India gold market update: Festive shine

17 October, 2025

Highlights

- Gold price rally intensifies and domestic premium climbs

- The festive season starts strongly, powered by investment demand and jewellery sales

- September sees record inflows into gold ETFs and the momentum carries forward

- Listed jewellers report strong quarterly revenue gains despite the high gold price and base effect

- Gold imports hit a 10-month high in August, supported by seasonal buying and investment demand.

Looking ahead

- Expectations for a strong festive season remain high across the gold trade, driven by continued demand for investment products and wedding jewellery, despite challenges in the broader jewellery market amidst a rising gold price.

- Increased disposable income for consumers – following GST cuts and the prevailing low inflation environment1 – may give gold a boost.

Fresh record for gold

Gold continues its extraordinary price rally, having reached 48 all-time highs this year.2 Geopolitical tensions, strong investment demand, dollar weakness, financial market risk and expectations of dovish Fed policy lifted international prices by 11.6% in September and by an additional 7.9% in the first two weeks of October, pushing past the US$4,000/oz milestone. Notably, the surge from $3,500 to $4,000 occurred in just 36 days, a stark contrast to the previous $500/oz increments, which took over three years on average. International gold prices have surged by 58% y-t-d, marking the largest increase in 45 years. Domestically, gold prices have mirrored this upward trend, rising 66% y-t-d, with gains further amplified by weakness in the Indian rupee.

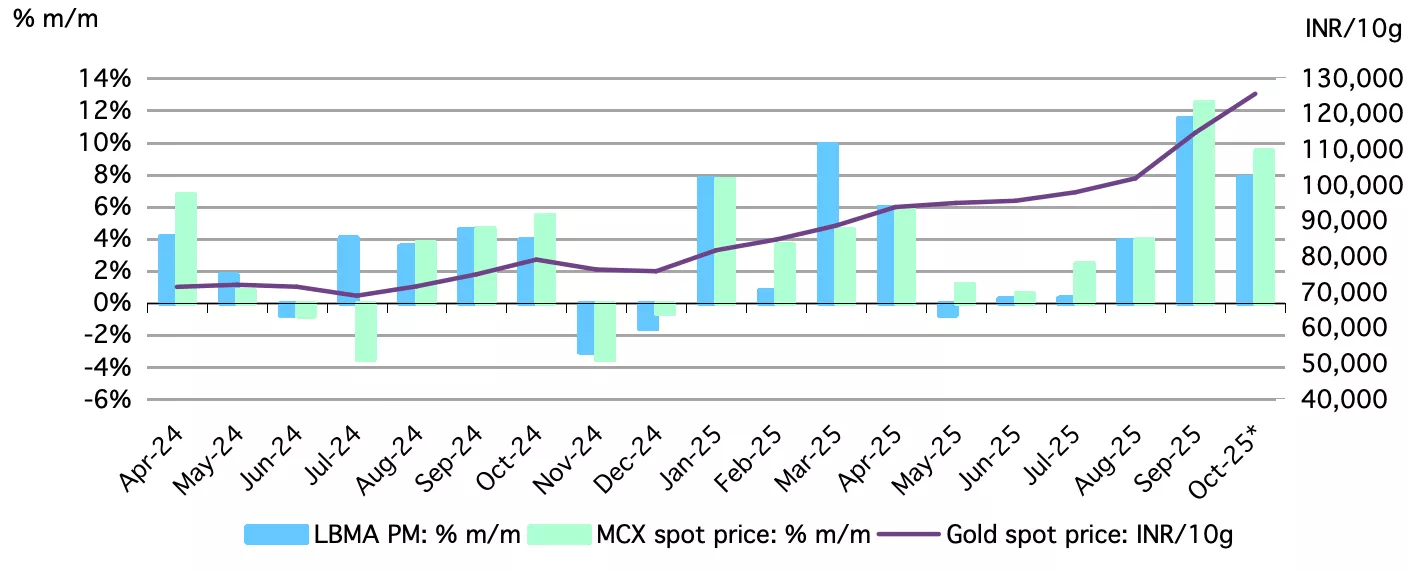

Chart 1: The gold rally continues in both international and domestic markets

End of month LBMA Price PM and MCX domestic spot price levels and m/m changes *

*Based on the LBMA Gold Price PM in USD and MCX spot gold price as of 15 October 2025.

Source: Bloomberg, World Gold Council

Since mid-September domestic gold prices have been trading at a sustained premium over international prices (Chart 2). As of mid-October the premium has risen to US$25/oz,3 marking the highest level since July 2024 when the customs duty cut boosted the spread. This move is indicative of the domestic demand conditions detailed below.

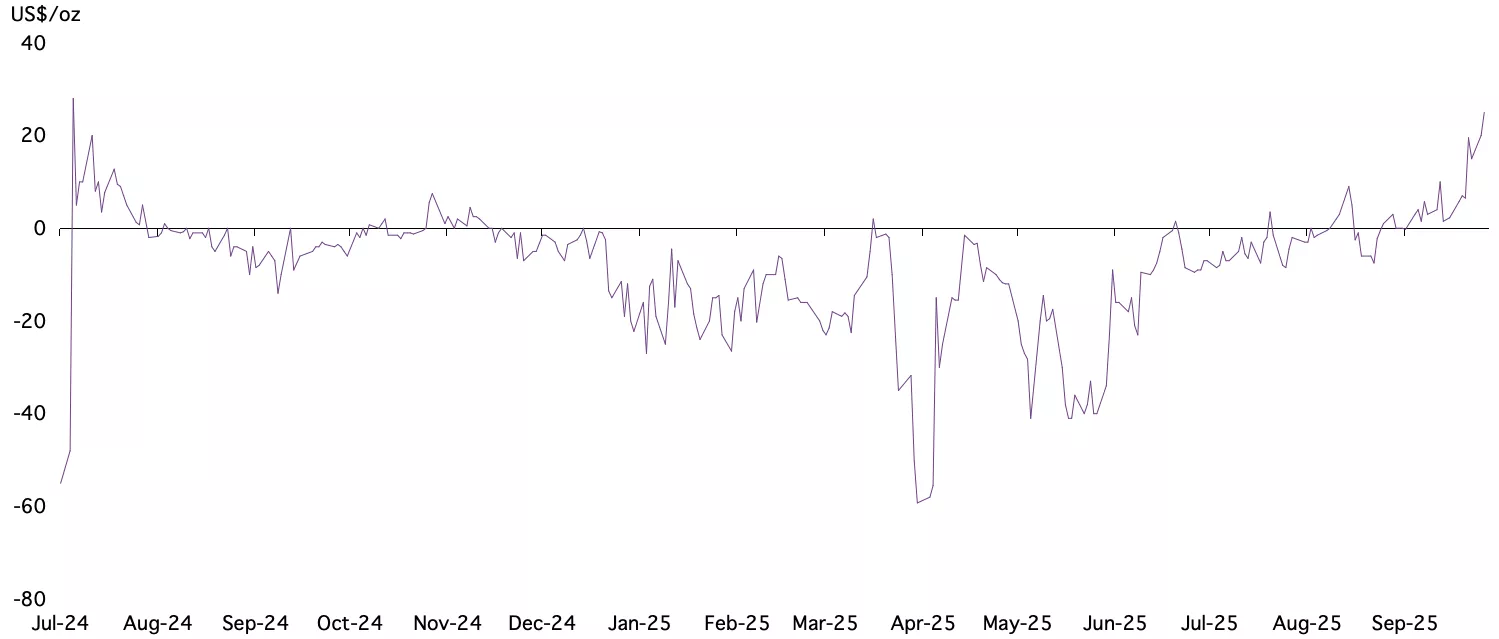

Chart 2: The domestic gold price premium has climbed as the festive season kicked off

NCDEX gold premium/discount relative to the international price*

*As of 14 October 2025.

Source: NCDEX, World Gold Council

Record prices fuel festive sales and investment interest

The festive season has begun on a positive note, with market feedback and anecdotal evidence indicating healthy demand for both physical investment products and jewellery. The record rally in the gold price has drawn investor attention and fuelled sustained interest in physical gold. As a result, the share of investment demand within overall domestic gold consumption is on the rise.4 Despite the pressure on gold jewellery consumption due to high prices and affordability, there has been a recent sales uptick, predominantly concentrated around wedding-related purchases and aligning with the wedding season. High prices are prompting consumers to opt for lighter-weight, lower-carat pieces, affecting overall retail volumes. While retailers’ revenues may benefit from a boost in jewellery sales, overall volume demand is bound to decline due to affordability constraints from high gold prices.

Retailer feedback highlights varying demand trends across store types. Large chain stores are witnessing a preference for lighter, lower-carat jewellery, while high-end independent stores catering to wedding customers are experiencing strong sales with minimal impact on volume. In contrast, smaller stores are struggling as footfall declines and sales fall.

Strong quarter for listed jewellers amid gold price surge

Despite the high base effect – caused by the July 2024 customs duty cut – and the current record-high gold prices (up ~43% y/y), listed jewellery retailers delivered a strong performance in the July-September quarter, with revenue growth ranging from 6.5% to 63%, according to their quarterly business updates.5

The early onset of the festive season (September vs. October last year) and strong wedding demand helped to partially offset the impact of last year’s high base. Targeted marketing campaigns, promotional initiatives, and customer-centric purchase schemes – such as old gold exchange offers, lightweight options and curated product launches – further supported consumer momentum. Retailers reported a notable uptick in demand for lighter, lower-carat jewellery as consumers adapted to higher prices. Meanwhile old gold exchange programs remained a significant sales driver across retailers.

Retail expansion also stayed strong, with leading players adding between five and 34 new stores during the quarter, including franchise and international formats, underscoring the sector's continued shift toward organised retail. Digital and e-commerce channels also saw significant traction, with some retailers reporting a y/y doubling of online revenue.

These large retailers remain upbeat about the current quarter, which is traditionally the strongest as it is driven by key festivals and peak wedding season demand.

ETFs: unprecedented inflows

Mirroring the global trend, Indian gold ETFs witnessed their largest-ever monthly net inflows in September, totalling INR83.6bn (US$947mn), a 282% increase m/m. Gold demand increased by 7.4t, closely aligned with our earlier estimate6 and marking the strongest month on record. The sustained and unprecedented gold price rally has captured investor interest, likely fuelling the surge in inflows; persistent safe-haven demand has also contributed. As per AMFI data,7 assets under management (AUM) in gold ETFs reached an all-time high of INR901.4bn (US$10.2bn), while cumulative holdings rose to 77.4t, a tenth of which was added in September alone.

Investor participation surged as well, with a record 629 thousand new accounts (folios) added in September. This took the total number of active folios to 8.66mn, a 33% increase since the start of the year.

Early data through October 10th indicates that this momentum is continuing, with strong net inflows of INR52.81bn(US$589mn) during this period.8

Investor profiles reveal notable differences in terms of AUM share and numbers of accounts. As per AMFI, retail investors accounted for 97% of total folios as of end-June 2025 but only 8% of AUM, reflecting their smaller average ticket size. In contrast, corporates and high-net-worth individuals (HNIs) held a much larger share – 61% and 31% of AUM, respectively – indicating significantly higher investment per account. While the corporate share of total folios remained steady at 0.2%, HNIs showed rising participation, with their share of folios increasing from 1.4% in June 2024 to 3% by June 2025. This suggests growing interest in gold ETFs from affluent investors, possibly driven by portfolio diversification strategies.

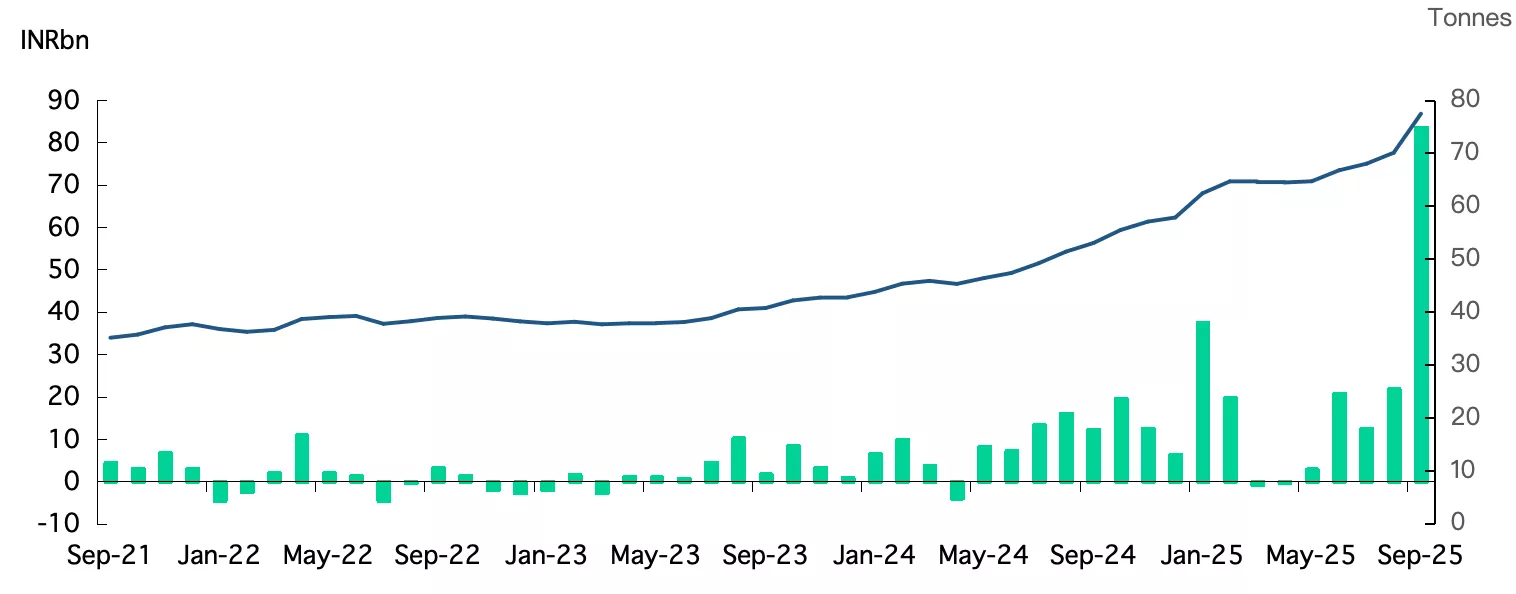

Chart 3: Indian gold ETF holdings rise on record inflows

Monthly gold ETF flows in INRbn, and total holdings in tonnes*

*As of end September 2025.

Source: AMFI, ICRA Analytics, CMIE, World Gold Council

Modest addition to RBI reserves

In September 2025, based on our estimates using the RBI’s weekly data, the central bank added 0.2t to its gold reserves, bringing its total holdings to 880.2t. While the RBI's gold purchases in 2025 have been relatively muted – just 4t were added during the first nine months compared to 50t in the same period last year – the share of gold in India's foreign exchange reserves has increased significantly, rising from 9% to 14% over this period, largely driven by valuation gains from the rising gold price.

Gold imports rise sharply on seasonal and investment demand

India's gold imports surged to a ten-month high in September. Imports totalled US$9.16bn, marking a 77% m/m increase. The surge reflects seasonal buying ahead of the festival season, supported by robust investment demand. In volume terms, we estimate imports to be in the range of 100-104t, up from 65t in August.

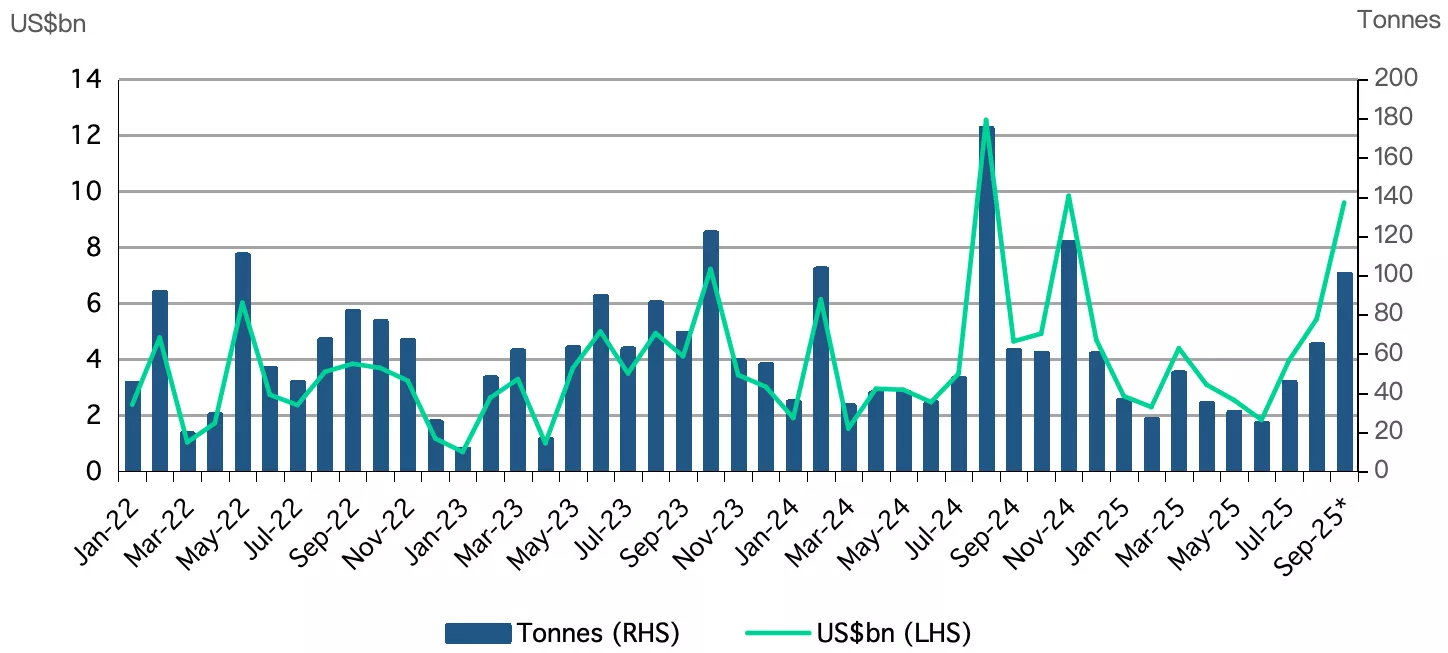

Chart 4: Gold imports have been steadily rising

Monthly gold imports in tonnes and US$bn*

*Includes World Gold Council estimates.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes:

1Retail inflation slips to over 8-year low of 1.54% in September, NDTV, 14 October 2015.

2Based on LBMA Gold Price PM as of 15 October 2025.

3As of 14 October 2025.

4The share of bar and coin demand in India’s gold consumption (including jewellery and bars & coins) has increased from 29% in Q2’24 to 34% in Q2’25, Gold Demand Trends: Q2 2025, World Gold Council.

5Quarterly update – Titan Company, Kalyan Jewellers, PNG Jewellers, PC Jewellers Limited, Senco Gold Limited.

6WGC’s preliminary estimate, based on partial data, indicated net fund inflows of US$903mn and demand of 7.3t.

7As per the Association of Mutual Funds of India (AMFI) September 2025 report.

8Based on World Gold Council’s estimates of fund-wise net inflows from 1st to 10th October.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.