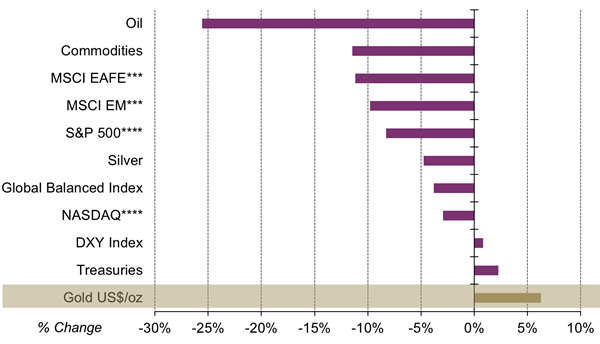

The stock market embraced the weakest one-week performance since the financial crisis last week on the back of growing concerns of the continued spread of the coronavirus across the globe. Despite the risk off-moves, gold was lower by more than 3% last week, which is historically unusual during these types of movements. There are a few potential reasons for the weakness.

- First, gold is the strongest performing major asset class this year; the only one in positive territory at this point, up over 5%. This may have led to some profit taking

Major markets performance YTD*

*as of 28 February 2020

Source: Bloomberg, ICE Benchmark Administration, Solactive AG, World Gold Council

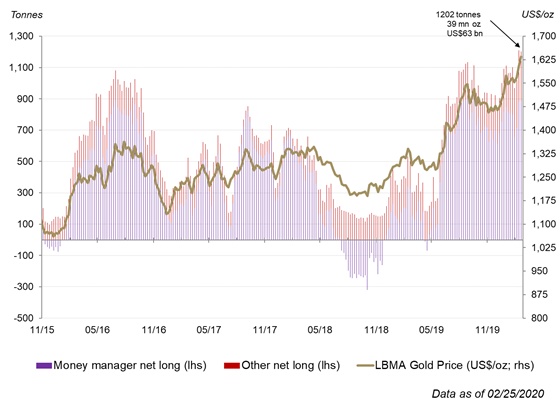

- Along with profit taking, sentiment in the COMEX futures market via net longs was extremely bullish, at all-time highs of 1,209t. Extreme positioning, both bullish and bearish, can sometimes lead to reversals in price.

COMEX net longs

Source: CFTC, Bloomberg

- We often discuss gold as a source of liquidity in times of crisis. Prior to the move in the markets, leverage in risky assets like stocks were at lofty levels. The quick, sharp, sell-off could have caused margin calls, requiring liquidity sourcing from liquid assets like gold. Gold trading volumes, finished the month sharply higher, more than 20% above the 2019 average, at $180bn a day.

But there are shifts that could bode well for gold.

- Investment demand for gold, particularly in the gold-backed ETF space remains strong. Last week there were inflows of over $1.5bn, and in February, global gold-backed ETF holdings grew 4% to new all-time highs. This was on the back on inflows in all-regions. We will release our February updated report on gold-backed ETF flows this Thursday.

- We often discuss the opportunity cost of holding gold. Bond yields in the US, in particular the 10y and the 30y, have reached all-time lows. Overnight, the 10-yr touched the 1.0% level. As yields move lower, gold becomes more attractive from an opportunity cost perspective

- As rates have fallen sharply, the probability of Federal Reserve cuts moved to expectations of 3.5 cuts in 2020, with a 100% predicted cut of 50bps at the March meeting. As noted, gold tends to outperform during periods of Fed easing.

- Technically, Gold remains in a bullish uptrend, despite last week’s pullback, and could continue higher as long as it holds the 50-day moving average of approximately $1,562/oz.

Gold price