Summary

- On 1 July, India’s gold import duty increased by 4.25%, with consumers now paying 18.45% tax for refined gold compared to 14.07% previously1

- We believe the higher import duty may have a slightly greater impact on short-term gold demand

- But we also believe that the gold duty increase may be a temporary measure. Should the trade balance improve and the Indian rupee (INR) stabilise, some of these tax increases may be rolled back.

What happened?

On 30 June, India’s Ministry of Finance notified the industry that basic custom duty (BCD) on gold would increase from 1 July. The following changes were announced:

- BCD on refined gold bars and gold doré will increase to 12.5% and 11.85%, from previous levels of 7.5% and 6.9% respectively

- Agriculture and Infrastructure Cess (AIDC) on gold was kept the same at 2.5%2

- Social Welfare Surcharge (SWS) imposed at 10% on BCD previously was exempted.

The total custom duties on gold bar and gold doré now stand at 15% and 14.35% respectively. With an additional 3% Goods and Services Tax (GST), consumers will now pay 18.45% in tax for refined gold (Table 1). Similarly, the gold refinery will now be paying 17.78% tax for gold doré compared to 13.39% tax previously.

The hike in gold duties came as quite a surprise to the industry. In the past year, government officials have taken steps towards formalising the gold industry through lowering the duty on gold, introducing mandatory hallmarking, and a free trade agreement with UAE to import bullion at 1% concessional duty to encourage jewellery exports from India.

Table 1: Tax calculation on refined gold for consumers from 1 July 2022 and prior to 1 July 2022

Source: Ministry of Finance, World Gold Council

The duty on gold was raised to mitigate the impacts of rupee weakness

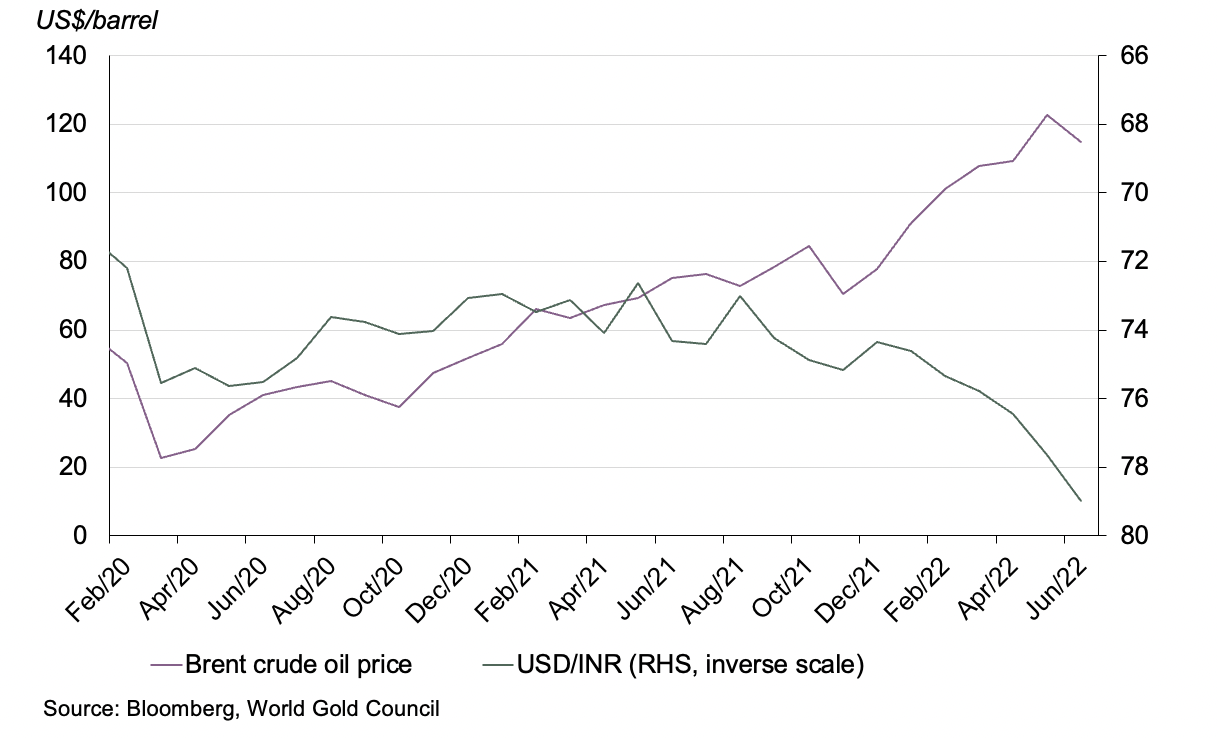

The context behind the hike in gold duty is the extreme depreciation of the INR. With rising crude oil prices after Russia’s invasion of Ukraine, the INR has faced severe pressure (Chart 1).3 Alongside this, given policy rate hikes by the US and other advanced economies, foreign portfolio investors (FPIs) have continuously pulled out money from Indian equity markets, with a net outflow of US$28.4bn during H1 2022 compared with a net inflow of US$3.8bn during 2021.4 The exodus of FPIs has put further pressure on the INR, which has depreciated by 6% against the US dollar during H1 2022. This current weakness has also impacted the trade balance, with India recording a current account deficit of 1.2% of GDP for fiscal year 2021–22 compared to a surplus of 0.9% of GDP for fiscal year 2020–21.

Chart 1: Higher crude oil price has kept Indian rupee under pressure

Further, India’s retail inflation has been on an upward trajectory since October 2021. With rising commodity prices and supply chain disruptions due to the ongoing Ukraine war, retail inflation has followed suit, remaining elevated at 7.04% in May 2022, while wholesale price inflation hit a 10-year high of 15.88% in the same month.5 The increase in international commodity prices has led to a rise in the contribution of imported components to retail inflation. With an increase in duty on gold, government officials intend to target the imported inflation via gold imports and arrest the depreciation in the INR.

What does this mean for the gold market?

- Consumer demand: Conventional wisdom would suggest a higher tax rate might be a headwind for gold demand. And to some extent that is true. Using an econometric analysis indicates that – holding everything else constant – a 1% increase in gold’s import duty imparts a 6t shock to the level of consumer demand in the long-term.6 Our analysis also suggests there may be an additional short-term effect. The model suggests that a 1% increase in gold’s import duty may decrease this year’s consumer demand by 0.8% or 6.4t of consumer demand.

Our econometric model suggests a longer-term impact stemming from the increase in duty that largely dissipates by 2026, decreasing demand by an estimated 22t during the first year, subsequently reducing in magnitude each consecutive year. Our analysis also indicates an additional potential short-term decrease in demand of approximately 28t in 2022. This latter decrease is, however, small – just 3% of the average Indian annual demand of 770t for the last 10 years.7 The short-term impact on retail demand due to the 4.38% duty hike on the end consumer is still lower than an increase of 5.8% in the domestic gold price during H1 2022.8 Moreover, the hike has come into effect during the monsoon season, a traditionally quiet period for gold. This gives the industry and consumers time to adjust their expectations ahead of the all-important gold-buying period during Diwali in October.

- Trade flows: Import costs will go up and this may impact official inflows in Q3 2022. We expect official imports to slow from May’s healthy level. And the relatively weak retail demand has led to a build-up of inventories across the supply chain.

A higher custom duty, however, provides further incentives for gold smuggling which would normally encourage an increase in grey market activity. This would hinder the government’s efforts to promote cashless transactions and to drive greater transparency in the gold market. But the Indian government has made great strides in clamping down on black money and illicit activities through the introduction of GST, income tax reforms, tighter border controls, and mandatory hallmarking, so it is no longer axiomatic that smuggling will rise. This is an area we will be watching closely.

Conclusion

While the increase in duty on gold was surprising, it should not be seen in isolation. The action by the government to hike gold duties is aligned with its current goal to fight higher inflation and arrest the slump in the INR. Although higher input costs and supply chain disruptions are expected to persist, a normal monsoon is anticipated, which may soften the retail inflation in months ahead. We believe that the recent increase in duty on gold may be a temporary measure and once the government’s trade balance becomes more favourable and the INR stabilises, some of these tax increases may be rolled back. Additionally, we believe that the government will remain committed to its focus on reforming the gold market through current measures such as the launch of the international and domestic gold spot exchange, the introduction of mandatory hallmarking across all the districts of India, and measures to boost jewellery exports.

Footnotes

The end consumer pays 3% Goods and Services Tax (GST) above the import duty.

AIDC is a form of tax levied over and above BCD.

Petroleum and crude oil is the largest commodity of Indian imports. Petroleum and crude oil accounted for 27% of Indian imports as compared to 8% for gold imports for the last 10 years from fiscal year 2010–11 to 2020–21.

National Securities Depository Limited (NSDL).

Press Information Bureau of India

We used a common approach to modelling called the Error Correction Model (ECM) to model long-term and short-term demand. It allowed us to overcome the informational limitations of short-run models and statistical limitations of long-run models to capture the dynamics of demand. Short-term fluctuations deal with the annual deviations from the long-term equilibrium. We used data from 1990 to 2021.

Indian average annual demand for the last 10 years from 2012 to 2021.

Based on Multi Commodity Exchange of India (MCX) Gold Spot price on 30 June 2022 and 31 December 2021.