Summary

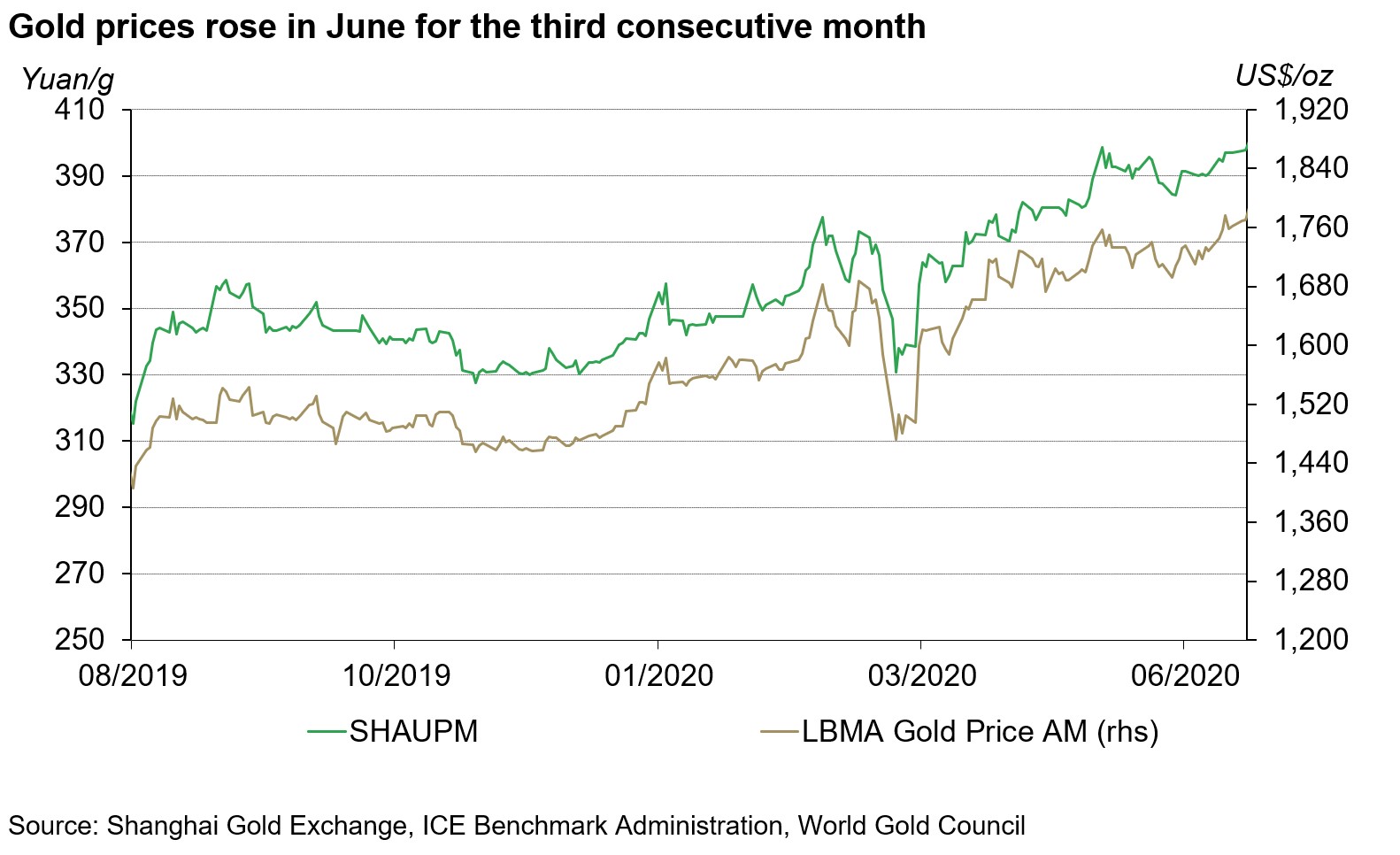

- Supported by the low rate environment and concerns for global economic growth, gold prices rose for the fourth consecutive month in June. While the LBMA Gold Price AM in US dollars reached the highest level in eight years during the month, the Shanghai Gold Benchmark PM (SHAUPM) in renminbi (RMB) set a new record at 399yuan/gram1

- Accommodative fiscal and monetary policies continued to drive China’s economic revival in June, but in turn the nation’s money supply grew rapidly

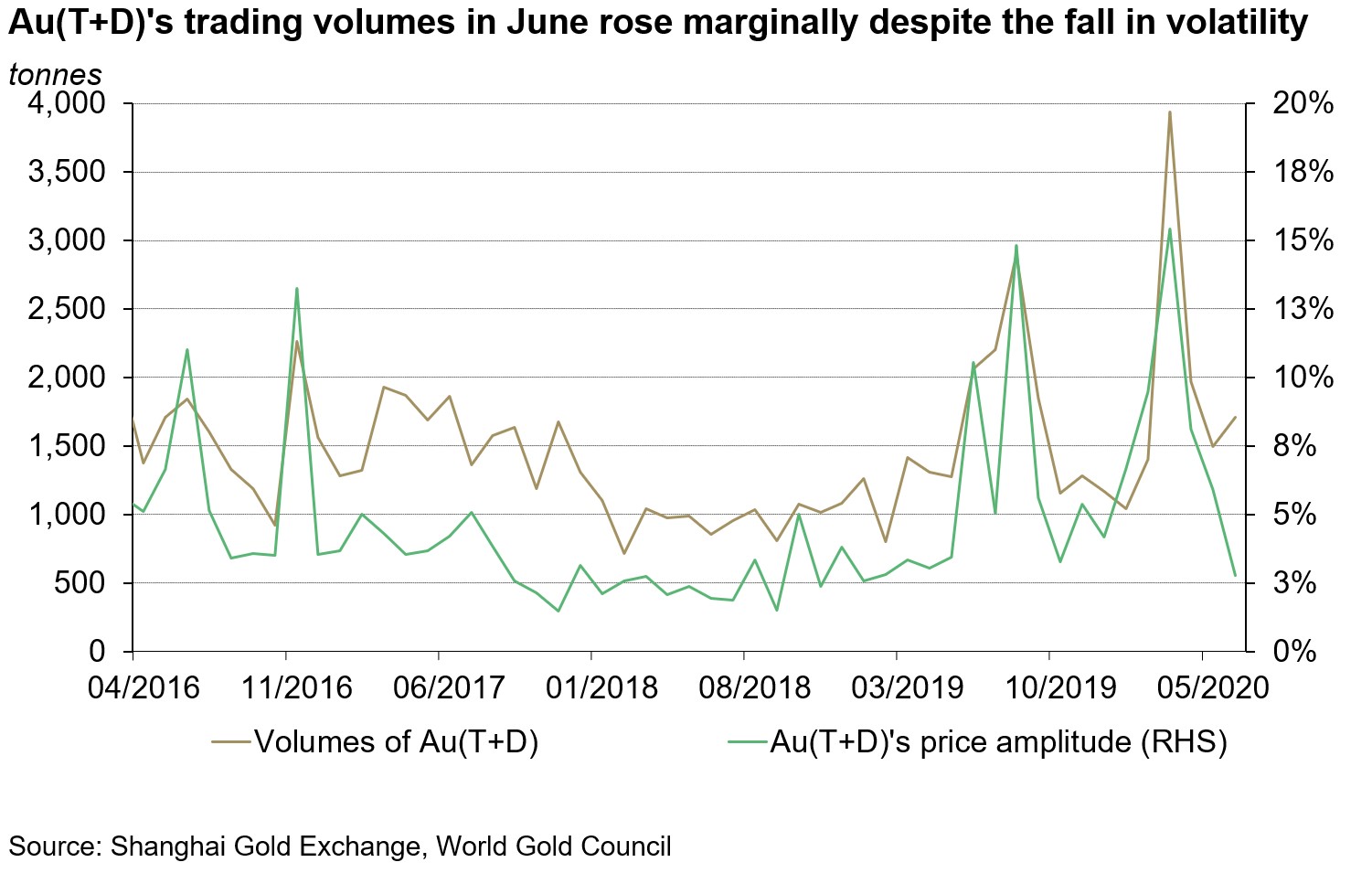

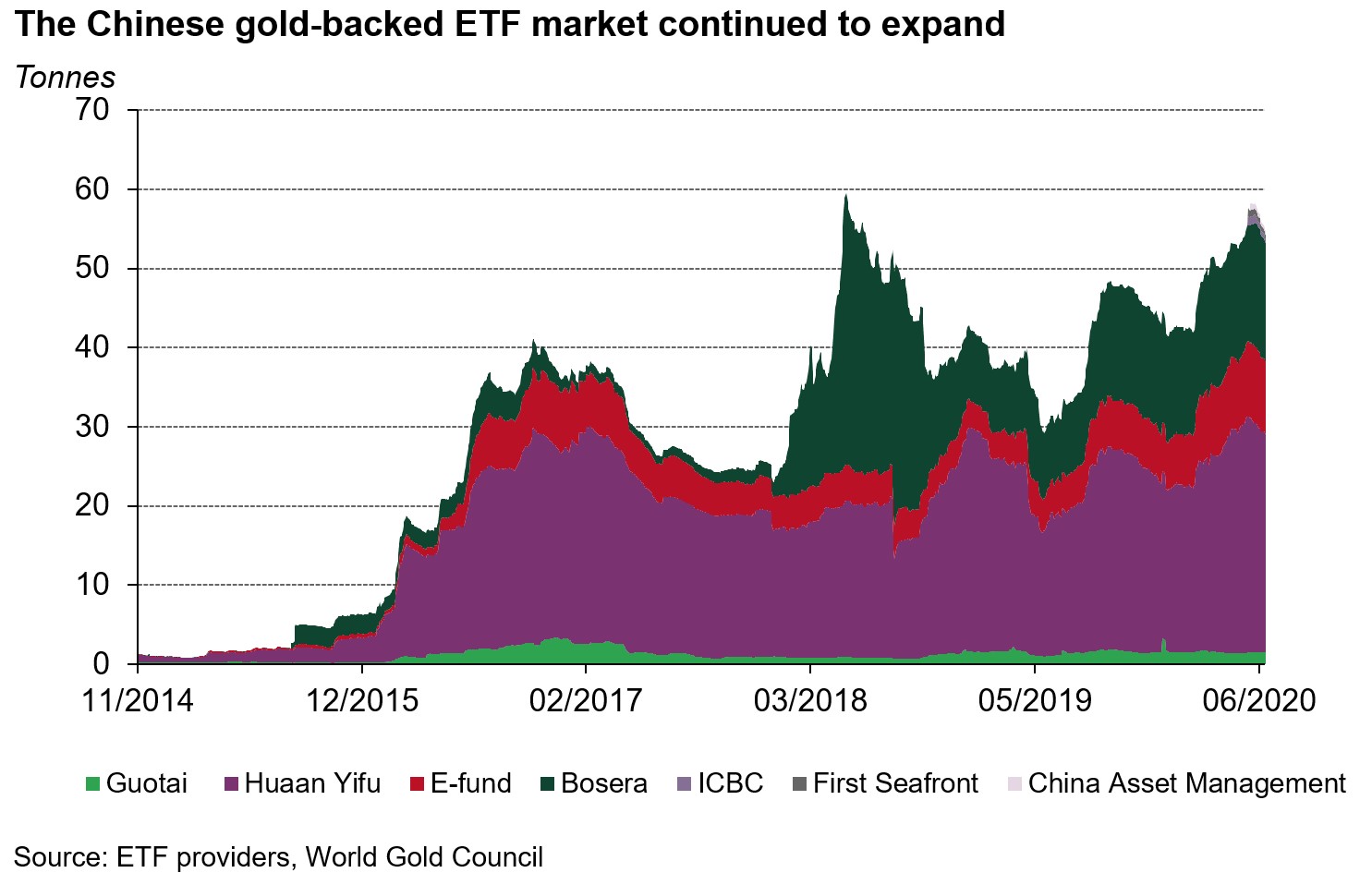

- Au(T+D) and gold-backed ETFs have grabbed Chinese investors’ attention during the first half:

- Au(T+D)’s daily trading volumes averaged US$5bn in H1, a 72% rise y-o-y

- Chinese gold-backed ETF holdings have increased by 21% so far this year

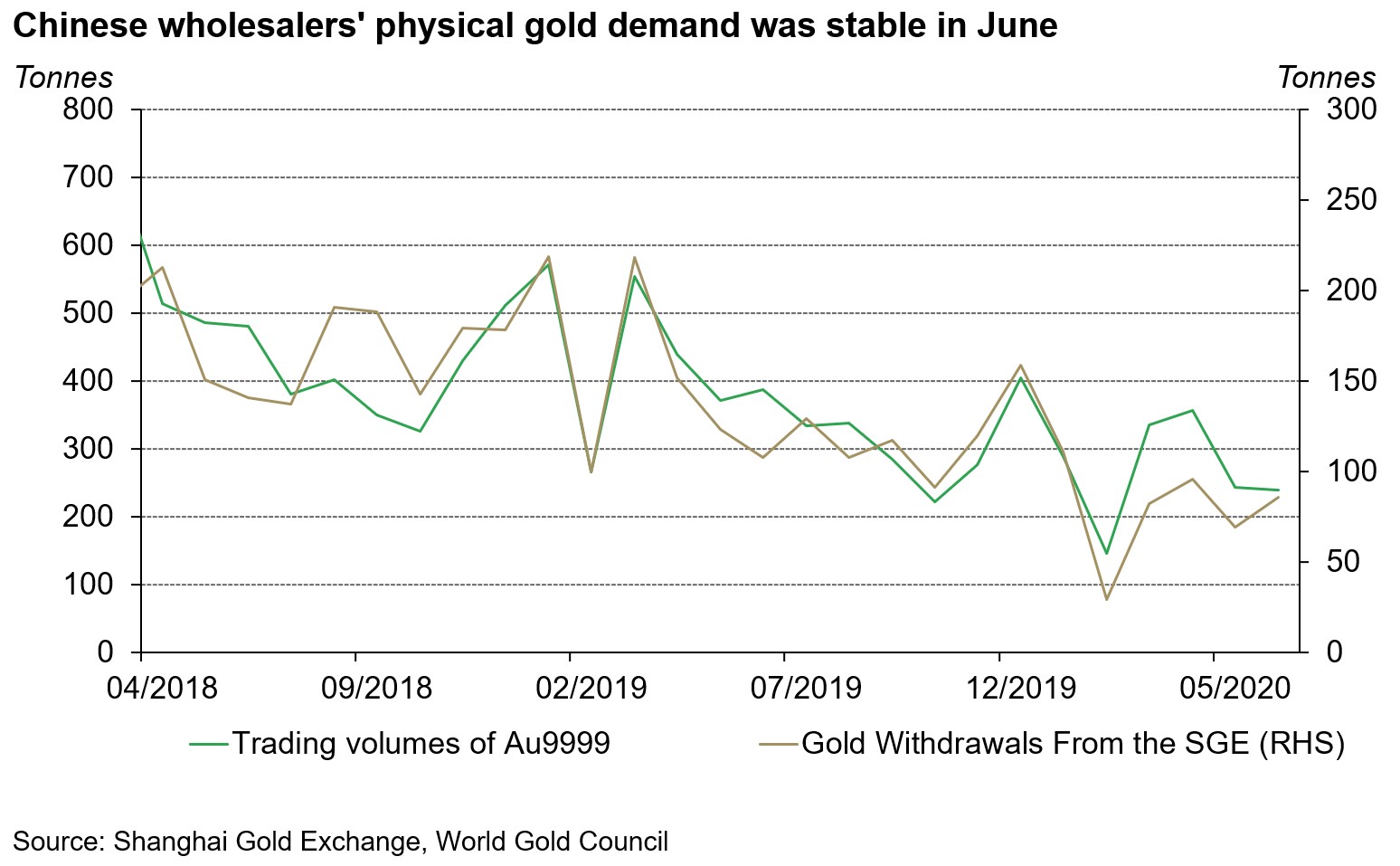

- Gold withdrawals from the Shanghai Gold Exchange (SGE) saw a marginal rebound in June as China’s gold demand as a whole slowly recovers. Despite m-o-m upticks, the volume of gold leaving the SGE’s vaults in the first half was still significantly lower than H1 2019, due to supressed gold demand amid a higher gold price and consumers’ lower budgets for discretionary items

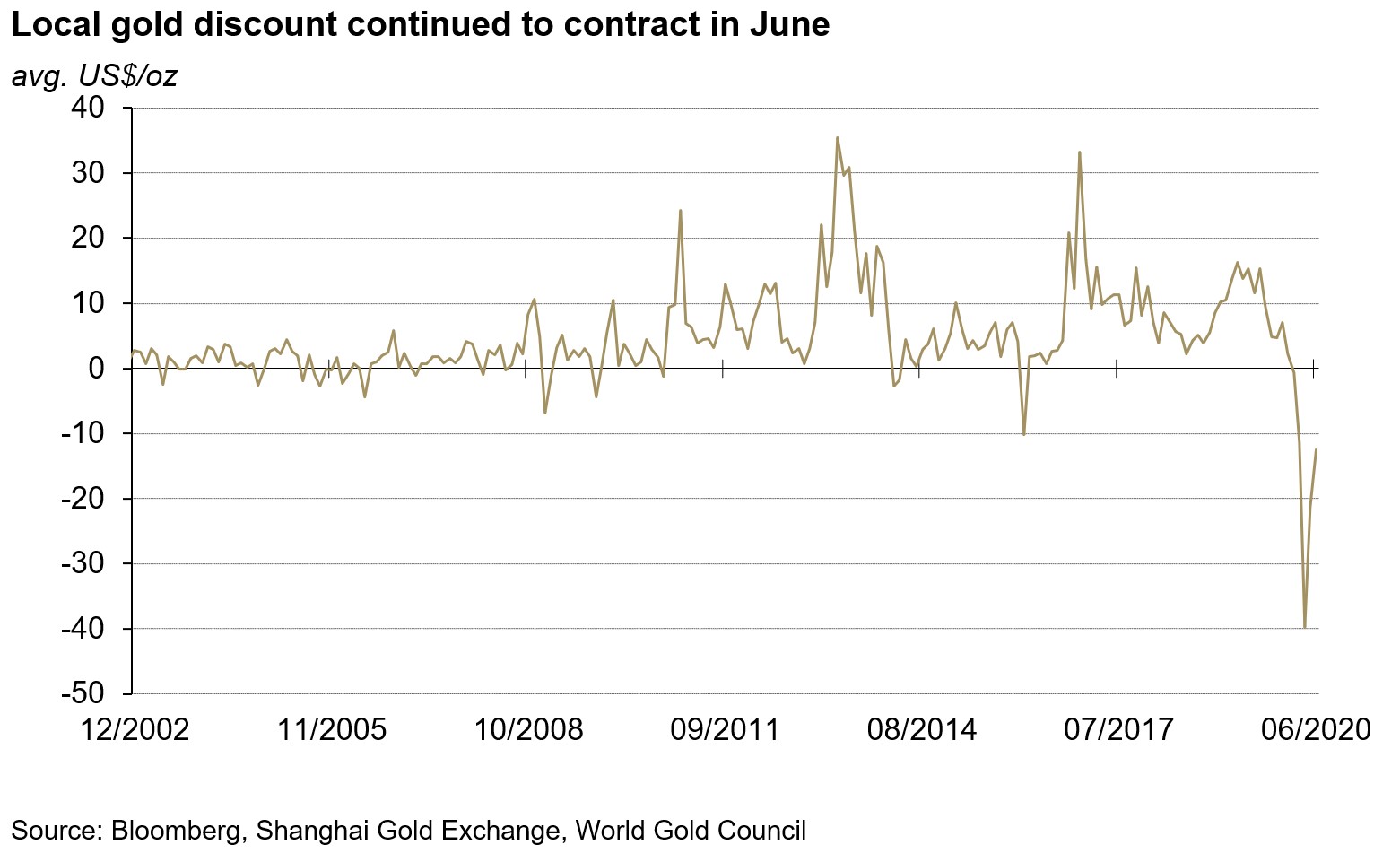

- Chinese local gold price discount2 narrowed further in the month, as gold demand continued to rebound following the significant deceleration it experienced earlier in the year and supply-chain disruptions in Western markets eased

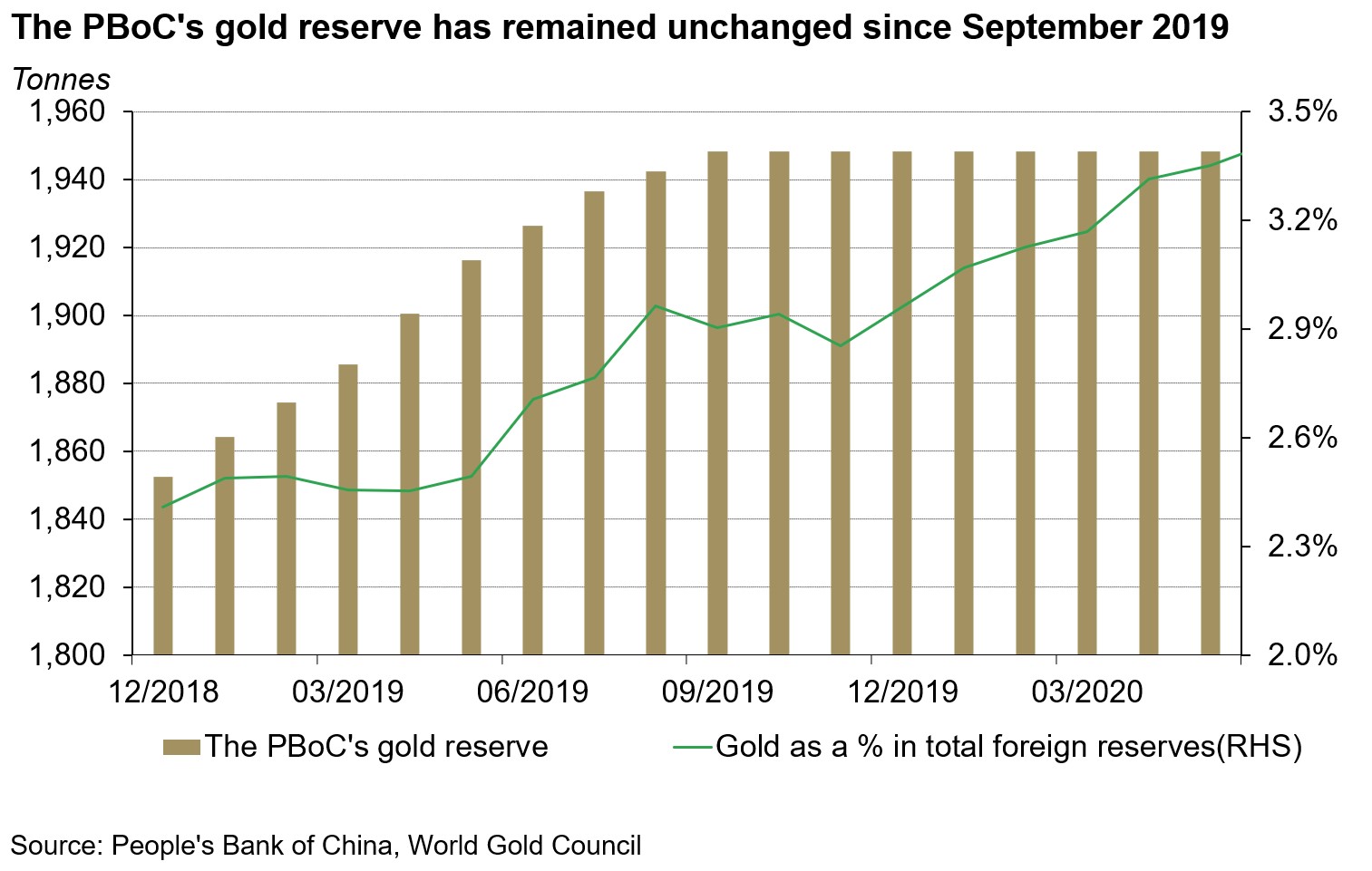

- The People’s Bank of China (PBoC) kept its gold reserves unchanged at 1,948t in June, accounting for 3.42% of its total reserves.

Gold prices edged higher in June. Primarily, the low interest rate environment globally and concerns about a possible recurrence of COVID-19 in major economies lifted international gold prices during the month. While there was a 2.6% rise in the LBMA Gold Price AM in USD, the SHAUPM climbed by 1.5% and reached a new high as the RMB strengthened.

The RMB gold price recorded a 16% rise during the first half of 2020, outperforming all other major Chinese assets. Moreover, the SHAUPM in RMB set a new record on 18 May by reaching 399yuan/gram. Rising risk and uncertainty amid the COVID-19 outbreak, reduced opportunity cost to hold gold amidst an ultra-low interest rate environment and the bullish gold price momentum have attracted strong investment flows to gold products such as gold ETFs and exchange-listed gold products, pushing up gold prices in different currencies so far in 2020 as a result.

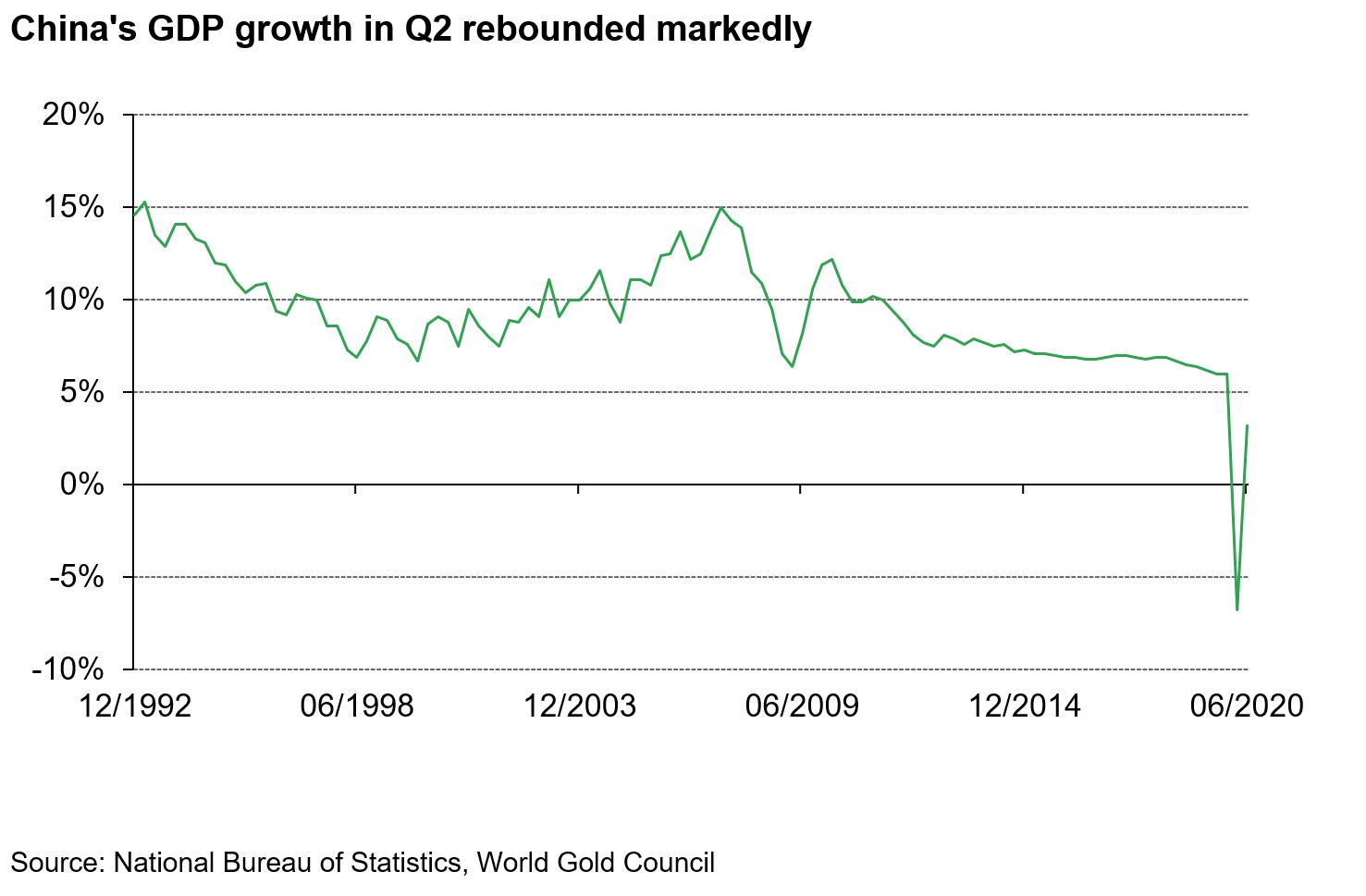

China’s economic resurgence continued. The small COVID-19 outbreak in Beijing during June had a limited economic impact as the government took swift measures to contain it.3 Key economic indicators such as Purchase Managers’ Indexes (PMIs) and retail sales improved further in June. China’s GDP growth in Q2 rebounded to 3.2% from -6.8% in Q1, supported by accommodative monetary and fiscal policies, as well as the overall containment of the pandemic.

Measures such as cutting the benchmark loan prime rate and widening 2020’s fiscal budget deficit have supported the swift economic recovery. However, these measures have not been without side effects: China’s M2 money supply soared in the first half. And this trend is likely to continue, as maintaining high growth in M2 to stabilise the economy was mentioned in the Government Work Report, potentially strengthening gold’s role as a hedge against currency depreciation.

Au(T+D)’s trading volumes totalled 1,710t in June, 14% higher m-o-m. The bullish gold price momentum in the month continued to attract tactical investors, pushing up the trading volumes of margin-traded contracts, despite the marginal fall in the gold price volatility. In the first half the contracts’ trading volumes accumulated 11,555t, 42% higher y-o-y.

Chinese gold-backed ETF holdings reached 56.4t as of June, a 1.5t outflow in the month.4 While the continuous bullish gold price momentum lured many investors, it also led to profit-taking activities by some. Even so, uncertainties surrounding the COVID-19 pandemic’s impact on the economy; reduced opportunity cost to hold gold; the bullish gold price momentum have drawn in 11.6t or US$647mn during the first half, lifting the total AUM of Chinese gold-backed ETFs to a record high at US$3.2bn.

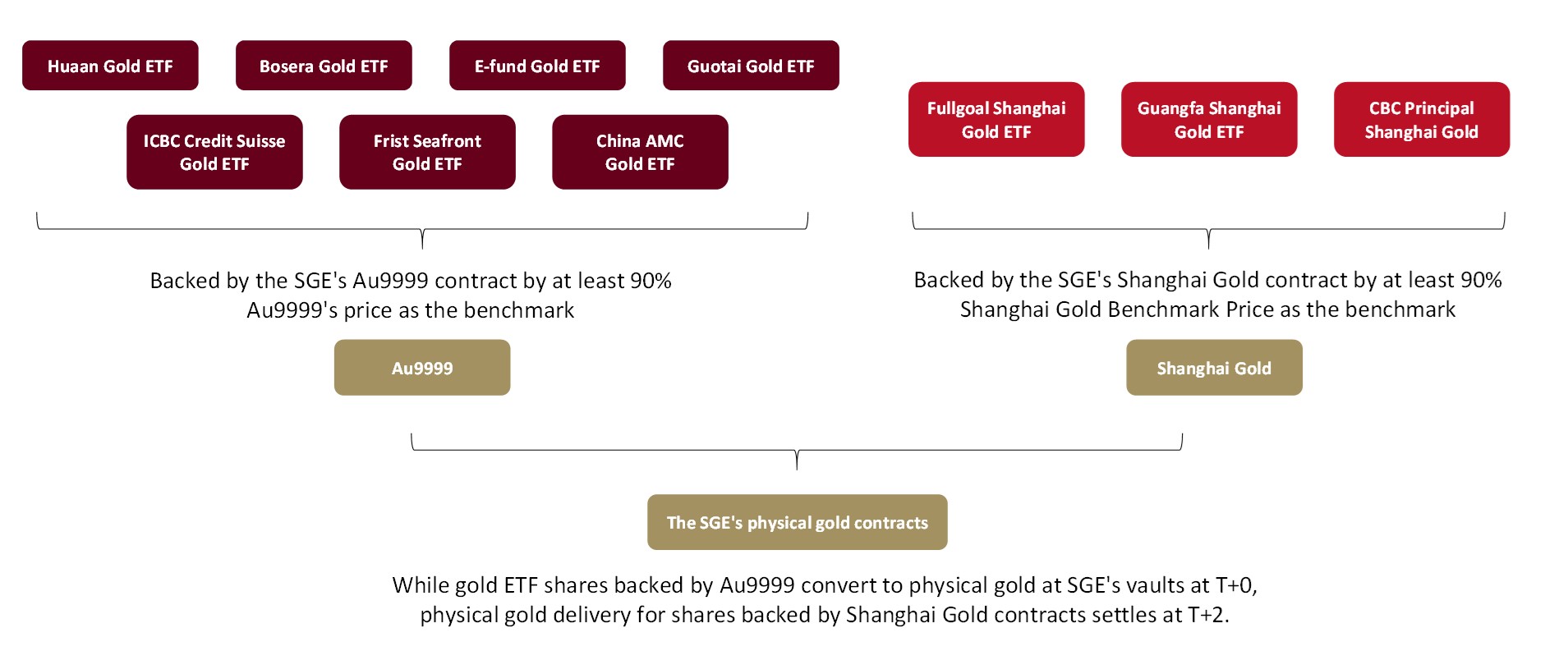

China’s gold ETF market is expanding rapidly. In June, China Asset Management Company Gold ETF, another Chinese gold ETF that is at least 90% backed by the SGE’s Au9999 physical gold contract, was listed at Shanghai Stock Exchange. Furthermore, Fullgoal Shanghai Gold ETF, Guangfa Shanghai Gold ETF, CBC Principal Shanghai Gold ETF and Bank of China Shanghai Gold ETF are all scheduled to launch soon. Similar to existing listed Chinese gold ETFs, at least 90% of their AUMs invest in physical gold contracts at the SGE. But unlike current listed products, which invest in Au9999, these Shanghai Gold ETFs will be backed by the SGE's Shanghai Gold Benchmark contracts.

A total of 86t gold left the SGE’s vault in June, 24% higher m-o-m and 20% lower y-o-y. With the economy rebounding, retail sales also increased on a m-o-m basis, leading to a gradual revival in wholesale gold demand. But the principal Chinese jewellery manufacturers told us that gold demand in the first half remained under pressure from the high gold price and reduced consumer discretionary budgets. According to the Bureau of Statistics, consumer expenditure on education, cultural items and entertainment in the first half fell by 36% y-o-y. As such, gold withdrawals from the SGE, totalling 473t during the first half of 2020, witnessed a 49% y-o-y fall.

Chinese local gold price discount averaged US$12/oz in June, 41% lower than May. China’s gold demand slowly rebounded as s during the month and the gold supply chain in countries outside of China improved; this led to a contraction in the local gold price discount.

In addition, China Customs reported that the increased trading volumes through customs warehouses and the higher demand for processed jewellery exports that use imported gold material, led to China becoming a net gold exporter in both April and May as companies in the gold supply chain took advantage of the cheaper Chinese gold price, partially contributing to the narrowing of the local gold price discount after mid-April.5

But the rapid recovery in China’s economy and sufficient containment of the pandemic have led to a strong equity market, diverting Chinese investors away from safe-haven assets such as gold. As a result, Chinese local gold price remained at discount to the LBMA gold price PM.

There was no change in the PBoC’s gold reserves in June. The PBoC’s foreign reserves totalled US$3,112.3bn as of June, a m-o-m increase of US$10.6bn, according to the State Administration of Foreign Exchange. Primarily, a marginal drop in the US dollar and asset price increases in main regions contributed to the m-o-m rise in total reserve assets. The PBoC’s gold reserve has remained unchanged at 1,948t since September 2019 and currently makes up 3.42% of total reserves, slightly higher than May due to the rise in the gold price.

Footnotes

1 We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit en.sge.com.cn/data_BenchmarkPrice.

2 For more information about premium calculation, please visit www.gold.org/goldhub/data/local-gold-price-premiumdiscount.

3 Please visit: www.chinadaily.com.cn/a/202007/07/WS5f046397a310834817257d3a.html for more.

4 Please note that Bosera’s I & D shares only provide updates at the end of each quarter.

5 Please visit

http://english.customs.gov.cn/ for China’s gold imports and exports data, currently, the data was updated to May. And please visit www.gold.org/goldhub/data/local-gold-price-premiumdiscount for daily local gold price discounts.