Who’s cutting?

It’s old news that the world economy is suffering. Ongoing trade tensions between the US China (and elsewhere too1), the draining Brexit saga, as well as a myriad of other geopolitical uncertainties, have taken their toll. Global growth is slowing, and investors are downbeat on world economic prospects. Recession in many major economies is now a real possibility.

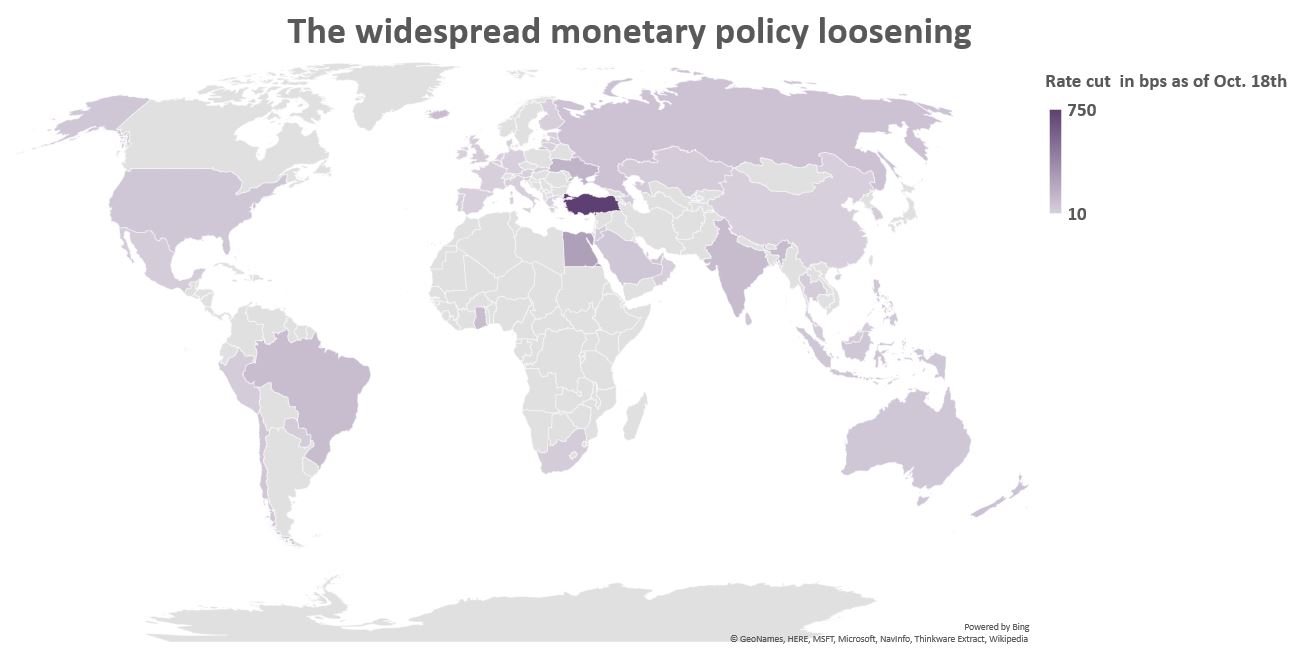

As a result, central banks around the world have been busy cutting rates. A total of 54 central banks across developed and emerging markets have cut their policy/base interest rates as of October.

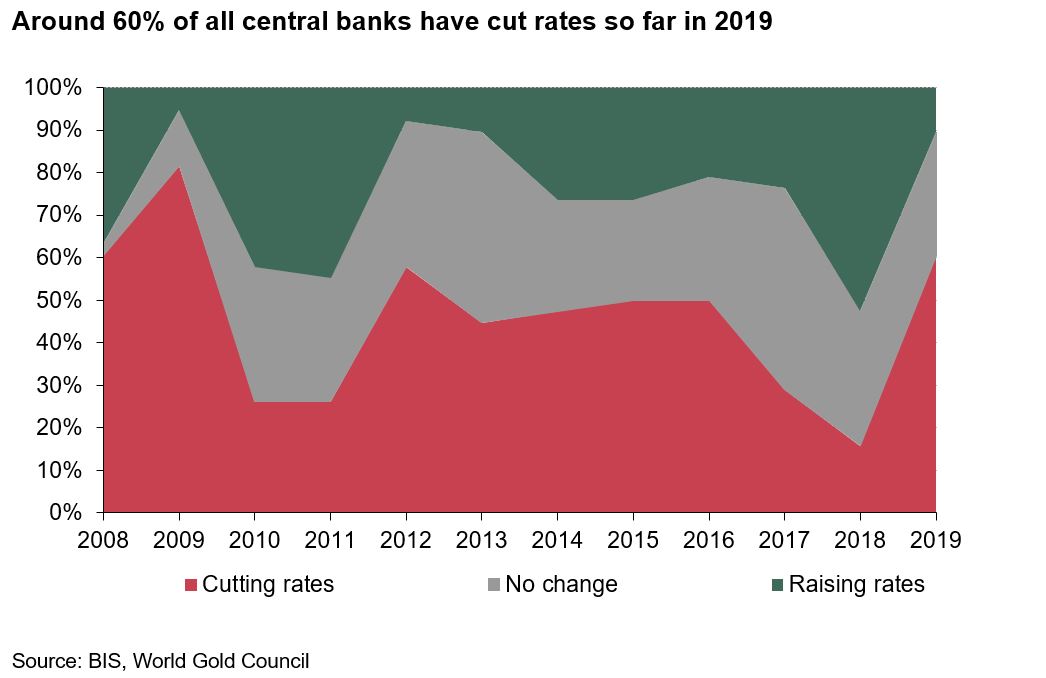

So far in 2019, according to data from the Bank of International Settlements tracking the activities of 37 central banks, around 60% of them have cut rates – the highest level since the global financial crisis… and there are still two months of the year left.

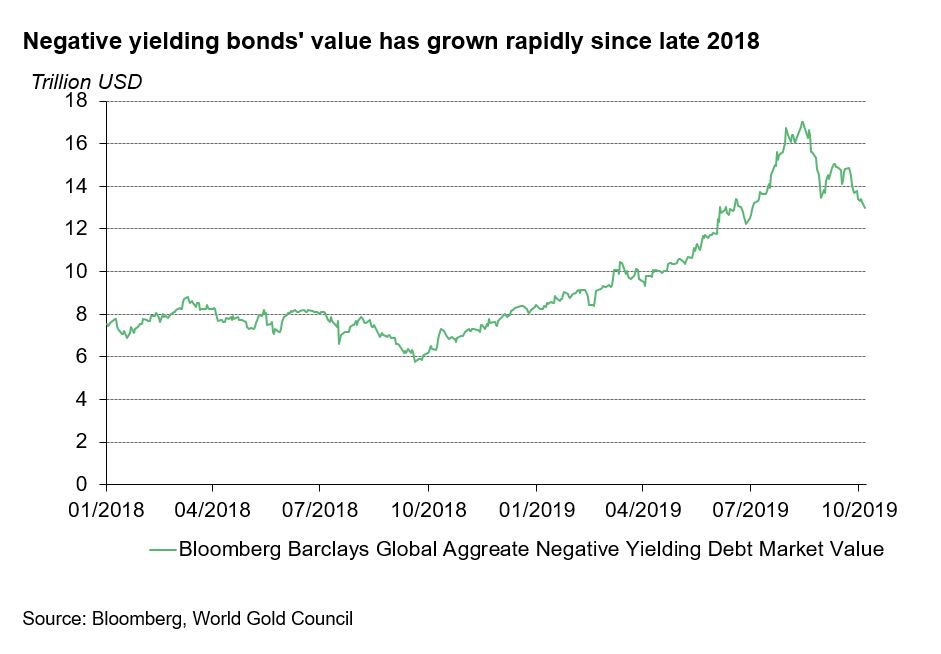

Looser monetary policies have boosted the stock of negative-yielding debt. Bloomberg’s aggregate negative yielding debt value is now 260% higher than a year ago, and 80% higher since the start of the year. And with this latest round of easing, against a backdrop of a weakening economic environment, we might see even more yields move into negative territory.

Why rate cuts matter

So, what does this mean for gold? Well, when we evaluate gold’s performance, we think about the four major drivers of gold:

- Economic expansion: when economies expand, people in those economies buy more jewellery, invest more in technology and add to their long-term savings.

- Risk and uncertainty: market downturns often boost investment demand for gold because it is seen as a safe haven.

- Opportunity cost: the price of competing assets, such as bonds (through interest rates), currencies and other assets, influences investor attitudes towards gold.

- Momentum: capital flows and price trends can enhance or dampen gold’s performance.

Among these, opportunity cost has been the most important factor driving the gold price up in 2019. As shown above, interest rates have been lowered and the stock of negative yielding bonds has grown rapidly, lowering the opportunity cost for holding gold. Falling rates and negative returns have made government debt less attractive and haver increased the possibility of higher inflation and currencies depreciation in the future.

These factors contributed to investors renewed interest in gold helping push gold-backed ETF holdings to a record high in September. Looking ahead, more central bank interest rate cuts are likely, further supporting investor interest in gold.