Industry Insights

Terry Heymann

Chief Financial Officer World Gold CouncilDenver Gold Forum panel: Gold Mining’s Contribution to the UN Sustainable Development Goals

Today we launched our new report, Gold Mining’s Contribution to the UN Sustainable Development Goals. The release coincided with the annual Denver Gold Forum which brings together mining CEOs from around the world to discuss the latest developments in the gold mining industry.

Terry Heymann

Chief Financial Officer World Gold CouncilLaunch: Gold Mining’s Contribution to the UN Sustainable Development Goals

World Gold Council

The experts on goldThe First Year of the RGMPs – through the eyes of a practitioner

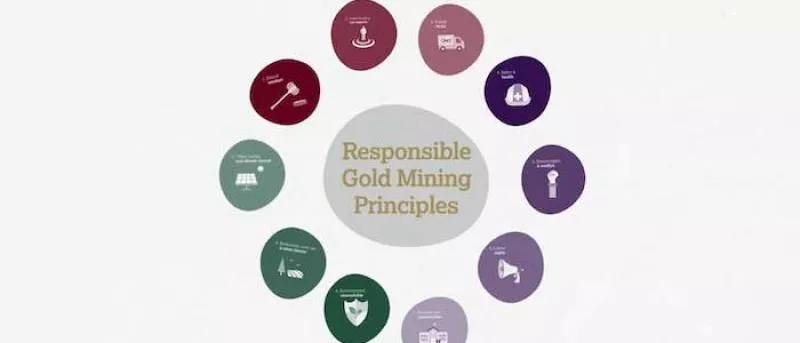

World Gold Council member companies have embarked on the three year implementation phase of the Responsible Gold Mining Principles. It’s been a year since the launch in September 2019 and three members describe their experience thus far.

Peter Sinclair

Senior Advisor World Gold CouncilRe-imaging gold as an ESG investment

In-depth: In a world where consumers of every age group are increasingly interested in the source of their products and the ethical standards by which they are produced, some may think gold doesn’t stack up as a responsible investment.

World Gold Council

The experts on goldCo-operation along the gold supply chain

All actors in the supply chain have responsibility for ensuring that gold has been responsibly mined and responsibly sourced. Gold mining should contribute to the development of producer countries and to local communities and to the delivery of the Sustainable Development Goals.

Terry Heymann

Chief Financial Officer World Gold CouncilVideo: a coffee chat on the Responsible Gold Mining Principles

Terry Heymann, our CFO, participated in a Mining Coffee Chat with Remi Piet, Senior Director Infrastructure, Energy & Natural Resources at Americas Market Intelligence. Watch their conversation on the Responsible Gold Mining Principles and more.

Terry Heymann

Chief Financial Officer World Gold CouncilEight months on from launch

John Mulligan

Head of Sustainability Strategy World Gold CouncilAfter the virus: gold and the climate crisis

In-depth: Whilst the COVID-19 pandemic and its economic consequences are currently all-consuming, attention must not be diverted from ESG performance and commitments to tackle the climate crisis. Any further delays in implementing change will be damaging and costly, suggests John Mulligan.

Terry Heymann

Chief Financial Officer World Gold CouncilVideo: Discussing the Responsible Gold Mining Principles at Evolve 2019

Last month, we launched the Responsible Gold Mining Principles (RGMPs), a new framework that sets out clear expectations for consumers, investors and the downstream gold supply chain as to what constitutes responsible gold mining. In this video, Gary Goldberg, at the time CEO of NewmontGoldcorp, Mick Wilkes, CEO of OceanaGold and I discuss why we developed the RGMPs, investor expectations around ESG and expectations as to how the mining industry will evolve over the next 5 to 10 years.

Terry Heymann

Chief Financial Officer World Gold CouncilTakeaways from the Responsible Asset Owners Global Symposium

Last week, I was delighted to be asked to speak at the inaugural Responsible Asset Owners Global Symposium in London . More and more investors are – quite rightly – thinking about how to incorporate environmental, social and governance (ESG) factors into their investment choices. But there is still a lot of uncertainty about what this means, and in particular, what framework investors should use to assess ESG performance