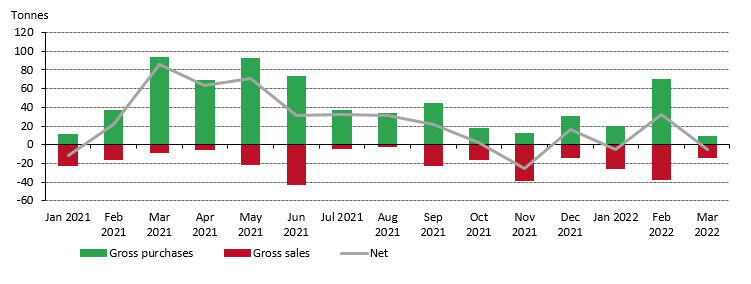

Global central bank gold reserves fell by 4t in March (based on latest available data), flipping back to net sales following healthy net purchases of 32.3t in February (Chart 1). 1, 2

Global central banks flipped back to net sales in March

26 April, 2022

*Data to 26 April 2022. Note: Japan’s reported 81t increase in its gold reserves in March 2021 has been excluded as this was the culmination of an off-market transaction between two different divisions within the Ministry of Finance.

Source: IMF IFS, Respective Central Banks, World Gold Council

Activity in March was confined to a small number of banks, dominated by significant changes at just one or two. Kazakhstan was the largest seller in the month, decreasing its gold reserves by a further 12t, following 5t sale in February. Gold reserves now total 368t (69% of total reserves). Kazakhstan has traditionally bought from domestic sources and it is not uncommon for gold producing nations to swing between buying and selling. Uzbekistan sold a modest 1t in the month, taking its gold reserves to 338t – the lowest level of gold holdings since December 2020. As we have noted previously, this is not the first significant transaction by Uzbekistan in recent years: active management of its gold reserves means changes are common. Even after the sale in March, gold reserves still account for 60% of total reserves.

Net purchases were dominated by Turkey, which added 5t to its gold reserves in March. This takes y-t-d buying to 37t and pushes total gold reserves to 431t (28% of total reserves). India bought 2t in March, taking its total gold holdings to 760t. Ireland added another 0.8t in March- seventh consecutive monthly purchases since September 2021, taking its total gold reserves to 12t (6% of total reserves).

We will have a full review of central bank gold activity in Q1 2022 in our upcoming Gold Demand Trends report which will be published at the end of April.

Footnotes

1 Our data set is based on IMF data but is supplemented with data from respective central banks where it is available and not reported through the IMF at the time of publication. This data may be revised in our next monthly update should more data become available.

2 All figures are net except where otherwise indicated.