Key highlights

- Gold prices fell marginally in January: the Shanghai Gold Benchmark Price PM (SHAUPM) and LBMA Gold Price AM dropped by 1.4% and 0.8% respectively1

- The local gold price premium remained above its 2021 annual average ahead of the Chinese New Year (CNY) holiday despite local gold price weakness2

- Following a 7t increase in December 2021, holdings in Chinese gold ETFs decreased by 9t (US$0.5bn, RMB3bn) in January 2022,3 bringing collective holdings down to 66t (US$4bn, RMB25bn )

- Gold withdrawals from the Shanghai Gold Exchange (SGE) in January totalled 186t, 16% higher y-o-y and well above the 2021 average

- China’s gold imports totalled 818t in 2021, a significant y-o-y increase on the back of a strong recovery in local gold consumption.

- China’s gold consumption boomed during the CNY holiday. A lower local gold price and freed-up travel budgets – due to COVID outbreaks in different regions – might have spurred consumer interest in gold products, especially Heritage gold jewellery and tiger-themed items

Looking ahead

- We remain relatively positive on the 2022 outlook for gold demand in China, despite the possibility of a slowdown in the country’s economic growth. For more details please look out for our 2022 Chinese Gold Market Outlook, due for release later in February.

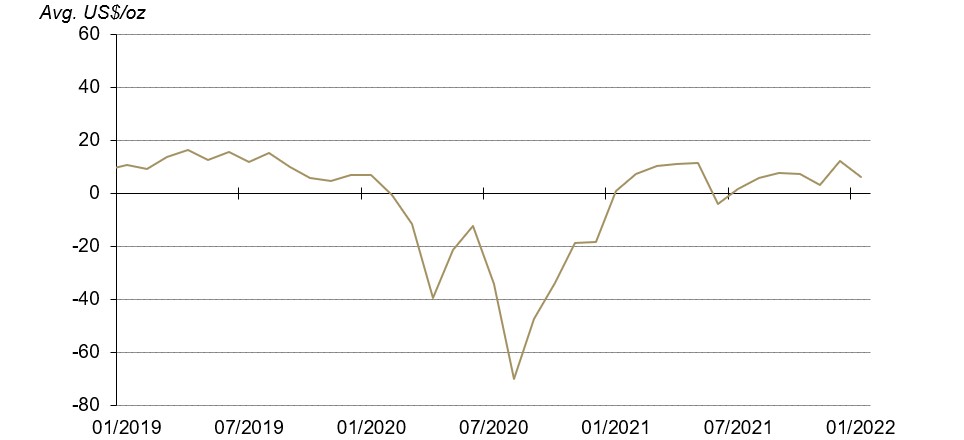

The Shanghai-London gold price spread stayed elevated

Gold prices ended January with mild losses. A hawkish US Federal Reserve weighed on international gold prices that had climbed steadily amid equity market turbulence and geopolitical tensions earlier in the month. And the local Chinese gold price was weaker than its USD peer primarily due to a stronger RMB.

Despite the local gold price weakness, the Shanghai-London spread remained above its 2021 average amid strong wholesale gold demand – albeit marginally lower m-o-m – ahead of the Chinese New Year holiday, averaging US$6.3/oz in January. It is also worth noting that December’s average spread surged to US$12.2/oz – US$9/oz higher m-o-m – as local retailers were actively replenishing for the holiday season.

The local gold price premium remained elevated ahead of the CNY holiday

The average monthly spread between SHAUPM and LBMA Gold Price AM in US$/oz*

Source: Bloomberg, Shanghai Gold Exchange, World Gold Council

*Before April 2014 the spread calculation was based on Au9999 and LBMA Gold Price AM; click here for more.

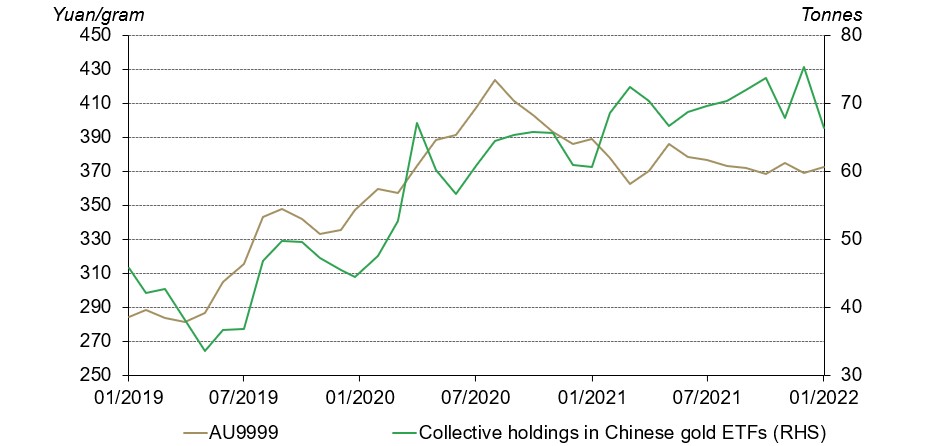

Chinese gold ETFs saw outflows in January after reaching a record high in December

After reaching an all-time high in December as investors took advantage of the lower gold price,4 collective holdings in Chinese gold ETFs fell 9t to 66t (US$4bn, RMB25bn) at the end of January 2022.

Drivers of the January outflow are, in our view, two-fold. First, investors tend to cash their investments before the CNY to avoid uncertainties in the global gold market during the Chinese holiday week. Second, weakness in the gold price and a hawkish US Fed might have persuaded investors to reduce their ETF holdings in anticipation of a bearish gold price performance in the short run.

Chinese gold ETFs saw outflows in January

Source: ETF providers, Shanghai Gold Exchange, World Gold Council

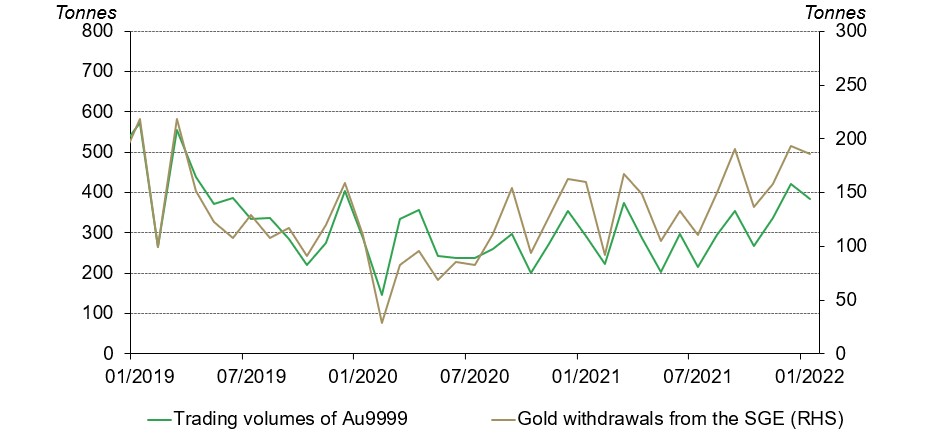

China’s wholesale physical gold demand was strong ahead of the holiday period

With local manufacturers and retailers restocking ahead of the CNY holiday, China’s wholesale gold demand was strong during December 2021 and January 2022. Local manufacturers withdrew 186t of gold from the SGE in January – a small 4% m-o-m decline but a substantial increase y-o-y – was well above the 2021 monthly average of 146t. The 4% decline was likely due to some manufacturers replenishing early and some starting the CNY holiday early.

January's wholesale gold demand stayed strong

Source: Shanghai Gold Exchange, World Gold Council

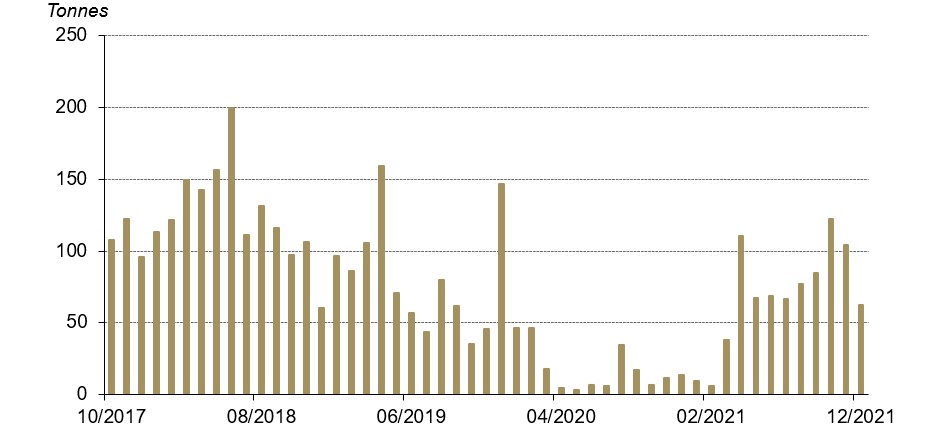

According to the latest data release by China Customs, China imported 818t of gold in 2021, 36% higher than 2020 and close to the 2019 level. The country’s border controls have been relatively relaxed in the face of low COVID cases but the key driver for the growth in imports might have been the strong recovery in 2021’s gold consumption and the local gold price spread turning into premium from discount in 2020.

Gold imports rebounded strongly in 2021

Chinese gold imports reported by China Customs under HS code 7108

Source: China Customs, World Gold Council

Strong gold demand during the Chinese New Year holiday

The expected CNY holiday gold consumption did not disappoint. Promotions from retailers and a relatively low gold price enhanced the allure of gold for many. According to the Shanghai Gold Jewellery Association, gold jewellery consumption in Shanghai reached RMB1.1bn during the CNY holiday, 12% higher y-o-y.5 Tiger-themed gold products – 2022 is the year of the tiger in China – and Heritage gold jewellery were popular, according to the Association.

Due to sporadic outbreaks of COVID variants in different regions, many chose to cancel their travel plans and stay put. Their freed-up travelling budgets may have been a further boost to gold jewellery buying during this period.

Looking ahead

Chinese gold demand is likely to remain positive in 2022

On the one hand, slowing economic growth and the downward trend in marriage registrations are likely to limit the sector’s growth as they are key demand drivers. But on the other hand, should the gold price fall in 2022, Chinese gold jewellery demand could benefit – our analysis shows that when the gold price declines gold jewellery demand rises during the same period.

We believe the following factors are likely to bode well for China’s bar and coin investment:

- rising inflationary pressure

- lowering local bond yields

- a weaker RMB.

There are also other dynamics that could impact gold demand in China this year:

- Greater pricing transparency in China’s gold jewellery market

- Shifting tastes and mindset of the young towards gold jewellery as an investment as well as a consumer good

- A greater push from commercial banks in bar and coin sales as their other retail gold business remain restricted.

For more details please look out for our China Gold Market Outlook 2022, which will be released later this month.

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange.

For more information about premium calculation, please visit our local gold price premium/discount page. The 2022 CNY Holiday lasted from 31 January 2021 to 6 February 2022.

Please note that the inflow/outflow value term calculation is based on the end-of-period Au9999 prices in RMB and the USD/CNY rate.

Holdings in Chinese gold ETFs reached 75t at the end of December, the highest ever in both tonnage and value terms.

For more information, please visit: https://mp.weixin.qq.com/s/VJZPRm_hK-dIV1pL42HxJg