Key highlights:

- Safe-haven demand pushed gold prices higher; both the Shanghai Gold Benchmark Price PM (SHAUPM) and LBMA Gold Price AM rebounded sharply in the month1

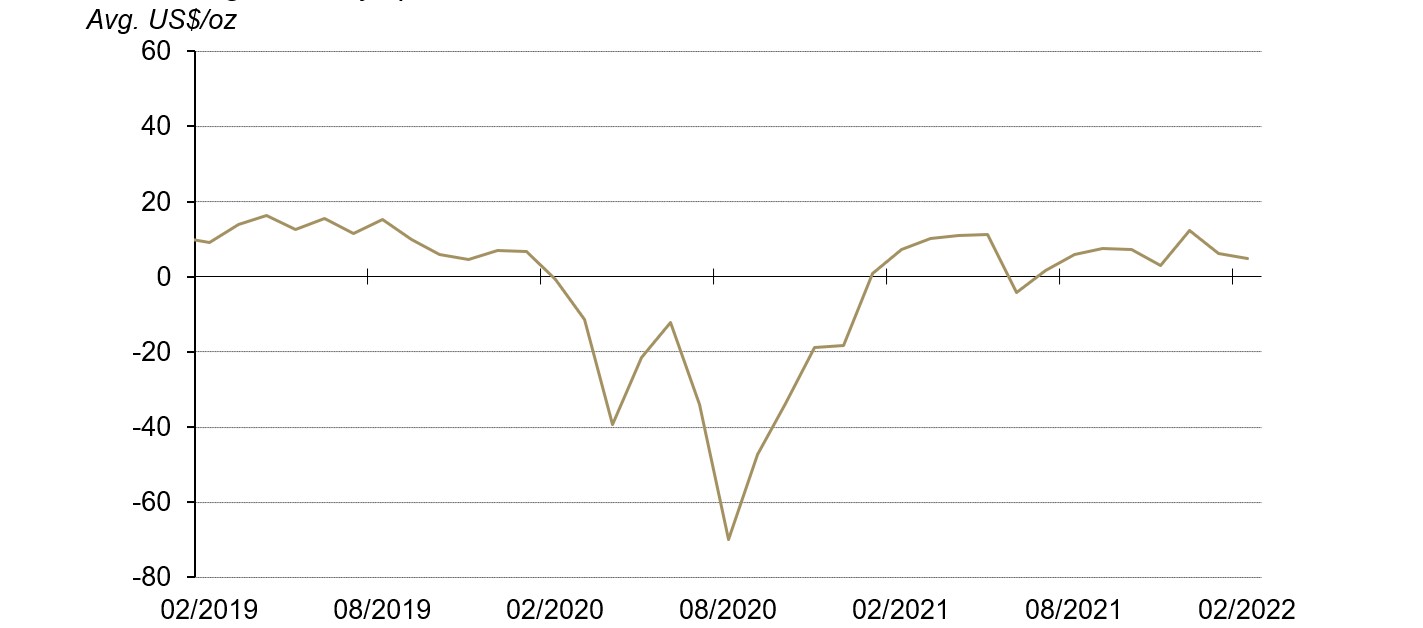

- The average local gold price premium trended lower in February – weakened wholesale physical gold demand in the month might be a key driver2

- Holdings in Chinese gold ETFs totalled 59.4t (US$3.6bn, RMB22.7bn) as of February, 6.9t (US$288mn, RMB2bn) lower m-o-m3

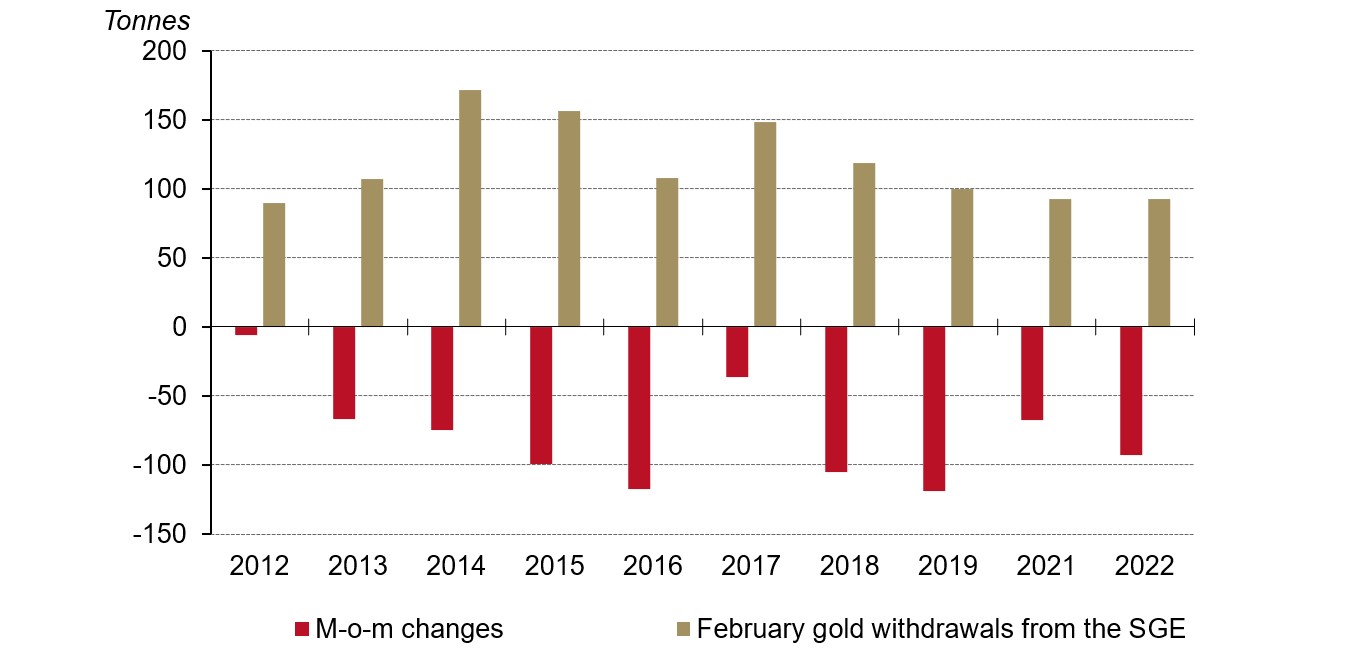

- Due to fewer working days in the month and manufacturers’ active replenishing ahead of the Chinese New Year (CNY) holiday, gold withdrawals from the Shanghai Gold Exchange (SGE) in February fell m-o-m.4

Looking ahead:

- The prioritisation of economic growth in 2022 and related supportive policies highlighted in the recent 2022 Government Work Report could bode well for China’s gold consumption this year

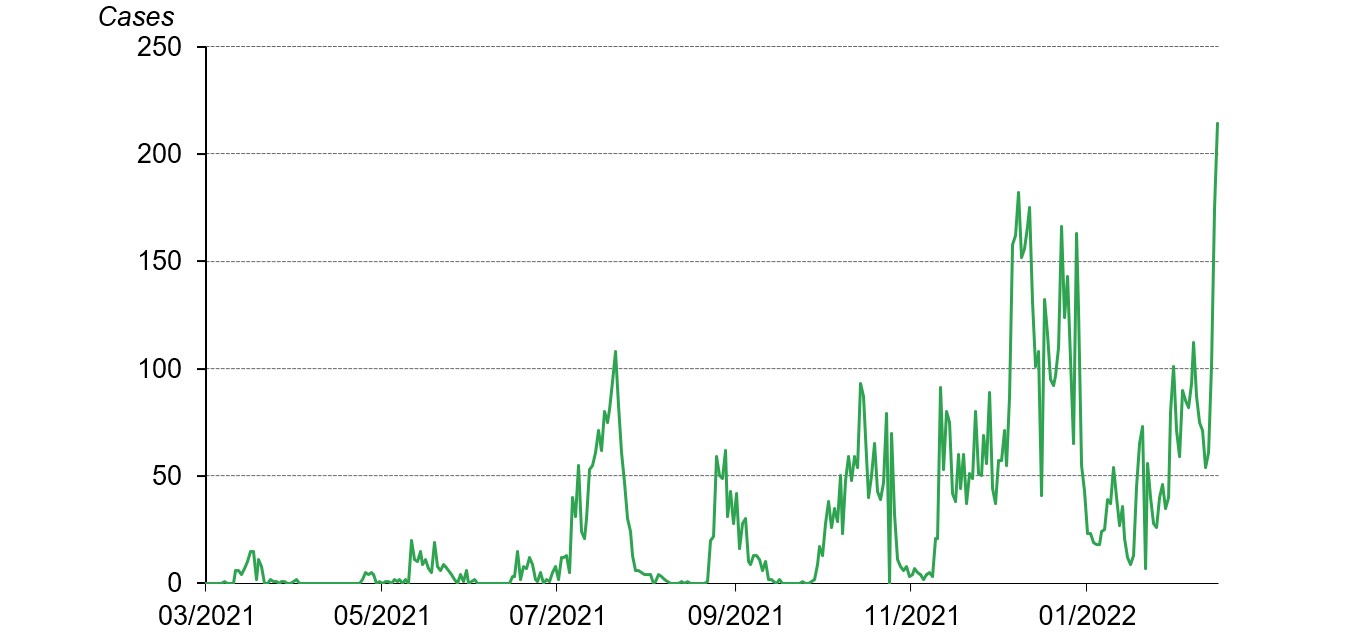

- In the short run, physical gold demand might be challenged by surging confirmed COVID-19 cases in various regions and a rocketing local gold price which is usually negative correlated with gold jewellery demand during the same period

- If the geopolitical uncertainties remain, retail physical gold investment might extend its current strength.

Gold prices rose, Shanghai-London spread fell

Gold prices rallied amid heightened geopolitical risks in February. The SHAUPM in RMB and the LBMA Gold Price AM in USD jumped 5.2% and 6.3% respectively in the month. The relative underperformance in the RMB gold price was likely due to the near 1% appreciation in the local currency against the dollar last month. In February, the Shanghai-London spread averaged US$4.8/oz, a US$1.5/oz decline m-o-m. This could be a reflection of the relative weaker performance in the local gold price and the seasonally lower wholesale physical gold demand this month compared to January. More detailed analysis can be found below.

The local gold price premium lowered marginally in February

The average monthly spread between SHAUPM and LBMA Gold Price AM in US$/oz*

Chinese gold ETF holdings declined further in February

Chinese gold ETFs continued to see outflows last month. Collective holdings stood at 59.4t (US$3.6bn, RMB22.7bn) at the end of February, 6.9t (US$288mn, RMB2bn) lower than the end-January level. Local investors taking advantage of the rising gold price to capitalise gains might be a key driver of the outflow.

Chinese gold manufacturers withdrew 92t gold in February, virtually unchanged y-o-y but representing a sizable decline m-o-m. Examining past data we found that February’s gold withdrawals from the SGE tend to be lower than the previous month mainly due to:

- fewer working days in the month which is compounded by the seven-day CNY holiday, e.g. the 2022 CNY holiday lasted from 31 January 2022 to 6 February 2022

- manufacturers’ relatively ample inventory as they often actively re-stock prior to the CNY holiday.

Looking ahead

In China’s gold market outlook 2022, we analysed China’s gold consumption across various hypothetical scenarios. Results of these assumed scenarios are encouraging, implying stronger gold demand in 2022 than in 2021. And the recent Chinese Government Work Report, which prioritises a 5.5% y-o-y GDP increase (higher than some of our scenario assumptions) as well as supportive fiscal and monetary policies, boosts our confidence in a positive picture for 2022’s Chinese gold demand.

In the short run, however, wholesale physical gold demand might encounter some headwinds. First, recent spikes of COVID-19 cases in various regions including Shenzhen – the gold product manufacturing centre – have led to strict regional controls and partial lockdowns.5 Not only could this hinder local retail gold consumption, but gold supply chain logistics and showroom businesses in Shenzhen may also be impacted. Second, our model shows that a higher gold price is likely to hurt gold jewellery consumption. With the gold price performing strongly, retail gold jewellery sales may stall.

On the other hand, reports suggest that retail physical gold bar and coin demand has been strong, amid current gold price momentum and geopolitical uncertainties.6 If these uncertainties continue, such demand could remain strong.

1We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange.

For more information about premium calculation, please visit our local gold price premium/discount page.

Please note that the inflow/outflow value term calculation is based on the difference between end-of-period assets under management which is based on the end-of-period Au9999 prices in RMB and the USD/CNY rate.

The 2022 CNY holiday lasted from 31 January 2022 to 6 February 2022.

For more information, please visit: Confirmed cases across China exceed 100, strict dynamic zero-COVID approach 'still necessary' - Global Times.

For more information, please visit: 黄金又火了!有门店销量大增!银行人员:金条库存都要卖完了…|金条|黄金|银行_新浪新闻 (sina.com.cn).