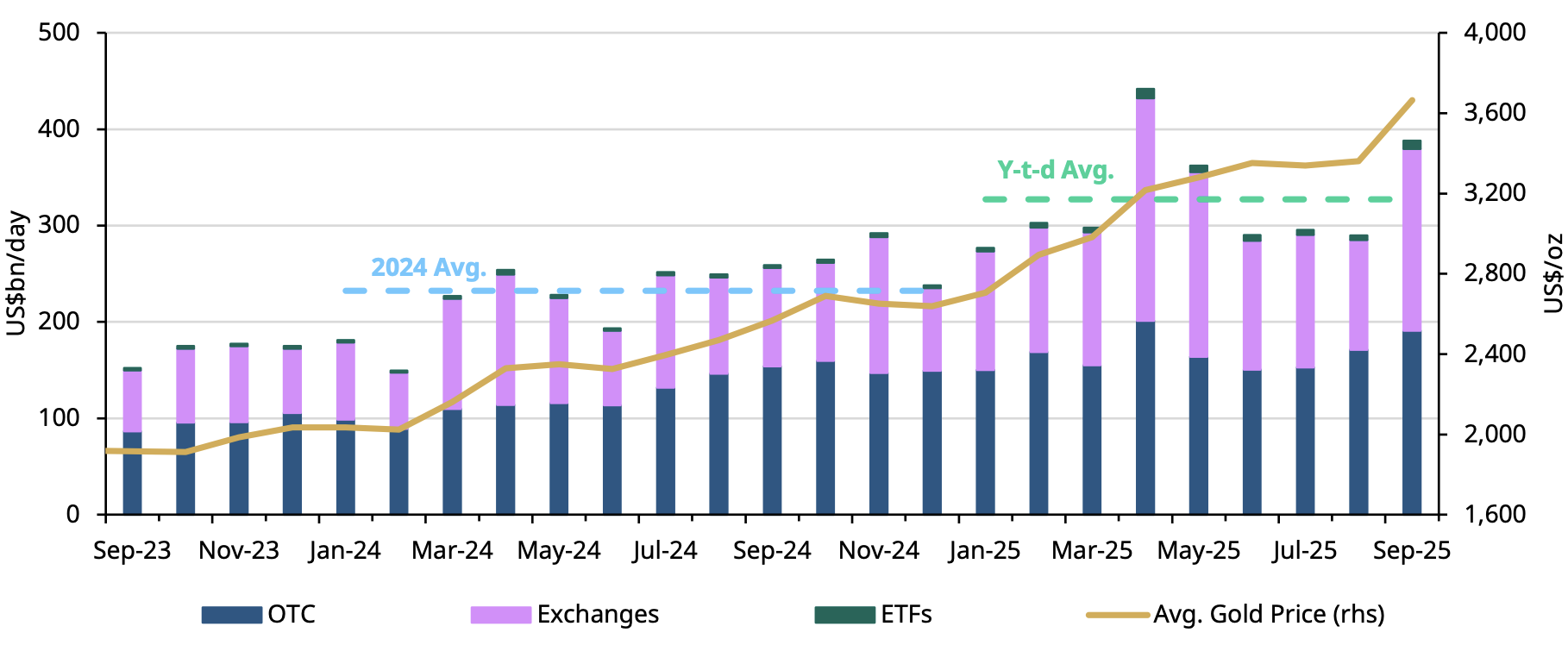

Volumes rally with gold price

Gold market trading volumes surged in September, averaging US$388bn per day – increasing 34% m/m.4 The jump in volumes occurred across all trading segments as gold prices moved higher; in fact, the gold price set 13 new ATHs during the month.5

Exchanges led the way increasing 66% m/m to an average of US$188bn/day – with trading at both COMEX (+58%) and Shanghai Futures Exchange (+84%) driving the bulk of the flows.

OTC trading activities rose to US$191bn/day, an increase of 12% m/m and 50% higher than the 2024 average of US$128bn/day. Gold ETF trading volumes exploded, reaching US$8bn/day, increasing 84% m/m. This was primarily led by North American funds, which saw average volumes of US$6.5bn/day (+78%m/m) and accounted for 78% of physically gold-backed ETF trading volumes.

Total net longs in COMEX gold rose 23% during the month, concluding at 806t.6 Money manager net longs rose 7% to 493t. Other net longs drove a notable share of demand, increasing 33% to 313t and reaching their highest level since 13 September 2022.

This increase in demand was largely driven by factors similar to those we flagged earlier, such as dollar hedging, inflation concerns, geopolitical tensions, and ongoing US government risks, including the shutdown in early October.7

Against this backdrop, investors piled into the gold trade, and consecutive price increases ensued throughout the month.

Chart 3: Gold volumes surged recording their second strongest month in 2025

Average daily trading volumes by segment*

*Data as of 30 September 2025. Gold price based on the monthly average LBMA gold price PM USD.

For more information on trading volumes please visit our Trading Volumes page on Goldhub: Gold Trading Volume | Gold Daily Volume | World Gold Council.

Source: Bloomberg, Nasdaq, COMEX, ICE Benchmark Administration, Shanghai Gold Exchange, Shanghai Futures Exchange, ETF providers, Multi Commodity Exchange of India, Dubai Gold & Commodities Exchange, Japan Exchange Group, Thailand Futures Exchange, Borsa Istanbul, Bursa Malaysia, Korea Exchange, World Gold Council