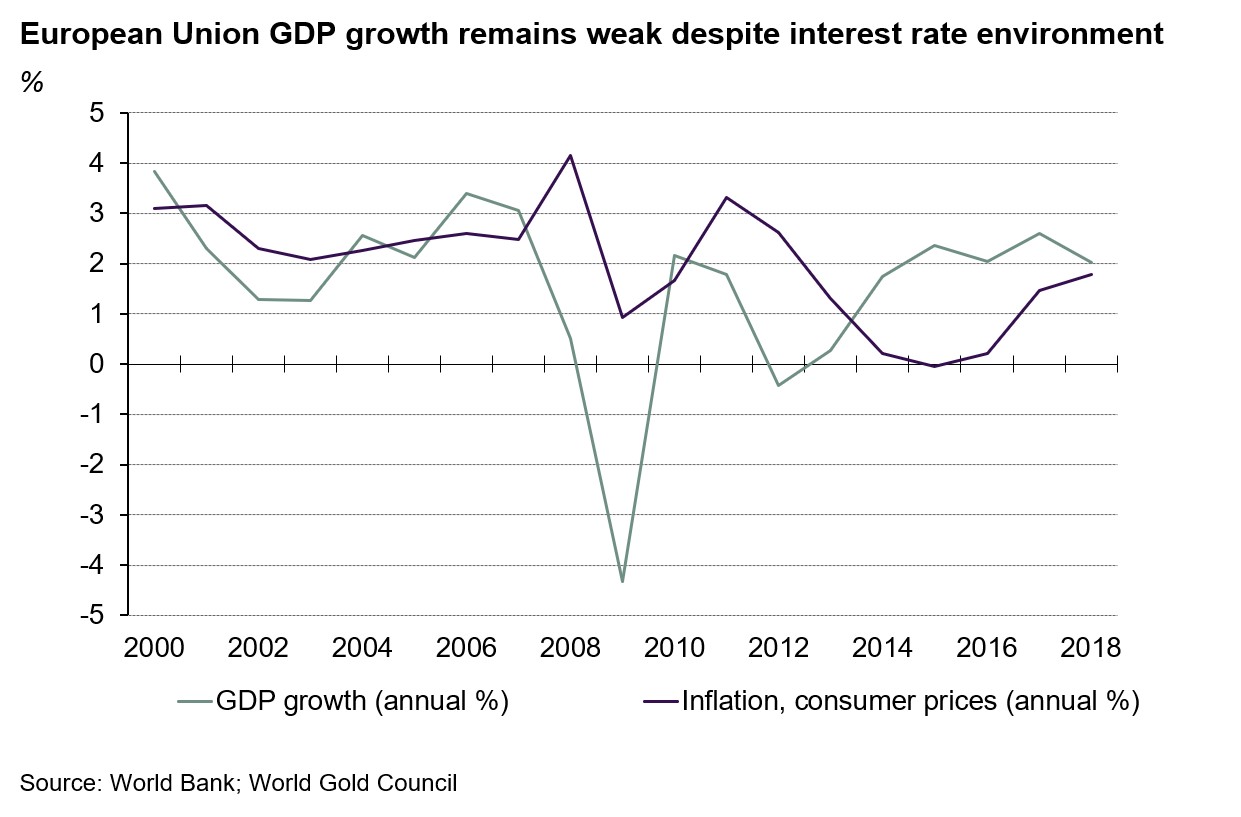

But concerns around the impact that these low and negative rates may have are being discussed.4 Rather than jump-starting growth in the region, the economic situation remains stalled. While the ECB’s main refinancing operations rate (0%) and its marginal lending facility rate (0.25%) remain in positive territory, its deposit rate facility rate turned negative in 2014 and hasn’t looked back – it currently sits at -0.5%. And this is putting stress on the region’s financial system.5 6

Couple this with the increasing number of European sovereign bonds which are providing negative yields, the situation for investors and savers is fraught with challenges and risks.

Note: Data as of 14 February 2020. Source: Bloomberg

But with the ECB taking the next 12 months to assess its approach, how can investors manage these risks in the interim?

While gold’s lack of yield – owning to not having credit risk – may deter some, the opportunity cost of holding it is drastically reduced in the current interest rate environment. As we note in our Gold Outlook 2020: “… in an environment where a whopping 90% of developed market sovereign debt is trading with negative real rates, we believe the opportunity cost of gold almost goes away. And it may even provide what can be seen as a positive “cost of carry” relative to bonds.”7

Gold’s performance has also positively correlated to the level of negative yielding debt over the last four years and has shown historical strength when during periods of negative rates.

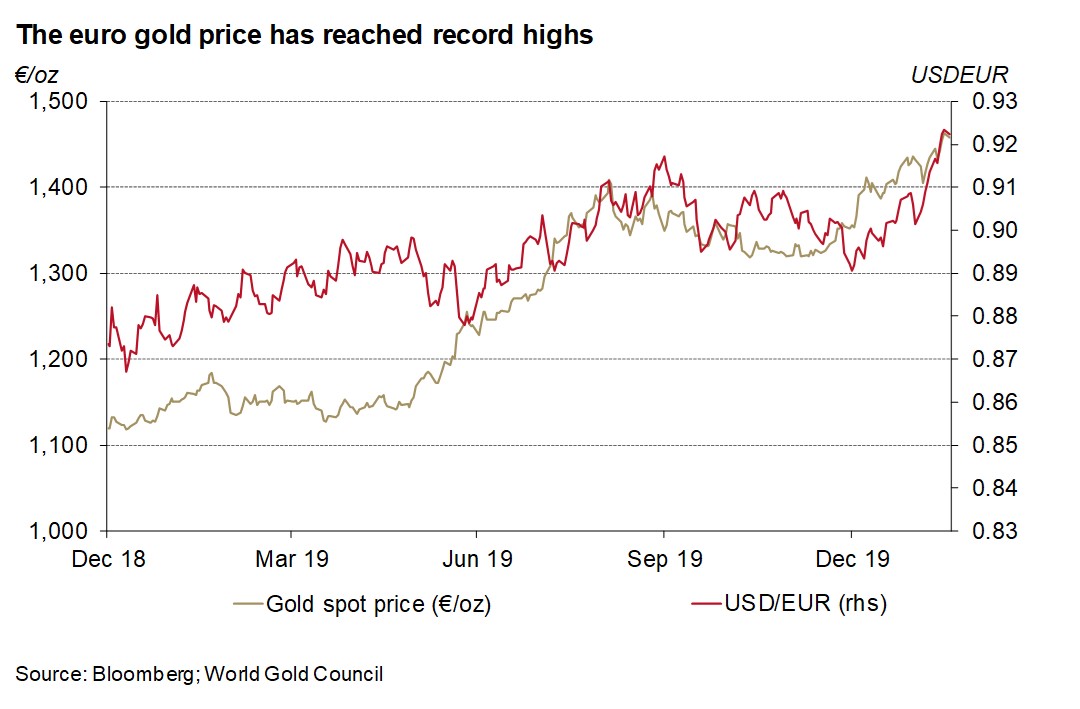

Weakness in the euro – against the US dollar – as a result of Europe’s ongoing issues has helped boost the euro gold price to record levels over €1,460/oz in recent days. This is almost 30% higher than at the end of 2018.

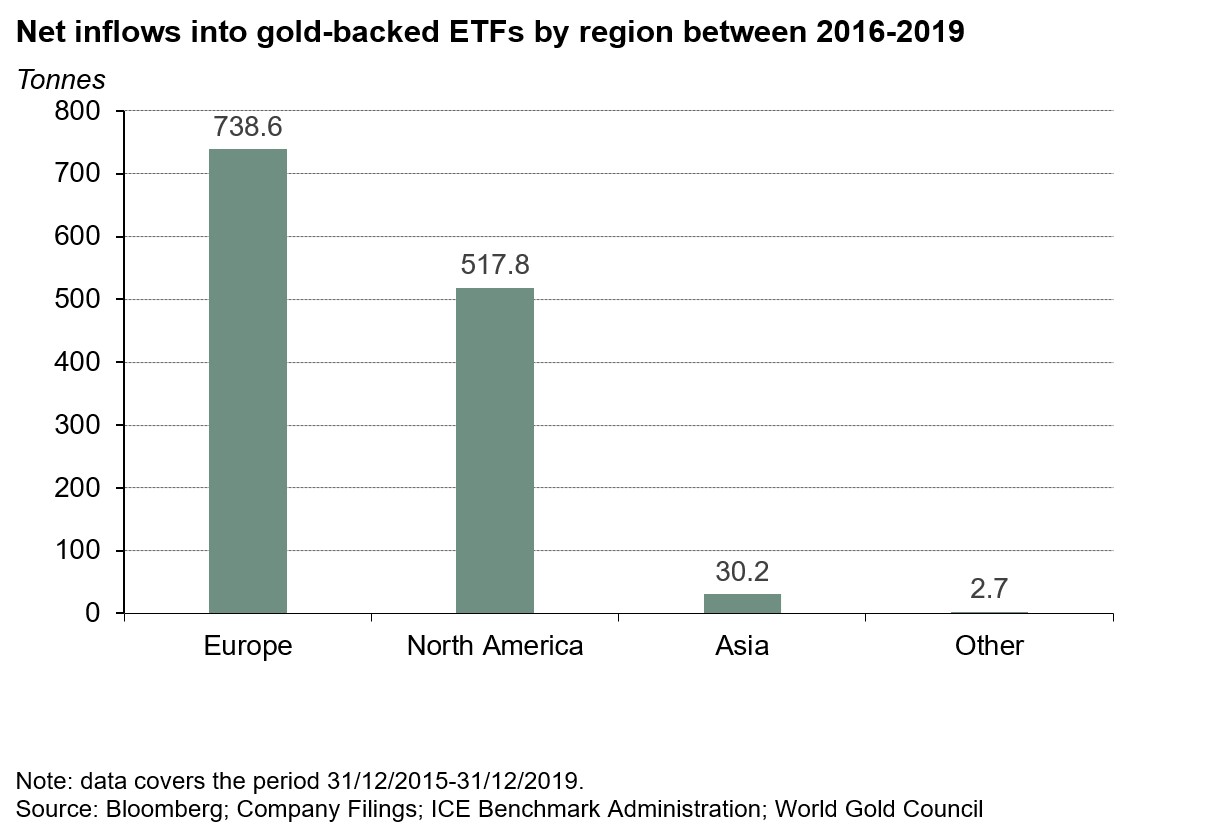

And we have seen evidence that monetary policy decisions – not just by the ECB – have been a major driver of gold investment in recent years. And his has been most visible in gold-backed ETFs. Inflows into these funds have been totalled almost 1,300t over the last four years, taking global holdings to 2,885.5t at the end of 2019.8 And 57% of these inflows have been into European-listed funds. As we noted in our Fully Year 2019 Gold Demand Trends report: “Four years ago, US-listed funds accounted for almost two-thirds of global holdings (922.8t) and European-listed funds for just over one-third (583.6t). This regional split is now closer to 50:50 after holdings of European-listed funds more than doubled: by the end of 2019, they held 1,322.1t.”9

And we have continued to see inflows into 2020, with a net 61.7t added in January – 33t of which was into European funds – as geopolitical and economic uncertainty persisted. We believe with the ECB likely to maintain low/negative interest rates in the short term, expectations of further cuts from the Fed, and the sluggish growth outlook, gold investment is likely to remain well supported.10

Despite a chorus of calls for further clarity in monetary policy from the ECB – and central banks in general – it seems that little will substantially change until President Lagarde has left no stone unturned.

Footnotes

3 www.gold.org/goldhub/gold-focus/2019/10/gold-thriving-lower-interest-rates

4 www.ft.com/content/7efcedb4-ea25-11e9-85f4-d00e5018f061

6 www.bloomberg.com/opinion/articles/2019-12-17/negative-interest-rates-are-destroying-our-pensions

7 www.gold.org/goldhub/research/outlook-2020

8 www.gold.org/goldhub/data/global-gold-backed-etf-holdings-and-flows

9 www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2019/investment

10 www.axios.com/market-fed-rate-cuts-2020-f347ea30-4ca1-4e65-9414-f14c54eac728.html