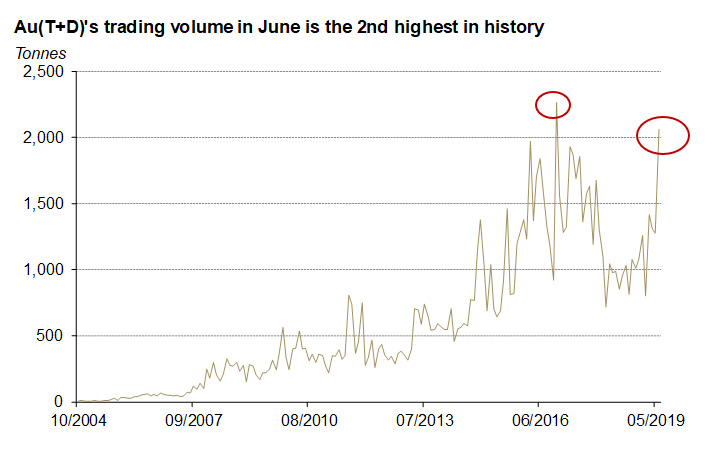

Au(T+D)’s trading volume: Hot in June

Having risen over 3% in May, the loco-China gold prices continued to soar in June. Au(T+D), the most liquid and margin-traded gold contract at Shanghai Gold Exchange, rose 8.71%, the best monthly performance in 3 years.

Trading also rocketed, with the contract recording the 2nd highest monthly trading volume in history with a whopping 2,062t, or US$92 billion. The all-time high was in November 2016, when its monthly trading volume reached 2,266t due to a depreciating CNY and a rising inflation. In fact, these are the only two instances when Au(T+D)’s monthly trading volume has risen above 2,000t.

Source: Shanghai Gold Exchange

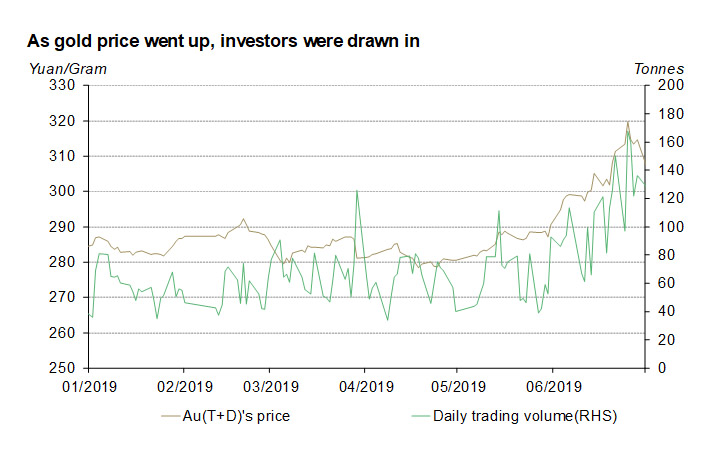

Representing investors’ interest, momentum in gold price was one of the main factors fuelled the impressive jump in Au(T+D)’s trading volume in June.

Source: Shanghai Gold Exchange

Geopolitical tensions globally and expectations for easing monetary policies among central banks have been pushing gold prices up recently. In the face of rising uncertainties and lower interest rates, gold has become increasingly important to investors for risk hedging and value preservation purposes.

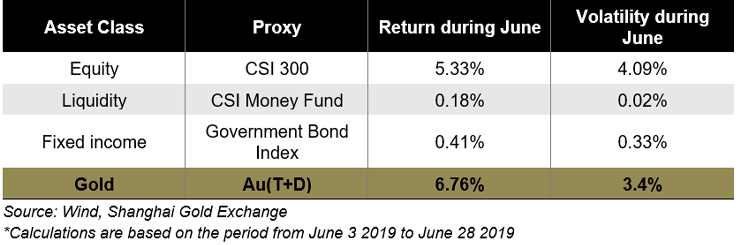

Once again, gold has proven to be a valuable strategic asset allocation with a higher return and a lower volatility compared to other major asset classes in circumstances like this.

Risk hedging and value preservation have been two of the major reasons driving investors to gold. While numerous uncertainties cast a fog over the future, gold’s strategic role in asset allocations might become increasingly relevant.