You asked, we answered: Is mined gold production peaking?

7 January, 2026

Introduction

Global gold mining has been stable in recent years. Despite short-term impacts stemming from the pandemic, safety stoppages and industrial action, mined gold production averaged a near zero annual y/y change between 2018 and 2024.

And in 2024 mined gold production reached 3,645t, 4t higher y/y and the second highest annual total after the 2018 high of 3,658t (Chart 1). During the first three quarters of 2025 gold production totalled 2,717t, a 16t y/y rise. Against the background of a surging gold price, we have seen only mild upticks in output, raising critical questions about whether the industry is nearing its limits – and what that means for future supply.

Chart 1: Mined gold production saw a mild rebound in 2024

Source: Metals Focus, Refinitiv GFMS, World Gold Council

Is mined gold production peaking?

We believe 2025, based on Q1-Q3 data and trends, is well positioned to achieve a new record high in mined gold production. This is supported by key drivers:

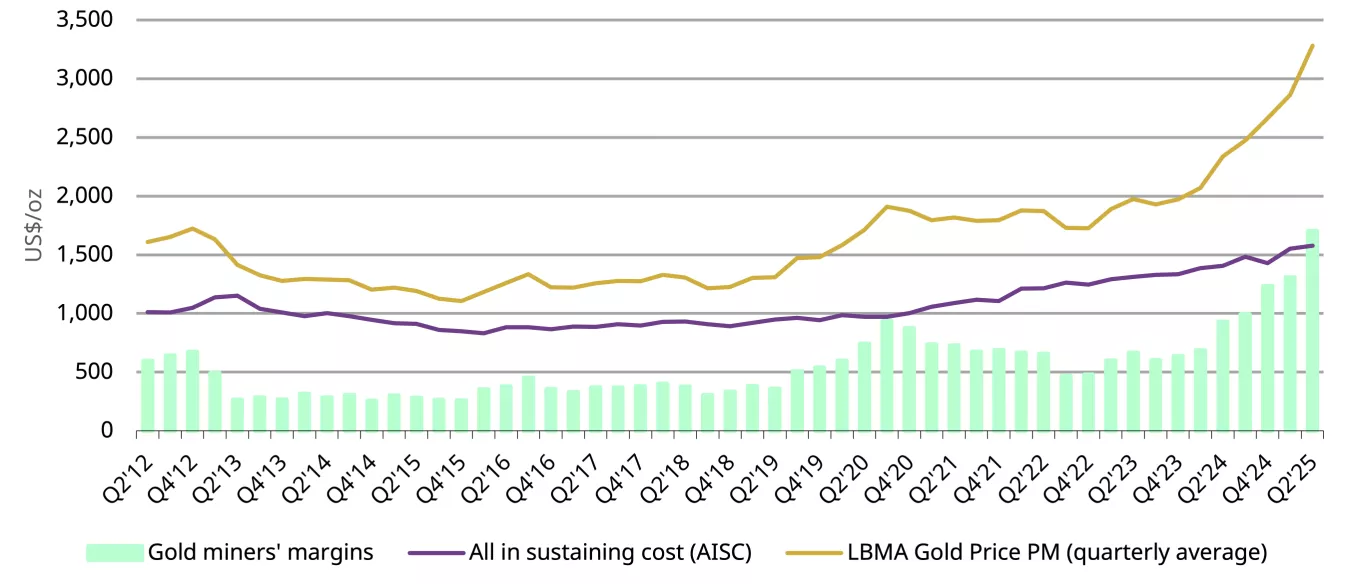

- Rising margins (Chart 2)

- New projects (notably in Canada)

- Operational expansions elsewhere

- Rising output from artisanal and small scale gold mining (ASGM), as noted in our Gold Demand Trends report.

While sanctions could slow development, additional contributions from new mines in regions like Russia may further boost total production. That said, the suspension of a few operations has had a notable impact on global output during 2025 and could continue to limit growth.

Chart 2: Gold miners’ margins have risen notably over recent quarters

*Data to Q2 2025. Gold miners’ margins=quarterly average LBMA Gold Price PM – quarterly average AISC.

Source: Metals Focus, World Gold Council

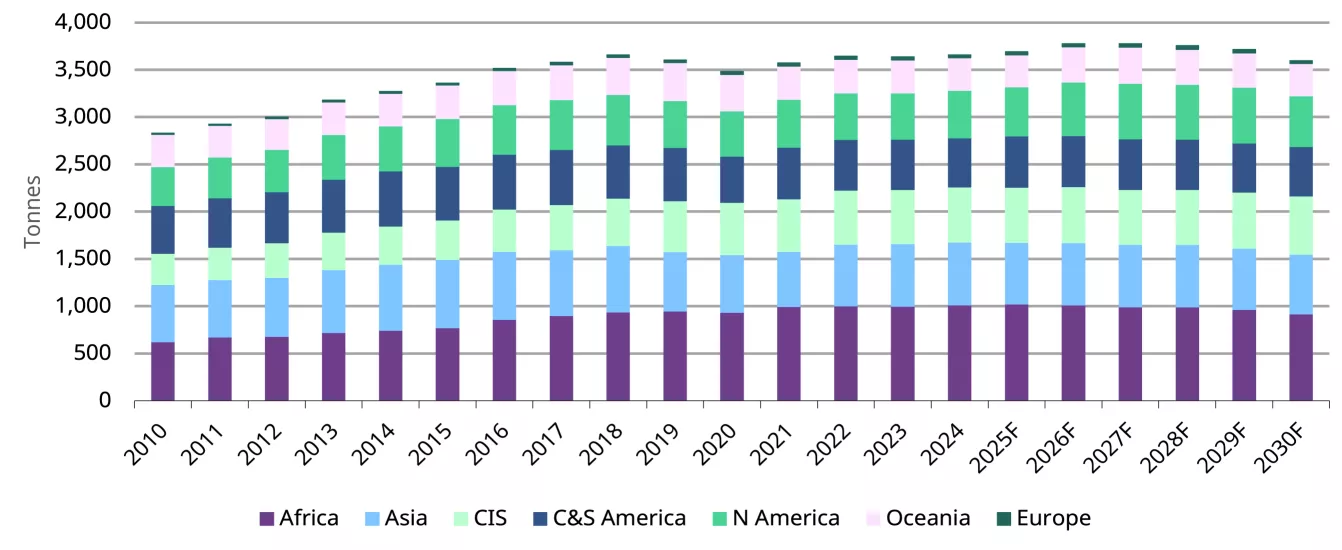

That being said, our analysis and projections from Metals Focus show that global mined gold production is likely to gradually plateau over the next few years, rather than peak and then fall (Chart 3). While new projects and ramp-ups should provide continued support, declining reserves, disruptions and gold miners’ CAPEX costs may limit the upside potential of gold production.

Chart 3: Based on projections from Metals Focus, mined gold output may gradually plateau

Five-year mined gold supply projection*

*Projections from Metals Focus based on their estimation as of Q2 2025.

Source: Metals Focus

Why hasn’t gold production caught up with the price surge?

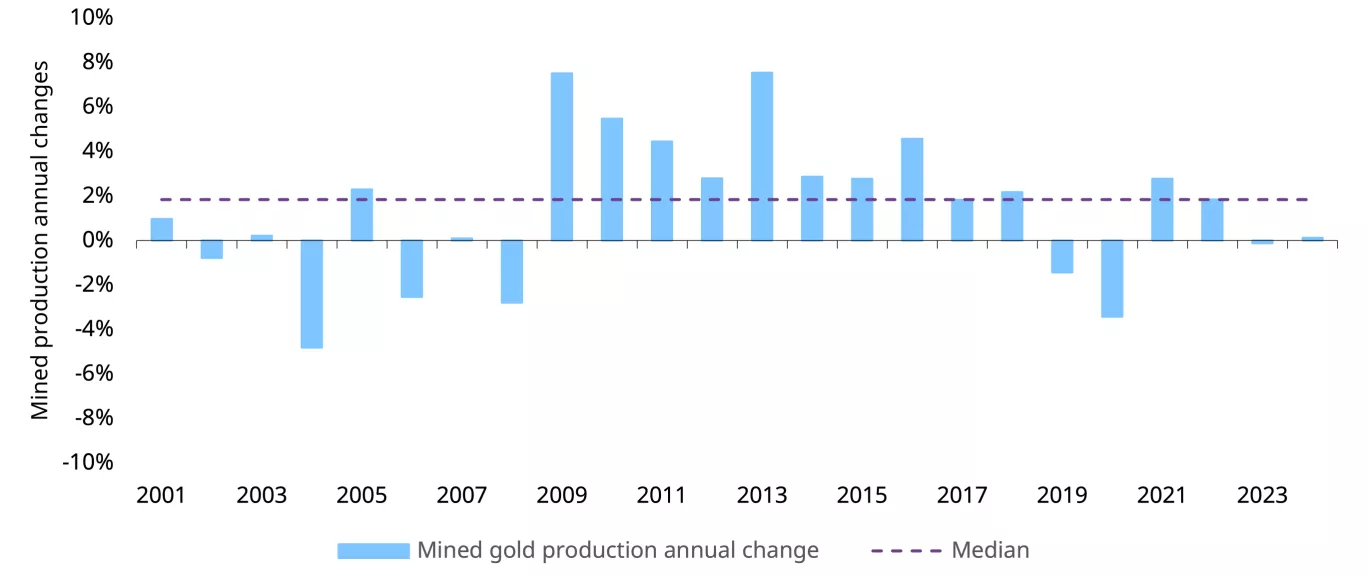

Let’s take a step back and look into the stability of global mined gold production over recent years. Mined gold production was virtually unchanged in 2023 and 2024; and volatility in production volumes over the past decade only amounts to 2.3%,or 2.7% in the past 15 years and 3% in the past 20 years (Chart 4).

Chart 4: Changes in mined gold production have been relatively low

Annual mined gold production changes and the median*

*Annual data to 2024. Median change based on data between 2001 and 2024.

Source: Metals Focus, World Gold Council

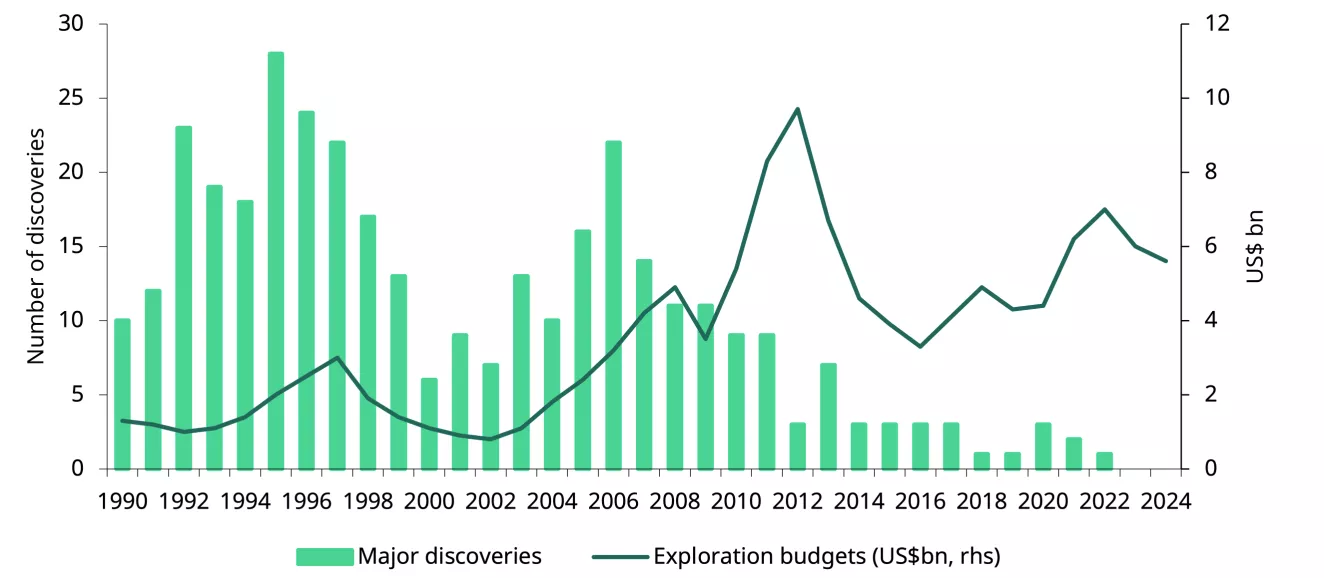

Why is this the case? First, gold is mined on every continent except Antarctica and such geographical dispersion brings stability to global mined gold production even in the face of various disruptions.1 Second, the length of the mining process means that it is not easy for miners to increase or decrease production in the short-term. It is also becoming more difficult to find, gain permits for and construct new mines with major discoveries steadily declining (Chart 5), making any substantial increases challenging. It is also important to note that existing mines will age and phase out gradually. And absent margin motivations, it is possible that gold production could fall in the medium to longer term, and declining older mines could partially offset any new increase.

Chart 5: New projects are becoming harder to discover

Annual major discoveries and exploration budgets in the global gold mining industry*

*Annual data to 2024. For more, see: New finds remain scarce despite gold from major discoveries at 3 Boz | S&P Global

Source: S&P Global Market Intelligence, World Gold Council

A rising gold price, which usually pushes up miners’ margins, is likely to:

- Encourage the opening of new mines

- See old mines, which were once closed due to lack of profitability, re-open, or maintain existing mines beyond their anticipated life

- Incentivise growth in ASGM.

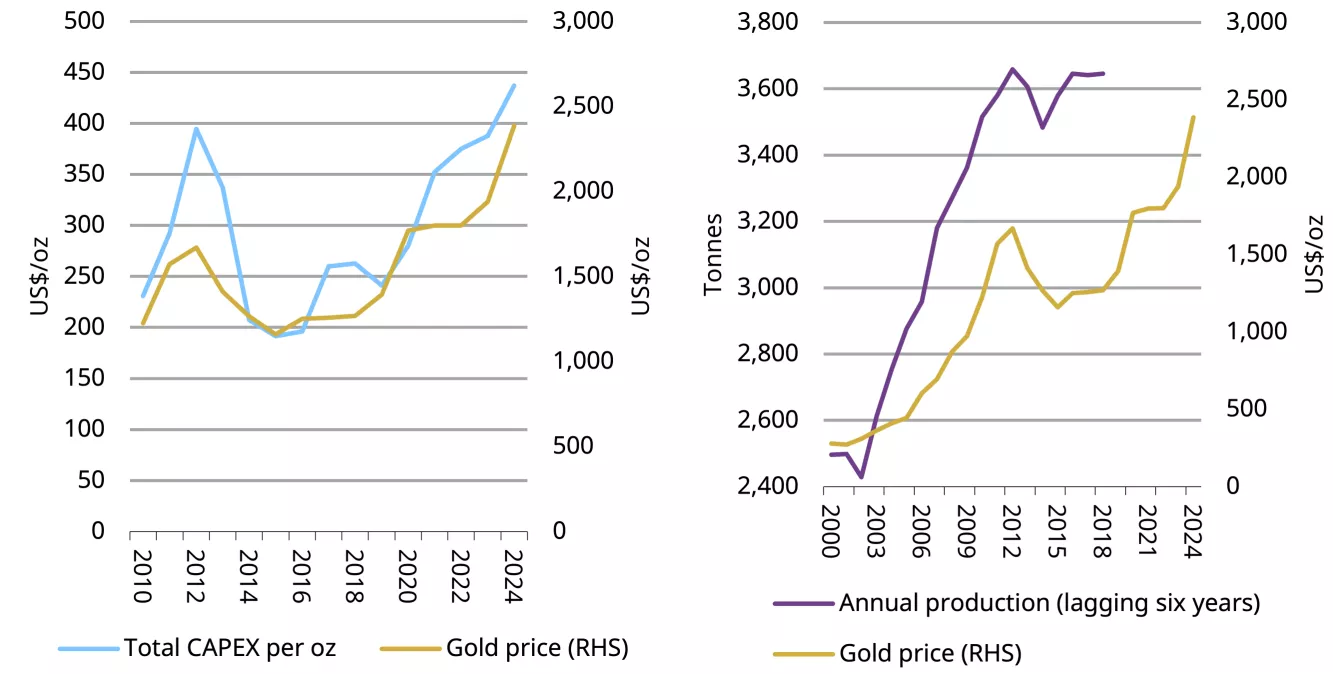

While re-opening old mines and growth in ASGM may have immediate impact on gold production, it takes much longer and becomes more difficult for new mines to start producing as noted before. We found that while a rising gold price usually coincides with higher gold miners’ CAPEX in the same year, mined production lags the gold price by at least six years (Chart 6).

Chart 6: Gold miners’ CAPEX and production’s reaction to the gold price*

*Annual data to 2024. Total gold miners’ CAPEX includes total sustaining CAPEX, non-sustaining CAPEX, and study and exploration expenditure per oz.

Source: ICE Benchmark Administration, Metals Focus, World Gold Council

Summary

The projections from Metals Focus indicate that global gold mining production may be nearing its peak. Rather than peaking and then falling, they anticipate mined gold supply to gradually plateau over the next couple of years. Mined gold production has remained relatively steady over past decades, with only minor annual changes despite short-term disruptions. This stability is underpinned by the geographically diverse nature of gold mining, the lengthy development timeline for new projects, and the gradual phase-out of older mines. And for these reasons, mined gold supply usually lags gold price changes.

Alongside relatively stable gold demand – due principally to gold’s dual nature as a consumer good and an investment asset – the global gold market is one of resilience and balance.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.