Wishful thinking. That’s how Angel Gurría, secretary general of the Organisation for Economic Co-operation and Development (OECD), responded to any prospect of a swift economic recovery from the coronavirus pandemic. But the scale of the impact on the global economy – as well as our daily lives – has been matched by the scale of the financial response.

Potential side-effects of monetary and fiscal medicine

26 March, 2020

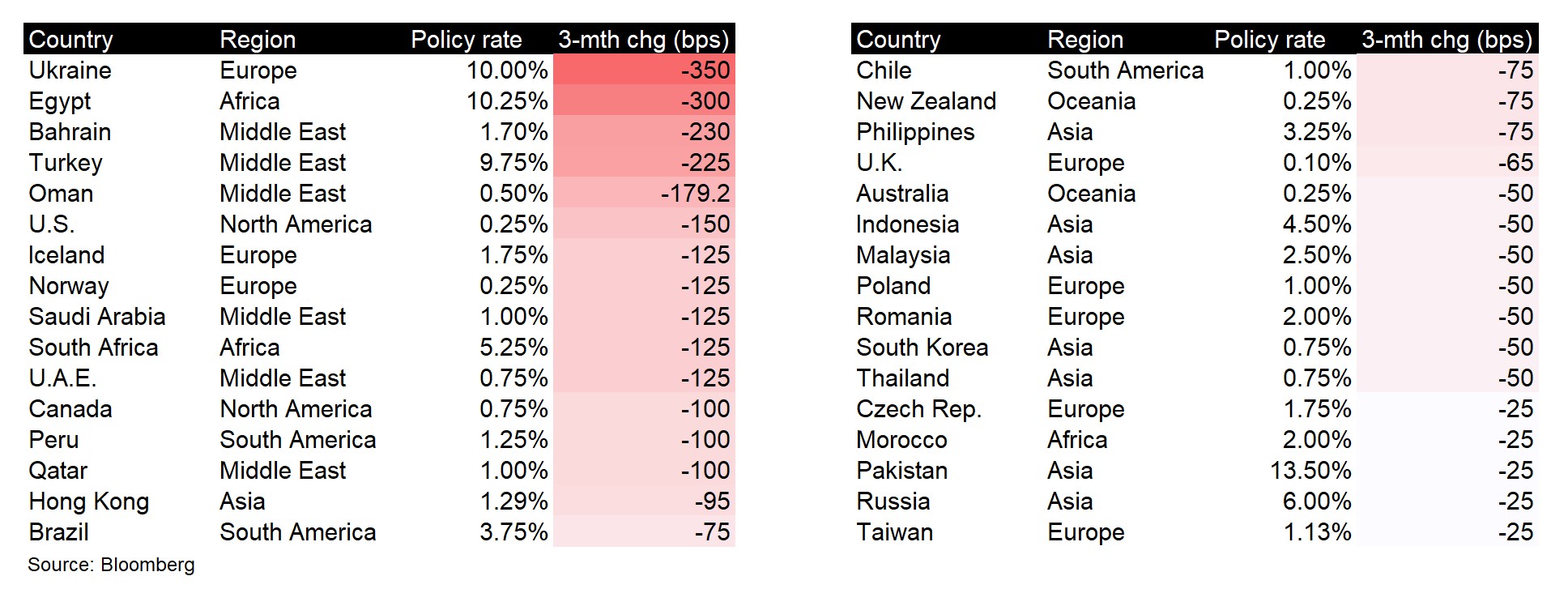

Who’s cutting in 2020?

While sluggish economic growth and geopolitical uncertainty was expected in 2020, the swift and sizeable impact of the coronavirus outbreak has led to policy decisions few expected. Under these unprecedented circumstances, central banks have taken even more action in order to prop up the global economy. The US Federal Reserve (Fed) has made two unscheduled rate cuts this year – the first unscheduled action since 2008 – bringing rates to near zero. But they were far from alone. The action was co-ordinated with the eurozone, the UK, Japan, Canada and Switzerland.

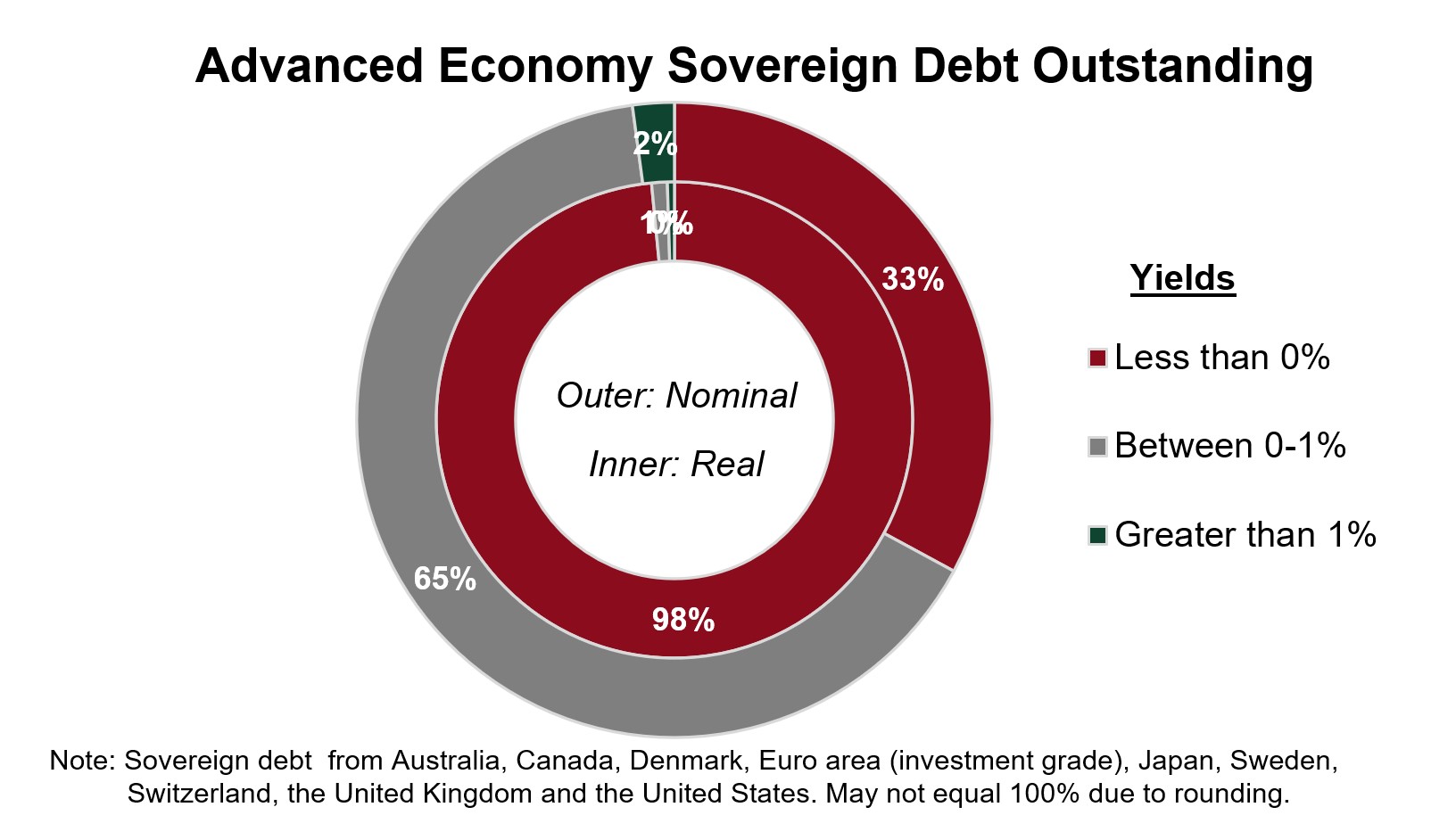

Last year, we published a blog post which looked at how central banks around the globe had been cutting interest rates in response to slowing economic growth, the growing pile of negative-yield debt, and what this meant for gold. Our conclusion?

"…opportunity cost has been the most important factor driving the gold price up in 2019…interest rates have been lowered and the stock of negative yielding bonds has grown rapidly, lowering the opportunity cost for holding gold. Falling rates and negative returns have made government debt less attractive and have increased the possibility of higher inflation and currencies depreciation in the future."

Source: Bloomberg

Fiscal policy joins the fight

On top of this, central banks and governments around the world are injecting trillions of dollars – far in excess of the levels seen in response to the Global Financial Crisis in 2008. And this week, the Fed went even further, by announcing unlimited asset purchases, and, for the first time, buy corporate debt. Some of the notable stimulus packages which have been announced are:

- Fed will inject US$4tn of liquidity through business loans, while the US government has agreed a US$2tn stimulus package

- The European Central Bank may remove limits – currently €750bn (US$821bn) – on its Pandemic Emergency Purchase Programme1

- Germany has enacted a loan programme – through its state-owned bank KfW – which could provide up to €550bn (US$610bn) in corporate loans

- Italy unveiled a €25bn (US$28bn) in stimulus plan, split into two packages, which includes loans to small- and medium-sized companies

- The Bank of Japan is significantly increasing spending on ETFs and corporate bonds, and the Japanese government has issued two loan packages totalling nearly US$20bn

Investopedia give a more detailed summary of all the monetary and fiscal stimulus measures being put into place so far. But these unprecedented actions to maintain the flow of credit, in the hope of limiting the damage to the economy, could profoundly distort asset prices and allocations in the years to come.

Beyond short-term fluctuations

The impact of these co-ordinated cuts and stimulus measures has been limited, so far anyway. And questions are again being asked on whether these are ultimately blunt tools, leaving central banks without much out of room to manoeuvre in the future, and governments with ballooning debt piles.

Investors are still worried about of the full impact of coronavirus on the global economy, resulting in the heightened levels of volatility across markets. And gold has not been immune to this volatility. The price has fallen significantly in recent weeks, as investors look for liquidity in order to stem losses elsewhere in their portfolios. But beyond this recent negative price action, the policy decisions that are being made in response to the coronavirus pandemic are likely to have long-lasting implications on the global economy, and, as a result, continue to support gold investment demand for the foreseeable future.