Summary

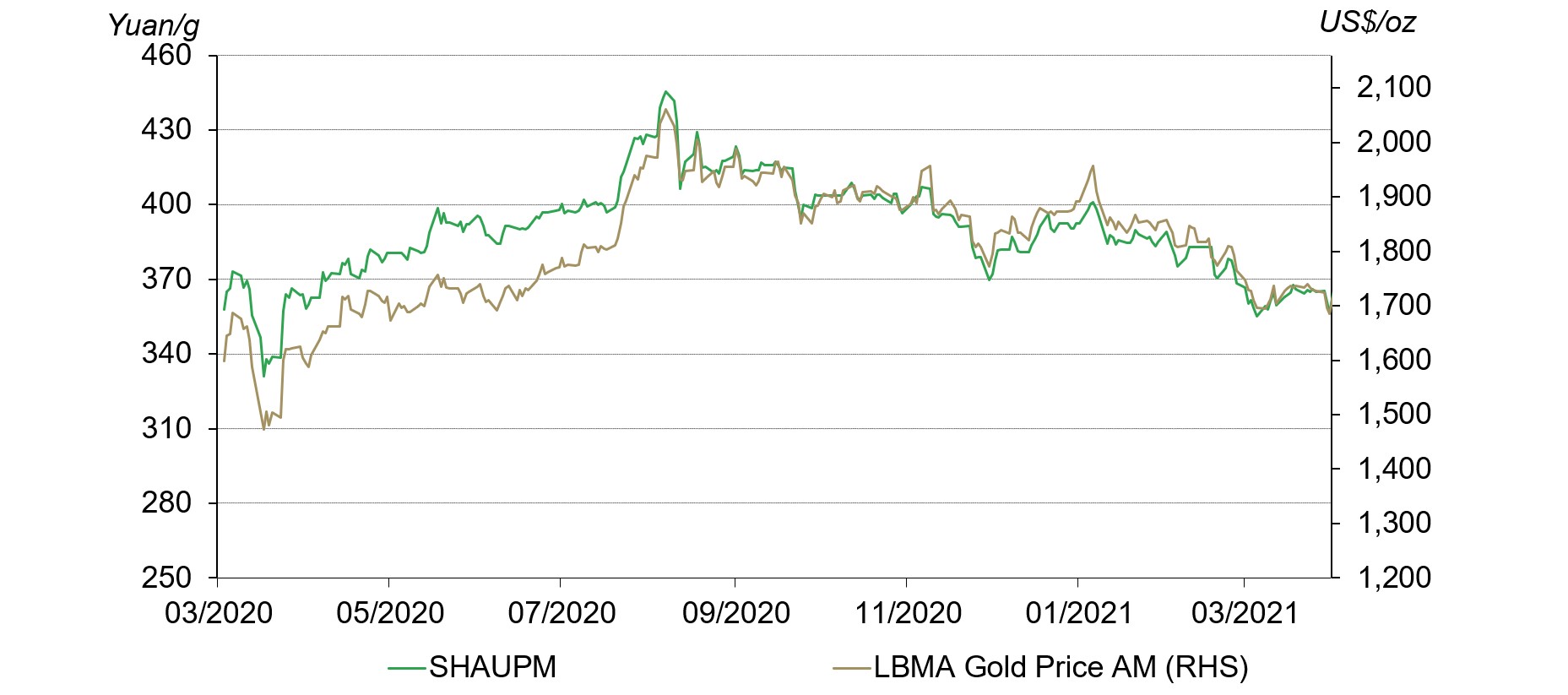

- The LBMA Gold Price AM (USD) declined by 4.5% and the Shanghai Gold Benchmark Price PM (SHAUPM) (RMB) dropped 3.2%in March1

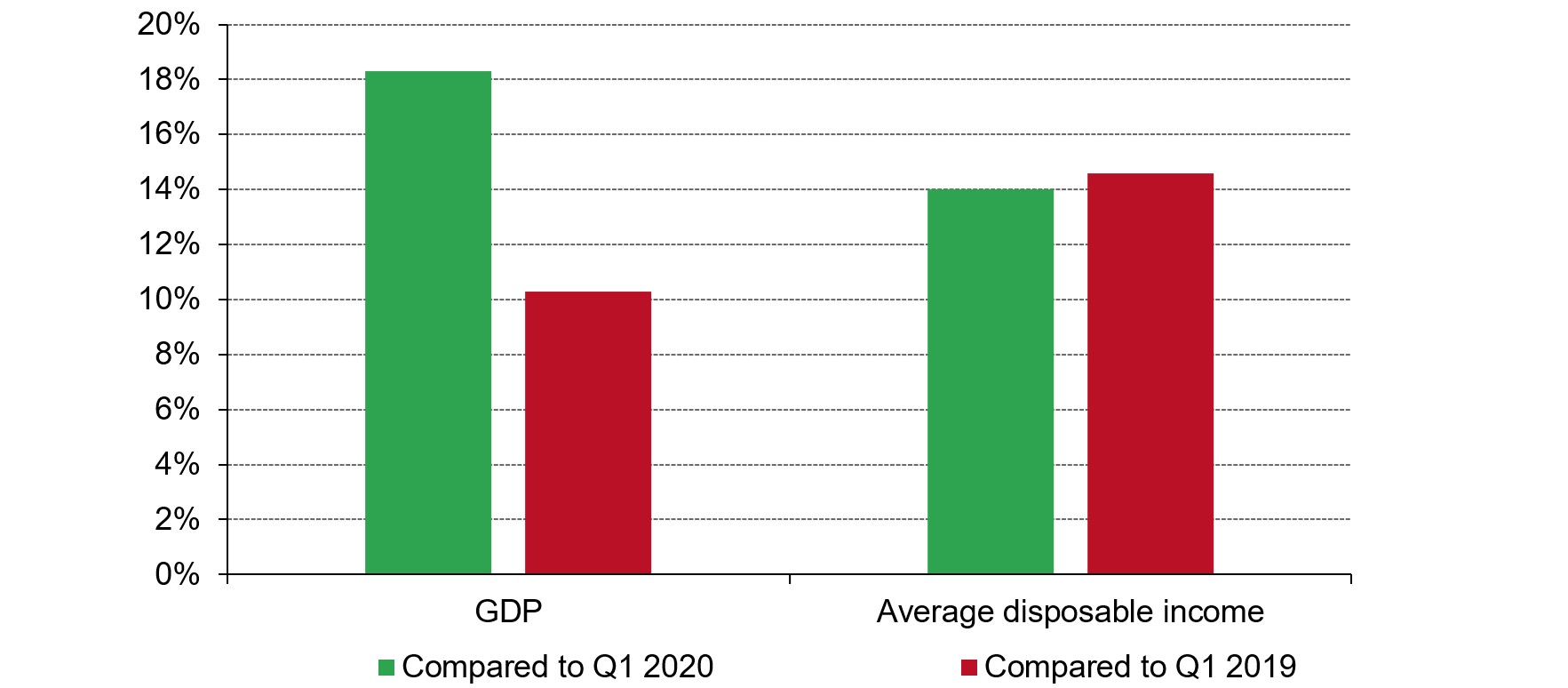

- China’s economy started 2021 with a strong Q1

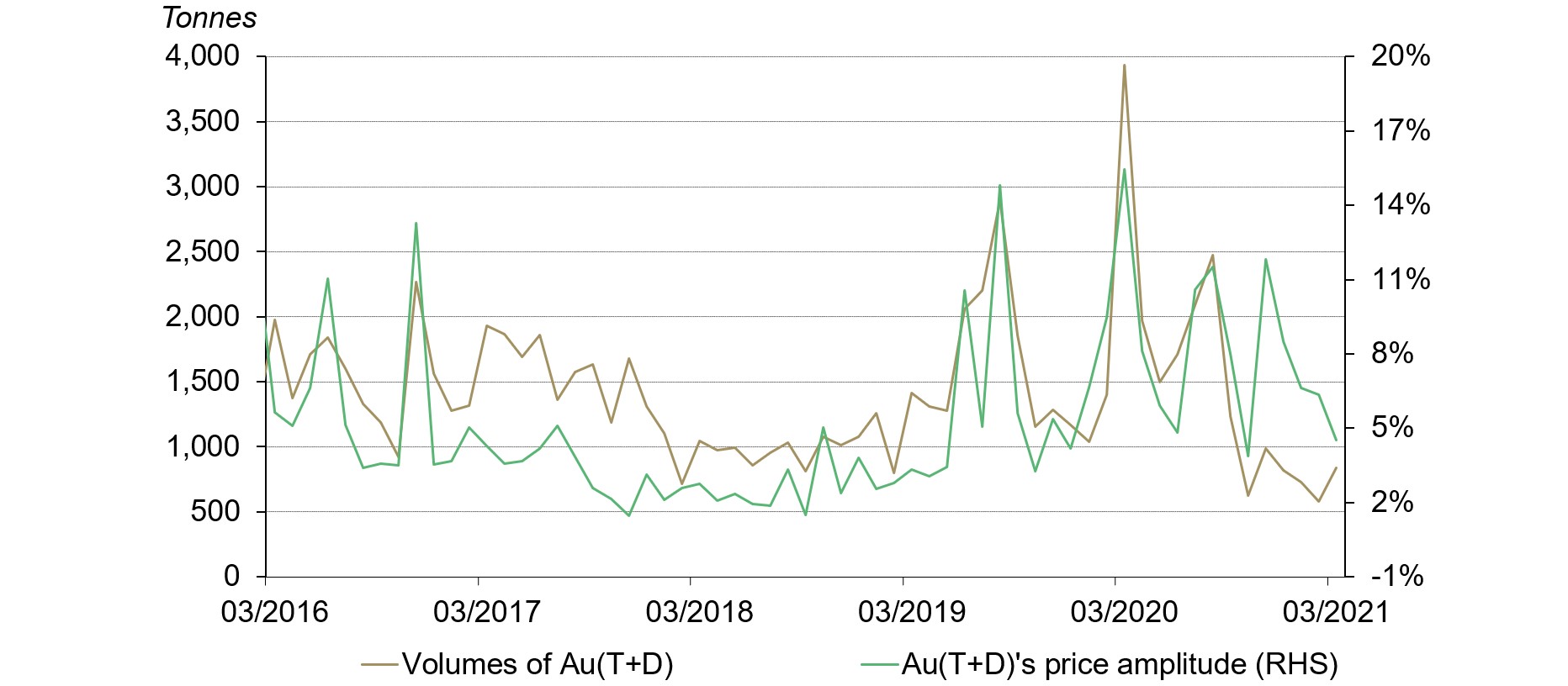

- Au(T+D)’s trading volumes dropped significantly in March, yet Chinese gold ETF holdings set a new record:

- Au(T+D)’s trading volumes in the month totalled 836 tonnes (t), 3,099t lower y-o-y despite a 255t m-o-m rebound

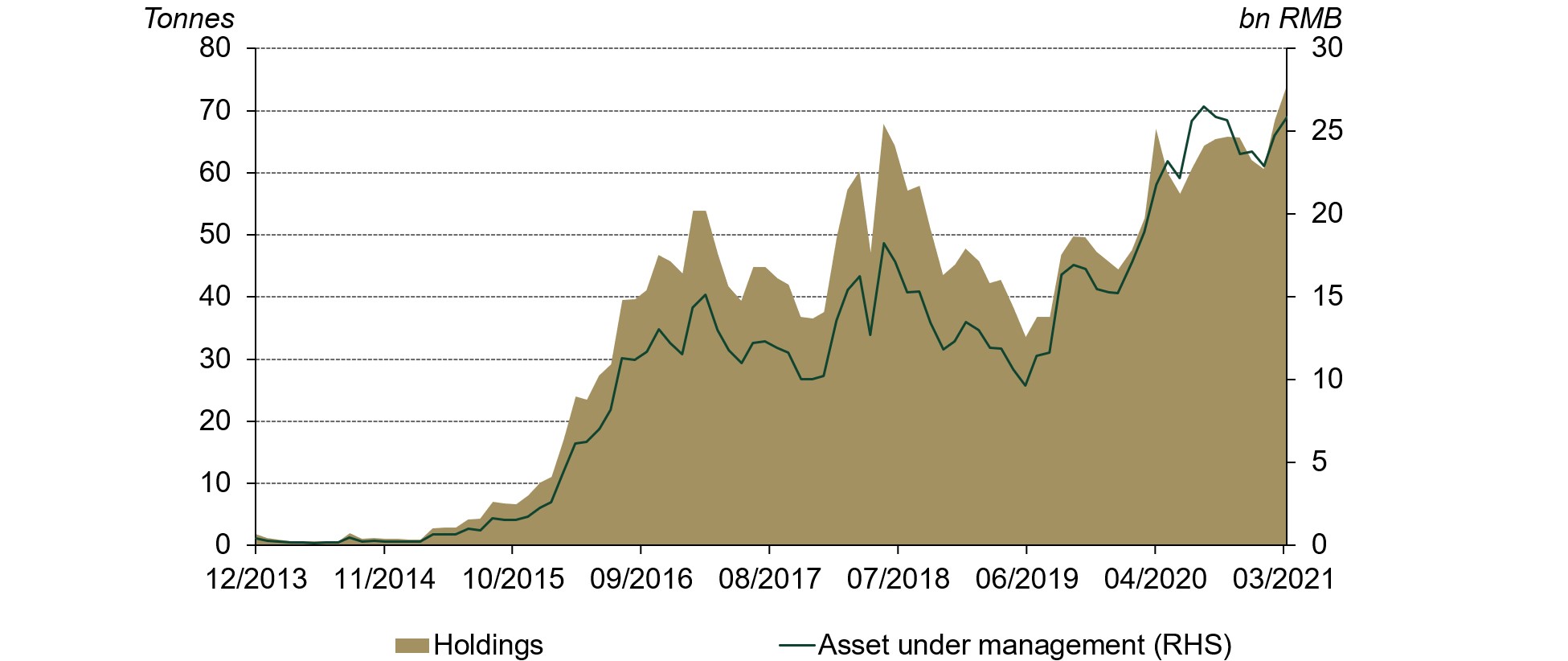

- Chinese gold ETF holdings increased by 5.3t (US$287mn; RMB1.9bn) in the month, reaching 72.4t (US$3.9bn; RMB25.8bn) in collective holdings, the highest on record

- Gold withdrawals from the Shanghai Gold Exchange (SGE) in March were 82% higher m-o-m and 104% higher y-o-y

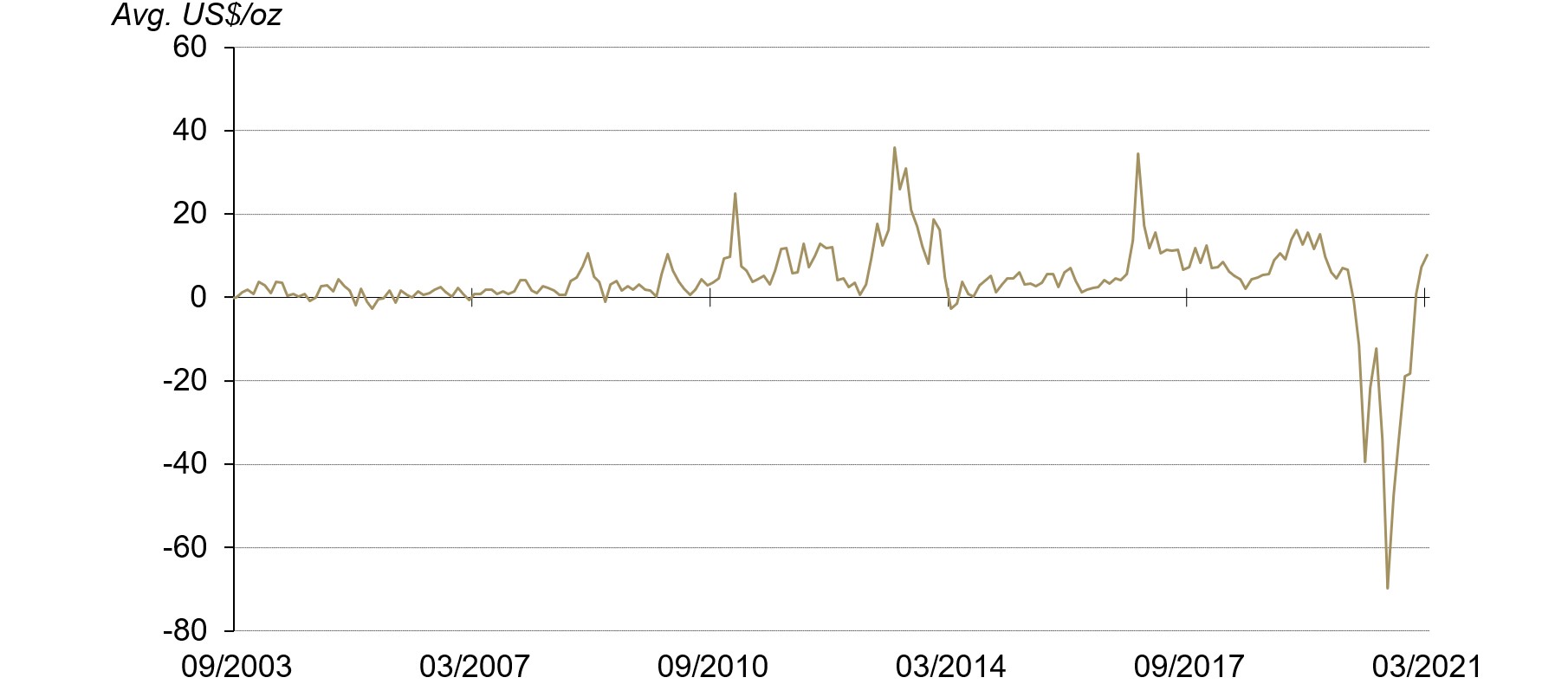

- In March, the Shanghai-London gold price spread rose to US$10.2/oz on average, US$3/oz (42%) higher m-o-m2

- The People’s Bank of China gold reserves remained at 1,948t at the end of March, accounting for 3.2% of its total reserves. The Chinese central bank has kept its gold reserves unchanged since September 2019.

- As we enter Q2, the off season for Chinese gold consumption, China’s wholesale gold demand in April could face challenges

Rising real rates continued to weigh on gold prices in March. Real yields in key regions climbed further – representing an opportunity cost to hold gold and reflecting improved economic conditions in these markets, as well as investor expectations of higher inflation to come. Our short-term gold performance attribution model also suggests that the rising opportunity cost of holding gold last month was a major contributor to the subdued gold prices.

Gold price performances remained weak in March

Source: Shanghai Gold Exchange, ICE Benchmark Administration, World Gold Council

The Chinese economy kicked off 2021 with a strong Q1. In the first quarter of the first year of the nation’s 14th five-year plan – a plan sets out the country’s principal economic targets and policy priorities in the next five years – China’s y-o-y GDP growth reached 18.3% - the highest on record – and local residents saw their disposable income increase by 13.7% y-o-y.

Compared to Q1 2019, Chinese residents’ disposable income and the nation’s GDP in the first quarter were 10.3% and 14.8% higher respectively. And anecdotal evidence suggests that local gold consumption usually benefits from a strong economy.

China's economy in Q1 saw strong growth

Source: National Bureau of Statistics, World Gold Council

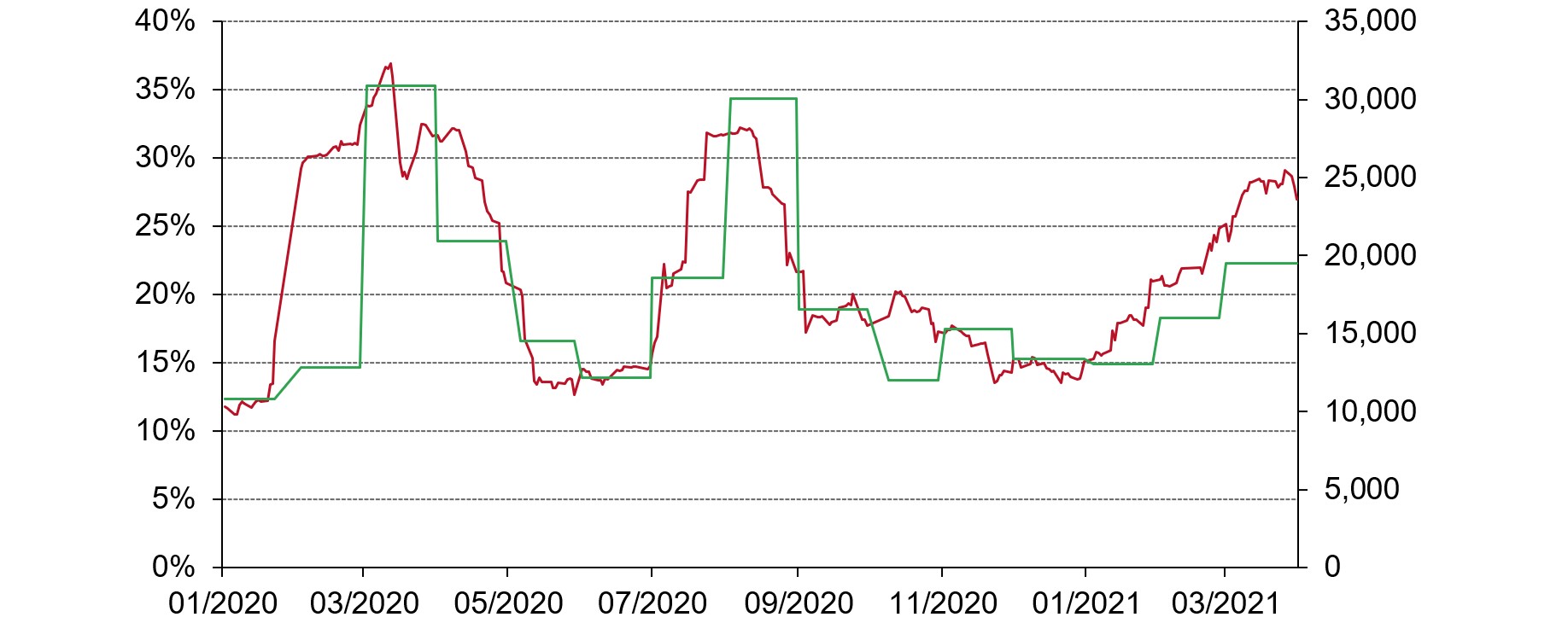

Despite the m-o-m rebound, Au(T+D)’s trading volumes fell by 79% y-o-y in March. More trading days in March than in February were the chief driver of the 44% m-o-m increase; however, two main factors underpin the y-o-y plunge in the contract’s trading activities:

- volatility in the local gold price was significantly lower than March 2020, diminishing the contract’s attractiveness to short-term traders

- one year ago gold was headlining local news amid the COVID-19 pandemic and was enjoying a surge in related safe-haven demand

Au(T+D)'s trading volumes rebounded m-o-m but fell sharply y-o-y

Source: Shanghai Gold Exchange, World Gold Council

Chinese gold ETF total holdings stood at 72.4t (US$3.9bn; RMB25.8bn) as of March, 5.3t (US$287mn; RMB1.9bn) higher m-o-m. In tonnage terms, Chinese gold ETF holdings set a new record in March and in value terms, the second highest.

Chinese gold ETF holdings set a new record in March

Source: ETF providers, World Gold Council

A turbulent stock market remained the main driver of inflows into Chinese gold ETFs last month. Due to pullbacks amid lofty valuations, the CSI300 stock index ended March with a 5.4% decline and showed the highest volatility since last August. As volatility climbed, the Baidu Search Index of gold – measuring the frequency of online searches using the keyword “gold” via Baidu – rose synchronously, implying an elevated interest in gold from potential investors.3

Heightened stock market volatility has spurred local interest in gold

Source: Wind, Baidu Index, World Gold Council

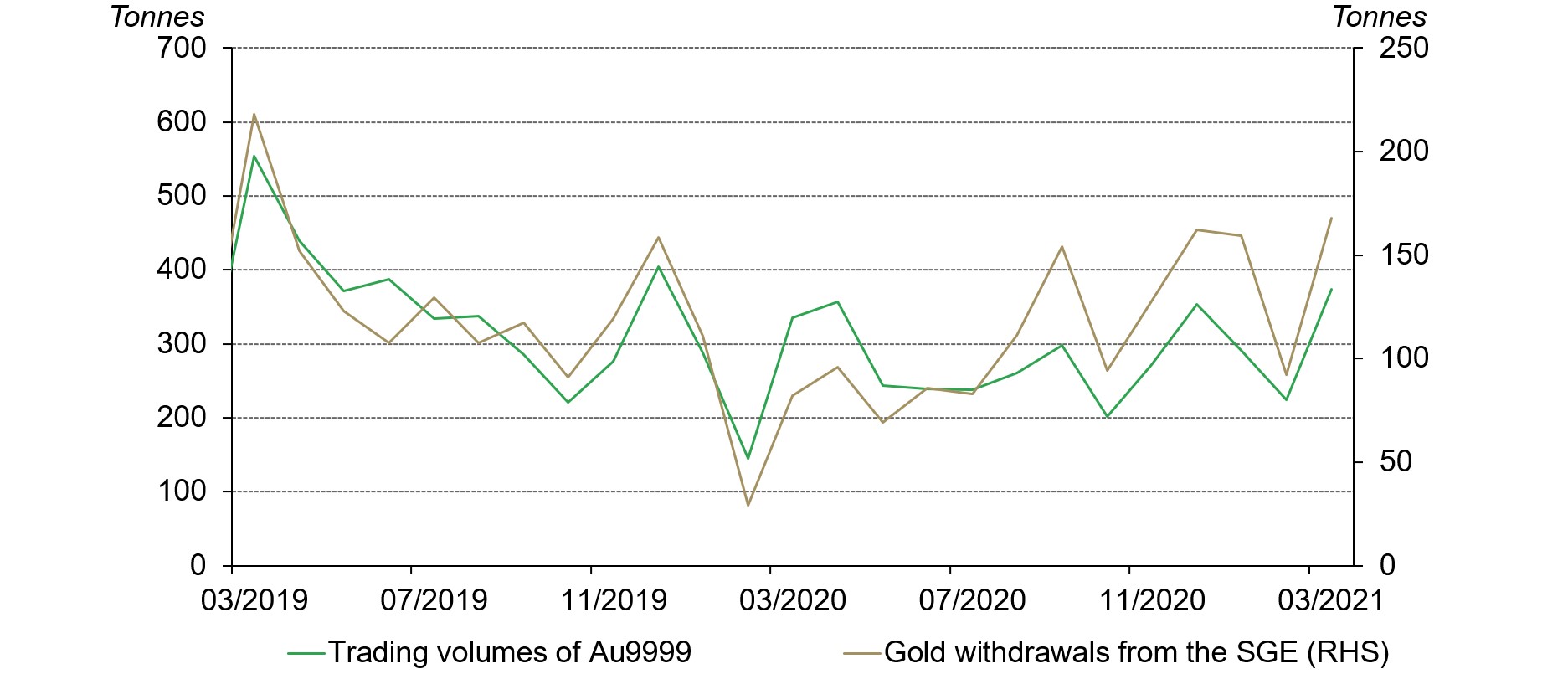

Gold withdrawals from the SGE last month totalled 168t, 75t higher m-o-m and 85t higher y-o-y. Gold retailers replenishing their stocks, more working days in March than February and the low base from 2020 were key to the m-o-m and y-o-y increase in China’s wholesale gold demand as mentioned in my last monthly update. Even though the Q1 total hasn’t yet recovered to pre-pandemic levels, in our recent visits we found major Chinese jewellers to be optimistic about the future. They tell us their positivity is backed by:

- improved economic conditions and the nation’s domestic consumption stimuli

- the potential boosts brought to gold consumption from the inconvenience to travel amid pandemic related restrictions

- a lower gold price than last year.

The wholesale physical gold demand in China rebounded

Source: Shanghai Gold Exchange, World Gold Council

The Shanghai-London gold price spread rose further in March, reaching US$10.2/oz on average, edging closer to the 2019 average of US$11/oz. As mentioned earlier, China’s wholesale gold demand picked up during the month, supporting the local gold price premium. Data from the National Bureau of Statistics also shows that China’s gold, silver, jade and gem jewellery retail sales in March were 83% higher y-o-y and 18.7% higher than 2019.

The Shanghai-London gold price premium continued to rise

Source: Bloomberg, Shanghai Gold Exchange, World Gold Council

*SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used. Click here for more.

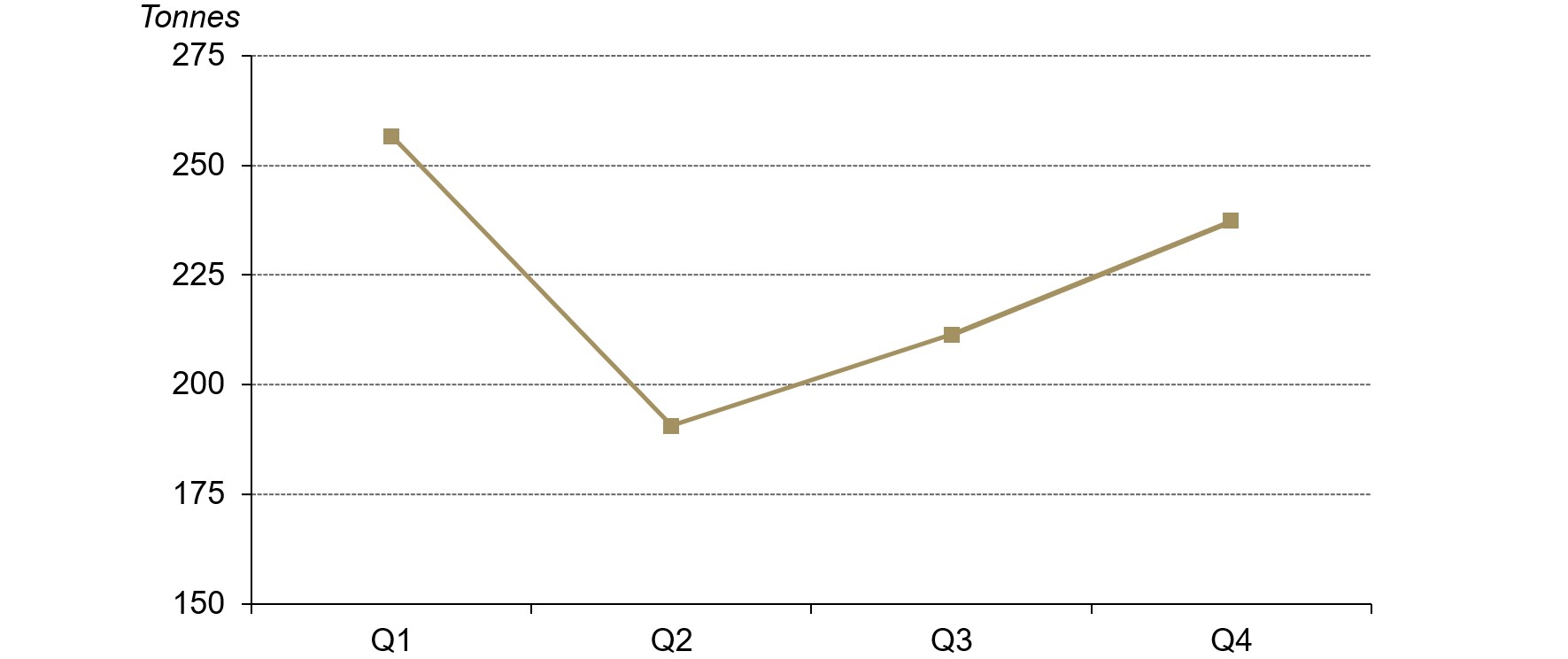

Traditionally Q2 is the low season for gold consumption in China, especially for gold jewellery sales. This is primarily due to consumers choosing lighter gold jewellery pieces as temperatures rise and fewer outdoor activities take place. This may cause China’s wholesale gold demand to be negatively impacted in the upcoming months.

Q2 is usually an off season for gold consumption in China

Average quarterly consumption of gold jewellery, bars and coins in China between 2010 and 2019*

Source: Metals Focus, World Gold Council

*Based on average quarterly Chinese gold demand between Q1 2010 and Q4 2019, excluding 2013 and 2020 as quarterly gold consumption in these years was severely distorted and does not reflect the seasonality pattern. For more information please visit our Gold Demand Trends for 2013 and 2020.

Footnotes

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange

For more information about premium calculation, please visit our local gold price premium/discount page.

Baidu is the largest online search engine in China, for more information, please visit here.