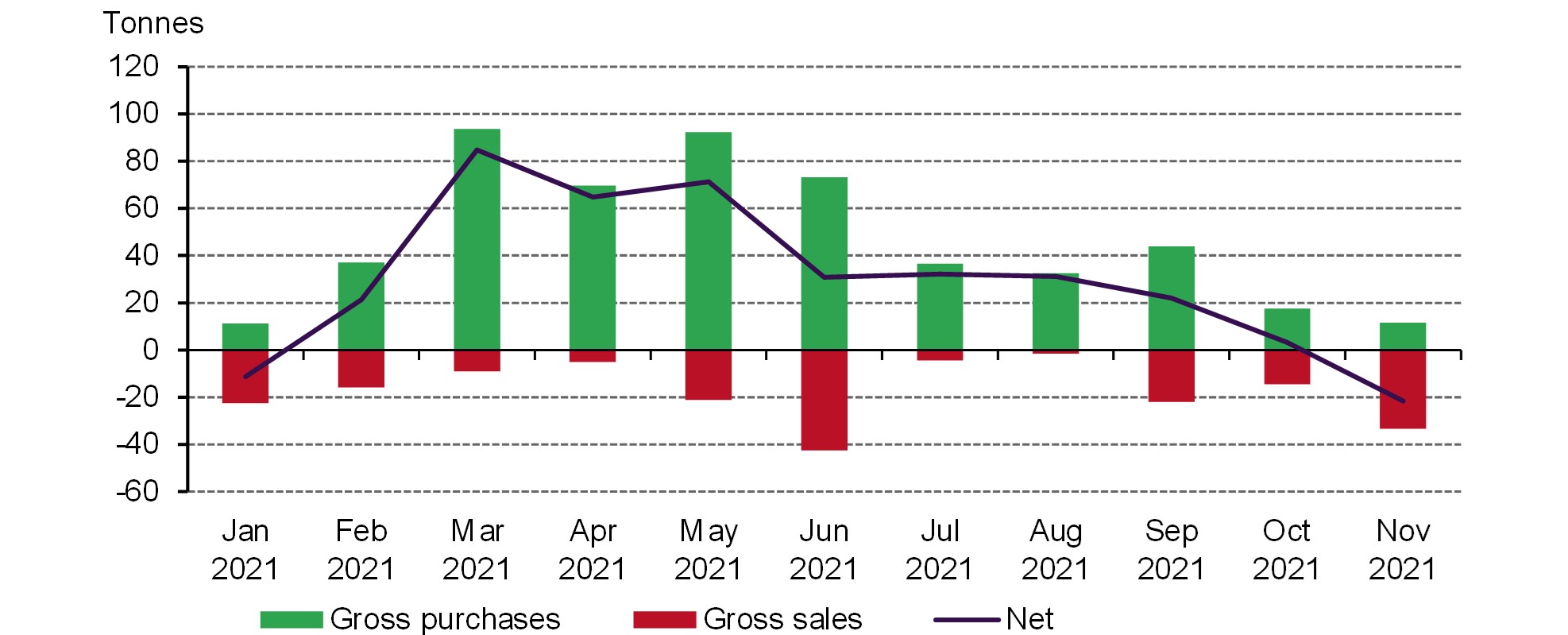

Global official gold reserves fell by 21.5t in November according to data released by the IMF.1 A sizable sale from Uzbekistan tipped the balance in what would have otherwise been a flat month. This marks the first monthly decline since January 2021, when central banks collectively sold a net 11.2t.

Central banks slide into net sales in November

6 January, 2022

Selling activity in November was dominated by four central banks. Uzbekistan registered the largest decline; its gold reserves fell by 21.5t to 353.6t. This is not the first significant sale, or purchase, we have seen from Uzbekistan over recent years: the active management of its gold reserves means changes are common, and something which Bobir Abubakinov, Deputy Governor of the Central Bank of Uzbekistan discussed in a recent blog. Despite this sizeable move, gold reserves still account for nearly 60% of total reserves, and have increased by 21.2t so far in 2021.2 Turkey (-7t), Russia (-3.1t), and the Kyrgyz Republic (-1.4t) were the other notable sellers during November.

Net purchases during the month were concentrated amongst a small group of regular buyers: Kazakhstan (4.3t), Poland (3.4t), India (2.8t), and Ireland (0.7t). Ireland’s addition was the third consecutive month of purchases, taking year-to-date buying to just under 3t.

Despite the swing into net sales in November, central banks remain on course to be healthy net purchasers for 2021. We will be assessing the full year performance in our upcoming Gold Demand Trends report which will be published at the end of January.