Summary

- The domestic gold price ended 2.4% lower in August at Rs47,106/10g1

- Retail demand strengthened during the month with a correction in the gold price and wedding purchases

- Official imports hit a five-month high in August and the local market flipped back to a premium

- Optimism regarding prospects for economic recovery, higher vaccination rates, and a 9.4% return on BSE Sensex led investors to divert money into equity. Total holdings of gold ETFs remained at the same level of 34t by the end of August

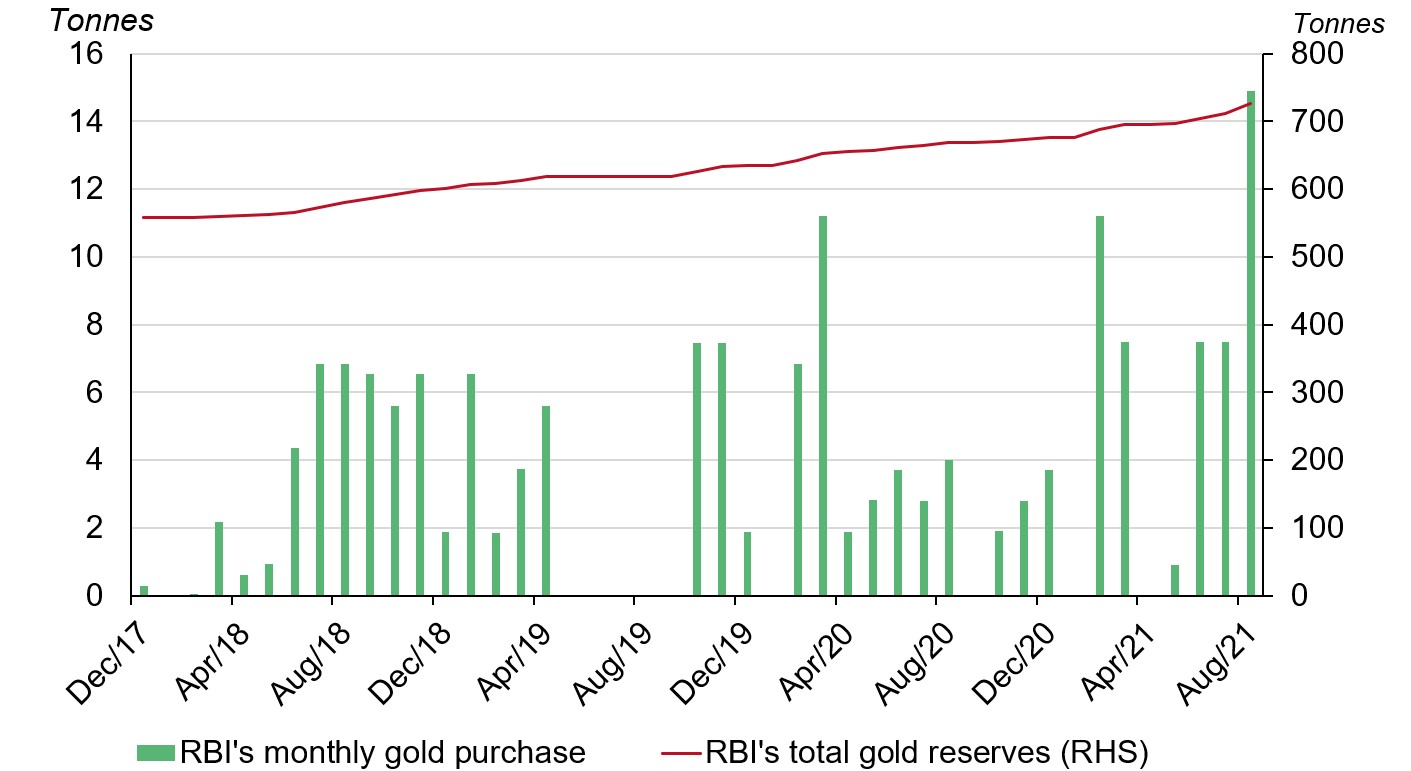

- The Reserve Bank of India (RBI) added 14.9t of gold in August, increasing its total gold reserves to 726.1t

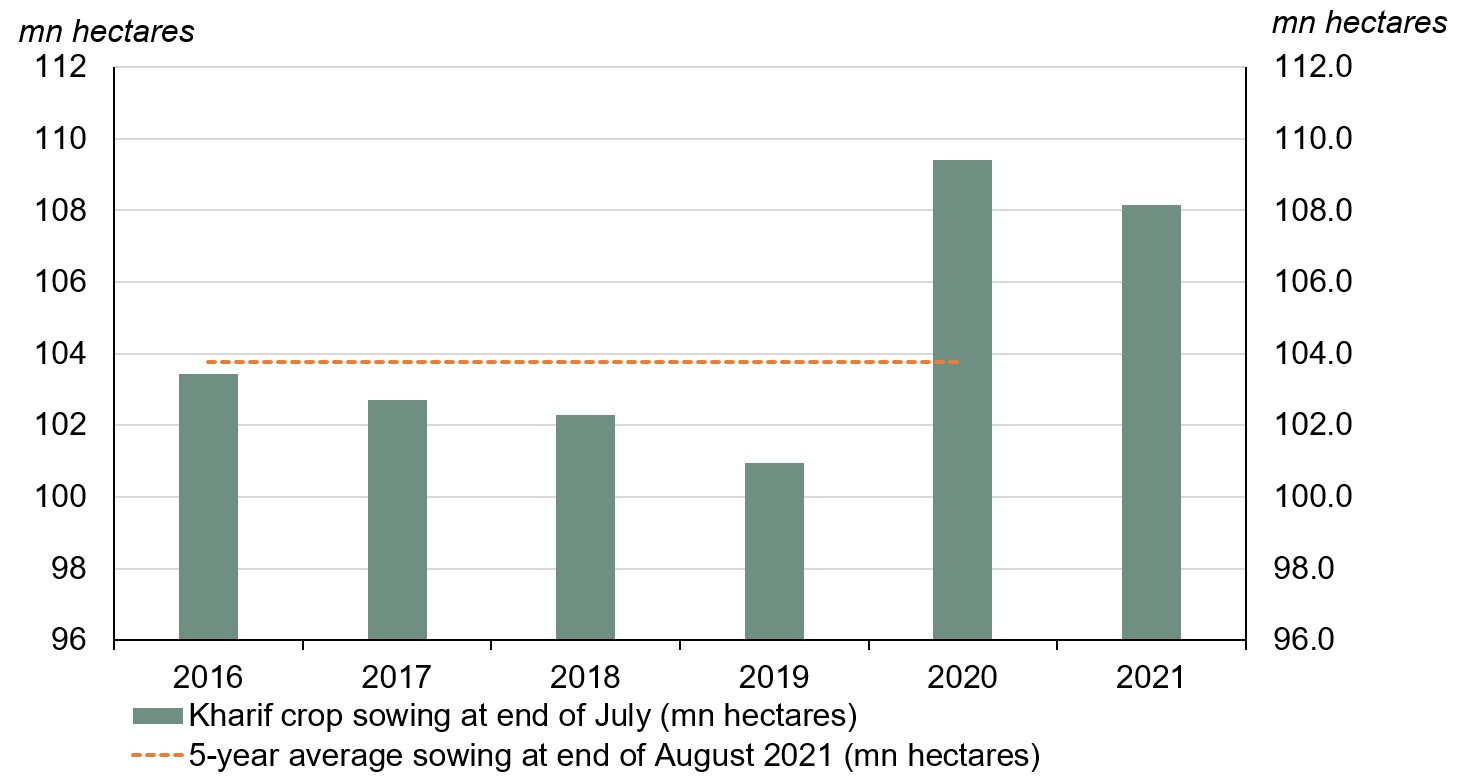

- Cumulative rainfall between June and August was 10% below the long-period average (LPA). Kharif sowing remained 1.1% lower than last year but 4.2% higher than the five-year average up to the end of August.

Gold prices declined in August

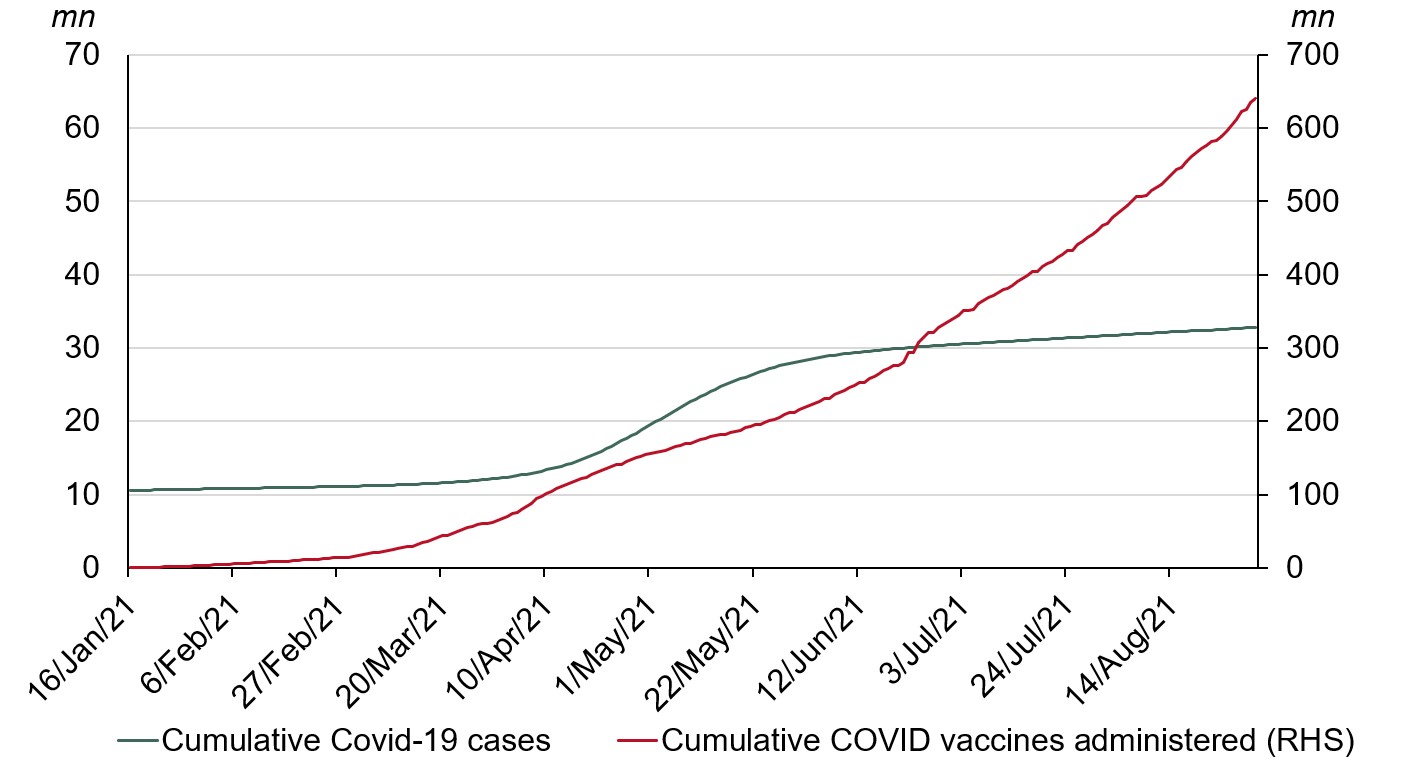

Gold fell slightly during August, in US dollars, on modestly firmer interest rates following strong US jobs data. During the month LBMA Gold Price AM in USD and MCX Gold Spot in INR fell by 0.8% and 2.4% respectively due to INR appreciating by 1.7% in the month (Chart 1).2

Chart 1: Gold prices declined in the month

Domestic gold price in rupees vs LBMA Gold Price AM in US dollars

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Economic activity is supported by higher vaccinations and fewer COVID cases

With the increased reach of the vaccination programme (Chart 2) and the release of pent-up demand following the easing of lockdown restrictions, several economic indicators showed signs of recovery during the month. The high-frequency indicators of trade and demand, such as E-Way bills, fuel demand, tractor sales, and labour participation rates, witnessed m-o-m growth in August.3 In the light of this sustained recovery in demand, rating agency CRISIL upgraded its credit outlook for India from cautiously optimistic to positive.

Chart 2: India's economic activity is supported by higher vaccinations and fewer COVID cases

India's cumulative COVID-19 cases vs cumulative vaccines administered

Source: Bloomberg, Our World in Data, World Gold Council

Lower prices and wedding purchases strengthened retail demand in the month

Following the improvement in July, retail demand strengthened in August. The correction in the domestic gold price on 9 August of 2.4% provided a fillip to demand in the first half of the month – largely driven by wedding purchases – although this tailed off slightly after the subsequent price recovery. Demand was also supported by buying on Onam, with anecdotal evidence suggesting an improvement y-o-y due to the low base of 2020 and improved consumer sentiment following the economic revival after the second wave of COVID-19.4 Based on interaction with the trade, large organised retailers reported 35–40% higher retail demand y-o-y in the month.

Retail demand is expected to remain healthy in September with the correction in the gold price, but may soften marginally with the onset of Pitru Paksha from 20 September – considered an inauspicious period for gold purchases.5

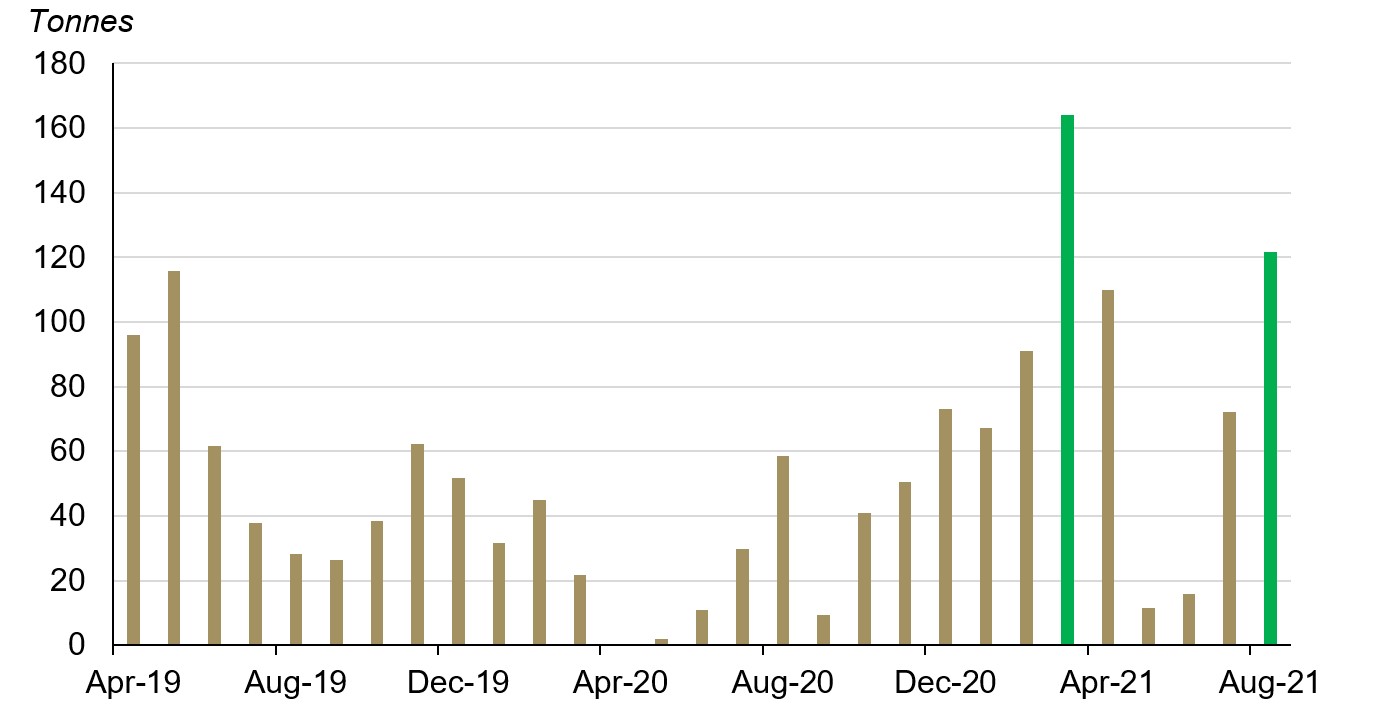

Indian official imports hit five-month high in August

Indian official gold imports hit a five-month high and totalled 121.8t in August 2021 – more than double the 58.5t from August 2020 and 68% higher than the 72.3t from July 2021 (Chart 3). Higher official imports in August were driven primarily by the following factors:

- Healthy retail demand in August and restocking by retailers ahead of the festive and wedding season in Q4 2021

- Lower customer tariff rate at US$563/10gm from 14 August till the end of the month from US$589/10gm, making gold imports cheaper thereby prompting trade for higher imports, with 64% of the official imports in the month landing after 14 August

- Increased momentum in manufacturing activity ahead of India’s leading B2B jewellery show, IIJS 2021, held between 15 and 19 September in Bangalore

- Strong uptick in gold jewellery exports to USA, Hong Kong, and China with continued recovery in these economies. Gold jewellery exports from India jumped more than three times between April and August on a y-o-y basis. Exports may get a further boost from the proposed Free Trade Agreement with UAE, with UAE being one of the top three jewellery export markets for India.

A total of 12 banks, nominated agencies, and exporters imported 104.7t of bullion and 19 refineries imported an equivalent 17.1t of fine gold content in the form of gold doré.

From a total of 121.8t in official imports, 58.2t was imported via the Sri City Free Trade Warehousing Zone (FTWZ).6 Seven overseas banks were responsible for these imports, with JP Morgan, ANZ, Rand Merchant Bank and Citi Bank accounting for 84% of the total. These imports have already landed in the custom-bonded warehouse of FTWZ and will help in reducing the logistics time in supplying gold to the trade ahead of the seasonally busy period of festivals and weddings in Q4 2021.

We anticipate that official imports will remain healthy in September. The further correction in the gold price in September and restocking by trade may support gold imports during the month.

Chart 3: Indian gold official imports hit five-month high in August

Indian monthly official gold imports from April 2019 to August 2021

Source: Infodrive India, Ministry of Commerce & Industry Govt. of India, World Gold Council

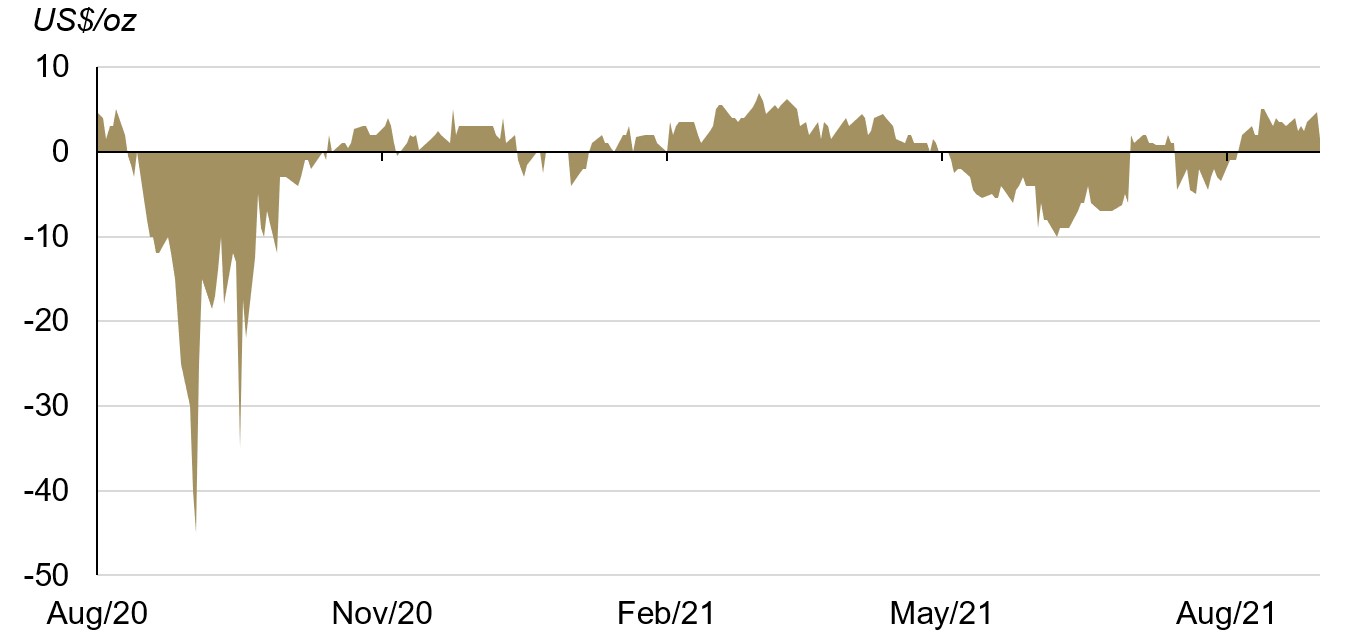

Local market flipped back to premium after demand strengthened in August

The local market flipped to a small premium of ~US$0.5–1/oz by the end of the first week of August and further widened to US$4–5/oz by the second week following the price drop. However, it narrowed to US$2–3/oz by the third week, and US$1-2/oz by the end of the month as the gold price recovered (Chart 4).7 With the momentum of retail demand continuing in September, the local market remained at a premium of US$1–2/oz in the first two weeks of the month.

Chart 4: Domestic market flipped back to premium after demand strengthened in August

Difference between MCX Spot Gold price and landed gold price in India derived from LBMA Gold Price AM

Source: NCDEX, World Gold Council

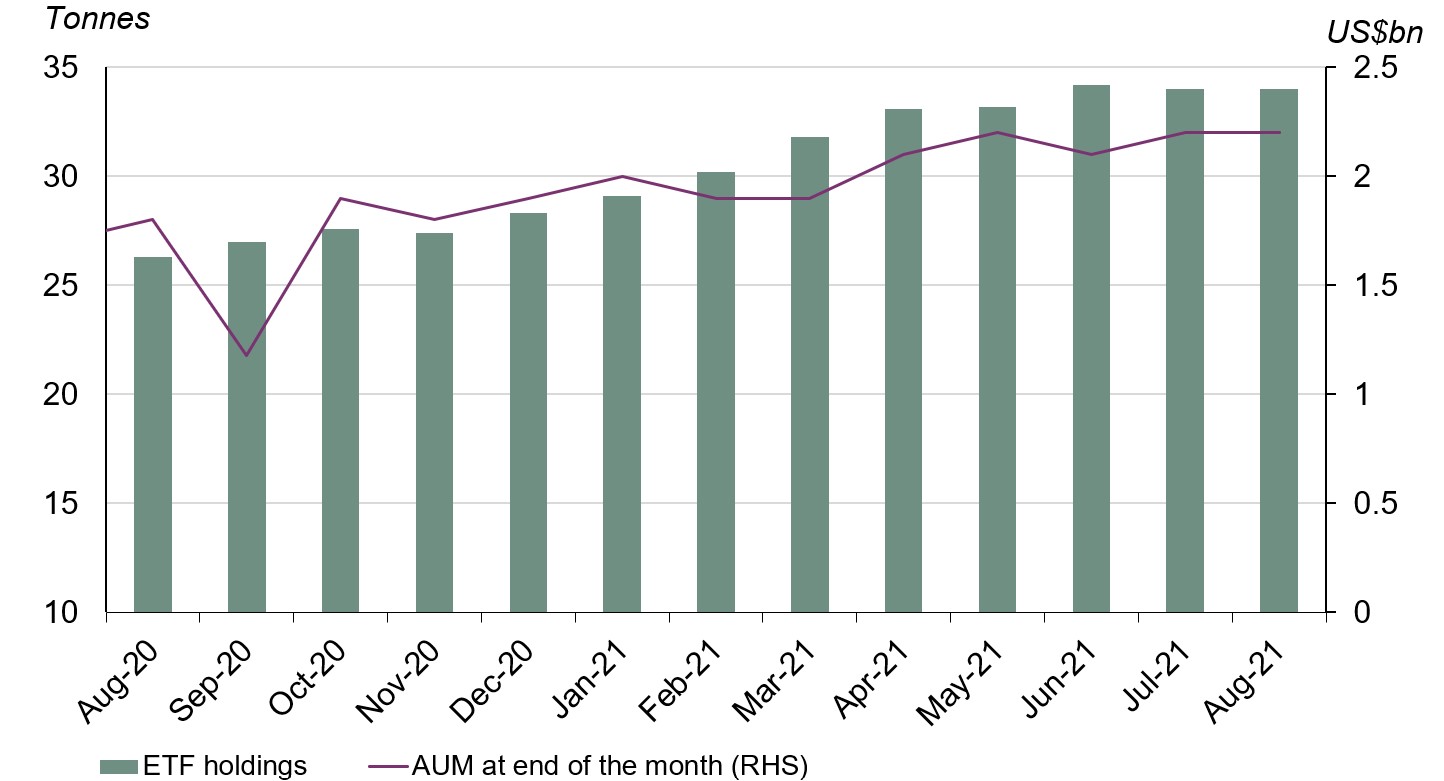

Gold ETF holdings saw no changes during the month

Renewed optimism over the economic recovery, higher rates of vaccination, and 9.4% return on BSE Sensex in the month led investors to divert money into equity. As a result, inflows increased by Rs0.24bn (US$3.2bn) during August, keeping total gold ETF holdings to 34t (Chart 5).

Chart 5: Indian gold ETF holdings saw no change at the end of August

Source: Respective ETF providers, Bloomberg, World Gold Council

The RBI added 14.9t to its gold reserves

After purchasing 7.5t of gold in the previous month the RBI purchased an additional 14.9t gold in August, taking its gold reserves to 726.1t or 6.6% of total reserves. The monthly purchase in August is the highest purchase since the RBI started purchasing gold frequently since December 2017 (Chart 6).8 The RBI has stepped up gold purchases over recent years and has added 49.56t to its gold reserves y-t-d.

Chart 6: RBI added 14.9t to its gold reserves in August; the highest level since it started purchasing gold in December 2017

Source: IMF, RBI, World Gold Council

Monsoon weakened in August but kharif sowing remained healthy

After a weak July, the monsoon weakened further in August with rainfall 24% below the LPA in the month – the weakest in the last 12 years with cumulative rainfall 10% below the LPA by the end of the month. If the lower rainfall affects crop yields, reduced kharif crop production could lead to higher food inflation – especially pulses and oilseeds, of which the government does not have high buffer stocks as compared to rice and cereals. The lower crop yield of kharif foodgrain could be a headwind for gold demand in Q4 2021. Even with a lower rainfall, the pace of kharif crop sowing has been sustained. Although 1.1% lower than 2020, up until the end of August it stands 4.2% higher than shown in the last five-year average sowing data (Chart 7).9

Chart 7: The sowing of kharif crops at the end of August remained healthy compared to the 5-year average sowing data

Source: Department of Agriculture and Farmers Welfare, World Gold Council

Footnotes

Based on MCX Gold Spot price in rupees as of 31 August 2021.

We compare the LBMA Gold Price AM with MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

An E-Way bill is an electronic bill for movement of goods and is generated on the E-Way Bill Portal. A Goods and Service Tax (GST) registered person cannot transport goods in a vehicle without an E-Way bill if the value of goods exceeds Rs50,000.

Onam is an annual Hindu harvest festival celebrated in the state of Kerala. It is considered an auspicious day for gold purchases. Onam fell on 21 August 2021.

Pitru Paksha is a 16-day period in the Hindu calendar where Hindus pay homage to their ancestors. Pitru Paksha starts from 20 September and ends on 6 October.

FTWZ offers a distinct advantage as overseas suppliers can import gold into the custom-bonded warehouse of FTWZ without paying customs duty for authorised operations. Imported gold can be stored in FTWZ for a long period – as long as the letter of approval (LOA) is valid – thus reducing the logistics time in supplying to the domestic market as compared to importing from the overseas market.

The premium/discount data is based on the gold premium polled spot price from National Commodity & Derivatives Exchange Ltd.

Central Bank data is taken from IMF-IFS; IFS up until July and weekly statistics from the RBI for August. Please refer to our latest Central Bank Statistics: https://www.gold.org/goldhub/data/monthly-central-bank-statistics.

Department of Agriculture and Farmers Welfare.