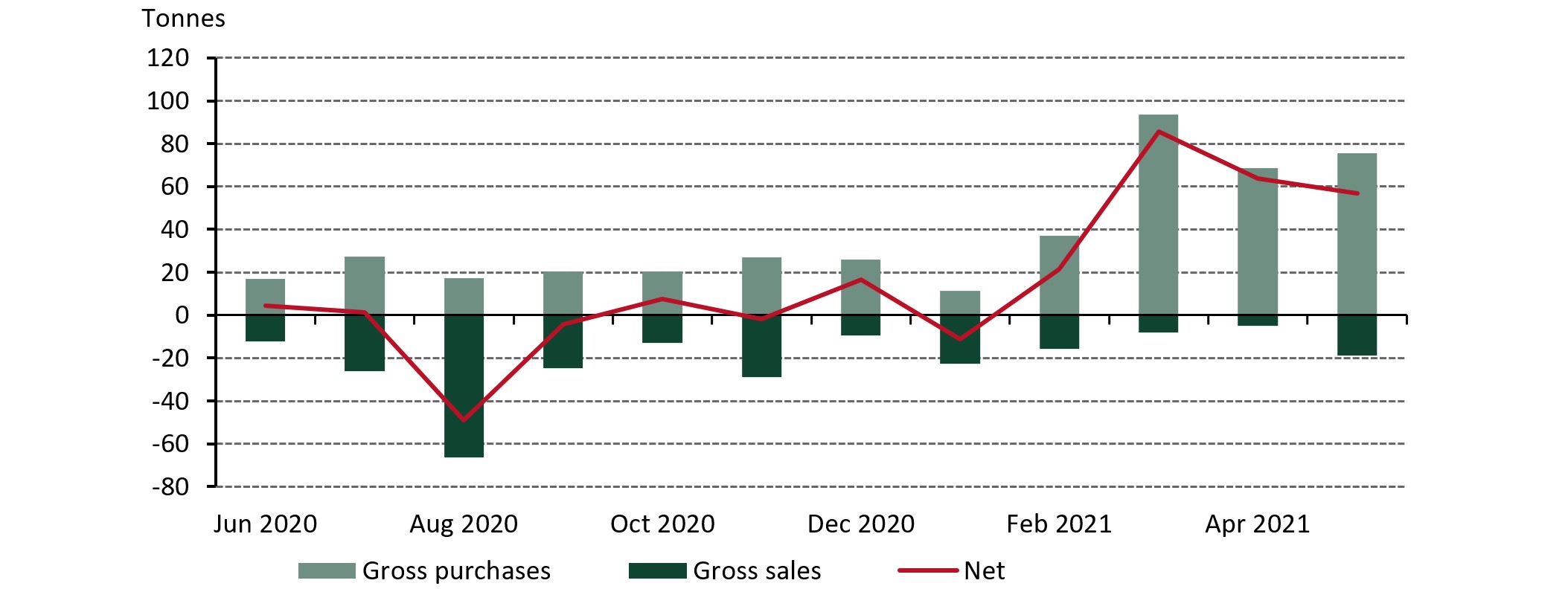

Following a higher level of monthly net purchases in March and April, our latest data published today shows that this trend continued into May. Central banks net purchases totalled a healthy 56.7t during the month, down 11% m-o-m but 43% above the y-t-d monthly average.1,2 The steady buying in recent months stands in contrast to the more inconsistent picture from mid-2020 when central banks switched between net buying and selling.

Healthy levels of central bank net purchases in recent months

Central bank net purchases in tonnes*

*Data as at 31 May 2021. Note: Gross purchases in March exclude the 81t increase in Japanese gold reserves as reported to the IMF. For more information on this, please see Gold Demand Trends Q1 2021.

Source: IMF IFS, Respective Central Banks, World Gold Council

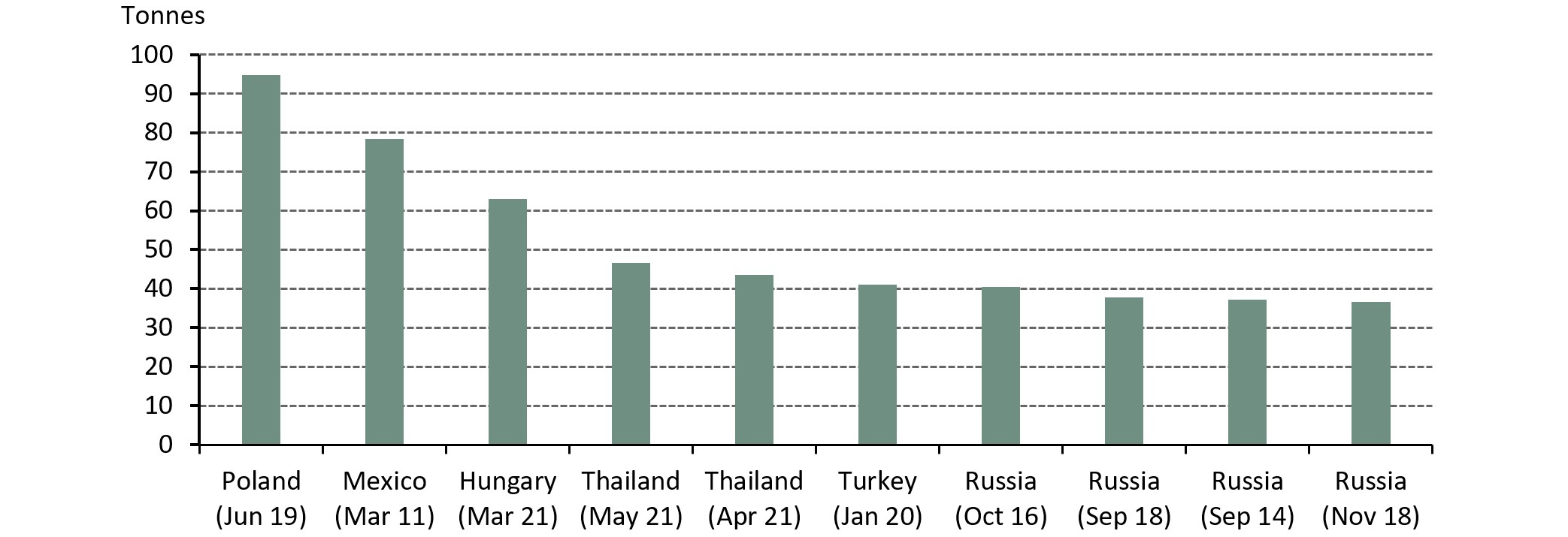

While the pick-up in net purchases over the last three months is significant, the vast majority of this came from just two central banks: Hungary and Thailand. Together, they have bought over 150t between the start of March and end of May, and these recent monthly additions have been among the largest individual central bank purchases we have seen since the start of 2010.

Recent monthly purchases from Hungary and Thailand are among the largest since 2010

Largest monthly net purchases by individual central banks*

*Data as of 31 May 2021.

Source: IMF IFS, Respective Central Banks, World Gold Council

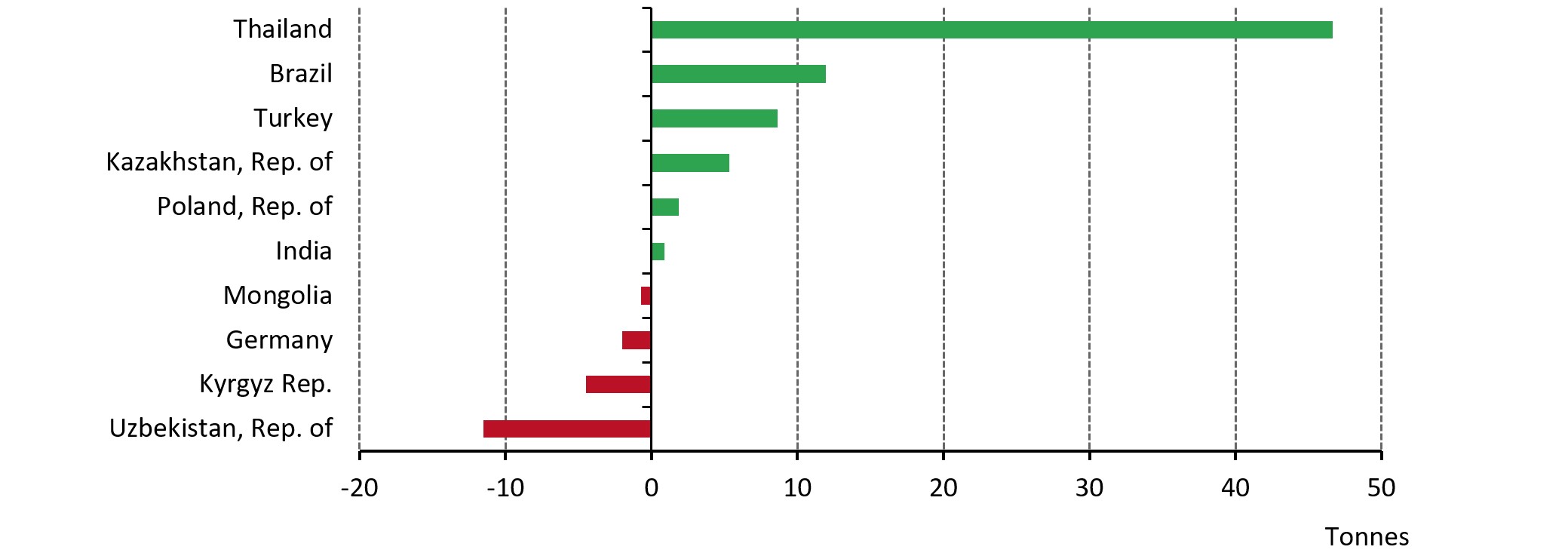

For a second consecutive month, Thailand was the biggest buyer, adding a further 46.7t in May and accounting for 82% of total net purchases for the month. This was on top of the 43.5t bought in April, and brings Thailand’s gold reserves to 244.2t, or 6% of total reserves. This represents an almost 60% increase in gold reserves since March. Recent comments from Dr Sethaput Suthiwartnarueput, Governor of the Bank of Thailand, indicated the bank’s belief that gold addresses the key objectives of security, return, diversification and tail-risk hedging.

Turkey also increased gold reserves by 8.6t during the month, bringing official sector reserves to 415t.3 This increase was calculated using data published by the Central Bank of the Republic Turkey and reflects newly available, more granular data, which enables us to better separate out gold held at the central bank that belongs to non-official sector institutions. Based on this new information we have also revised our Turkish official sector data series going back to 2017. More detail on this change to our data can be found here.

Brazil increased gold reserves by 11.9t, its first addition since November 2012. Gold reserves now stand at 79.3t (1% of total reserves) – the highest level since November 2000. Kazakhstan (5.3t), Poland (1.9t), and India (0.9t) were the other notable buyers during the month. This is Poland’s first increase in gold reserves since the middle of 2018, when the central bank bought 100t between May and July. This continues the increased level of interest in gold we have seen among Central and Eastern European countries in recent years.

There was also a m-o-m pick-up in sales during May, with gross sales totalling 18.9t, the highest level since January (22.5t). This was predominately driven by four central banks: Uzbekistan saw the largest fall in gold reserves, of 11.5t, with the Kyrgyz Republic (4.5t), Germany (2t), and Mongolia (0.7t) the other major sellers during the month.

Six central banks increased gold reserves in May, led by Thailand, while four saw gold reserves fall

Significant net purchases and sales in May in tonnes*

*Data as of 31 May 2021. Note: Chart only includes changes greater than 0.5t.

Source: IMF IFS, Respective Central Banks, World Gold Council

The full monthly dataset can be downloaded here. In addition, our 2021 Central Bank Gold Survey also provides additional insight into how the central banking community currently view gold.

A full update on central bank demand will be available in our upcoming Gold Demand Trends Q2 2021 report which will be published at the end of July.

1Our data set is based on IMF data, but is supplemented with data from respective central banks where is it available and not reported through the IMF at the time of publication. This data may be revised in our next monthly update should more data become available.

The y-t-d average for this calculation excludes the 81t increase in Japanese gold reserves as reported to the IMF. For more information on this, please see Gold Demand Trends Q1 2021.

Official sector reserves refers to combined gold reserves by the Central Bank of the Republic of Turkey (CBRT) and the Turkish Treasury.