China gold market update: Physical demand cools in May

16 June, 2025

Highlights

- The LBMA Gold Price PM in USD declined 0.7% and the Shanghai Benchmark Gold Price PM (SHAUPM) in RMB fell 1.4% last month, mainly due to a stronger local currency

- Gold withdrawals from the Shanghai Gold Exchange (SGE) saw a seasonal m/m dip of 35% to 99t in May

- Chinese gold ETFs lost RMB3.3bn (US$461mn) in May, the first monthly outflow since January. Their total assets under management (AUM) fell to RMB153bn (US$21bn) and holdings reduced 4.6t to 198t

- The People’s Bank of China (PBoC) announced another gold purchase in May – the seventh consecutive month of buying – adding 1.9t to its gold reserves, which now stand at 2,296t or 6.7% of total foreign exchange assets

- The latest data shows a notable m/m rebound in gold imports during April, driven primarily by strong investment demand and surging local gold price premium in the month.

Looking ahead

- Facing tepid consumer sentiment and the off season, gold jewellery consumption may remain weak

- Investment momentum may cool further amid easing US-China trade tensions in the near term. But with government bond yields lowering and global geopolitical risks remaining elevated, we believe investor interest in gold should remain intact.

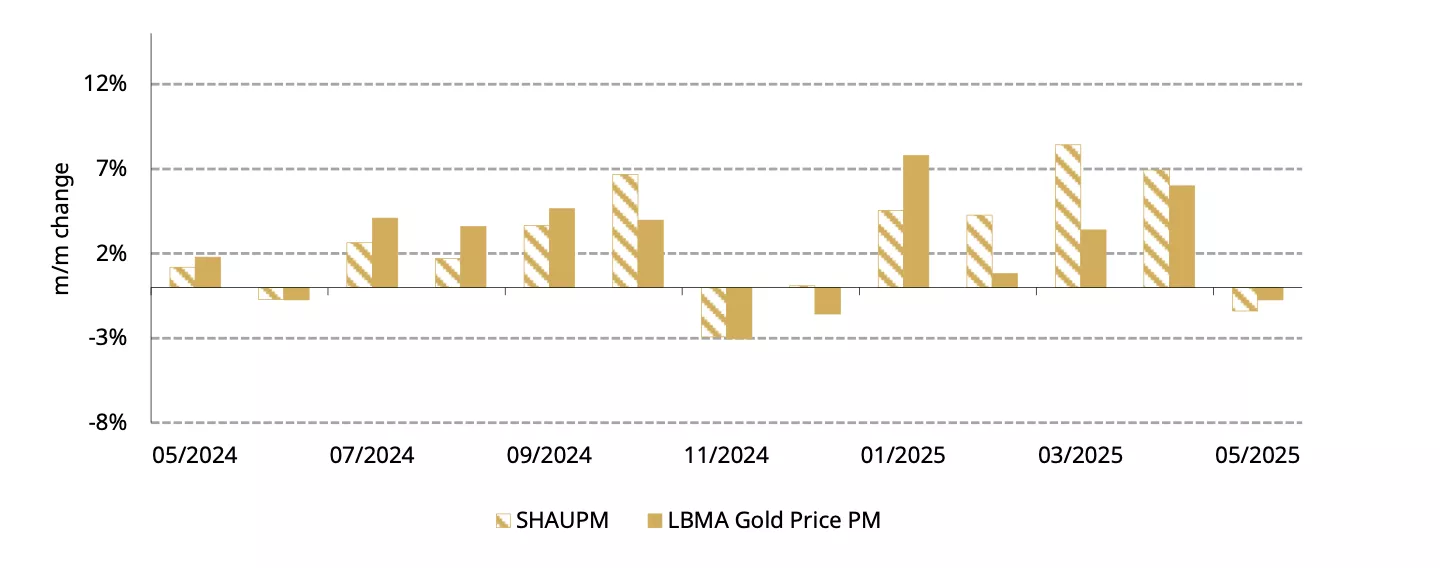

Chart 1: Gold took a breather in May

Monthly returns of the SHAUPM in RMB and the LBMA Gold Price PM in USD*

*Data as of 31 May 2025.

Source: Bloomberg, World Gold Council

Gold takes a breather

Gold prices fell mildly in May (Chart 1). Cooling gold investment momentum – as investors sold gold ETFs and gold’s implied volatility fell – overshadowed the lagging impact of a weaker dollar, leading to the gold price weakness in May.

A weak May ended the SHAUPM’s five-month rising streak, and the four consecutive monthly rises we have seen in the LBMA Gold Price PM also came to a halt. The gold price in RMB was weaker than that in USD amid a notable appreciation in the local currency against the dollar. Nonetheless, during the first five months of 2025, returns of the SHAUPM in RMB and the LBMA Gold Price PM in USD have stayed strong at 23% and 17%, respectively.

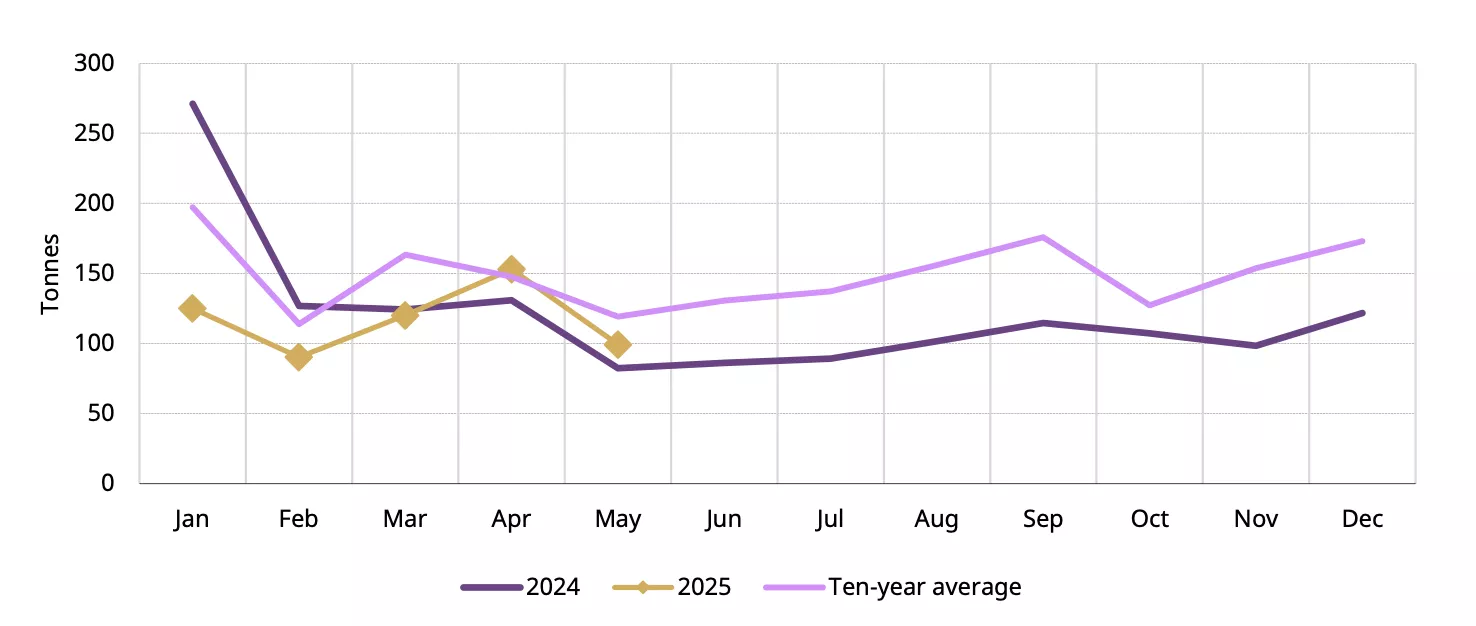

Wholesale demand saw a seasonal dip

The amount of gold leaving the SGE in May totalled 99t, a 35% fall m/m (Chart 2). This decline was seasonal: the off season for gold consumption in Q2 and early Q3 usually supresses manufacturers’ re-stocking activities. In addition, cooling bullion investment momentum – as safe-haven demand reduced amid easing US-China trade tensions and the gold price performance weakened – also contributed to the m/m fall.

Despite a 21% y/y increase compared to the very weak May of 2024, last month’s withdrawals were below the 10-year average. As noted previously, the near-record gold price, while lifting bullion investment, has substantially weakened gold jewellery sales – a major component of SGE gold withdrawals – and led to weaker wholesale gold demand.

Chart 2: Wholesale gold demand saw a seasonal m/m dip*

*The ten-year average is based on data between 2015 and 2024.

Source: Shanghai Gold Exchange, World Gold Council

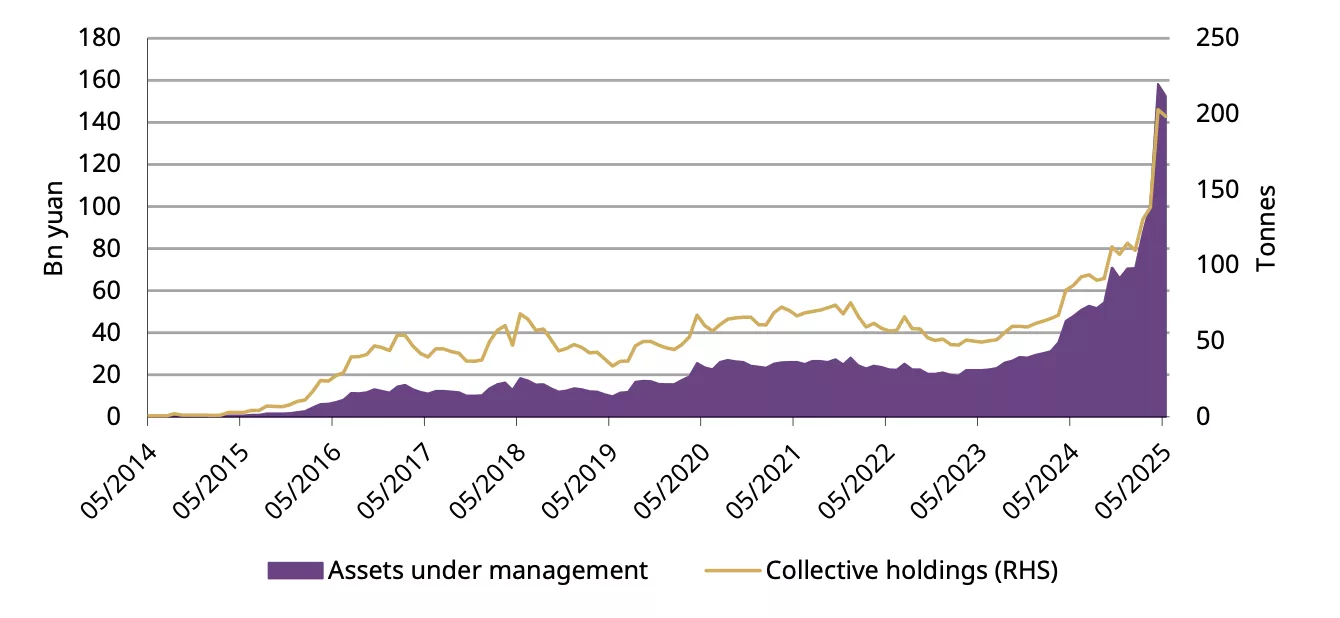

Gold ETF demand flips negative

Chinese gold ETFs saw outflows in May, losing RMB3.3bn (US$461mn) and ending their three-month inflow streak (Chart 3). Following these outflows and the gold price decline, total Chinese gold ETF AUM fell by 4% m/m to RMB153bn (US$21bn). Meanwhile, holdings dropped 4.6t to 198t.

Improved investor risk appetite was a major driver of gold ETF outflows last month. The temporary tariff truce between China and the US improved investor sentiment, evidenced by stronger equities, and the appreciating RMB reduced the safe-haven demand for gold. The weakening gold price momentum may have also discouraged investors.

Despite the May outflow, gold ETF demand so far in 2025 has remained strong: holdings have surged 84t and inflows have amounted to RMB63bn (US$8.6bn) – both unseen levels compared to the same periods throughout history.

Chart 3: Gold ETF flows turned negative

Collective holdings and monthly demand of Chinese gold ETFs*

*As of 31 May 2025.

Source: Company filings, World Gold Council

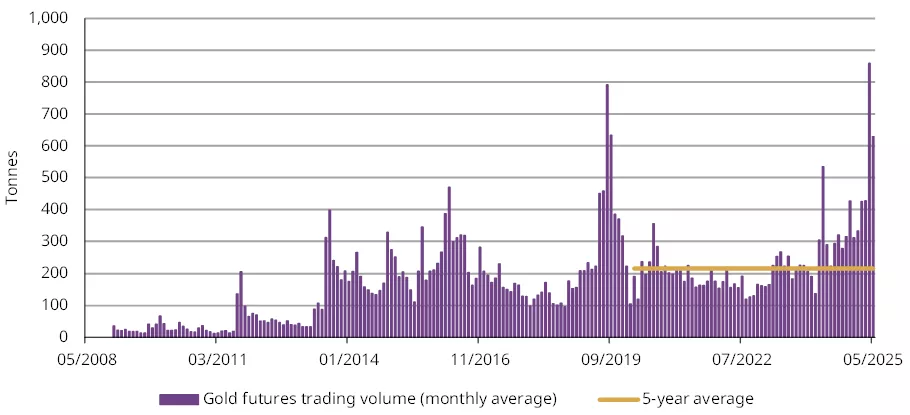

Trading momentum in gold futures also cooled, dropping 27% m/m to 628t per day on average in May (Chart 4). However, traders’ enthusiasm for gold futures stayed elevated: the May volume remained well above its five-year average of 216t/day.

Chart 4: Gold futures trading remained active in May

Average daily trading volume of SHFE gold futures*

*As of 31 May 2025.

Source: Shanghai Futures Exchange, World Gold Council

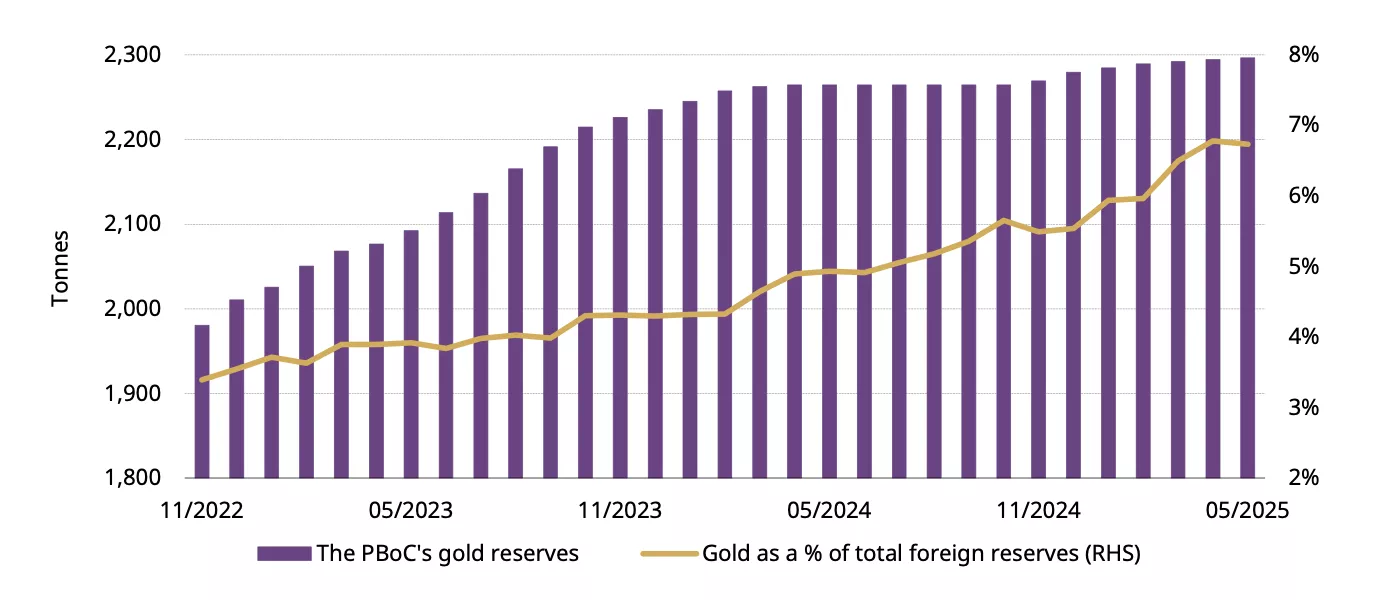

The PBoC gold purchasing spree continues

The PBoC has now reported gold purchases for seven months in a row, adding 1.9t to its reserves in May (Chart 5). Currently, China’s official gold holdings have risen to 2,296t, 6.7% of its total foreign exchange reserves. And in value terms, China’s gold reserves amount to US$242bn, a minor 1% fall m/m due mainly to a weaker gold price in the month. So far in 2025, the PBoC has reported gold purchases of 16.8t.

Chart 5: China’s official gold holdings rose further

Reported official gold holdings and gold as a percentage of total foreign exchange reserves*

* As of 31 May 2025.

Source: Administration of Foreign Exchange, World Gold Council

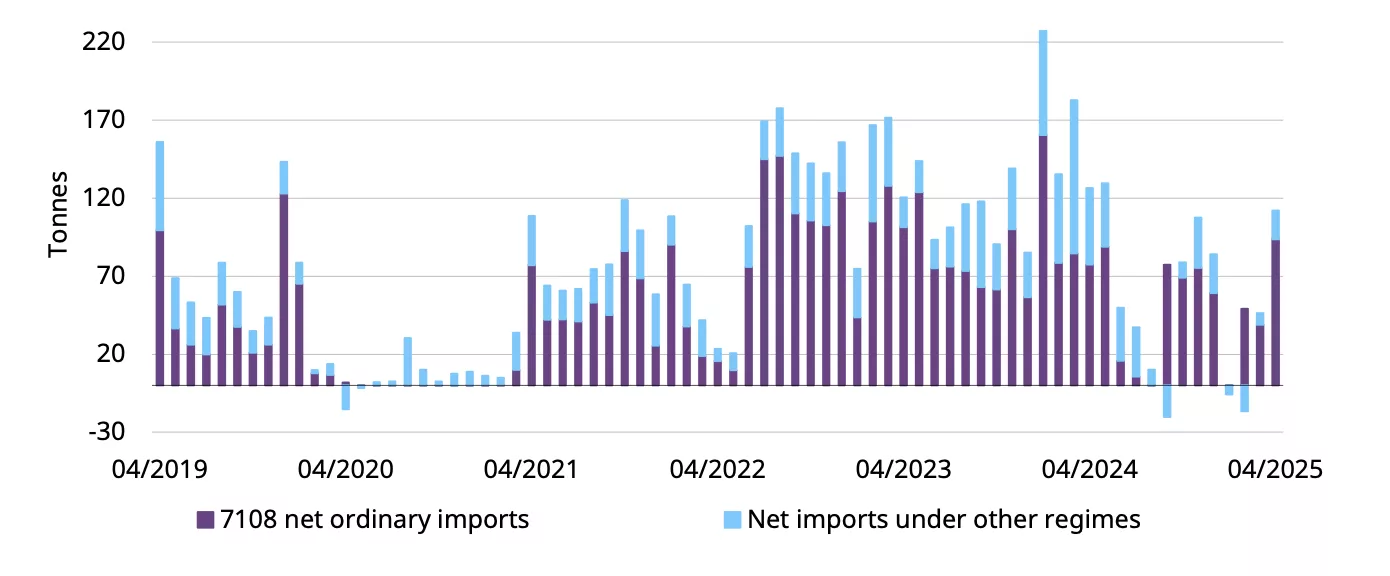

Imports rebounded in April

Net gold imports into China totalled 112t in April, based on the latest data available from China Customs, a notable m/m rebound of 66t and a mild 14t y/y decline (Chart 6). The escalating US-China trade tension during the month raised investor safe-haven demand for gold in China significantly – both bullion sales and gold ETF demand surged – leading to an increased need for imports. The rocketing local gold price premium in the month – amid strong investment demand – also encouraged importers.

Chart 6: Imports rebounded in April

7108 gold imports under various regimes*

*Based on the latest data available. Data to April 2025.

Source: China Customs, World Gold Council

Looking ahead

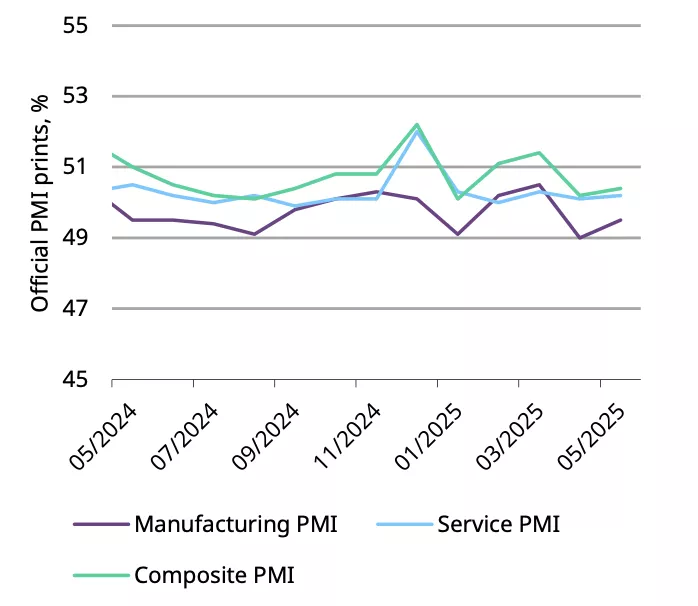

China’s economy showed mixed signs in May. Official PMIs – focusing on larger enterprises – in manufacturing and service sectors both showed rebounds (Chart 7), thanks to the PBoC’s rate cuts1, spending during the five-day Labour Day holiday2 and a reduction of US tariffs.3

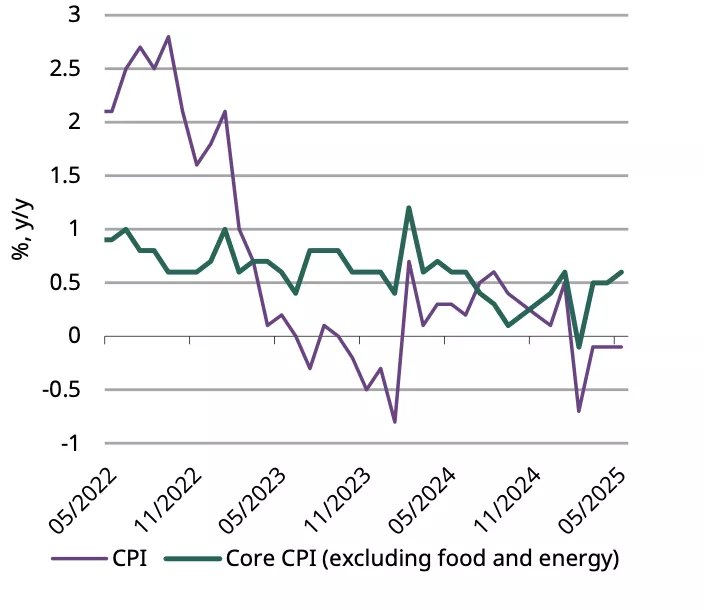

But export growth decelerated sharply in the month, dragged mainly by the US: the temporary US-China trade truce occurred in mid-May and it takes time for orders to turn into actual shipments. Meanwhile, the global economy slowdown also impacted exports. Domestic demand remained somewhat sluggish as May’s headline CPI was unchanged at -0.1% y/y, highlighting ongoing deflationary pressure in China (Chart 8).

Chart 7: Official PMI readings suggest a recovery in economic activity during May

Source: National Bureau of Statistics, World Gold Council

Chart 8: Tepid CPI prints reflect sluggish domestic consumption

Source: National Bureau of Statistics, World Gold Council

This divergence underscores the fact that while China’s economy, at a macro level, might have received some support from monetary and fiscal policies, sentiment at the consumer level is yet to recover. This can also be observed in recent credit data trends: y/y increases in total social financing were mainly driven by strong government debt issuance amid various fiscal support while households remained reluctant to borrow.

Facing such challenges, combined with seasonality, gold jewellery consumption could remain tepid in tonnage terms in coming months. But the stabilising gold price and the above-mentioned rate cuts may provide some support.

In the near term, easing trade tensions and gold price consolidation – should it continue – may further weigh on safe-haven investment demand for gold. But we believe that declining government bond yields, together with elevated global geopolitical risks, may provide support for gold investment in the mid-to-longer term.

Footnotes

1See: China's first RRR cut for financial institutions in 2025 takes effect, 15 May 2025; China cuts LPR to spur bank lending and boost borrowing - Global Times, 20 May 2025.

2See: China’s Labor Day Holiday Tourism Spending Rises 8% on Road Trip and Cultural Demand, 6 May 2025.

3See: Modifying Reciprocal Tariff Rates to Reflect Discussions with the People's Republic of China – The White House, 12 May 2025.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.