In addition, investors have experienced a prolonged ultra-low interest-rate environment, and this is creating structural changes in asset allocation. Investors are adding more risk to their portfolios in search for returns which, in turn, has required them to revisit their risk management strategies.

Our analysis suggests that this could increase the need to hold assets such as gold for downside protection and diversification.

This applies not only to private individual and institutional investors; central banks have steadily increased their allocation to gold so far in 2021 and our research suggests they will continue to do so. And we believe that, collectively, they may deliver net purchases at the same rate or potentially higher than in 2020.

Inflation could come in different flavours

Inflation has become a key concern for many investors. But while inflation has been on the rise, there are mixed views as to whether the increase in consumer prices will be temporary or more sustained. If price inflation becomes persistent, history shows that gold could perform well. For example, gold had an annual average return of 15% in years when the US Consumer Price Index (CPI) was higher than 3%.7 Our research also indicates that gold may respond to factors other than higher CPI inflation. Gold is highly correlated to broader inflation metrics such as money supply which is on the rise, and this could later result in inflation bubbles, currency debasement, and potential market volatility around the world. Global investors may thus look to gold as a means to protect against the erosion of capital.

Entry opportunities on price pullbacks

Following the significant price pullback in late June, the gold options market showed interesting dynamics. The so-called ‘put skew’8 suggested that some of the selloff was likely softened by buyers. The price selloff also pushed gold’s relative strength index down significantly. And while some investors may remain concerned about downside risks, these metrics signal that others may see it as an entry opportunity – whether tactical or as a means to build strategic positions.

Consumer demand shows mixed signals

Overall, the global economic recovery and the recent price pullback should continue to support gold consumer demand. In China, for example, government stimulus, sales promotions, and seasonal patterns suggest stronger gold consumption during H2. In contrast, however, surges in COVID-19 cases due to new variants are significantly impacting key markets such as India.

Conclusion

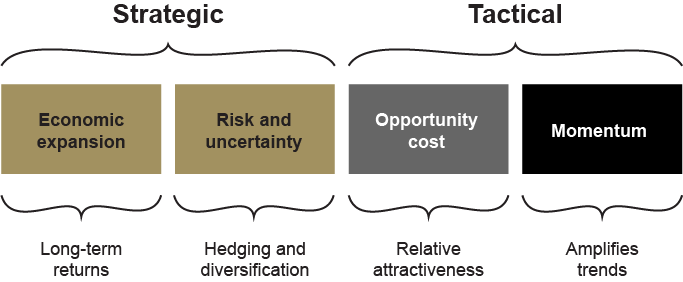

The performance of gold responds to the interaction of the various sectors of demand and supply, which are, in turn, influenced by the interplay of four key drivers (Focus 1). In this context, we anticipate that the need for effective risk hedges will continue to support investment demand, but gold’s performance will also be influenced by the direction of interest rates and the robustness of the economic recovery.