Summary

- The domestic gold price ended 1.7% higher in March at Rs51,317/10g1

- Retail demand remained sluggish as buyers postponed purchases in anticipation of a correction in the gold price

- This widened the local market discount to US$60/oz during the month, compared to a discount of US$14-15/oz at the end of February

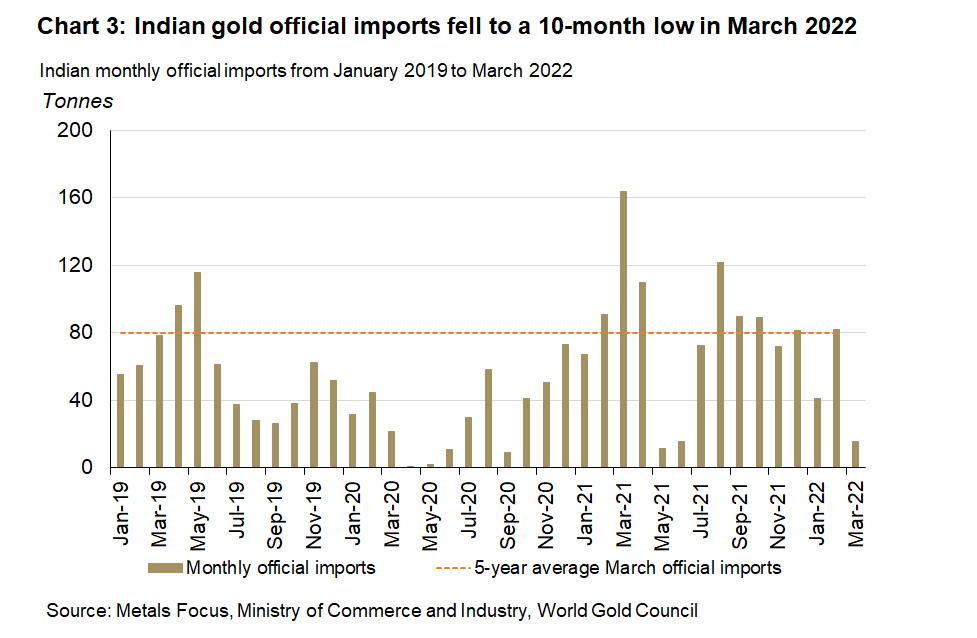

- Sluggish retail demand and higher gold recycling also depressed official imports to 15.8t in March, 90% lower y-o-y and 80% lower m-o-m

- India signed a Comprehensive Economic Partnership Agreement (CEPA) in February, which extends a 1% custom duty concession for up to 200t of bullion imported from the UAE; this will come into effect on 1 May 2022

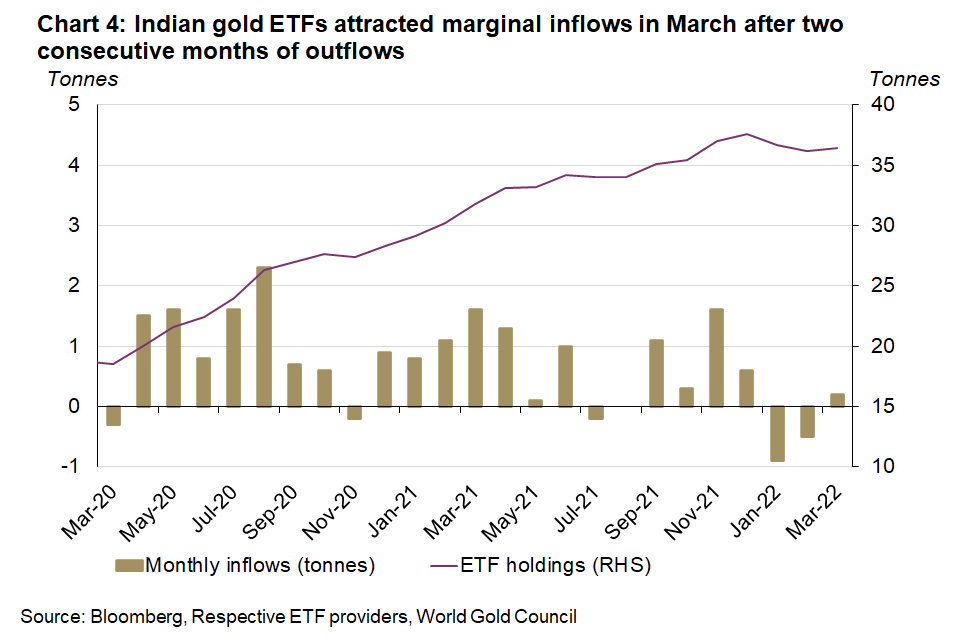

- Indian gold ETFs witnessed marginal net inflows of 0.2t in March, primarily driven by a correction in the gold price, which might have spurred investor interest; total holdings of gold ETFs were 36.4t2

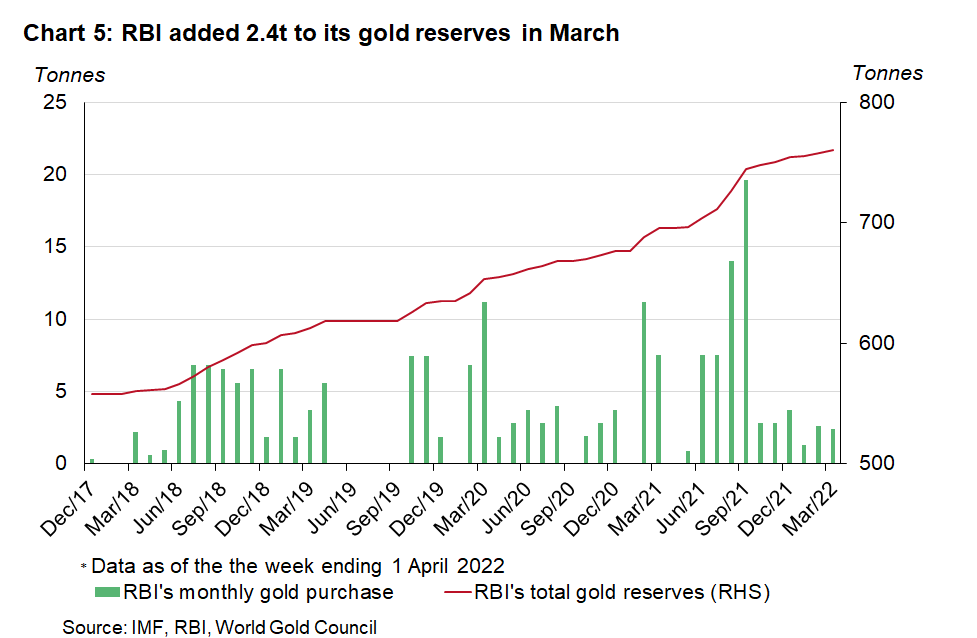

- The Reserve Bank of India (RBI) added 2.4t of gold in March, increasing its total gold reserves to 760.4t.

Looking ahead

- Retail demand could improve in April as consumers accept higher gold price levels. Demand will also receive support from festival- and wedding-related purchases during the month3

- Official imports could pick up due to restocking by the trade ahead of the Akshaya Tritiya festival in May.4

Discount in the local market rose to an 18-month high in March

Gold prices extended their gain in March, led by higher inflationary pressures and rising geo-political risks. The LBMA Gold Price AM in USD and the MCX Gold Spot in rupees (INR) rose by 1.1% and 1.7% respectively over the month.5

The higher – and more volatile – gold price resulted in sluggish retail demand and an increase in gold recycling. As a result, the discount in the local market widened to an 18-month high of US$60/oz in March, compared to a discount of US $14-15/oz at end of February (Chart 1).6

But market sentiment improved at the beginning of April, driven by festival- and wedding-related purchases and consumer acceptance of a higher gold price. Consequently, the domestic price discount had narrowed to US$12/oz by the second week of April.

Retail inflation (CPI) jumped to a 17-month high and the Indian 10-year bond yield rose to a 33-month high in March

Indian CPI jumped to a 17-month high in March (up 6.95% y-o-y) due to rising food and commodity prices. The government’s borrowing plans exceeded traders’ expectations and the Indian 10-year government bond yield rose to a 33-month high in the month (Chart 2).7

With expectations of volatile and elevated crude oil prices, global supply chain disruptions and higher input cost push pressures, the RBI raised its inflation forecast for FY 2022-23 to 5.7% from its April forecast of 4.5%. The monetary policy meeting committee decided to remain accommodative but suggested future rate hikes would be possible in response to the trajectory of inflation.

Retail demand remained sluggish and imports tumbled

Retail demand remained sluggish during March as buyers postponed purchases in anticipation of a correction in the gold price. An absence of weddings in the month further dented demand. Wholesale purchases by retailers and manufacturers remained muted in March as they opted to close their books ahead of the financial year end. As a result, Indian official gold imports totalled 15.8t during the month, 90% lower y-o-y and 80% lower m-o-m (Chart 3). Official imports were driven by:

- Weaker retail and wholesale demand

- Higher recycling volumes in response to higher gold prices.

Looking ahead, retail demand could improve in April compared to the weak demand in March as consumers begin to accept higher gold prices. Retail demand will also receive support from festival- and wedding-related purchases. Official imports could also pick up due to trade restocking ahead of Akshaya Tritiya.

The 1% duty concession on bullion imports from the UAE under a Comprehensive Economic Partnership Agreement (CEPA) will be effective from 1 May 2022

As highlighted in the previous monthly blog, India and UAE have entered into a free trade agreement under a Comprehensive Economic Partnership Agreement (CEPA). The Ministry of Commerce has now released the text of this agreement into the public domain and more clarity has emerged concerning the pro-rata of 200t of imports from UAE at a concession custom duty of 1%, and the pro-rata and concession of duty on jewellery imports from UAE. The agreement states that the 200t of bullion imports will be phased over five years with initial imports of 120t in 2022, increasing in steps of 20t to reach 200t by 2026. Similarly, for jewellery, the import duty will be reduced from 20% in 2022 to 15% in 2026 with a quota of 2.1t in 2022, increasing in steps of 0.1t to 2.5t by the end of 2026.8 The trade agreement will come into effect on 1 May 2022.

Mandatory hallmarking will be expanded to 287 districts from 1 June 2022

As per a notification from Ministry of Consumer Affairs, mandatory hallmarking for gold jewellery will be expanded to 287 districts of India from the previous 256 districts. The notification will come into effect on 1 June 2022. This will provide consumers with wider access to retailers from whom they can buy gold jewellery with exact purity.

Gold ETF holdings saw 0.2t of net inflows during the month

Indian gold ETFs witnessed marginal net inflows of 0.2t in March, primarily driven by a correction in the gold price, which might have spurred investor interest. The inflows in March followed two consecutive outflows in January and February with a total outflow of 1.4t during these two months. Net March inflows of 0.2t (Rs2.1bn, US$27mn) took total gold holdings to 36.4t by the end of the month (Chart 4).

The RBI added 2.4t to its gold reserves

The RBI’s gold purchases increased in March by a marginal 2.4t, slightly below the 2.6t bought in February. This took total gold reserves to 760.4t by the end of March (Chart 5).9 India’s foreign exchange (fx) reserves slumped by US$11.17bn in the week ending 1 April to US$606.48bn – the steepest weekly fall – due to higher crude oil import prices as a consequence of the war in Ukraine. This steep fall in fx reserves meant that gold’s share of total reserves rose to 7.8% in March from 7.3% in February.

Footnotes

Based on the MCX Gold Spot price in INR as of 31 March 2021.

The Indian 10-year government bond yield rose to 6.68% on 31 January 2022 from 6.45% on 31 December 2021.

Gudi Padwa is a spring festival celebrated in the state of Maharashtra. It is considered auspicious to purchase gold before Gudi Padwa or on the day of the festival. Gudi Padwa was celebrated on 2 April 2022.

Akshaya Tritiya is a major gold buying festival in India. Akshaya Tritiya falls on 3 May 2022.

We compare the LBMA Gold Price AM with the MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

The premium/discount data is based on the gold premium polled spot price from National Commodity & Derivatives Exchange Ltd.

The government plans to borrow Rs8.45 trillion in H1 FY 2022-23 amounting to 59% of the target for the entire fiscal year of 2022-23.

Annex 2A - Schedule of Specific Tariff Commitments of India on Trade in Goods

Central bank data is taken from IMF-IFS: IFS up until February and weekly statistics from the RBI for March. March’s purchases are as of the week ending 1 April 2022. Please refer to our latest central bank statistics: https://www.gold.org/goldhub/data/monthly-central-bank-statistics.