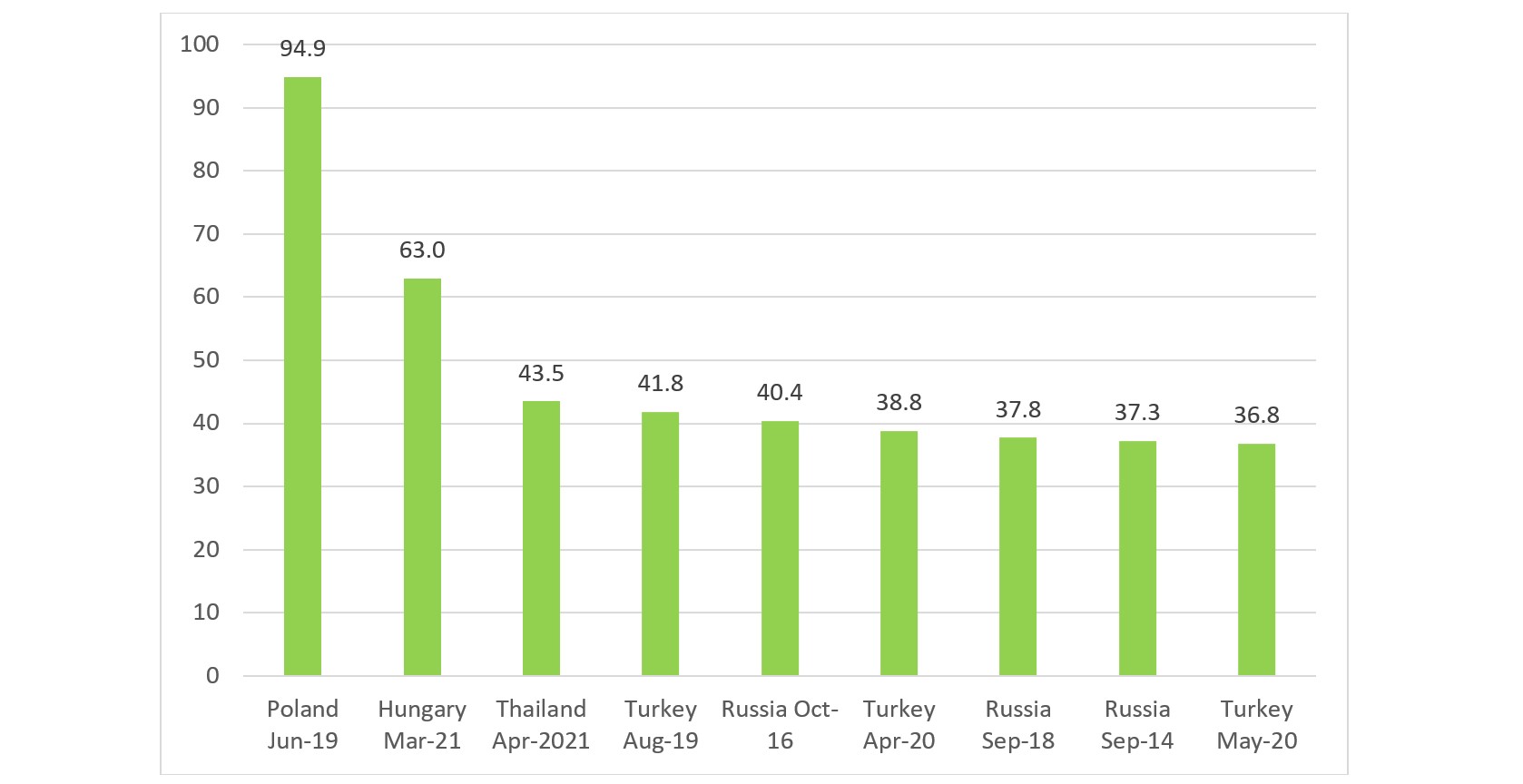

As Krishan Gopaul’s blog post last week pointed out, central banks have been buying gold during the first four months of 2021. Over that period, we estimate that the official sector has added 150-200 tonnes of gold. A significant portion of this buying has come from the central banks of Hungary and Thailand, who added 63 tonnes in March and 43.5 tonnes in April, respectively. In fact, these two purchases are the second and third largest monthly central bank gold purchases in recent history, eclipsed only by Poland’s 100 tonne purchase in June 2019 (see chart below).

Thailand’s gold purchases appear to be continuing in May as well. The Bank of Thailand publishes weekly reserve position data on gold, although reported in US dollar terms and not tonnage. Between 30 April and 28 May 2021, the value of the Bank of Thailand’s gold reserves grew from US$11.2 billion to US$14.9 billion, an increase of US$3.7 billion. A back-of-the-envelope calculation shows that this growth may imply a 40-50 tonne increase. We will have to await the May update from the IMF to see what the exact change in Thailand’s gold reserves is.

The Bank of Zambia has also started to accumulate gold in recent months, albeit on a smaller scale than the aforementioned central banks. Since February 2021, it has added 2,100 ounces per month to its reserves. Zambia has already reported its May gold holdings to the IMF, which now total 8,400 ounces or 0.26 tonnes. These purchases are likely the result of the central bank’s decision to build its gold reserves from domestic production. Zambia now joins the central banks of Mongolia, the Philippines, and several other countries in sourcing gold reserves from domestic mine supply.

Hungary issued a press release that accompanied its March purchase which cited “new risks arising from the coronavirus pandemic” as playing a key role in its decision to buy. Bank of Zambia Governor Christopher Mvunga said that “during periods of market stress – when assets would be losing value – gold would be adding value, thereby shielding the whole portfolio from large losses.” Our 2021 Central Bank Gold Reserves survey found that gold’s performance during crisis periods is now the most relevant factor for central banks to hold gold, echoing the sentiments above. As uncertainty over the post-pandemic recovery hangs over global markets, it will undoubtedly continue to drive central bank investment decisions over the coming year.