Summary

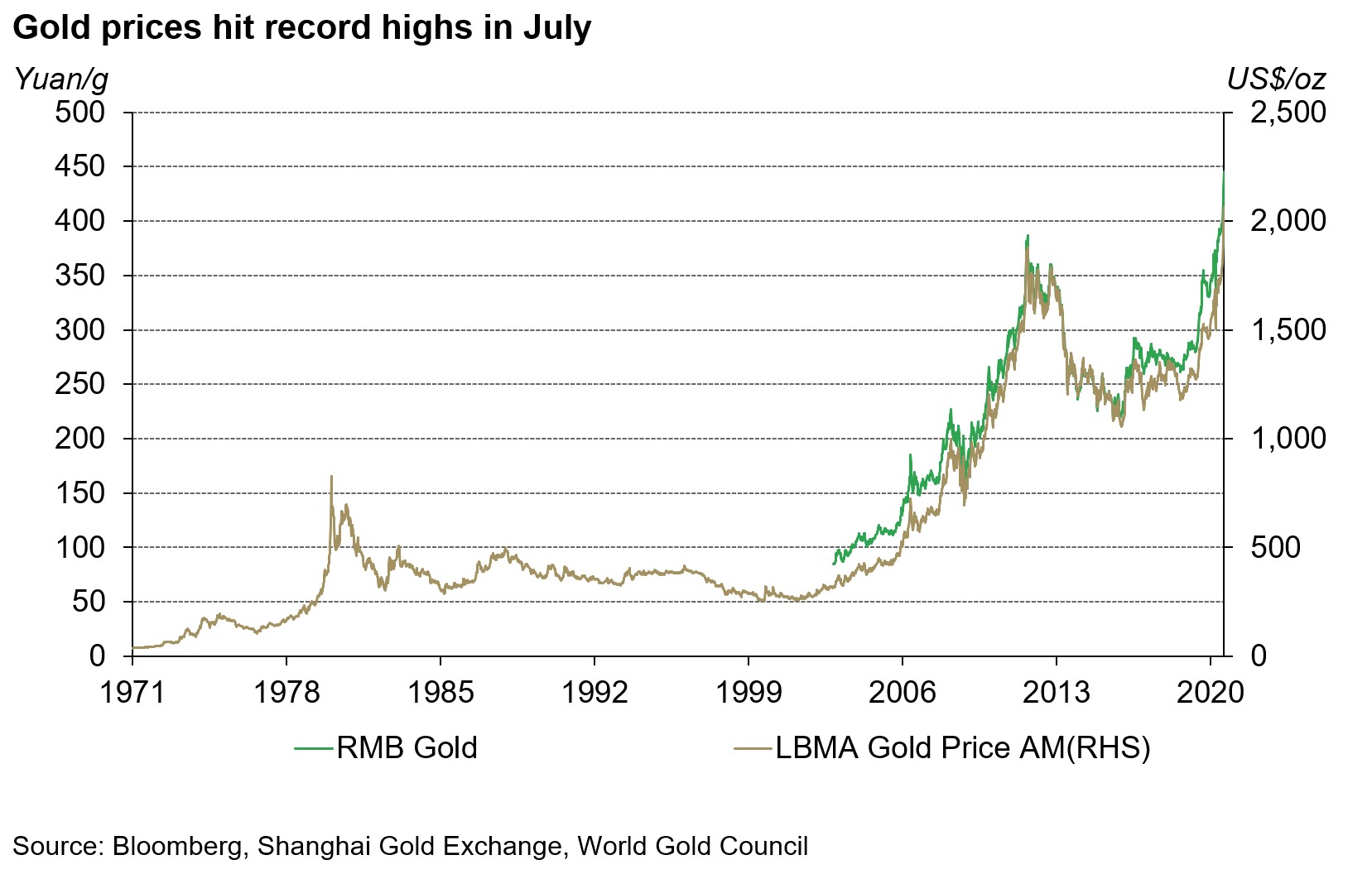

- Global expansionary monetary policies and bullish gold price momentum pushed both the LBMA Gold Price AM in US dollars and the Shanghai Gold Benchmark Price PM (SHAUPM) in renminbi (RMB) to historical highs in July1

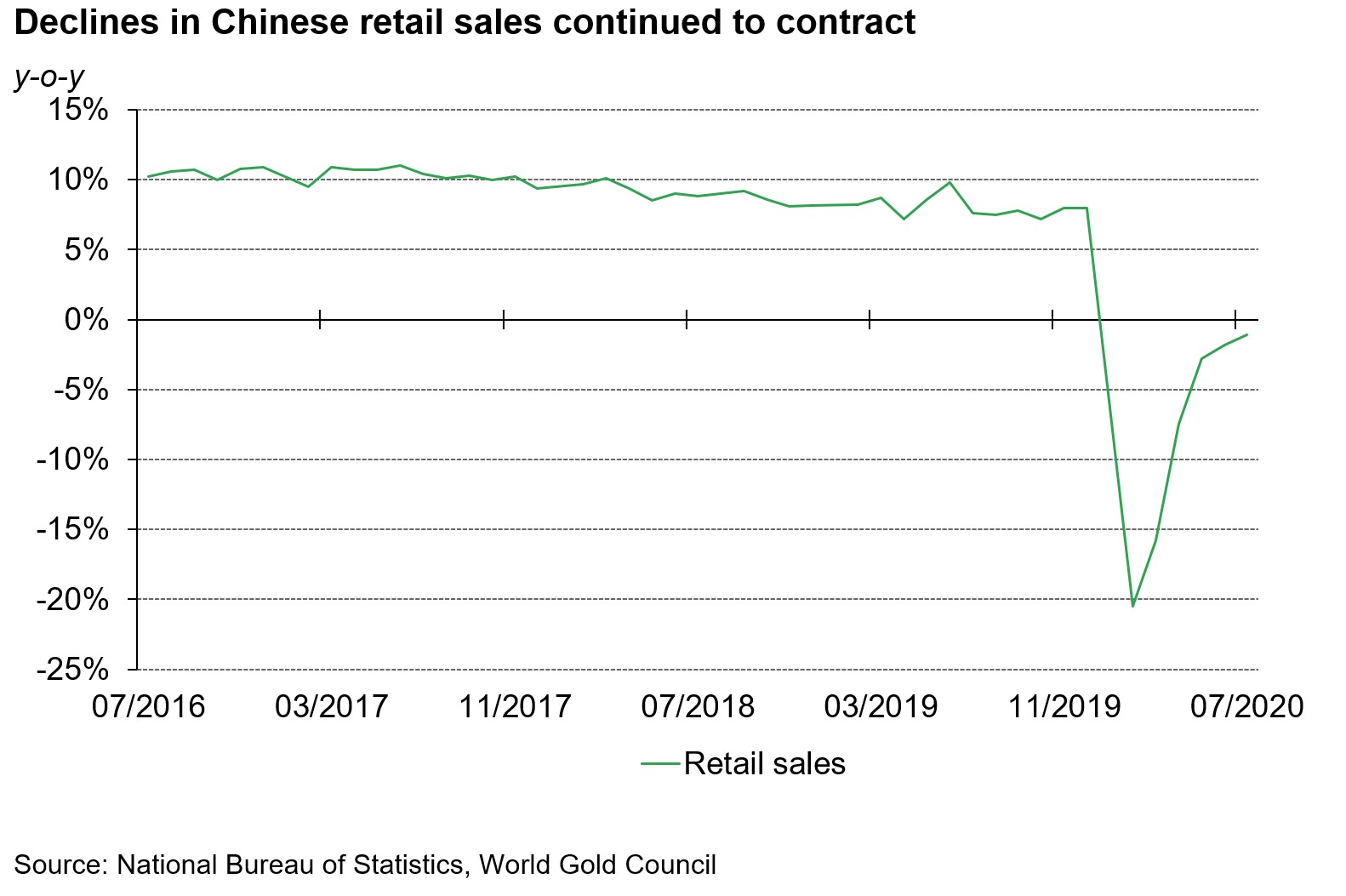

- China’s economy continued to see signs of improvement in July and the government has positioned the stimulation of domestic demand as a strategic focus for China’s future economic development

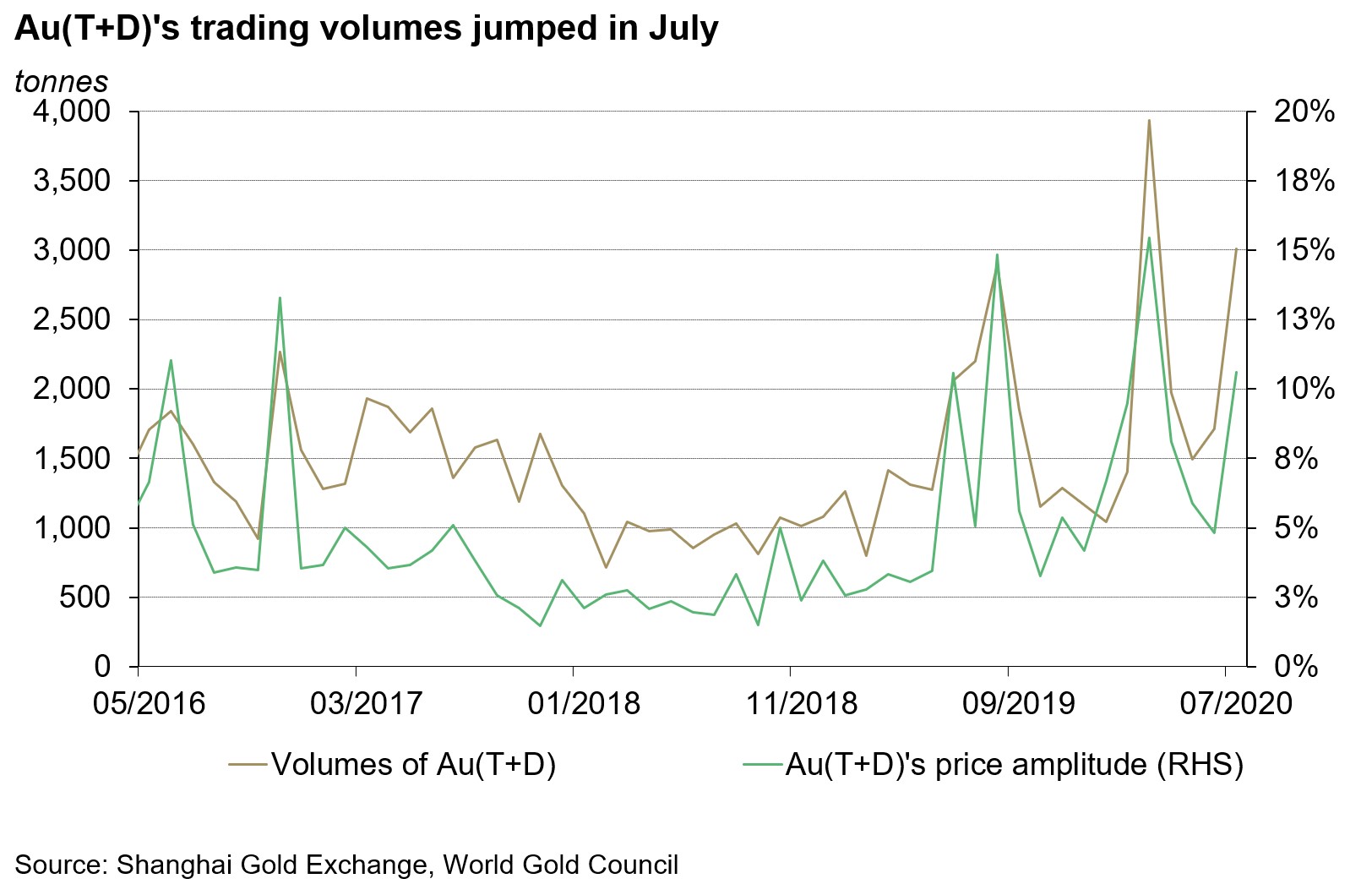

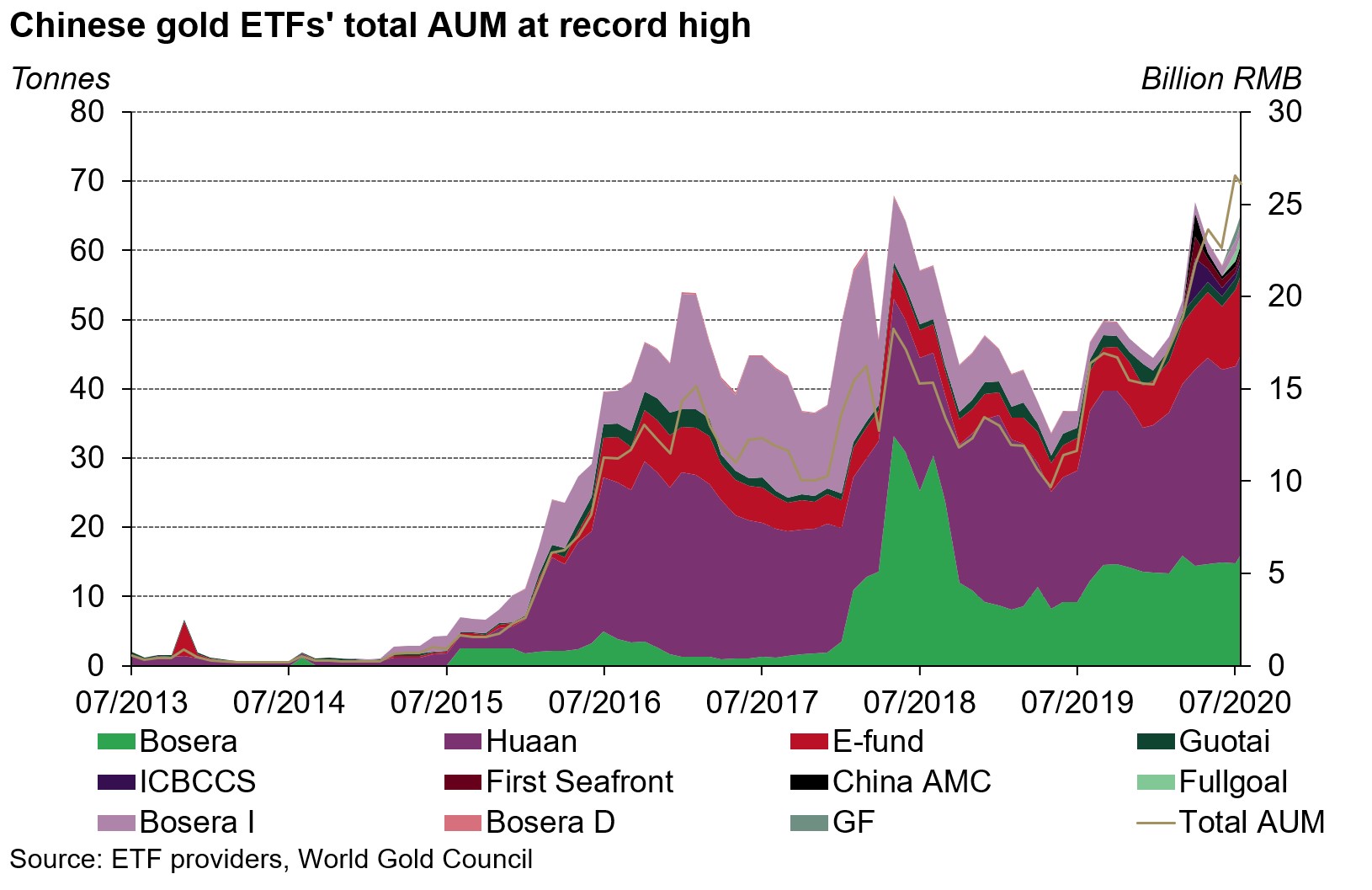

- Au(T+D) and gold-backed ETFs’ popularity among Chinese investors grew further:

- Au(T+D)’s volumes in July reached the second-highest level ever

- Chinese gold-backed ETFs’ total asset under management (AUM) recorded another historical high in July

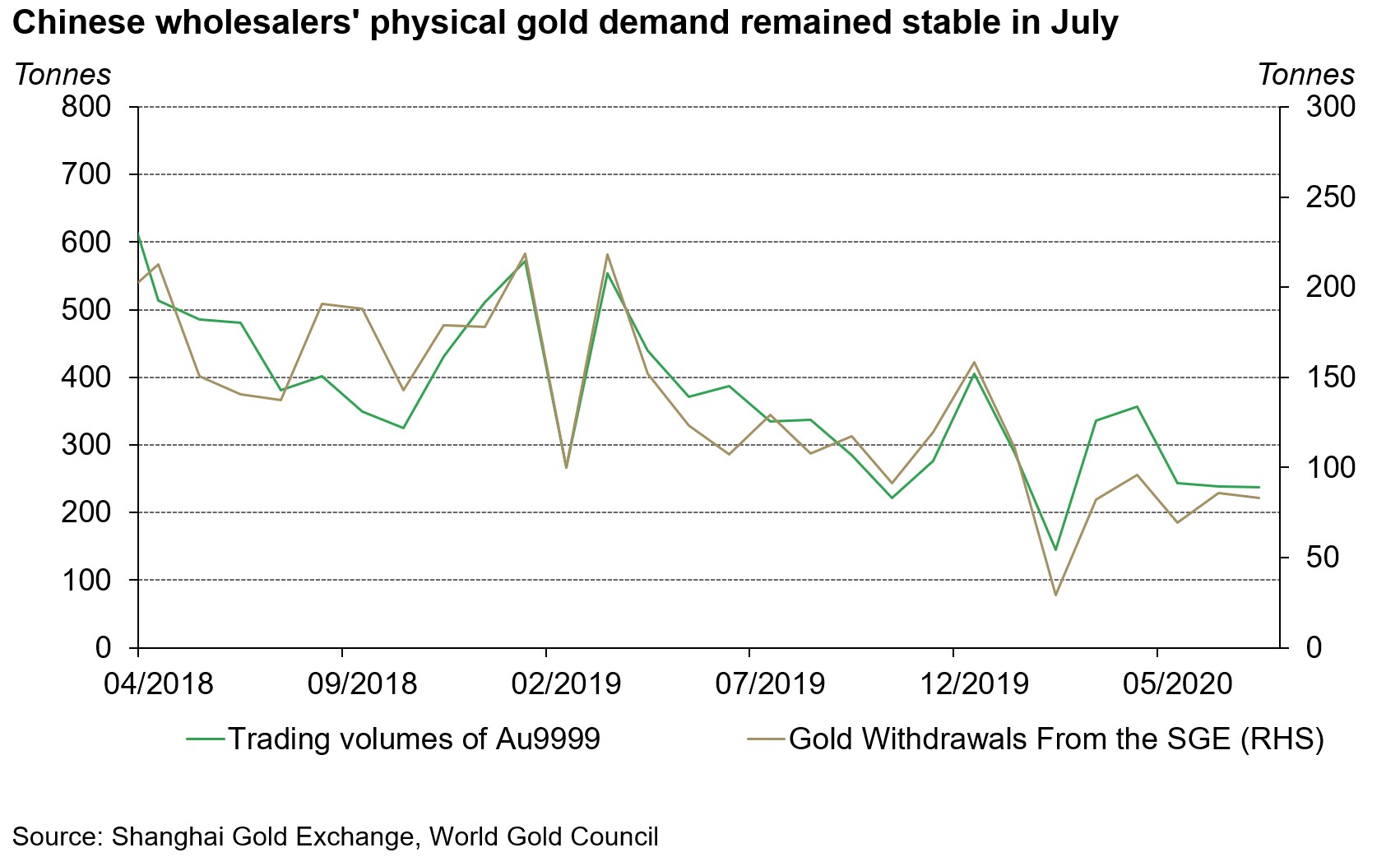

- Both the amount of gold withdrawn from the Shanghai Gold Exchange (SGE) and Au9999’s trading volumes stabilised in July

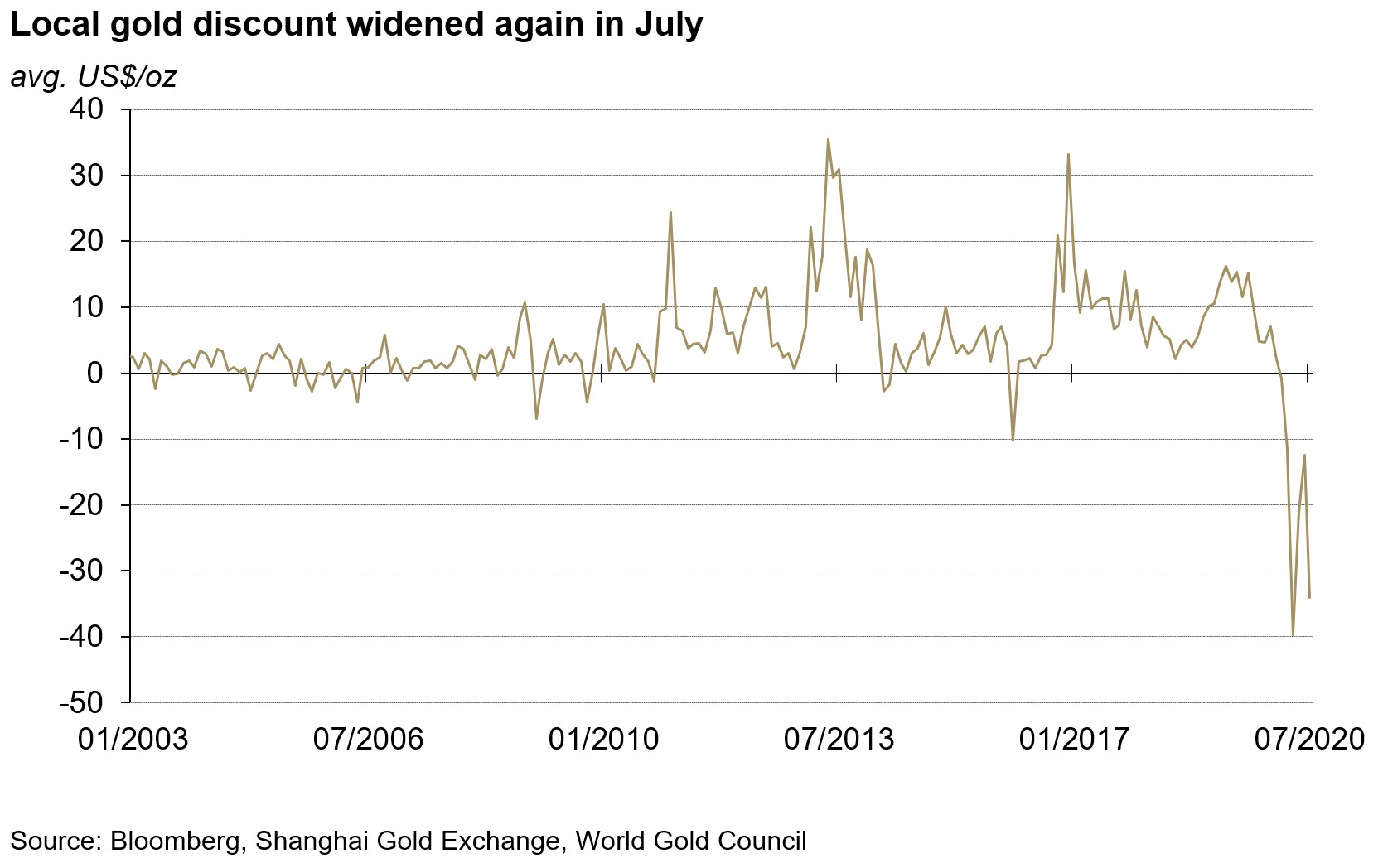

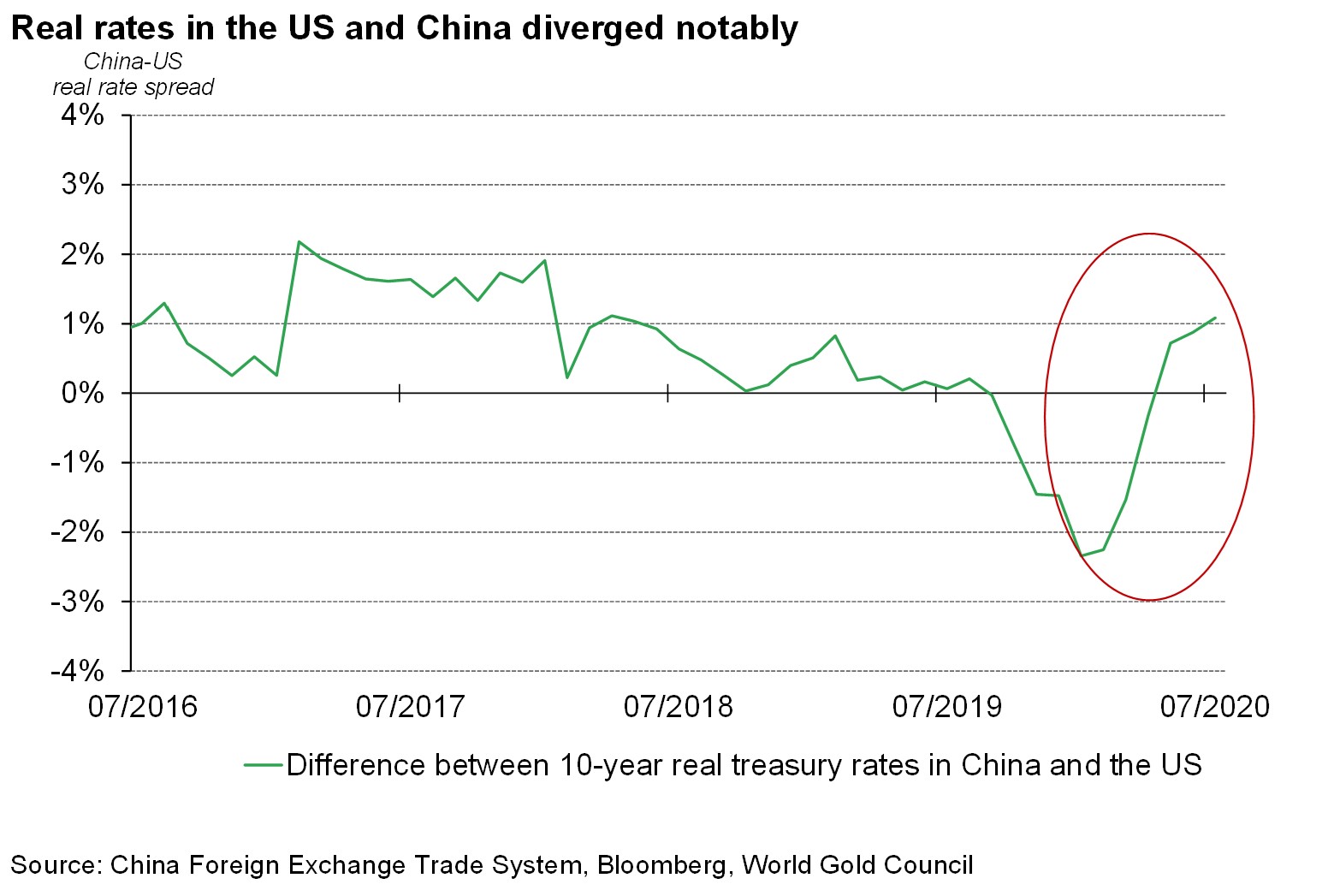

- The Chinese local gold price discount2 widened significantly last month and the main driver might be the changing monetary environment in China

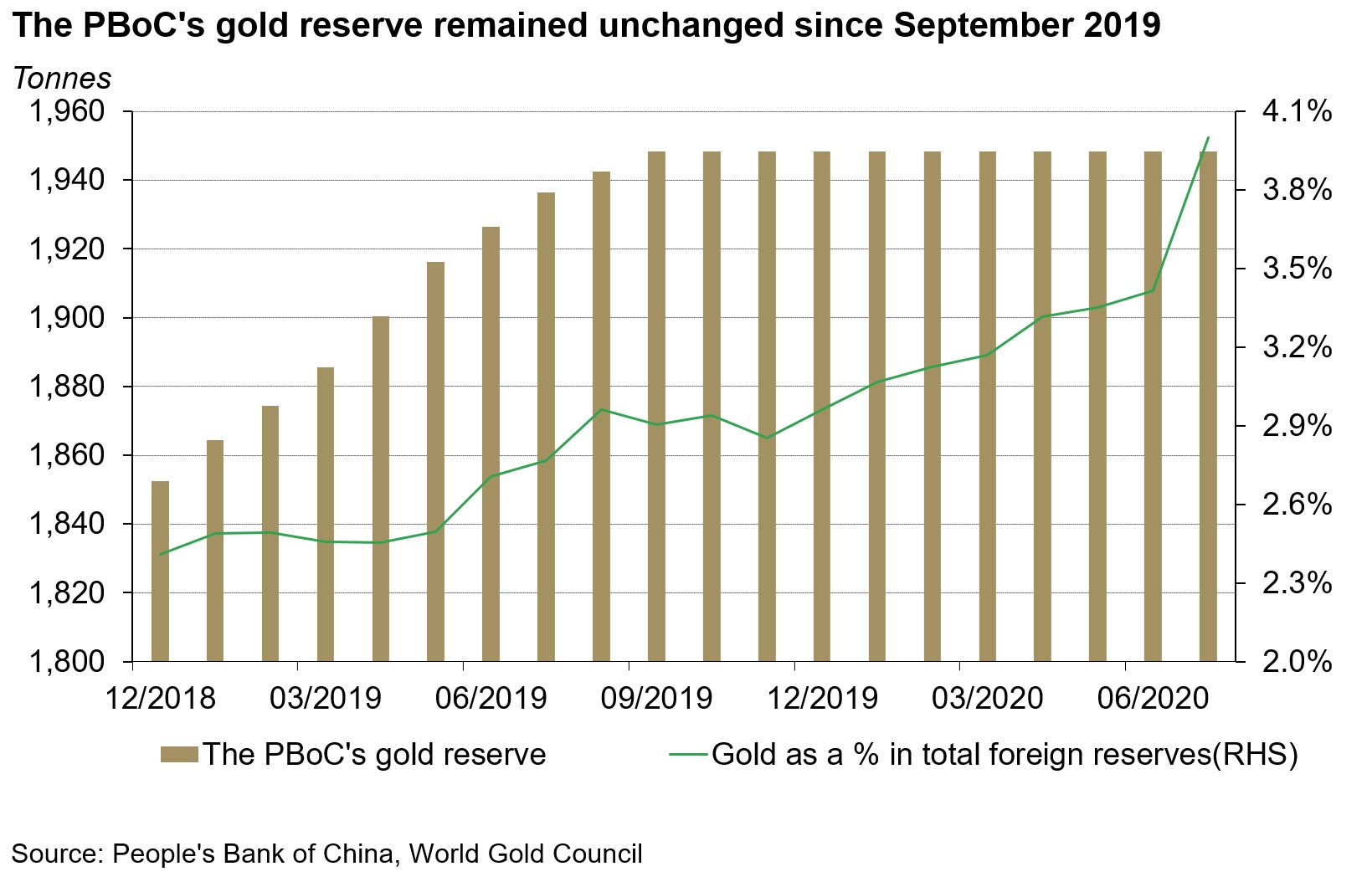

- The People’s Bank of China (PBoC) kept its gold reserves unchanged at 1,948t in July, accounting for 3.7% of its total reserves.

Gold prices surged in July

An easing monetary environment globally and the bullish gold price momentum were main contributors for gold prices’ record-breaking performances in the month. The LBMA Gold Price AM in USD jumped by 11% whereas the SHAUPM rose 7.4% in the month as RMB continued to appreciate, both breaching record highs. And even though the heightened volatility in Chinese equity markets after mid-July attracted many gold investors, a 14% surge in the CSI300 stock index during the first half of July stole some thunder away from the local gold market.

China’s economy continued its steady recovery in July

With COVID-19 infection cases remaining low in the month, key economic indicators such as Purchase Manager Indexes (PMIs), fixed asset investment, retail sales, and exports continued to improve.

China has positioned the promotion of domestic demand as its strategic focus on economic development in coming years

During July’s Political Bureau Meeting of the CPC Central Committee, Chinese leaders decided that “internal circulation” should be of strategic importance to complement the challenging external demand.3 This means that China will increase its efforts to stimulate domestic consumption and investment, potentially boding well for local gold jewellery demand. As a part of the domestic consumption stimulation plan, Chinese cities such as Hangzhou have started to build a holistic credibility system for all retailers, enabling consumers to review retailers’ credit ratings based on a set of mixed metrics upon entering the store. The aim is to encourage local retailers to pay attention to their reputation and thereby build up consumers’ confidence and trust in them.

Au(T+D)’s trading volumes in July reached 3,006t – the second highest in history – a 76% increase m-o-m

Au(T+D)’s trading volumes soared last month as the bullish gold price momentum and heightened volatility – which could bring more short-term profiting opportunities – attracted many tactical traders. Moreover, as the Baidu search index of gold in July spiked to its highest level since 2013 due to gold prices breaching record highs, gold investment products gained popularity.4

Chinese gold-backed ETFs’ total asset under management (AUM) reached US$3.8bn as of July, the highest ever5

Their total gold holdings increased by 5t in the month, totalling 63t. While a volatile equity market led to more investors seeking diversification after mid-July, gold being a trending topic during the month also played a role in attracting investors’ attention. Meanwhile, the listing of Fullgoal Shanghai Gold ETF and GuangFa Shanghai Gold ETF was another main contributor to the market’s expansion in July.

Both Au9999’s trading volumes and gold withdrawals from the SGE levelled off last month

Our trade partners in the industry have told us that while the nation’s emergence from the COVID-19 outbreak continues to provide support, China’s gold jewellery demand in July still felt the pressure from a surging gold price and the offseason impact, preventing its further rebound. But there is some cause for optimism. Expectations for the demand for gold wedding jewellery in October and December – the traditional peak season for weddings – are relatively positive as many couples postponed their ceremonies to the second half of 2020.

The Chinese local gold price discount widened markedly in July

On average, the SHAUPM’s discount to the LBMA Gold Price AM reached US$34/oz during the month, widening by US$22/oz compared to June. Fundamentally, the quick recovery in Chinese gold’s supply and the tepid gold consumption amid the impact of COVID-19 have kept the gold price in China below that of the Western market where physical gold demand has been much stronger since February.

Note: SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used. Click here for more.

Meanwhile, the relatively different monetary policy environments accelerated local gold price discount’s widening. As a vital driver for local gold prices, China’s real rate has risen in recent months as China’s economy has rebounded and the PBoC became more prudent in supporting liquidity, increasing Chinese investors’ opportunity cost to hold gold.6 As stated in July’s Political Bureau Meeting, while the nation will keep liquidity reasonably ample, the monetary policy should be prudent and neither “too tight nor too loose”.7 In contrast, real rates in the US and Europe witnessed sharp declines and remained negative in the month, significantly reducing Western investors’ opportunity cost to hold gold.

What’s more, the rocketing Chinese stock market in early July diverged some investors away from gold, limiting the rise of the RMB-gold price.

There was no change in the PBoC’s gold reserves in July

The PBoC’s foreign reserves totalled US$3,154.4bn as of July, up by US$42.1bn m-o-m, according to the State Administration of Foreign Exchange (SAFE). The PBoC’s gold reserve has remained unchanged at 1,948t since September 2019 and currently makes up 3.7% of total reserves.

Footnotes

1 We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit en.sge.com.cn/data_BenchmarkPrice.

2 For more information about premium calculation, please visit www.gold.org/goldhub/data/local-gold-price-premiumdiscount.

3 Please visit www.chinadaily.com.cn/a/202008/14/WS5f35eff9a310834817260521.html for more.

4 Baidu search index of gold measures the frequency of searches of “Gold” conducted by Chinese internet users using Baidu, the largest search engine in China.

5 Please note that Bosera’s I & D shares only provide updates at the end of each quarter.

6 Chinese and European real rates refer to the 10-year treasury rates in the regions less inflation, while the real rate in the US refers to the real 10-year US treasury yield.

7 Visit www.chinadaily.com.cn/a/201907/31/WS5d40e488a310d83056401e3c.html for more.