Q1 saw gold demand of 815.7t

Strengthening consumer demand mitigated the impact of ETF outflows as global economies continued to recover

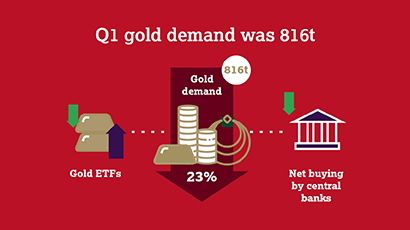

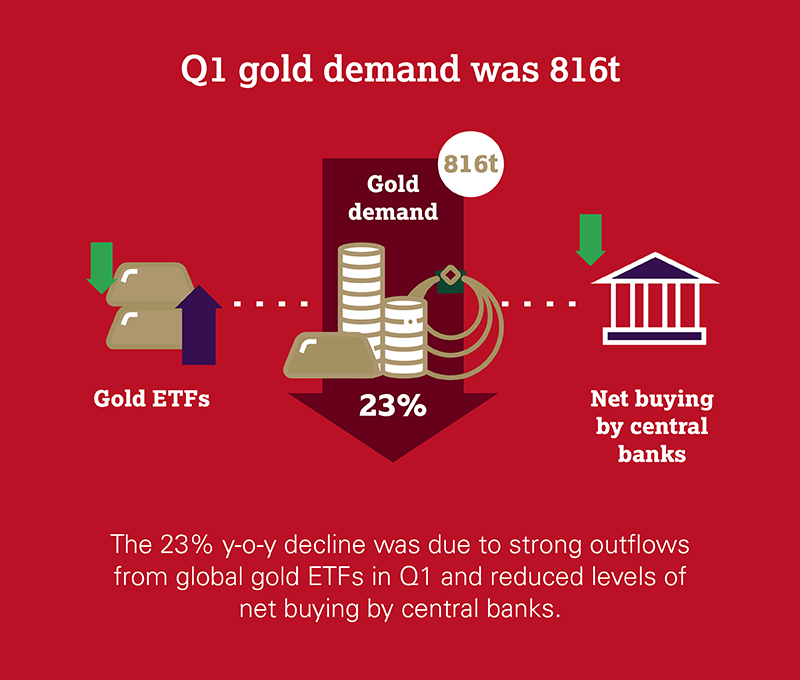

Q1 gold demand (excluding OTC) was 815.7t, virtually on a par with Q4 2020, but down 23% compared with Q1 2020.

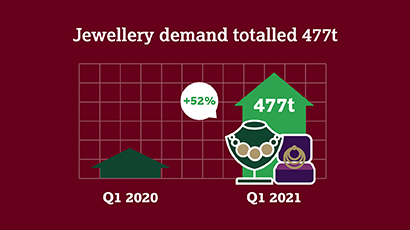

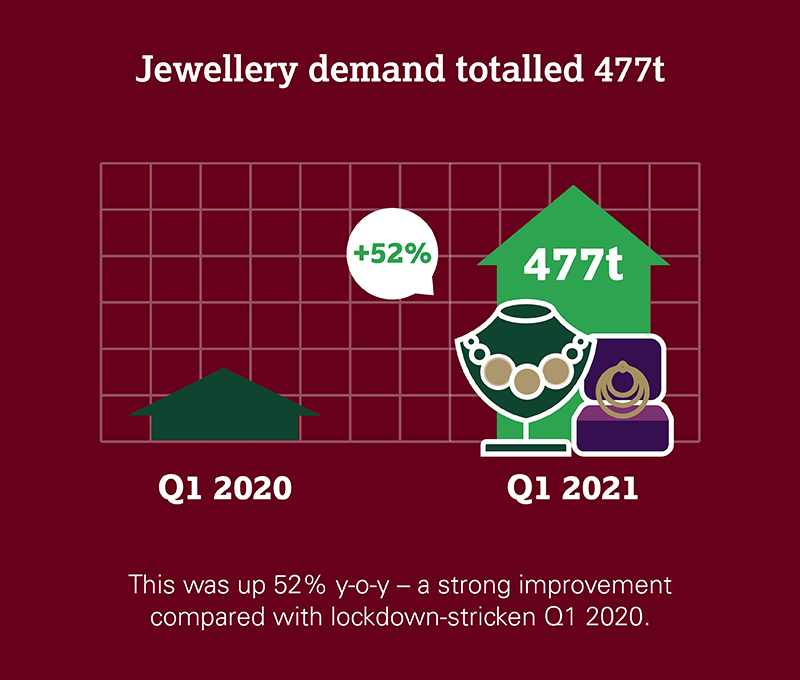

While the average gold price in Q1 was 13% higher y-o-y, it declined by 4% q-o-q.1 The opportunity to buy at lower prices, relative to the highs seen last year, boosted consumer demand, particularly as many markets continued to emerge from lockdown and economic recovery lifted sentiment.

Jewellery demand of 477.4t was 52% higher y-o-y . The value of jewellery spending – US$27.5 billion (bn) – was the highest for a first quarter since Q1 2013.

Bar and coin investment of 339.5t (+36% y-o-y) was buoyed by bargain-hunting, as well as by expectations of building inflationary pressures.

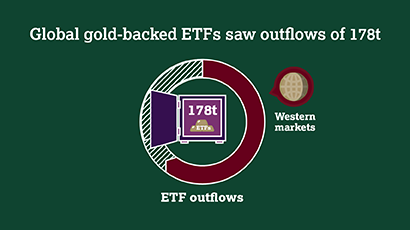

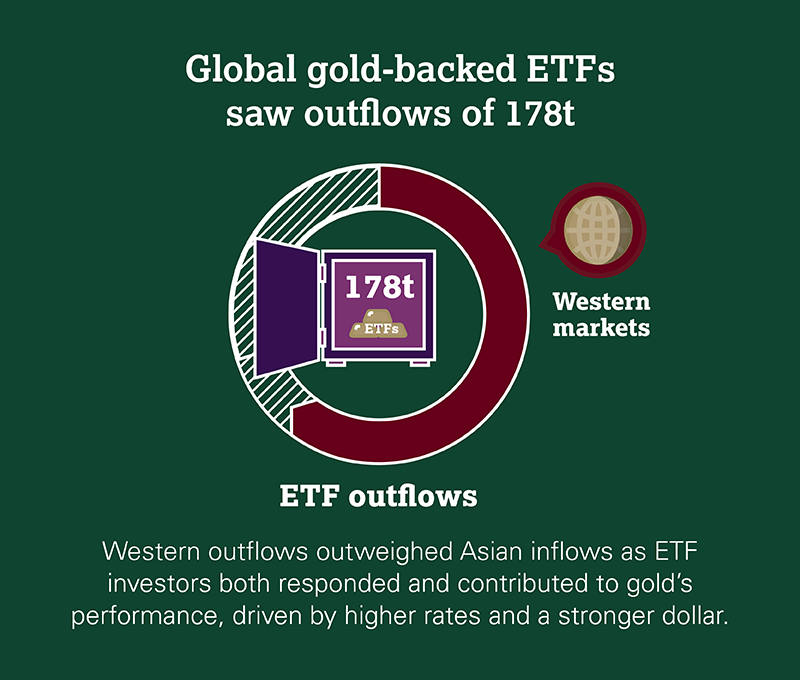

Growth in consumer demand was offset by strong outflows from gold-backed ETFs (gold ETFs), which lost 177.9 in Q1 as higher interest rates and a downward price trend weighed on investor sentiment.

Q1 saw continued healthy levels of net buying by central banks: global official gold reserves grew by 95.5t, 23% lower y-o-y, but 20% higher q-o-q.

Gold used in technology grew 11% y-o-y in Q1 as consumer confidence continued to recover. Demand of 81.2t was just above the five-year quarterly average of 80.9t.