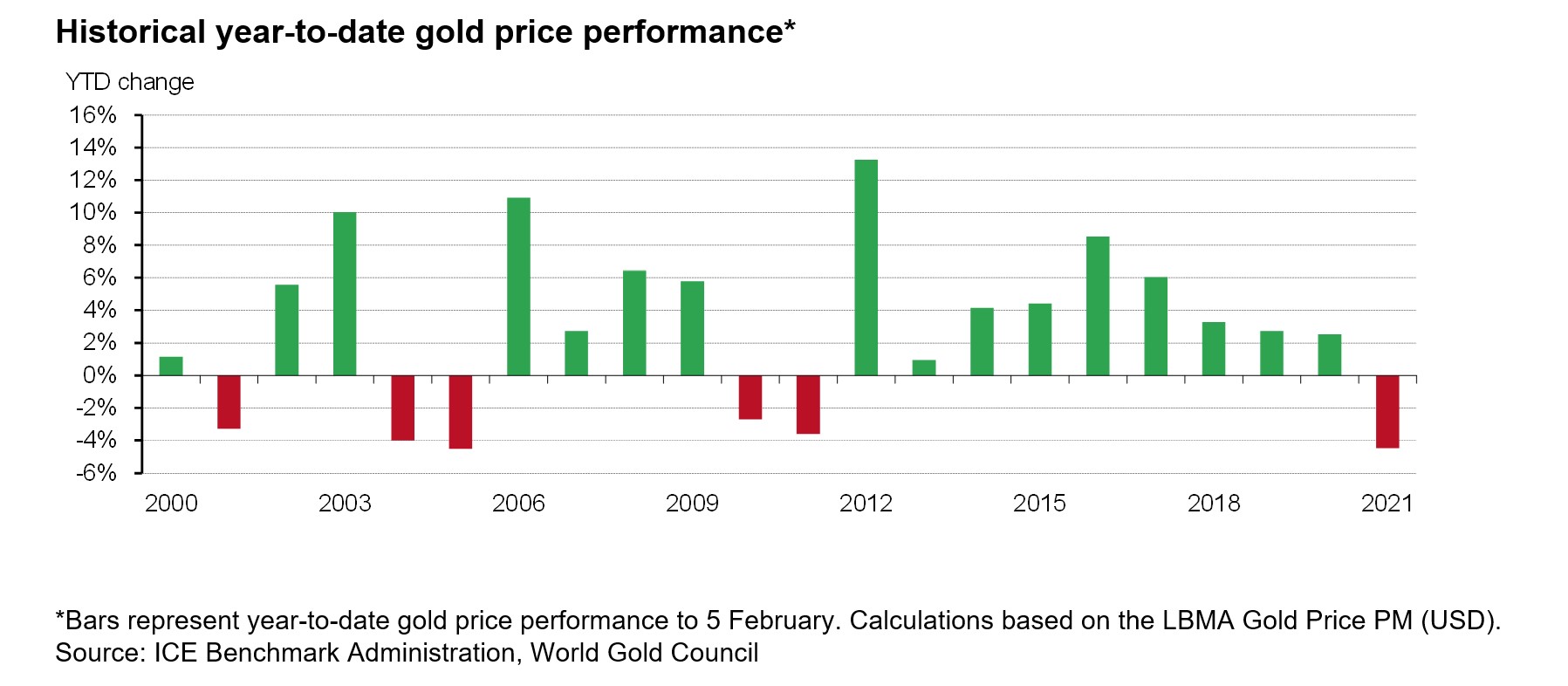

Despite returning investors an impressive 25% - making it one of the best performing assets – last year, gold has had a much less sparkling start to 2021. Year-to-date, gold has fallen 4.5% in US dollar terms, its worst start to a year since 2005.1 And the picture looks no better in other key currencies too.

We believe that gold’s performance so far this year can be explained by:

- Rising Treasury yields and a stronger US dollar

- Negative gold price momentum

- Investor concerns on inflationary pressures

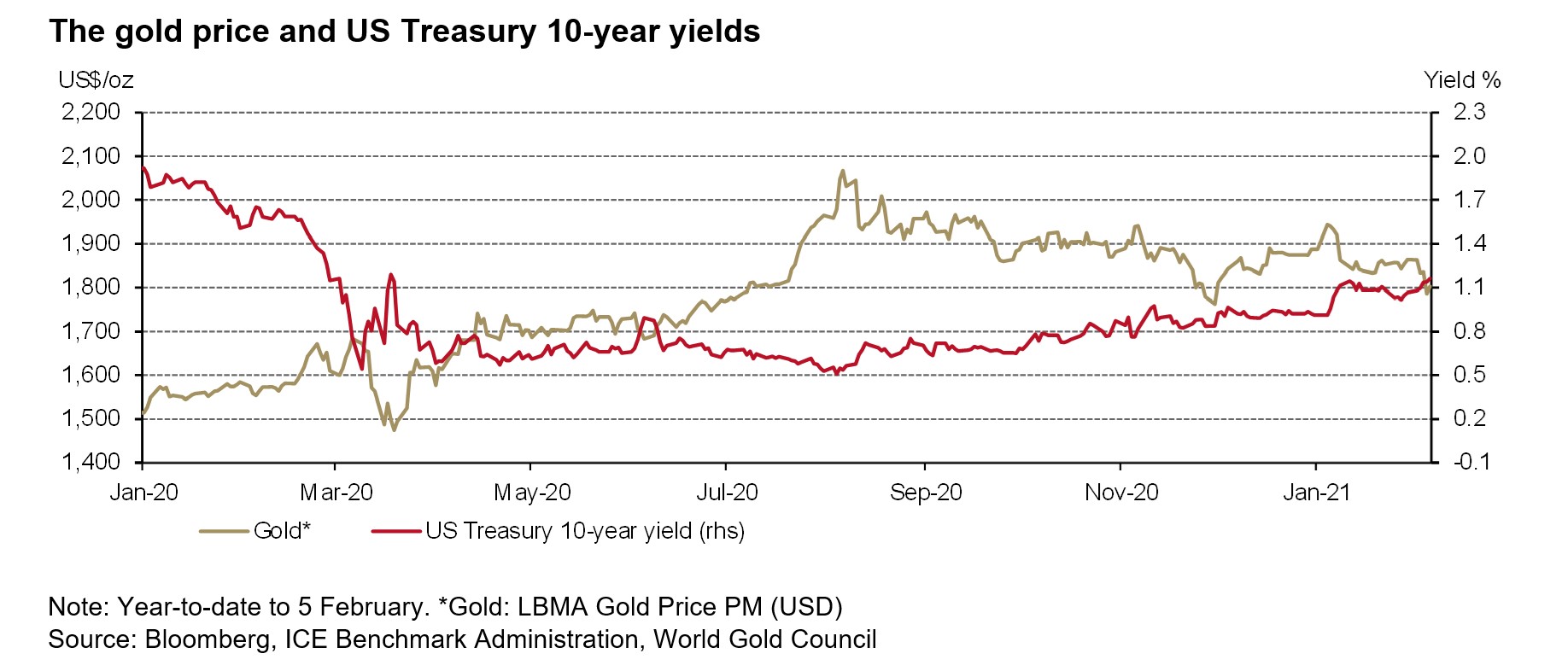

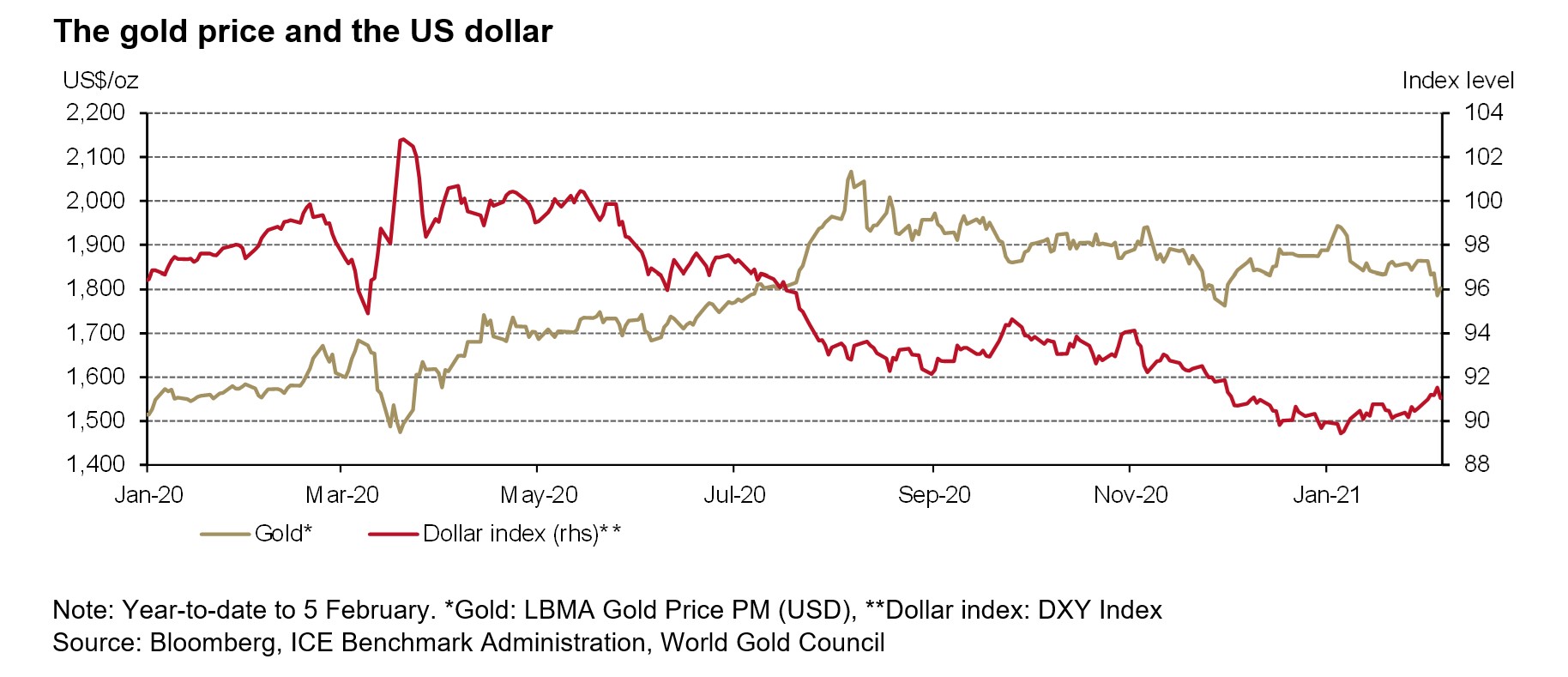

Gold started the year on a positive note, breaking above US$1,900/oz and up to US$1,959/oz, likely helped by rebalancing to a record weights in both the Bloomberg Commodity Index1 and S&P GSCI indices, expectations of a potential commodity-led reflation which sent Brent Crude surging on 5 January, and political wrangling in the US. But gold pulled back sharply as ebullient US treasury yields snuffed out gold’s rally. The 10-year Treasury yield pushed above 1% for the first time since March 2020. This was likely in response to the news that the Democratic Party had wrestled control of the US Senate, improving the prospects for increased government spending and, in turn, expectations of economic recovery but also of potential inflation. For the rest of the month, gold remained within a narrow US$40/oz range, finding resistance at US$1,860/oz and support at US$1,820/oz, before dropping below the US$1,800/oz level in early February.

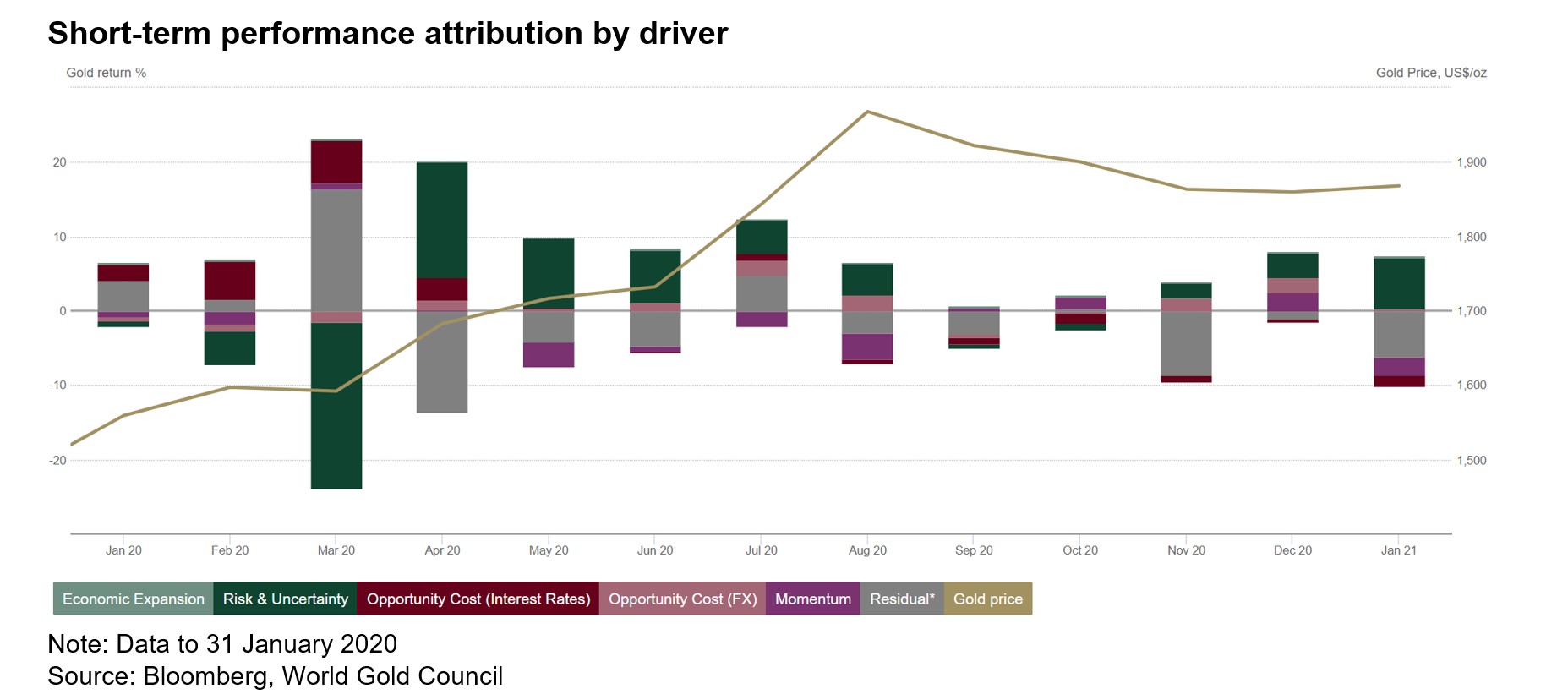

But the rise in US Treasury yields is unlikely to explain all gold’s price performance. Our short-term model provides a useful guide about what drove gold during the month:3

- We can see that the Opportunity cost category did indeed create a headwind for gold in January. While slightly higher interest rates will have contributed to this, it is likely that the US dollar also had an effect. It has steadily strengthened since the start of the year as optimism has grown over further government spending

- Negative momentum has also been a big factor in keeping gold’s performance subdued at the start of 2021. Gold has been on a downward trend since hitting its new nominal all-time high of over US$2,000/oz in early August, with investors increasing their risk-asset exposure as sentiment has improved in the wake of the US election and the successful development of several COVID-19 vaccines

- The short-term model indicates that there has been support coming from the “risk and uncertainty” category. As we noted in our Gold Outlook 2021: “…many investors are concerned about the potential risks resulting from expanding budget deficits, which, combined with the low interest rate environment and growing money supply, may result in inflationary pressures. This concern is underscored by the fact that central banks, including the US Federal Reserve and European Central Bank, have signalled greater tolerance for inflation to be temporarily above their traditional target bands.”4

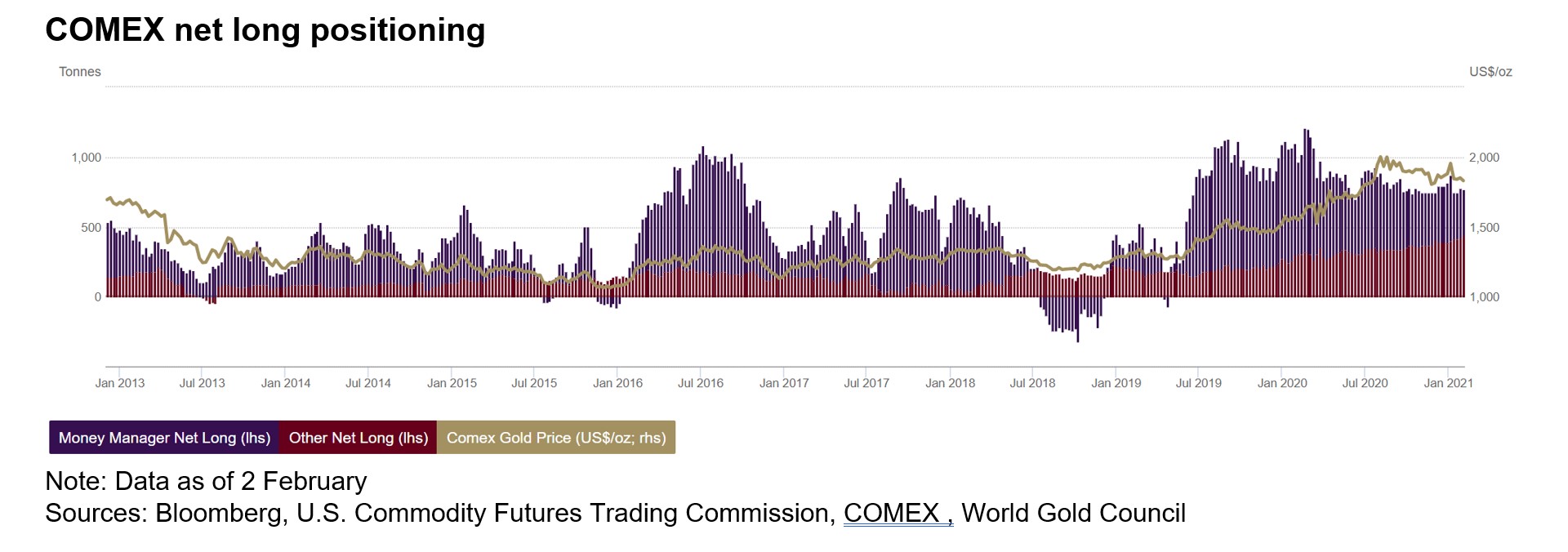

We believe that the 13.8t of inflows into gold ETFs in January, after two consecutive months of outflows, provides evidence for the view that gold investment will remain well supported. COMEX net positioning, via the recent Commitment of Traders (COT) report for gold COMEX futures, also shows that despite the recent price performance in gold, it remains elevated signalling that investors remain bullish on gold’s longer-term prospects.

While gold has struggled for upward momentum so far this year, we continue to believe that the outlook for gold investment demand remains positive. Investors still face an environment of uncertainty, with the need to navigate several potential portfolio risks such as ballooning budget deficits, inflationary pressures, and possible equity market corrections. In our view, gold is well-positioned to help investors manage these risks going forward.

Footnotes

1 Year-to-date performance to 5 February, calculated using the LBMA Gold Price PM (USD).

2 Bloomberg Commodity Index 2021 Target Weights Announced

3 While the short-term model provides an interesting perspective on recent gold price performance, this top-level analysis may mask important changes to the factors within each category.

4 FT: Fed to tolerate higher inflation in policy shift (August 2020) and The ECB begins its shift to a new inflation goal (October 2020).