Q4 & Full Year review

The year ended much as it began, with nominal interest rates and inflation jockeying for position as the key driver of gold. But unlike in Q1, inflation was a more dominant factor than interest rates in Q4. This helped gold make up some of the ground it had lost in the early part of the year (see Gold Market Outlook 2022).

While the price of gold finished the year 4% lower, the average price for 2021 was almost 2% higher than the average price seen in 2020. This performance is well explained by gold market dynamics observed in 2021.

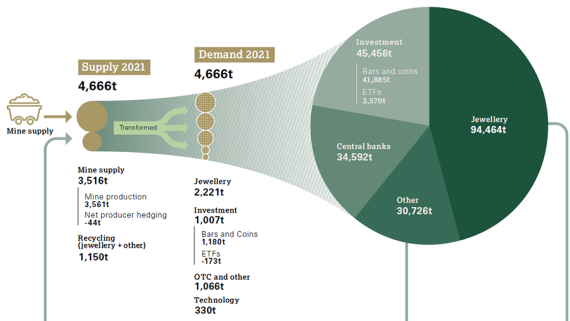

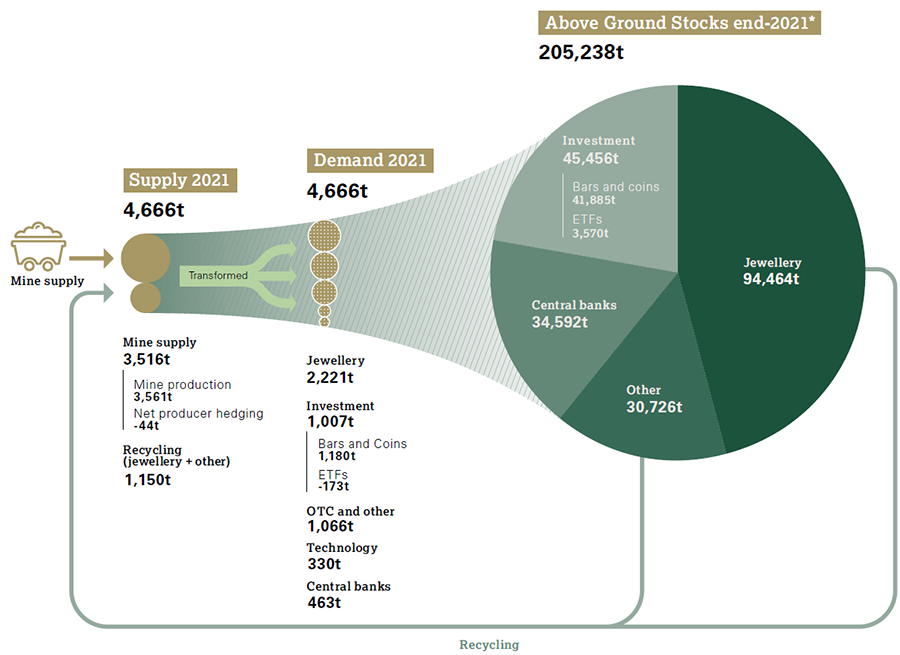

The tug-of-war between interest rates and inflation was reflected in investment demand and created a drag on price. Gold ETF outflows – concentrated in North America – were a feature for most of the year, bringing collective gold holdings in ETFs down 173t by the end of the year. Interest rates, representing the opportunity cost for holding gold, are historically a key determinant of ETF flows and last year was no exception. US 10-year Treasury yields ended the year 40 bps higher and shorter maturities like the US 2-year Treasury yields – reflective of market expectations of future Fed policy – rose almost every month of the year. These higher nominal yields helped put downward pressure on gold ETF holdings. Yet despite considerable outflows during the year, global holdings of these products remain significantly above pre-pandemic levels, likely reflecting the fact that much of 2020’s record inflows were due to longer-term, strategic buying.

Bar and coin demand, which our analysis suggests is more sensitive to changes in inflation than interest rates, ended the year 281t higher, helped by decades-high demand in both Europe and North America.

The solid recovery in jewellery demand was also supportive for gold. The market witnessed a strong bounce back from the pandemic-ravaged slump of 2020. Demand finished the year with a somewhat surprising surge as Indian buying hit a quarterly record. Chinese demand also impressed, posting one of its strongest Q4 numbers on record.

Meanwhile, central bank buying offered further reinforcement, particularly through the first three quarters of the year. A few large-scale purchases by banks including Thailand and Brazil added to the regular buying of smaller amounts by the likes of India and Uzbekistan to generate more than 460t of buying in 2021.

And gold’s relative stability throughout the second half reflects this combination of subsiding ETF outflows and strength in the consumer and central bank elements of demand.

Finally, supply had a somewhat neutral effect as higher marginally mine production was counterbalanced by considerably lower recycling.

Outlook

Consumer-driven demand for jewellery and technology will likely remain solid in 2022 amid generally strong economic growth and could be further supported if the gold price were to move sideways or to soften. However, the pent up-demand we saw in Q4 will probably subside in 2022 as some of it has likely already been met.

Demand in China for the beginning of 2022 could be restrained by increasing COVID-related restrictions and the current economic slowdown. For the rest of the year, slower growth could hamper demand, but it could benefit from lower price volatility.

Technology demand is expected to show a further modest rise this year, as it continues to recover from a weak 2020. The continued expansion of 5G infrastructure should help support demand for gold in this sector. But demand faces some risks from a slowdown in China as well as COVID-related restrictions.

Investment demand is likely to be pressured by higher nominal interest rates again in 2022 but could benefit from continued inflation concerns and COVID risks.

Bond yields have started the year on the front foot. This trend is likely to continue as long as central banks maintain a hawkish tone, thus increasing the opportunity cost for gold. Yet, gold has remained resilient in the first few weeks of the year, likely as a by-product of perceived continued risks.

Further, rising policy rates and the end of bond-buying programmes could be detrimental to financial markets much as they have arguably been very supportive over the last few years. Equity markets continue to ignore bad news, but a stronger pullback remains a major risk given valuations and earnings prospects. Bonds will not fare well in a rising environment and if supply chain restrictions are eased then commodity prices may soften.

In addition, rising policy rates are not exactly uncharted waters, but the experience from 2018-2019 suggests that the economy is more sensitive to higher rates given that debt levels are substantially higher. This poses the risk of a growth slowdown and a fall in long-term real interest rates.

Finally, gold has historically outperformed in the months following the onset of a US Fed tightening cycle.

ETF demand could largely see a repeat of 2021 with both economic resilience and higher nominal interest rates as headwinds. However, continued inflationary pressures, financial market wobbles and COVID restrictions present upside risk. The outflows that gold ETFs experienced in 2021 should be put into context, considering that they collectively added 2,200 tonnes between 2016 and 2020. The direction of ETFs will largely depend on which factor is stronger: demand for gold as a hedge, in light of persistent inflation and potential COVID-related market pullbacks, or further reduction in holdings in light of rising nominal interest rates.

Bar and coin demand is expected to be rangebound in 2022 compared to 2021, potentially weaker in some regions within an overall range of 1,000 to 1,200t. Price volatility and continued inflation concerns may help demand, but after two strong years some buying exhaustion may have set in. There is, however, some upside in China. Potential currency weakness and higher local inflation alongside continued low bond yields are all encouraging for Chinese bar and coin investment. In India, loosening restrictions have produced bumper numbers for Q4 2021. Some of this will likely wane in 2022 but economic growth should remain a catalyst for solid demand.

Central bank demand is likely to continue its positive 12-year trend but may struggle to match the strong performance of 2021. There were major strategic purchases in 2021 that may not repeat soon and previous significant buyers, such as Russia and China, have been relatively inactive in recent years. Both of these factors create more uncertainty around expectations, as do developments in Turkey, which could have a significant bearing on demand numbers. However, our central banks survey indicates a similarly positive inclination towards gold in 2022 as in 2021.

Supply is expected to be marginally softer in aggregate with mine supply rising slightly but outweighed by a fall in recycled gold.

Mine production can achieve similar growth in 2022 to 2021. Margins remain healthy despite rising costs, incentivising continued production. Certain risks to this growth stem from continued COVID-related disruptions and, of course, operational issues.

Recycling is likely to fall in 2022 and we expect a range of 1,050–1,110t for the full year. Global real GDP growth is expected to be solid, reducing the need for distress selling. As in 2021, government support could factor limit the need to sell and any price weakness – should it materialise – would act as a further disincentive. Higher inflation has also reduced the willingness to recycle and near-market supplies continue to be constrained after the historically high levels of recycling seen in 2019 and 2020.