Last month Hungary tripled its gold reserves. The decision by the National Bank of Hungary (Magyar Nemzeti Bank, MNB) to increase its gold reserves to 94.5 tonnes, a historic high, follows a 10-fold increase in Hungary’s gold holdings in the last quarter of 2018.

Both increases were made for strategic reasons and were driven by Hungary’s long-term policy objectives. The MNB increased its gold reserves in an effort to strengthen the stability of the country’s financial system during times of geopolitical uncertainty and structural changes in the international financial system. The role of gold as a safe haven and “a major line of defence under extreme market conditions” also factored in the decision about the purchases.1

Risk management in the wake of the Covid pandemic2 and its severe impact on the global economy, played a key role in the MNB’s decision to increase gold reserves earlier this year. The unprecedented response of monetary and fiscal policies to the pandemic has resulted in sharp increases in government debts and rising inflationary pressures, bringing to the fore the role of gold as a safe haven and a long-term store of value.3

Central and Eastern European (CEE) gold holdings on the rise

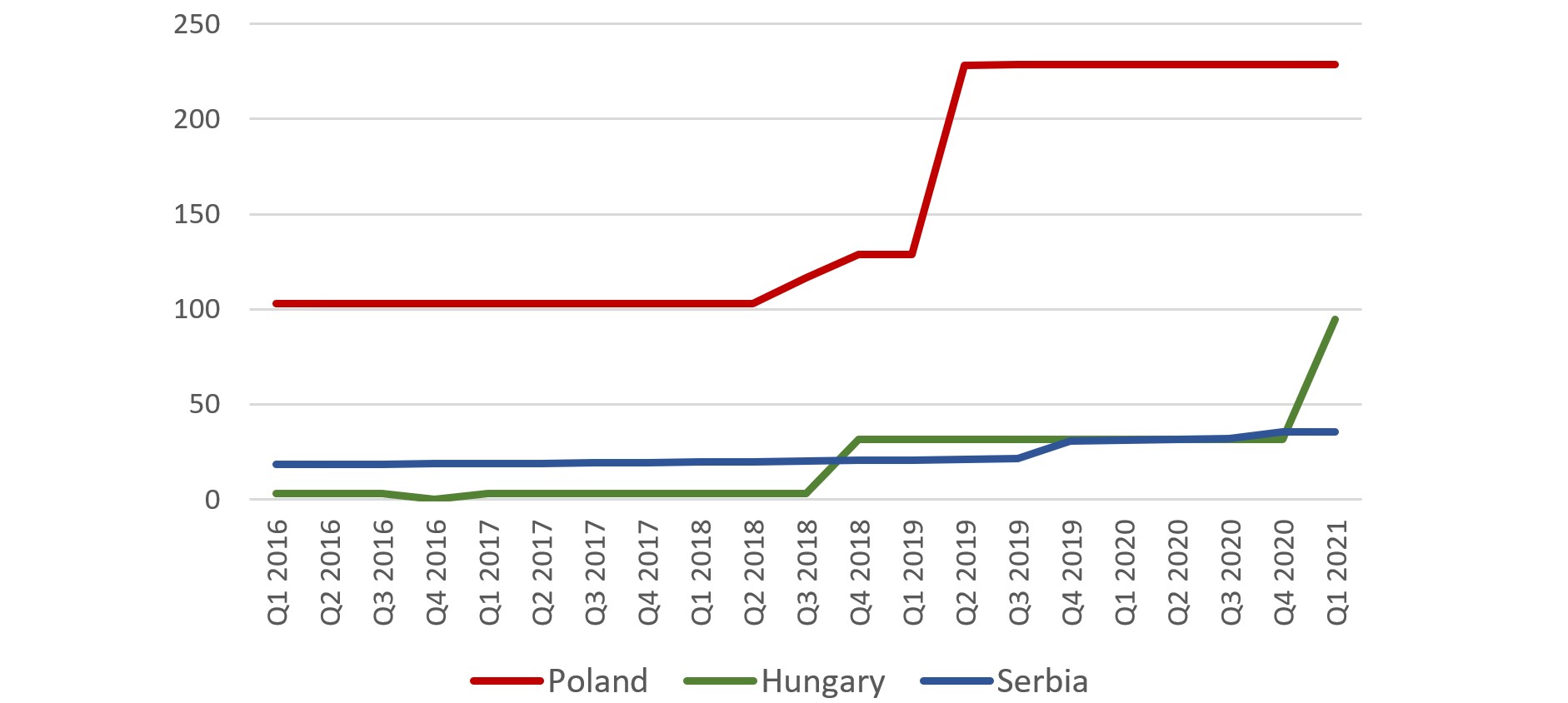

Hungary is not the only country in the region that has increased its gold reserves recently. Over the last three years the activity of CEE banks in the gold market has risen remarkably, with Poland, and Serbia - previously part of the former Yugoslavia – adding significant amounts of gold to their reserves (see Chart 1).

Chart 1. Gold holdings in tonnes 2016-2021

Source: World Gold Council

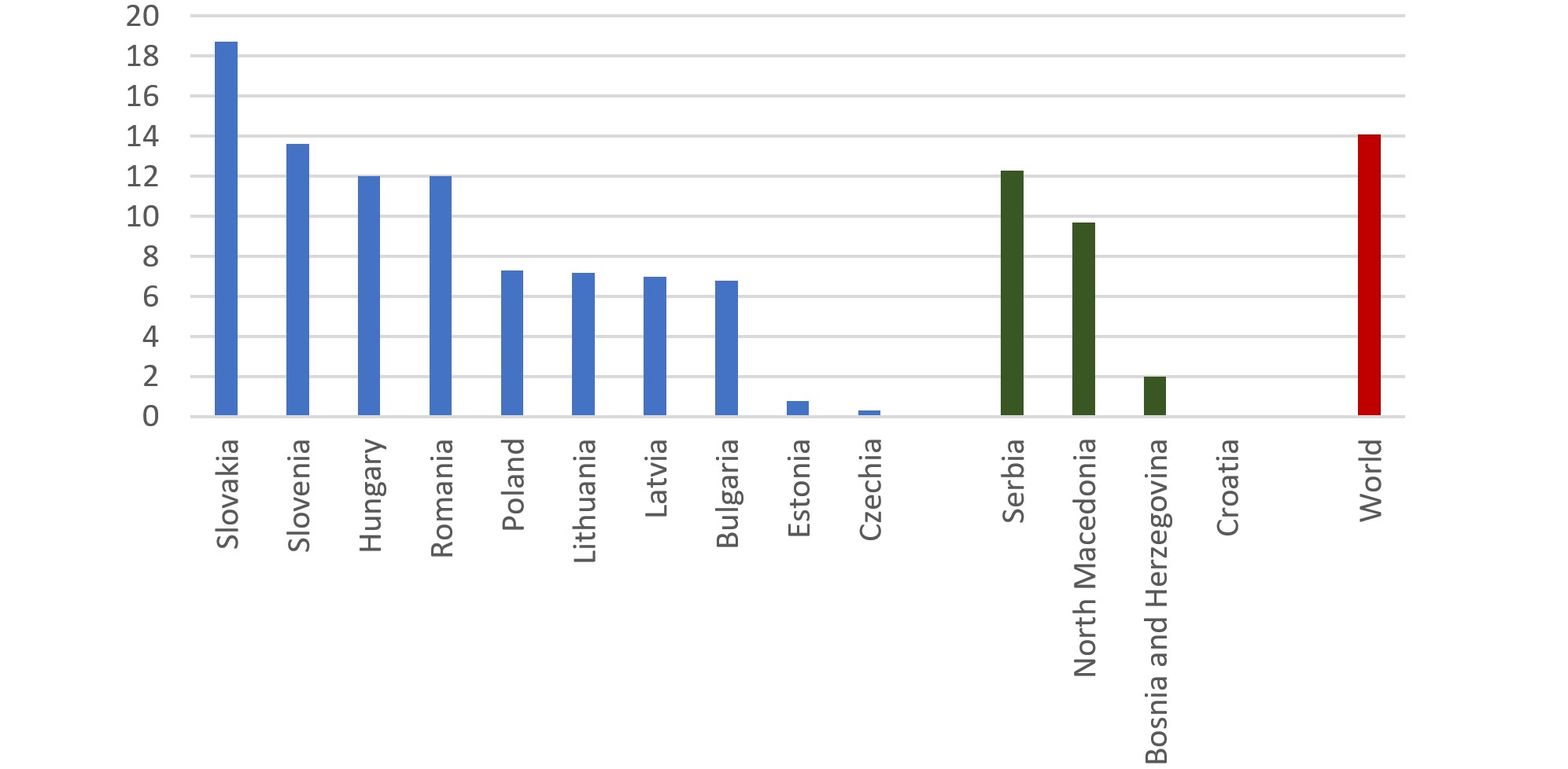

The National Bank of Poland (Narodowy Bank Polski, NBP) increased its gold holdings by 25.7 tonnes in the second half of 2018, and a further 100 tonnes in the second quarter of 2019, the largest global single gold purchase of the last decade.4 The strategic decision by the NBP to more than double its reserves was driven by the bank’s objective to diversify the geopolitical risk and strengthen the buffer protecting the country’s financial stability.5 The NBP regards gold as an asset that increases the country’s credibility and safeguards the robustness of its financial system during times of shocks and tensions. As a result of the purchases, which were made possible by a significant increase in Polish foreign reserves, the share of gold in Poland’s reserves has increased substantially; it is now closer to the world’s average (which in the fourth quarter of 2020 stood at 14.1%, see Chart 2), while the volume of Poland’s gold holdings has become highest in the region (see Table 1).

The National Bank of Serbia (Narodna Banka Srbije, NBS) has been gradually accumulating gold, adding about 0.2 tonnes a quarter since 2011. In 2019 the NBS stepped up its purchases, buying 9.2 tonnes in the third quarter of 2019 and a further 3.5 tonnes in the fourth quarter of 2020, doubling the share of gold in its reserves (see Table 1). The key driver behind these purchases was to shore up the stability of the Serbian financial system during a time of uncertainty and to guard against the heightened risk of a global crisis.6

Chart 2. Gold as % of total reserves of Central and Eastern European countries of the EU and countries of the former Yugoslavia

Source: World Gold Council

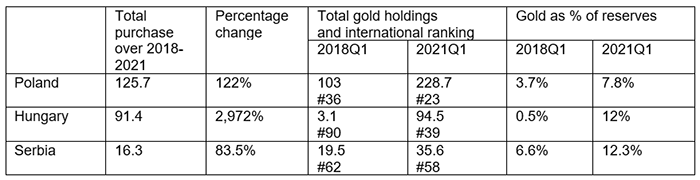

Table 1. Characteristics of recent purchases of gold by Poland, Hungary and Serbia

Source: World Gold Council

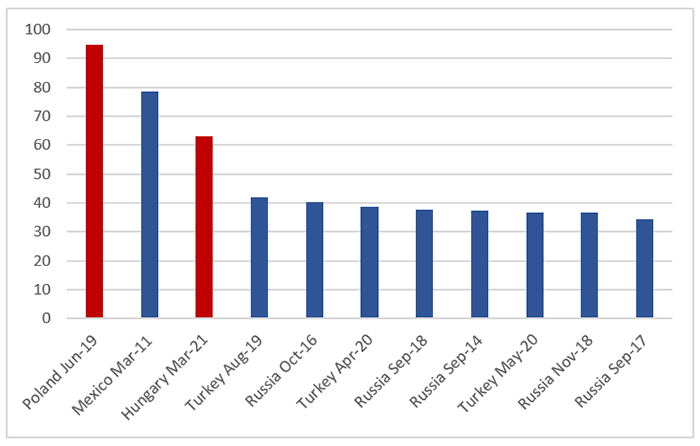

Poland, Hungary and Serbia increased their gold holdings quite sharply. The 100-tonne purchase by the NBP and the 63-tonne purchase by the MNB mark two of the three largest single monthly central bank gold buys over the last decade (see Chart 3). The NBP’s and MNB’s decisions to purchase gold were strategic in nature, taking into account the rapid structural changes in the global economy, such as shifts in the international financial system and global consequences of the pandemic.

Chart 3. Single largest monthly gold purchases in tonnes over 2011-2021

Source: World Gold Council

As a result of the recent purchases by Poland and Hungary, the CEE region has become a significant buyer of gold, accounting for 17% of total global central bank gold purchases over the last three years. The increased buying of gold from the region may continue into the future. NBP Governor Glapinski has recently announced that Poland may buy another 100 tonnes of gold over the next couple of years. Serbia, if it continues its policy of gradual acquisition of gold, may also continue adding small amounts of gold to its reserves. Thus, the CEE region may continue to be an important centre for central bank gold activity in coming years.