Summary

- The domestic gold price ended 5.1% higher in May at Rs48,993/10g1

- Retail demand collapsed amid COVID-induced lockdowns in the country

- Indian official imports slowed and the local market flipped to discount

- Monthly inflows into gold ETFs slowed as higher returns lured investors towards the equity market. Total holdings for Indian gold-backed ETFs (gold ETFs) reached 33.2t by the end of May; a net inflow of 0.1t (Rs2.9 bn; US$39mn)

- The Reserve Bank of India (RBI) added 0.9t of gold to its reserves in the month increasing its total gold reserves to 696.2t.

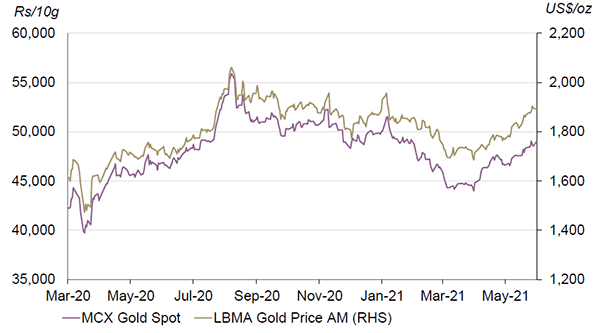

Gold prices rose in May for the second consecutive month. A fall in the real rates, along with momentum and a weakening dollar, lifted the USD gold price. But with the INR appreciating by 2.1% against the USD, the upside to the local gold price was curtailed. As a consequence, the LBMA Gold Price AM in USD and MCX Gold Spot in INR rose by 7% and 5.1%, respectively, during the month (Chart 1).2

Chart 1: Gold prices rose in May for the second consecutive month

Domestic gold price in rupees vs LBMA Gold Price AM in US dollars

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Economy remained fragile in the month

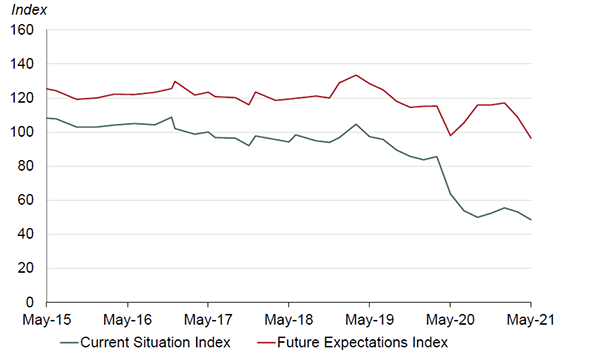

The ferocious second wave of infections continued in May, leading to regional lockdowns in most parts of the country. The intensity of cases, particularly in metros/cities, as well as the rapid spread of infection across states, regions and pockets of rural India, impacted demand throughout the month. Several high frequency indicators of trade and demand, such as E-Way bill, power demand and passenger vehicle sales, contracted in May.3 As per the RBI Survey, the Consumer Confidence Index fell to an all-time low of 48.5 in May from 53.1 in March and the one-year-ahead confidence index also recorded a sharp fall (Chart 2).4

Chart 2: Consumer confidence fell sharply in May

Note: Future Expectations Index is one-year ahead expectations compared with current situation

Source: RBI, World Gold Council

Wholesale and retail inflation spiked in the month

India’s wholesale inflation (WPI) rose to an all-time high (12.94% y-o-y), and retail inflation (CPI) jumped to a six-month high in May (6.3% y-o-y) due to the low base effect and rising food and commodity prices (Chart 3). Expectations for higher inflation are building: Indian households’ median inflation expectations for the current period and for three months ahead increased by 1.7% and 0.7% respectively.5 Rising WPI and CPI inflation leaves little space for rate cuts by the RBI even though the monetary stance is expected to remain accommodative.

Chart 3: India's wholesale price and retail inflation spiked in May

India's WPI % change y-o-y vs CPI % change y-o-y

Source: Bloomberg, World Gold Council

Retail demand collapsed amid COVID-19- imposed lockdowns

Retail demand was severely hampered throughout the month, as states imposed lockdowns in response to the surge in COVID cases. Retail demand on Akshaya Tritiya (AT) – the major gold buying festival, which fell on 14 May this year – crumbled due to store closures. Sales found marginal support through retailers’ digital/omni-channel strategies and demand for digital gold remained strong.

Retail demand is expected to improve in June. With the daily number of COVID cases falling to ~ 0.13mn at end of May from a peak of ~0.4 mn in the first week of the month, some states chose to ease lockdown restrictions from mid-June. Anecdotal evidence from states where jewellery stores are open suggests that gold demand remains slow with consumers predominantly making wedding purchases. Retail demand may improve further as more states relax COVID restrictions, allowing consumers wider access to gold purchasing channels.

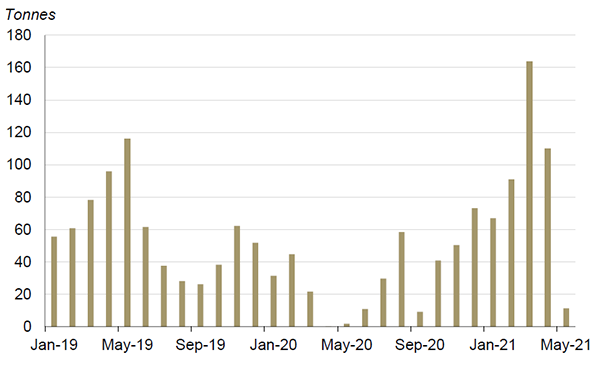

Indian official imports slowed in May

Indian official gold imports totalled 11.4t in May 2021 compared to a negligible 1.9t of imports in May 2020 – at which time imports were being hampered by global supply chain disruption and a pan-India lockdown. Official imports in May this year were 90% down on the April total of 110t (Chart 4), having been severely impacted by restrictions on international flights and state-wide lockdowns. During May, a total of five banks, nominated agencies and exporters imported 6.8t of bullion and 16 refineries imported an equivalent of 4.6t of fine gold content in the form of gold doré.

We anticipate that official imports will increase in June. The easing of state lockdown measures and the resumption of international flights will encourage gold flows into the country.

Chart 4: Indian gold official imports slowed in May

Indian monthly official gold imports from January 2019 - May 2021

Source: Infodrive India, Ministry of Commerce & Industry Govt. of India, World Gold Council

The local market flipped to discount in the month

With retail demand shattered due to localised lockdowns across states, the local market flipped to discount in May. The average discount during the month remained at US$4/oz compared to an average premium of US$2/oz in April (Chart 5).6 By the end of the month, weak retail demand had pushed a few bullion dealers into providing discount of up to US$6-8/oz, the highest level since mid-September 2020.

With the majority of states remaining under lockdown through to the second week of June, discount in the local market widened further to US$9-10/oz; however, with the easing of lockdowns and a resumption in activity, by the third week of June the discount had narrowed to US$4/oz.

Chart 5: Local market flipped to discount last month

Difference between MCX Gold Spot Price and landed gold price in India derived from LBMA Gold price AM

Source: NCDEX, World Gold Council

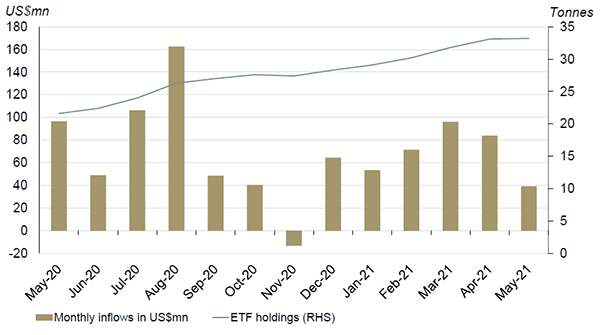

Monthly inflows into Gold ETFs slowed in the month

With the number of daily COVID cases declining in May, sentiment in the equity market improved. The BSE Sensex gained 6.5% in the month compared to a 1.5% decline in April. Higher returns lured investors towards the equity market resulting in monthly dollar inflows into gold ETFS slowing to a six-month low. Inflows increased by 0.1t (Rs2.9bn; US$39mn) during May, taking total gold ETF holdings to 33.2t (Chart 6).

Chart 6: Monthly dollar inflows into Indian gold ETFs slowed to a six-month low in the month

Source: Respective ETF providers, Bloomberg, World Gold Council

RBI added 0.9t to its gold reserves in May

After a pause in gold purchases last month, the RBI bought 0.9t of gold in May, increasing its gold reserves fractionally to 696.2t or 7.1% of total reserves (Chart 7).7 The RBI has stepped up purchases over recent years, adding 19.6t to its gold reserves y-t-d. As per our central bank gold reserves survey 2021, central banks continue to remain positive on gold, with roughly the same number of central banks expected to buy gold this year as compared to last year.

Chart 7: RBI added 0.9t to its gold reserves in May

Source: IMF, RBI, World Gold Council

Based on MCX Gold Spot price in rupees as of 31 May 2021.

We compare the LBMA Gold Price AM with MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

An E-Way bill is an electronic bill for movement of goods and is generated on the E-Way Bill Portal. A GST registered person cannot transport goods in a vehicle without an E-Way bill if the value of goods exceeds Rs50,000.

The Consumer Confidence Index is compiled from a survey conducted by RBI on 5,258 households in 13 major cities in India from 29 April to 10 May 2021.

RBI’s Inflation expectations survey (carried out from 29 April to 11 May 2021) was conducted via telephone interviews with 5,979 urban households living in 18 major Indian cities.

The premia/discount data is based on gold premium polled spot price from National Commodity & Derivatives Exchange Ltd.

Central Bank data is taken from IMF-IFS; IFS up until April and weekly statistics from the RBI for May. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics.