Key highlights:

-

In March the Shanghai Gold Price Benchmark PM (SHAUPM) in RMB and the LBMA Gold Price AM in USD climbed by 1.5% and 1.1% respectively, ending Q1 with the strongest quarterly performances since Q2 20201

-

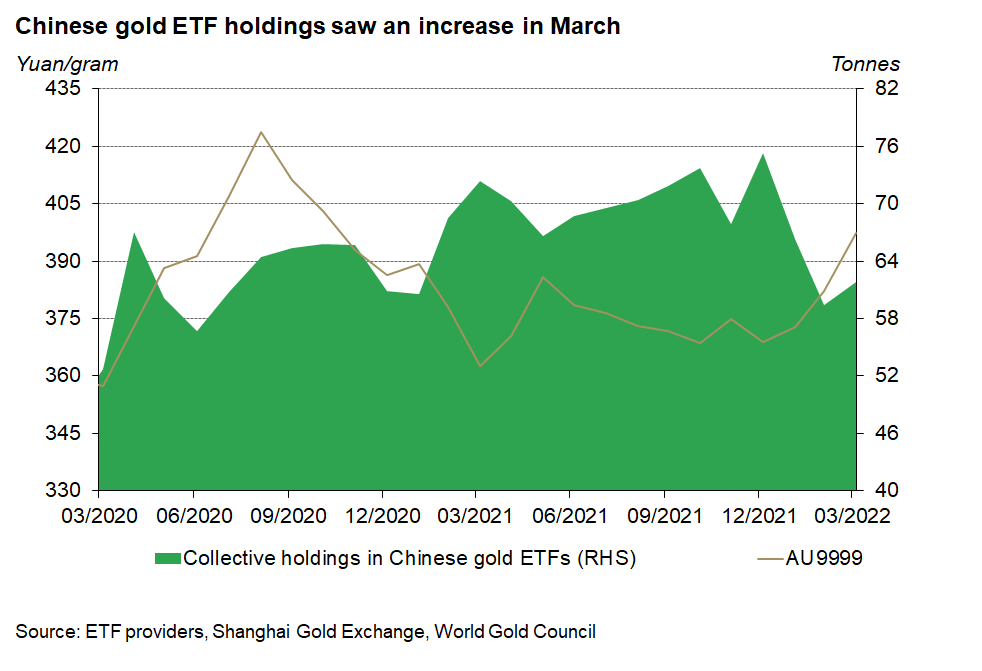

Chinese gold ETF holdings grew by 2.4t (US$150mn, RMB953mn) during the month, reaching 61.8t (US$3.9bn, RMB24.5bn). But the March inflows were unable to prevent a net Q1 outflow of 13.3t (US$0.8bn, RMB5.4bn)2

-

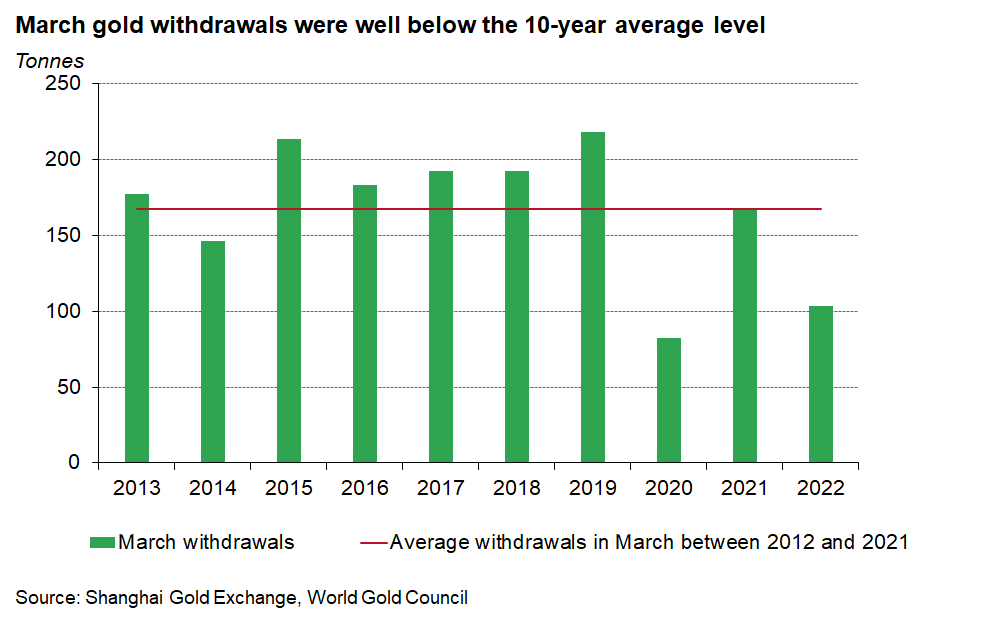

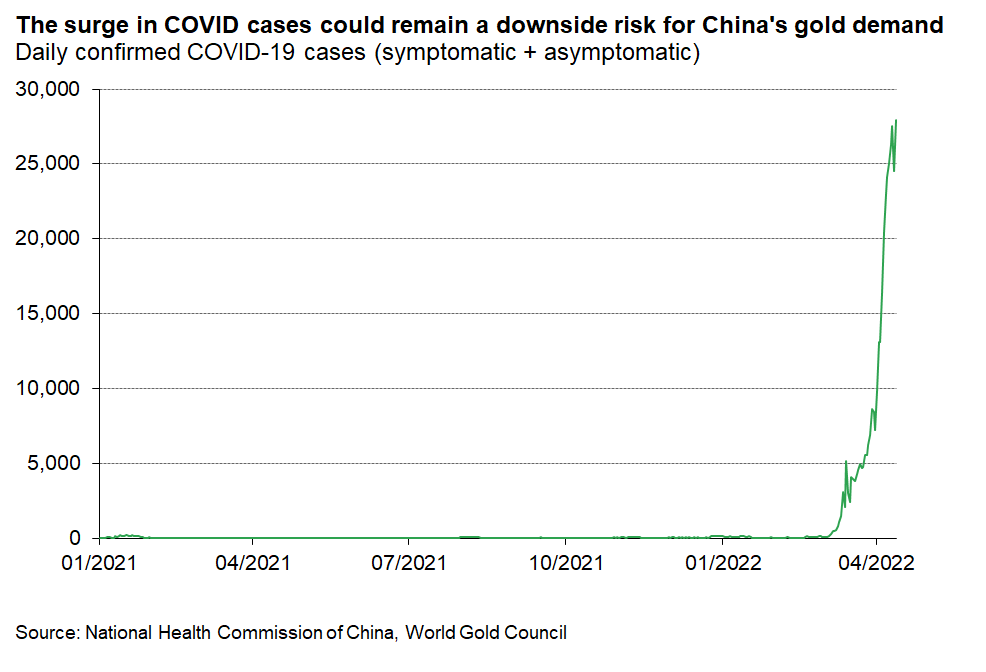

Gold withdrawals from the Shanghai Gold Exchange (SGE) saw a sizable y-o-y fall in March amid lockdown measures in major cities to contain the COVID-19 resurgence, leading to the second weakest Q1 for wholesale gold demand in the past decade

-

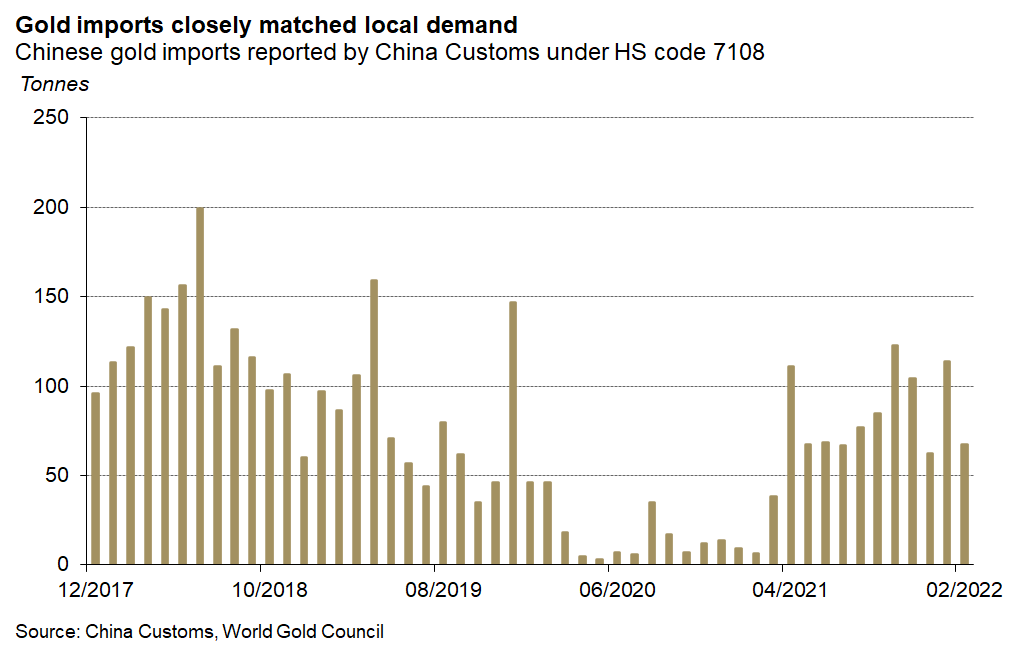

Gold imports in February were lower m-o-m amid seasonally weaker wholesale gold demand in China and a relatively lower Shanghai-London gold price spread.3

Looking ahead:

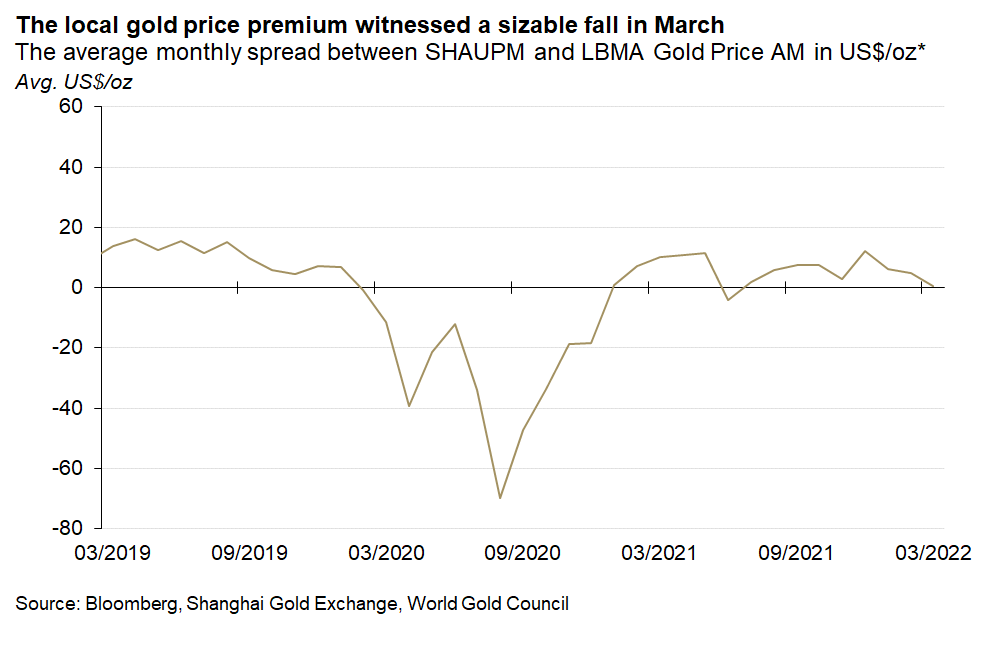

Gold prices rose further, local gold price premium plummeted

Gold prices extended their strength last month. The SHAUPM in RMB and the LBMA Gold Price AM in USD rose further in March, ending Q1 with a 5.2% and 5.7% gain respectively, the largest since Q2 2020. Despite higher interest rates acting as a headwind for gold, factors including geopolitical risks and higher inflationary pressure have been supportive throughout the quarter. For more detailed analysis, please see Gold Market Commentary.

But the Shanghai-London spread plunged. The US$0.4/oz March average represents a US$4.4/oz decline m-o-m, the lowest since June 2020. This was a reflection of significantly weakened local gold demand amid the resurgence of the pandemic and subsequent lockdowns in major cities.

Chinese gold ETF holdings increased in March

Collective holdings in Chinese gold ETFs rose to 61.8t (US$3.9bn, RMB24.5bn) in March, 2.4t (US$150mn, RMB953mn) higher than at the end of February. The 8% fall in the CSI300 stock index increased gold’s allure as local investors sought safe-haven assets. In addition, three new Shanghai Gold ETFs were listed at the Shenzhen Stock Exchange, expanding local investors’ choice to 15 gold ETFs.

Wholesale physical gold demand in March suffered from the COVID resurgence

Gold withdrawals from the SGE totalled 104t in March, 12% higher m-o-m and 38% lower y-o-y. The m-o-m rise was primarily due to the low base in February, which was a seasonally weak month for wholesale physical gold demand. The sizable y-o-y fall, on the other hand, reflected COVID-related lockdowns in cities such as Shenzhen - China’s gold manufacturing hub – and Shanghai.4

Gold imports in February were lower m-o-m

According to China Custom’s latest data publication, China imported 67t gold in February, a 41% fall m-o-m amid seasonally weaker wholesale demand. A relatively lower Shanghai-London gold price spread could have also contributed to the decline in February as it may have reduced the incentive for importers.

And even though the monthly import total remains below its pre-pandemic level due to fewer international flights and tighter border controls, it represents a 61t rise compared to February 2021 when restrictions were much stricter.

Q1 review and a peek at Q2

In the first quarter Chinese manufacturers withdrew 382t of gold, 9% lower y-o-y and 30% down from Q1 2019. While withdrawals in the first two months (+10% y-o-y) showed promising signs of a recovery to pre-pandemic levels, the resurgence of the virus and lockdowns in various cities disrupted the momentum. Meanwhile, Chinese gold ETFs experienced a 13.3t (US$0.8bn, RMB5.4bn) outflow in the first quarter.

Our previous blog identified the COVID-19 resurgence as a potential headwind for China’s gold demand in the short run. And mobility restrictions in key regions, along with their negative impact on consumers’ discretionary budgets, are likely to dampen local gold consumption in Q2 – already a traditional offseason for China’s gold demand.

For a more detailed analysis and outlook, please stay tuned for our Gold Demand Trends Q1 2022, which will be published later this month.

Footnotes

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange.

Please note that the inflow/outflow value term calculation is based on the difference between end-of-period assets under management, which is based on the end-of-period Au9999 prices in RMB and the USD/CNY rate.

There is a one-month lag in China Custom’s gold import and export data publication schedule.

For more information, please visit: The Shenzhen lockdown will affect everything from cars to iPhones: ‘It’s going to be really bad’, Fortune; Shanghai is on lockdown under China's 'zero COVID' policy, NPR.