Summary

- On 2nd February, India’s gold import duty decreased with consumers now paying 14.07% tax for refined gold compared to 16.26% previously

- We believe lower import duty may have slightly greater impact on short-term gold demand. Several rural welfare schemes may also boost rural demand for gold

- Lower import duty may hinder gold smuggling in India and encourage official imports

- Securities and Exchange Board of India (SEBI) has been notified as a regulator for gold spot exchanges. The move may spur infrastructure development, good delivery standards, and may enable India to emerge as a major bullion trading hub.

Announcements in the budget

On 1st February, during the annual budget, India’s Finance Minister Ms. Nirmala Sitharaman, made various announcements relevant for the Indian gold market:1

- In the budget of 2018-19, Government had announced its intent to establish a system of regulated exchanges. This year budget notified SEBI as regulator of the exchanges. Also, Warehousing Development and Regulatory Authority will be strengthened to set up a commodity market eco-system including vaulting, assaying, logistics in addition to warehousing.

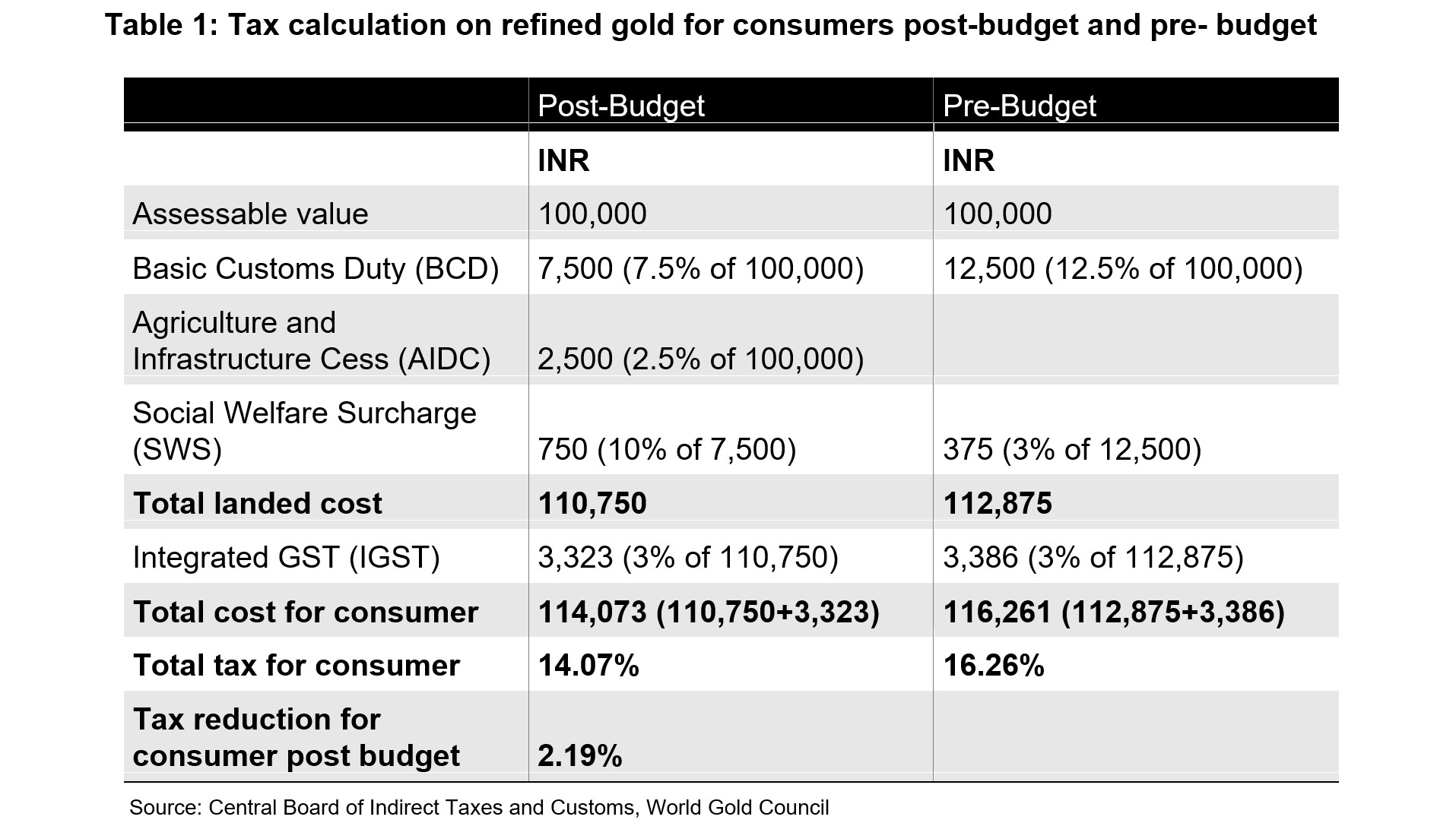

- The custom duty on gold bars and gold doré’ was rationalised keeping in view of rise in gold price since the increase in custom duty on gold bar to 12.5% from 10%.2 The various components in custom duty and rates are as follows:

a) The basic customs duty (BCD) on gold bar and gold dore’ was reduced to 7.5% and 6.9% from previous level of 12.5% and 11.85% respectively.

b) To improve agriculture infrastructure, an additional Agriculture and Infrastructure Cess (AIDC) is imposed on few items including gold at rate of 2.5%.3

c) Also, the Social Welfare Surcharge (SWS) is imposed on BCD at 10% but exempted on AIDC.

With an additional 3% IGST, consumers will now be paying 14.07% tax for refined gold compared to 16.26% previously- a reduction of 2.19% in tax post budget (Table 1).

- Revision in the pre-trial of disposal of seized gold for expediting such disposals

- Various rural welfare schemes were announced in the budget such as:

- Increase in agricultural credit to Rs1.65 trn (US$22.6bn) from Rs1.5trn (US$21bn)

- Increase in Rural Infrastructure Development Fund to Rs400bn (US$548 million) from Rs300bn (US$420 million)

- Connecting 1000 more mandis to e-Nam.4

What does this mean for the gold market?

- Consumer demand: Conventional wisdom would likely suggest a lower tax rate might be a tailwind for gold demand. And to some extent that is true. Econometric analysis we published in our report India’s gold market: Innovation and evolution, indicated that – holding everything else constant – a 1% decrease in gold’s import duty may increase consumer demand by 3t per year in the long-term.5 Our analysis also suggests there may be an additional short-term effect this year. The model suggests that, a 1% decrease in gold’s import duty may increase that year’s consumer demand by 1.9%. This could likely equate to a potential 6t increase this year for every 1% decrease in import duty.

The long-term impact of this lower import duty is just an increase in demand of 7t, while the short-term impact is an increase in demand of 13t in 2021.The important message to takeaway is that the short-term impact on gold demand may be higher than long- term as the effect of lower custom duty level (and lower gold price) fades over time. Also, the gold price has increased by 42% since the custom duty was increased to 12.5% in July 2019- further mitigating the impact of lower custom duty in the short term.

Moreover, the various rural welfare schemes announced in the budget may boost rural income and rural demand for gold.

- Trade flows: A lower custom duty may be headwind for gold smuggling in India. Import costs may come down and this may spur official inflows in 2021. With gradual recovery in gold demand, official imports began to recovery in H2 2020- with official imports 6% higher y-o-y in Q4 2020 as compared to 96% decrease y-o-y in Q2 2020. With a lower custom duty and recovering demand, we expect official imports may further gain strength in 2021 at the cost of unofficial imports.

The revision in the pre-trial disposal of seized gold by expediting such disposals may curb unofficial imports. A lower custom duty could expedite the government’s efforts to encourage cashless transactions and to drive greater transparency in the gold market. The Modi government has made great strides in clamping down on black money and illicit activities through the introduction of GST, income tax reforms, and tighter border control. A lower custom duty may further the government’s push towards transparency.

- Liquidity: The notification of SEBI as regulator of gold spot exchanges as well as setting up of commodity market ecosystem may spur infrastructure development, good delivery standards and may enable India to emerge as a major bullion trading hub.

We believe policy announcements made in the Union Budget should be positive for India’s gold industry. Lower import duty and rural welfare schemes may boost demand and hinder unofficial imports. The notification of SEBI as regulator of spot gold exchanges may infuse transparency and boost bullion trading in the country.

Footnotes

1 Budget Speech 2021-22

2 Custom duty on gold bar was increased to 12.5% from 10% in the Union Budget 2019 and was effective from 6 July 2019. Domestic gold spot price has increased by 42% during the period of 5 July 2019 to 31 January 2021.

3 AIDC is a form of tax levied over and above the Basic Custom Duty

4 Mandis are market-places where food and agri-commodities are sold. E-Nam is a pan India electronic trading platform for agri-commodities connecting mandis across India

5 We used a common approach to modelling called Error Correction Model (ECM) to model long-term and short-term demand. It allowed us to overcome the informational limitations of short-run models and statistical limitations of long-run models to capture the dynamics of demand. Short-term fluctuations deal with the annual deviations from the long-term equilibrium. We used data from 1990 to 2015