September summary

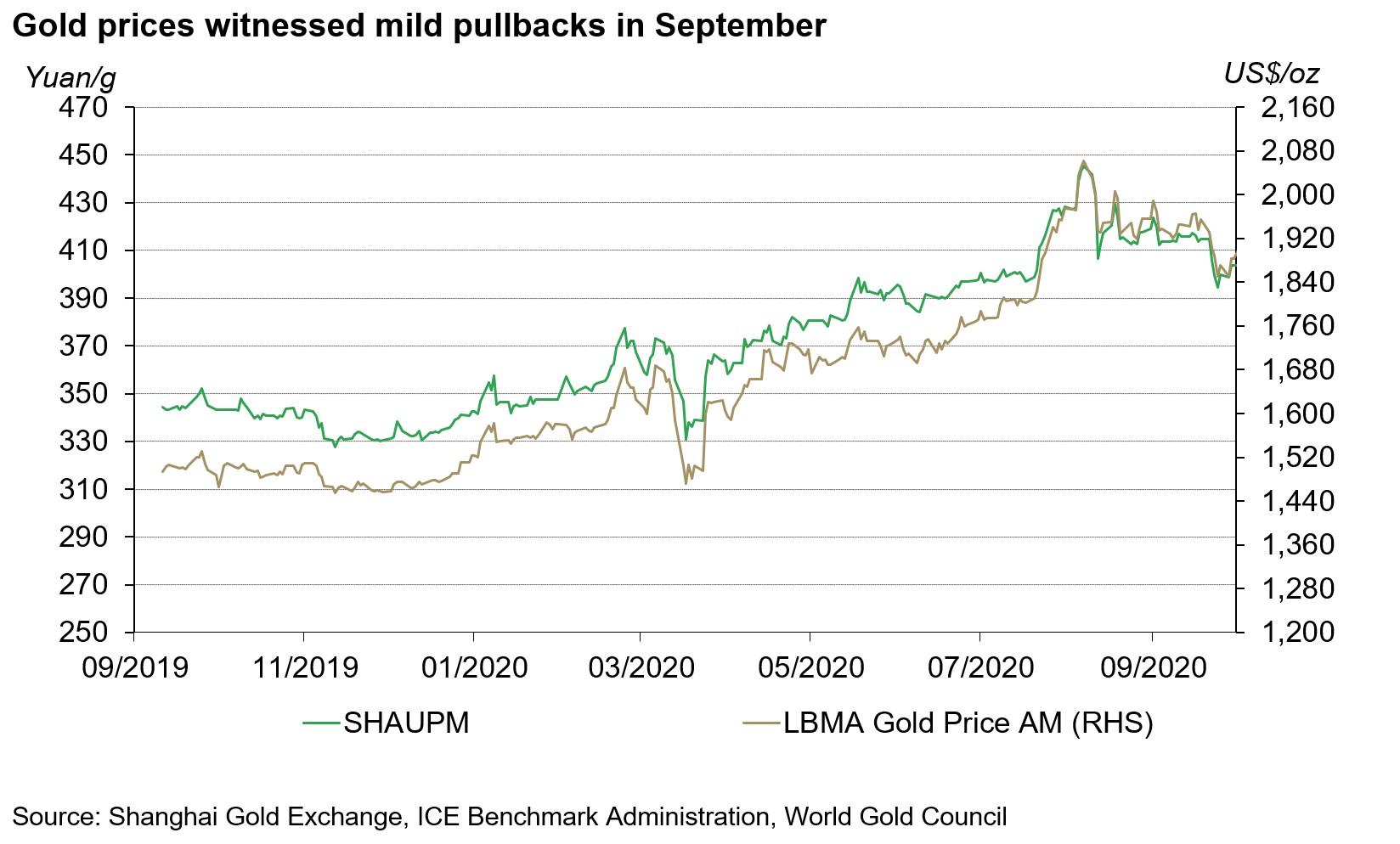

- Both the LBMA Gold Price AM in US dollars (USD) and the Shanghai Gold Benchmark Price PM (SHAUPM) in renminbi (RMB) fell marginally, mainly due to the rising real rates in key regions and profit-taking1

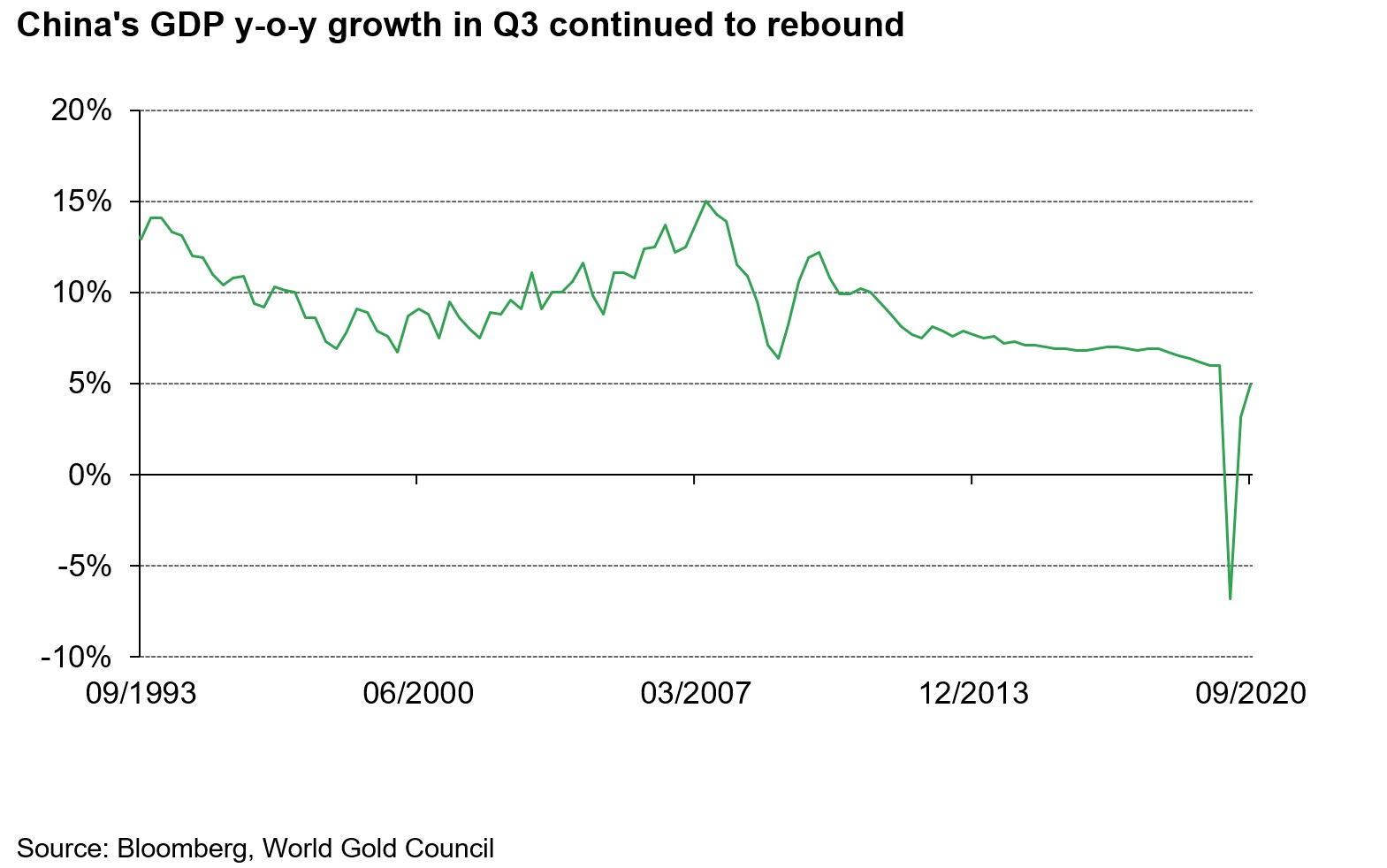

- China’s economy continued to recover although its supply side economic indicators rebounded at a much faster pace than demand

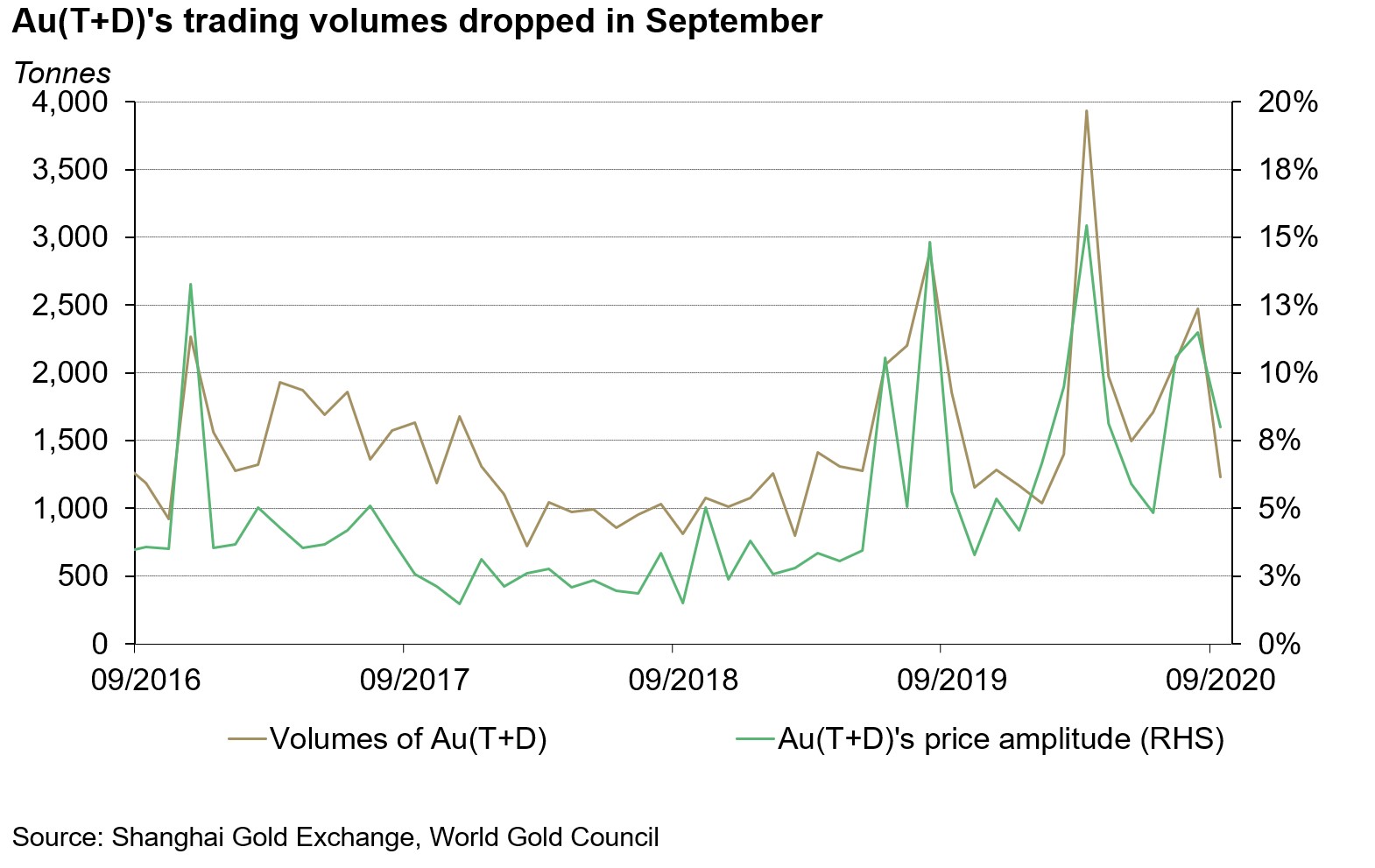

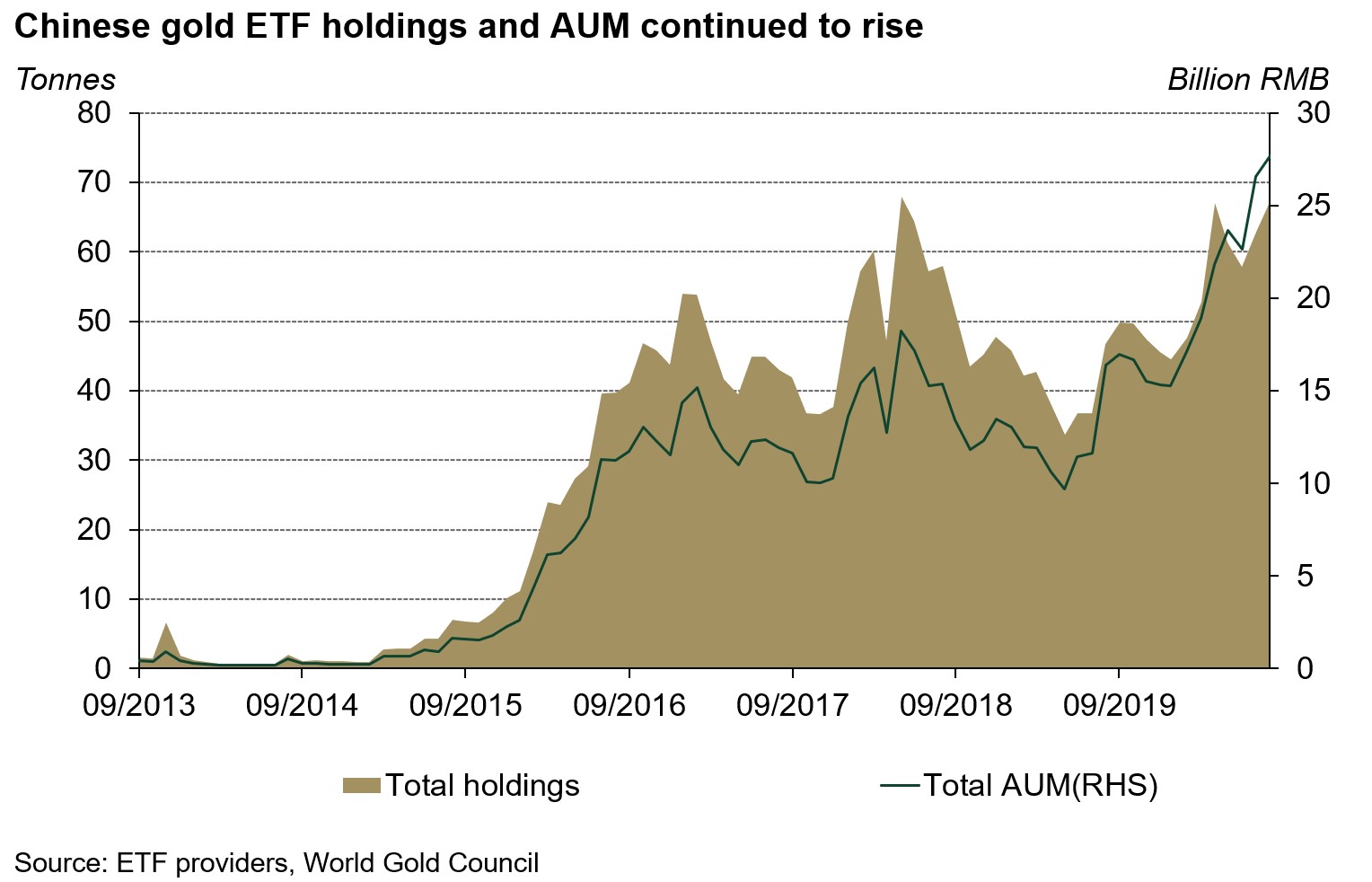

- While there was a notable m-o-m decline in Au(T+D)’s trading volumes, the Chinese gold-backed ETF market continued to expand

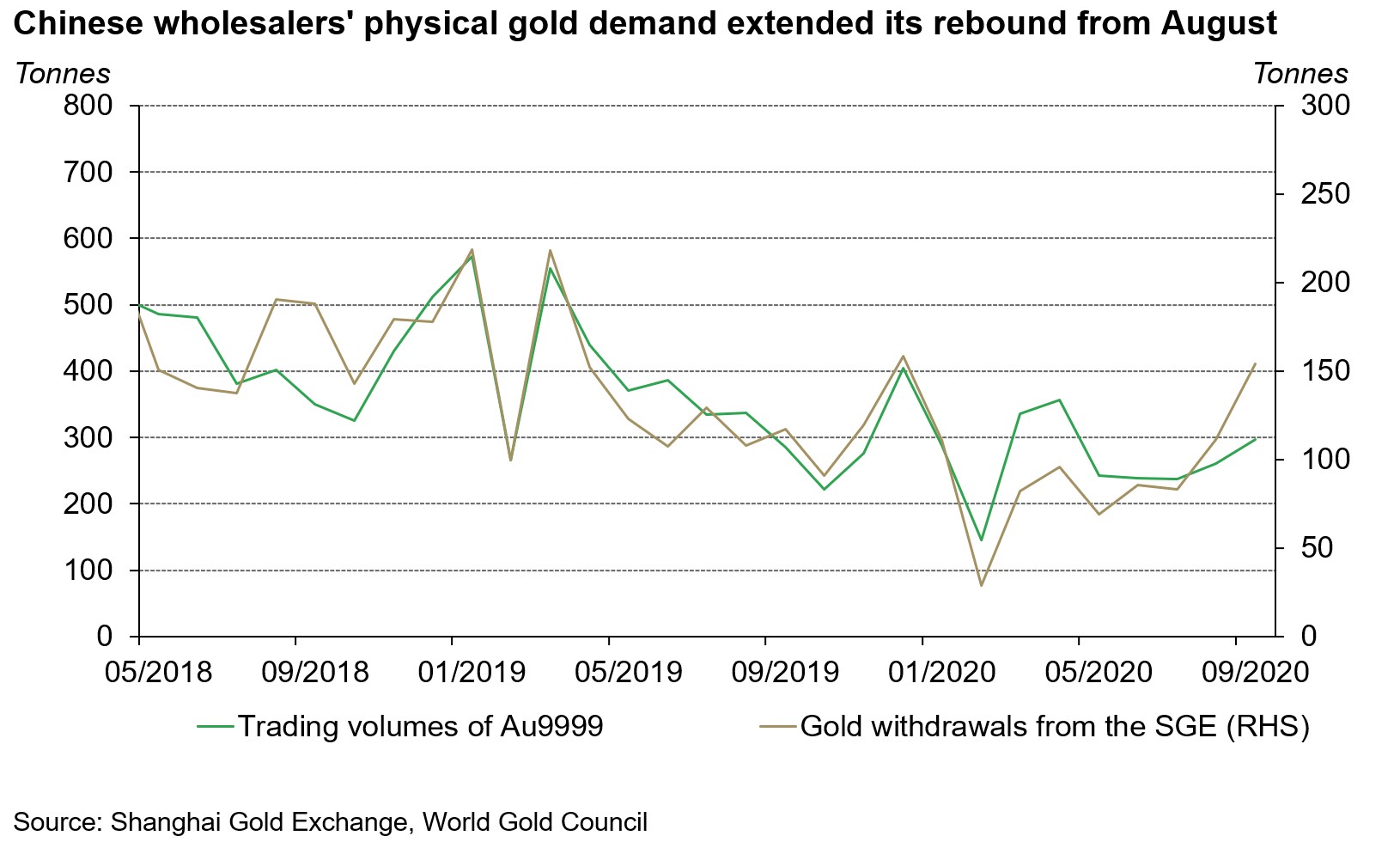

- The wholesale physical gold demand in China rose further: gold withdrawals from the Shanghai Gold Exchange (SGE) totalled 154t, jumping by 38% m-o-m and 43% y-o-y

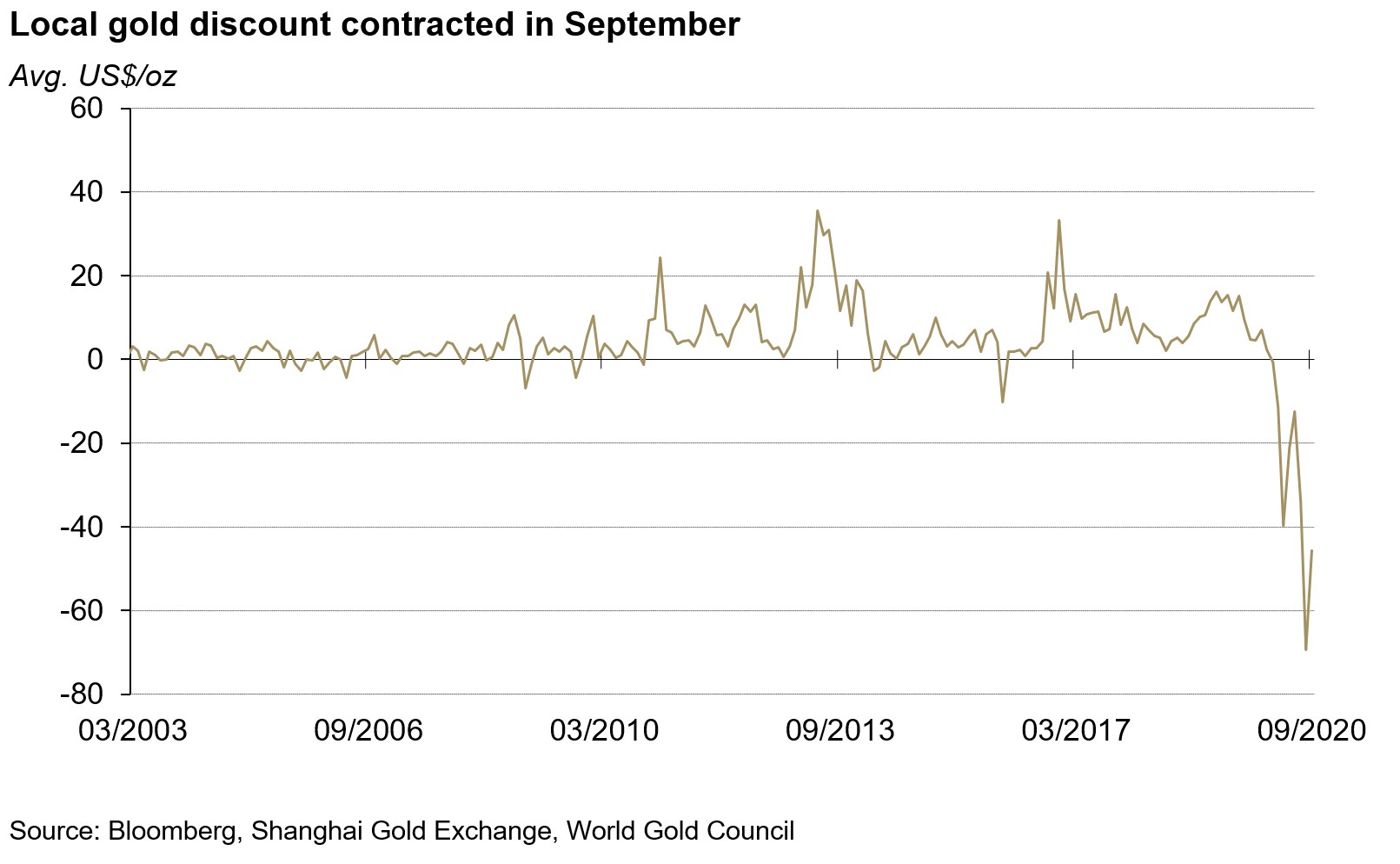

- The Chinese local gold price discount narrowed as physical gold demand continued to recover and the divergence in opportunity costs of holding gold in China and other major markets contracted2

- The People’s Bank of China’s gold reserves remained at 1,948t, accounting for 3.6% of its total reserves.

Gold prices witnessed marginal declines in September

Rebounding real rates in major markets, such as the US and China, were the main contributor to the 2.2% and 1.9% declines in the SHAUPM (RMB) and the LBMA Gold Price AM (USD). Meanwhile, with gold prices surging so far this year, a technical pullback related to profit-taking followed, as is often the case.

Primarily driven by the continued improvement in the domestic economy and policy makers’ prudent attitude towards monetary easing, the RMB strengthened further during the month, leading to a larger decline in the RMB-denominated gold price than in the USD.

China’s economic growth saw positive signs

According to the Bureau of Statistics, China’s GDP y-o-y growth continued to recover, rising to 4.9% in Q3 from 3.2% in Q2. Meanwhile, other key supply side indicators, such as PMI and industrial output, also showed strong improvement in September, rising above their average 2019 levels. Y-o-y growth in demand side indicators, such as retail sales and disposable income, also improved further. However, the rebound in demand has been weaker than on the supply side, with these indicators remaining below their 2019 levels.

But there are reasons to be optimistic around China’s consumption:

- First, the unemployment rate has been declining since Q1, following the successful containment of the COVID-19 pandemic.

- Second, with almost all industries returning to normal operation, consumers’ budgets have been improving, albeit slowly.

- Lastly, fully realising consumption’s importance to the economy’s sustainable growth, China has positioned consumption stimulation as a strategic focus in the coming years, launching various promotions and events across the nation aimed at accelerating the recovery.

There was a 54% m-o-m drop in Au(T+D)’s trading volumes, totaling 1,149t last month

Tactical investors’ interest in the margin-traded gold contract faded as the local gold price became less volatile – providing fewer profiting opportunities for these shorter-term traders – and the bullish momentum in the gold price weakened.

The Chinese gold-backed ETF market continued to expand

Both total gold holdings and assets under management in Chinese gold ETFs rose to their highest ever levels last month, at 69.5t and US$4.2bn respectively.3 Two Shanghai Gold ETFs, issued by CCB Principal Asset Management and Bank of China Asset Management, were listed in early September, expanding the choice for Chinese gold ETF investors to 11 funds. But this was not the only driver for growth: total gold holdings in the pre-existing nine funds also increased last month, as Chinese investors’ strategic allocation to gold kept rising as a hedge against possible future economic and geopolitical uncertainties in spite of the weakened bullish momentum in the gold price.

The wholesale physical gold demand continued to improve in September

Extending the rebound from August, both withdrawals from the SGE and trading volumes of Au9999 – the physical gold contract at the SGE and a proxy of China’s physical gold demand – rose further. This is due to two key factors. First, as mentioned in my last blog, many jewellery manufacturers and wholesalers held various promotional events in September in conjunction with the Shenzhen Jewellery Fair, attracting retailers from all over the country and boosting sales.

Second, Chinese jewellery retailers were stocking up in advance for the long-anticipated gold wedding jewellery sales boom during the eight-day ‘Golden Week’ holiday in early October.4 With many couples postponing their marriages D’amour to later in the year due to the pandemic, the number of weddings held during Golden Week – the traditional wedding peak – saw explosive growth. According to Hunliji – a main digital platform for wedding related products – over 600,000 Chinese couples held their weddings during this period, 11% higher y-o-y. And the Ministry of Commerce’s data showed that during Golden Week the sales of gold, silver, jade, and gem jewellery in key cities, such as Beijing, increased by more than 25% y-o-y.

The Chinese local gold price discount narrowed

The discount in SHAUPM relative to the LBMA Gold Price AM contracted to, on average, US$46/oz in September – US$24/oz narrower than August. While the recovery in China’s physical gold demand contributed to the contraction, the narrowing between real rates in China and other key markets such as the US – i.e. the difference in the opportunity costs of holding gold – also played a vital role.

Note: SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used. Click here for more.

Footnotes

1 We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit en.sge.com.cn/data_BenchmarkPrice.

2 For more information about premium calculation, please visit www.gold.org/goldhub/data/local-gold-price-premiumdiscount.

3 Please note that Bosera’s I & D shares only provide updates at the end of each quarter.

4 This year’s Golden Week holiday ran from 1 October to 8 October, covering the Mid-Autumn Festival and the National Day Holiday.