Summary

- The domestic gold price ended 4.8% higher in October at Rs47,794/10g1

- Retail demand strengthened in the month with festival and wedding purchases

- Official imports were flat m-o-m as stocks remained ample and the average local market premium traded at flat

- Indian gold ETFs saw 0.3t of net inflows amid festive demand. Total holdings of gold ETFs increased to 35.4t by the end of October

- The Reserve Bank of India (RBI) added 3.7t of gold in October, increasing its total gold reserves to 747.6t.

Looking ahead

- Retail demand remained robust in the first two weeks of November with retailers reporting volume sales on Dhanteras exceeding the pre-pandemic levels of 2019.2 From the third week of November retail demand appears to be weakening; this follows robust purchases during Dhanteras and a rising gold price

- We anticipate that official imports may remain flat or lower in November. The higher gold price, together with sufficient imports in the previous three months, may dissuade trade from increasing imports.

Gold price rallied, local price remained flat

Gold prices rallied during October on higher inflation expectations, rising net long positioning on COMEX and a soft dollar. During the month the LBMA Gold Price AM in USD and the MCX Gold Spot in INR rose by 3.8% and 4.8% respectively.3 The relative stronger INR gold price performance could largely be attributed to a depreciating INR, which fell by 1% over the month.

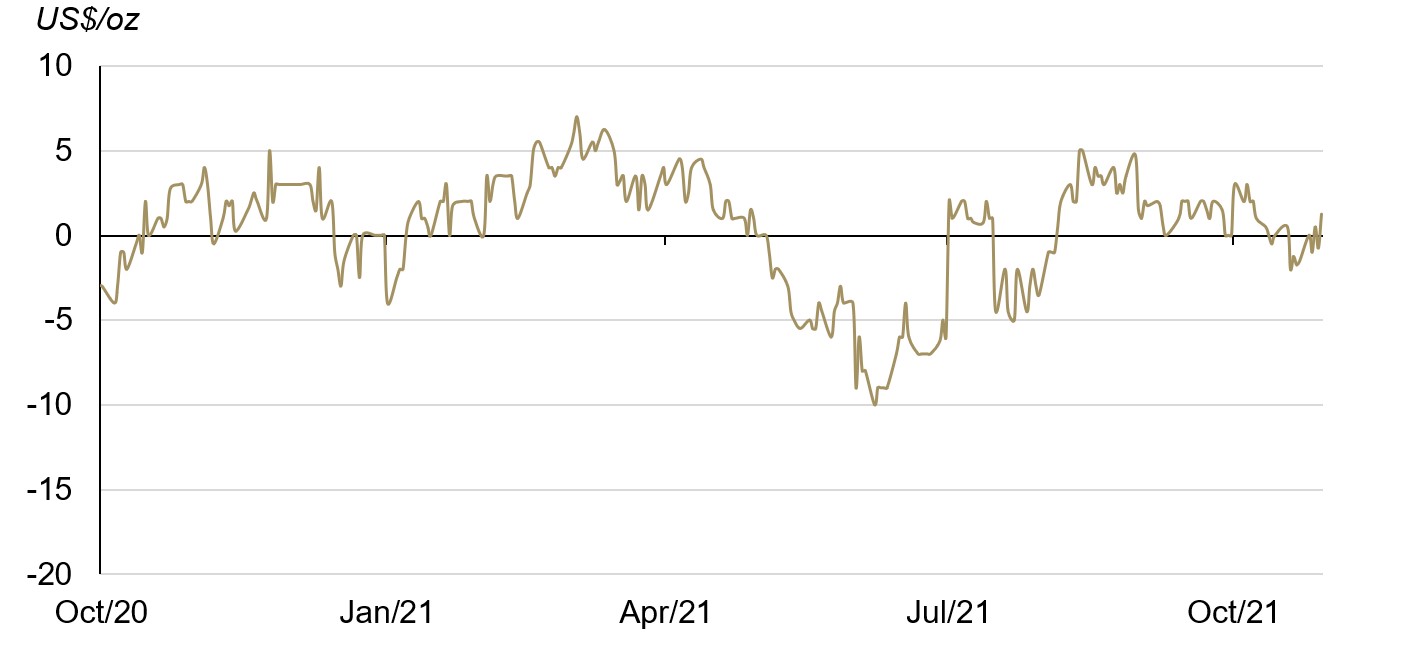

The average local premium remained flat at US$0.4/oz in the month, US$0.9/oz lower m-o-m. The domestic market remained in an average premium of US$1.3/oz in the first two weeks of the month but flipped back to an average discount of US$0.9/oz in the last two weeks as bullion offtake fell with the sudden increase in the gold price (Chart 1).4

Chart 1: The local gold price premium remained flat

Difference between MCX Spot Gold price and landed gold price in India derived from LBMA Gold Price AM

Source: NCDEX, World Gold Council

With the increased wholesale demand during Dhanteras, as well the ongoing wedding season, the local market remained at a premium of US$1–2/oz in the first two weeks of November, before it flipped back to discount of US$2-3/oz from third week of the month, driven by:

- a higher domestic gold price, which jumped to Rs49,400/10g during the third week of the month from Rs47,700/10g during Dhanteras

- ample bullion stocks with 211t of official imports: 121.8t in August and another solid 89.5t in September

- a slowdown in gold purchases after strong demand during Dhanteras.

Retail demand strengthened and imports remained flat

Retail demand got off to a strong start in October with anecdotal evidence of brisk sales during Dussehra.5 Retail demand was marginally soft during the third week of the month due to a higher gold price but bounced back during the final week, ahead of Dhanteras. Strong retail demand was underpinned by:

- festival purchases during Dussehra and Pushya Nakshatra, which supported jewellery as well as bar and coin demand6

- wedding purchases that supported jewellery demand

- higher y-o-y retail inflation (CPI inflation) of 4.48% in October compared to 4.35% in September, which supported investment demand.

Looking ahead to retail sales in November, anecdotal evidence points towards robust sales during Dhanteras, with retailers reporting volume sales exceeding the pre-pandemic levels of 2019. Retail demand appears to be weakening from the third week of November, coinciding with a rising gold price.

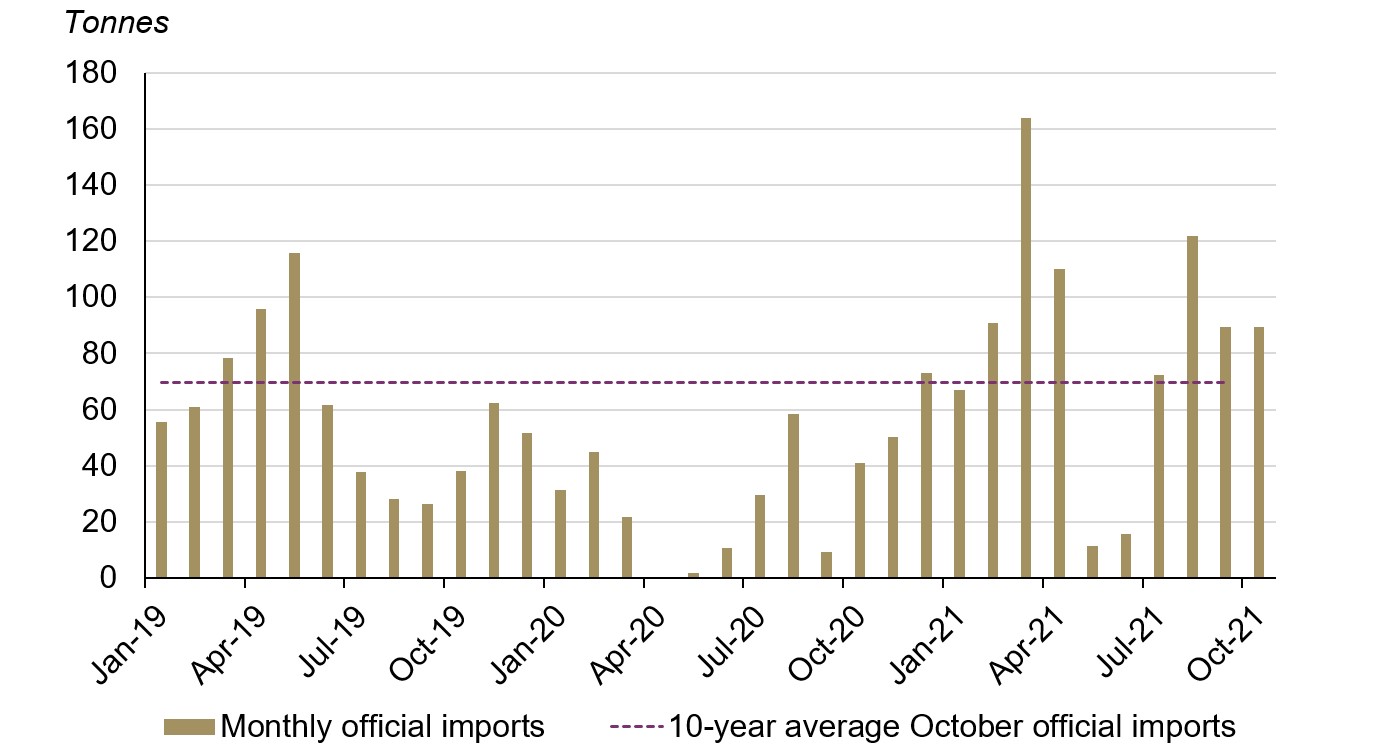

Indian official gold imports were 89.4t in October, flat m-o-m (Chart 2). The official imports in October were driven primarily by:

- a higher custom tariff rate of US$575/10g (up from US$560/10g) from 15 October until the end of the month aligned with higher gold price led to higher official import costs and consequently flat m-o-m imports

- sufficient supply in the market – following 211t of official imports during August and September – to fulfil retail demand in the month.

A total of eleven banks, nominated agencies and exporters imported 64.7t of bullion, and 20 refineries imported an equivalent 24.7t of fine gold content in the form of gold doré.

We anticipate that official imports may remain flat or lower in November. The higher gold price in November together with sufficient imports in the previous three months may dissuade trade from increasing imports further.

Chart 2: Indian official imports were above 10-year average

Indian monthly imports from January 2019 to October 2021

Source: Infodrive India, Ministry of Commerce and Industry, World Gold Council

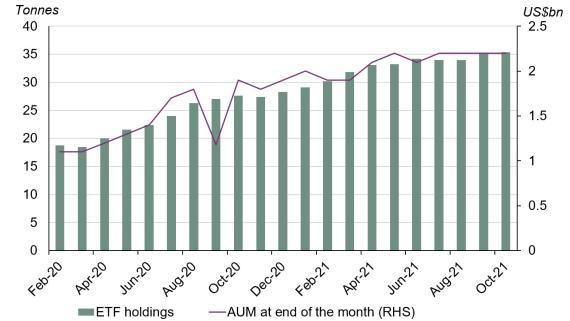

Gold ETF holdings saw 0.3t of inflows during the month

Indian gold ETFs continued to attract inflows in the month amid festive demand. Inflows into gold ETFs may been bolstered by retail participation via gold funds.7 Indian gold ETFs saw 0.3t (Rs3.03bn, US$40.4mn) of net inflows during October, taking total gold ETF holdings to 35.4t (Chart 3).8

Chart 3: Indian gold ETF holdings reached 35.4t at end of the month

Source: Bloomberg, Respective ETF providers, World Gold Council

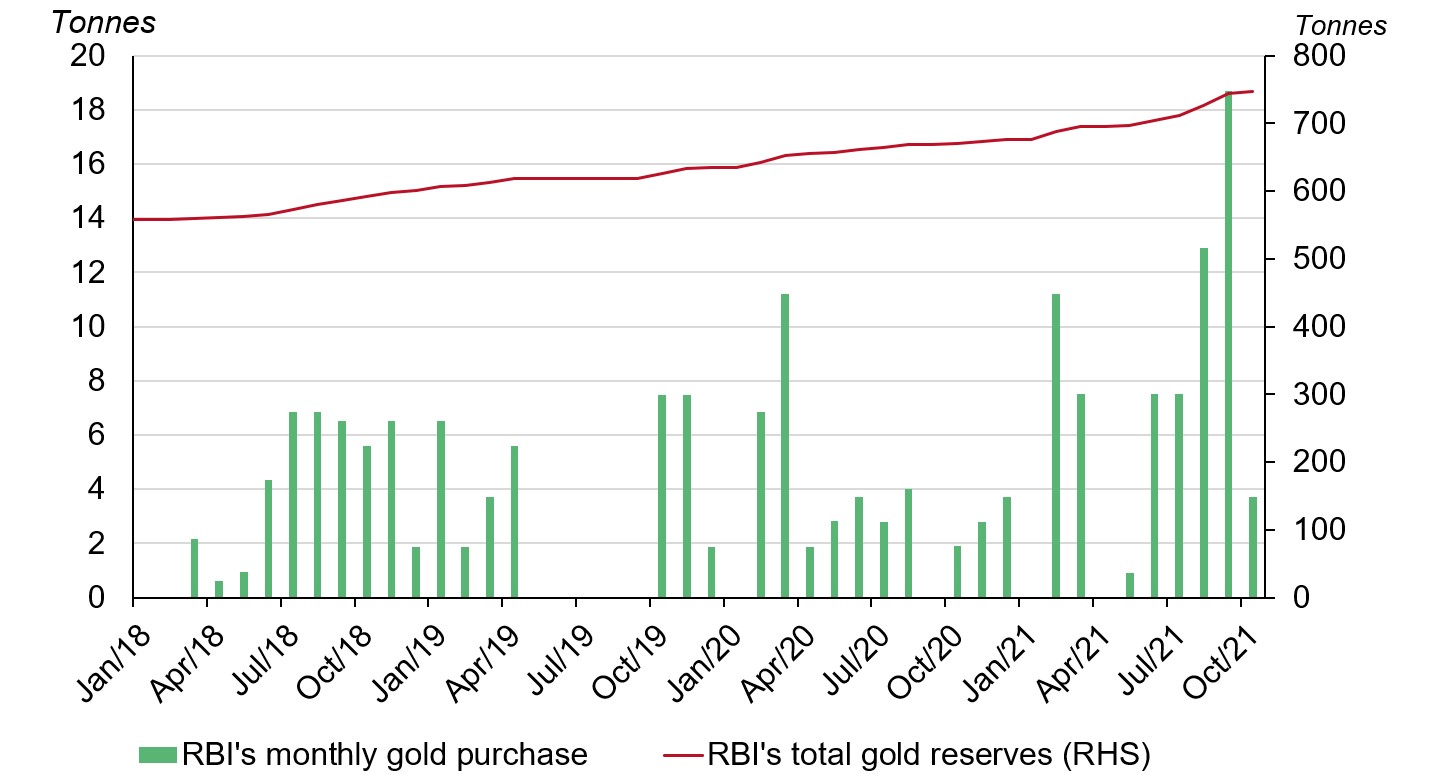

The RBI added 3.7t to its gold reserves

After purchasing 18.7t of gold in the previous month the RBI bought an additional 3.7t in October, taking its gold reserves to 747.6t or 6.6% of total reserves (Chart 4).9 The RBI has stepped up gold purchases over recent years and has added 69.9t to its gold reserves y-t-d; 2021 looks set to see the biggest annual increase in India’s official gold reserves since 2009.10

Chart 4: RBI added 3.7t to its gold reserves in October

Source: IMF, RBI, World Gold Council

Footnotes

Based on the MCX Gold Spot price in INR as of 29 October 2021.

Dhanteras fell on 2 November this year and marks the first day of the five-day long Diwali festival. On Dhanteras, Goddess Laxmi is worshipped and it is considered an auspicious day for gold purchases.

We compare the LBMA Gold Price AM with the MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

The premium/discount data is based on the gold premium polled spot price from National Commodity & Derivatives Exchange Ltd.

Dussehra is a major Indian festival celebrated at the end of Navratri each year. Navratri is an annual Hindu festival spanning nine nights and is celebrated as a mark of victory of good over evil. Dussehra was celebrated on 15 October 2021.

Pushya Nakshatra is considered the most auspicious nakshatra to bring home Goddess Laxmi – the Goddess of wealth – and is considered auspicious for gold purchases. Pushya Nakshatra falls a few days ahead of Dhanteras, and for 2021 this started on 24 October and ended on 25 October.

Gold funds provide an opportunity for retail investors to start a systematic investment plan (SIP) in gold ETFs without opening a demat account.

The goldhub data will be updated with revisions in the November monthly data release for ETFs, which will be published in early December.

Central bank data is taken from IMF-IFS; IFS up until August and weekly statistics from the RBI for September and October. Please refer to our latest central bank statistics: https://www.gold.org/goldhub/data/monthly-central-bank-statistics