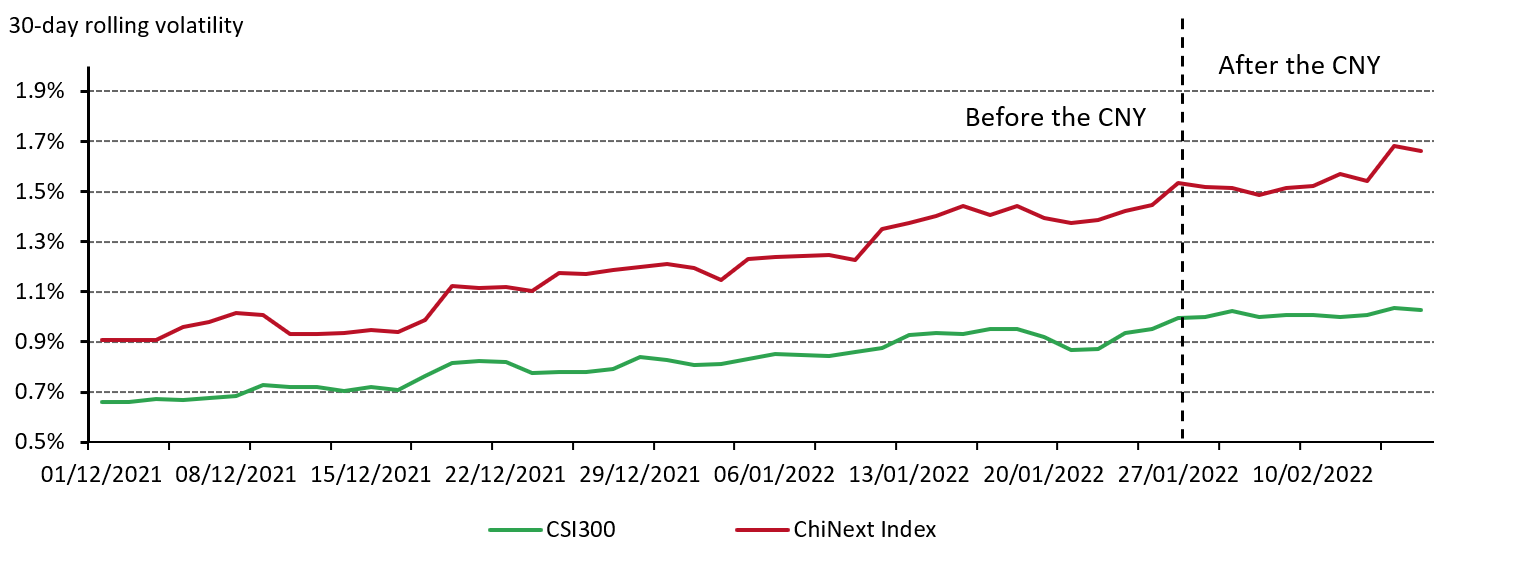

The local stock market remained volatile after the Chinese New Year (CNY) holiday (Chart 1). External uncertainties such as global equity market volatility amid central banks’ tightening expectations in main regions and adjustment in key sectors, among other factors, might be main contributors. Looking ahead, weaknesses in local economic growth and stagflation-like pressure could keep Chinese stock market volatility elevated throughout the year. And as we will show below, gold, a non-RMB asset, could play a strategic role in Chinese investors’ portfolios.

Gold: a vital asset to Chinese investors in 2022

18 February, 2022

Stagflation-like pressure may intensify in 2022

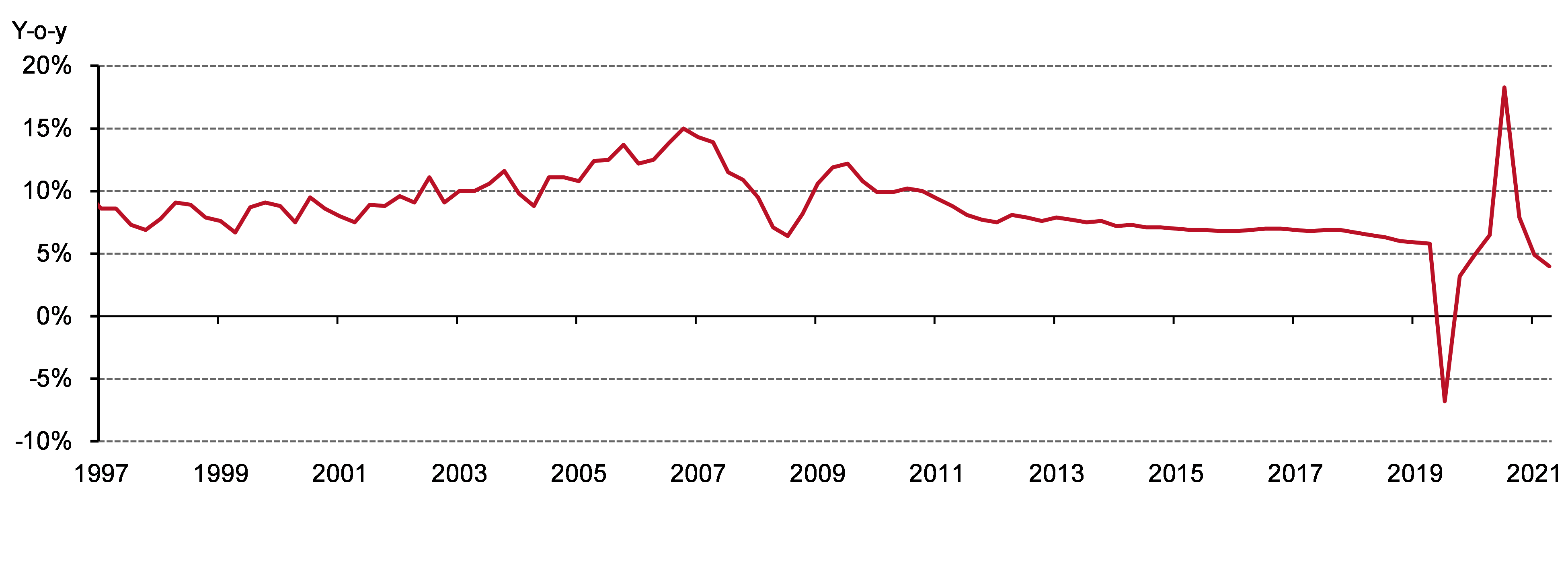

Driven by the low base of 2020, China’s GDP growth surged in the first half of 2021. However, sporadic COVID-19 outbreaks, surging costs for many industries amid supply-side shocks, the hampered real estate sector, and complicated external conditions led to a slowdown in the second half. Y-o-y growth in Chinese GDP amounted to 4.9% in Q3 and 4% in Q4, the lowest quarters in decades (Chart 1).

China’s economic growth slowed in H2 2021 and this could continue into 2022:

- GDP growth is likely to decelerate further in 2022 primarily driven by the country’s long-term economic growth path transition, continued stress in the real estate sector, threats of further pandemic-related lockdowns and geopolitical tensions.

- Inflationary pressure in China might rise. With downstream sectors’ margins being squeezed amid surging costs as the Producers’ Price Index rocketed last year, more and more consumer goods companies have begun to announce price rises.1 And if the pork cycle initiates, pork prices could rise in 2022 contributing further to higher inflationary pressure.2

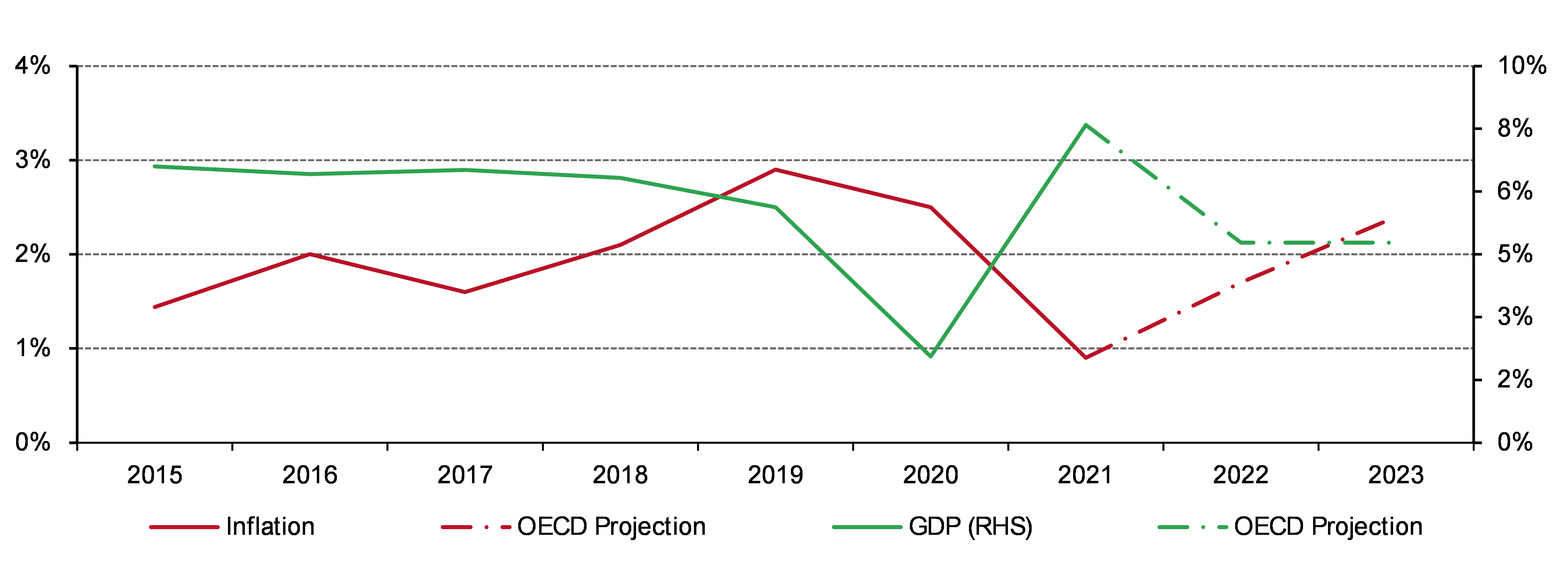

This echoes the OCED’s most recent outlook (Chart 3).

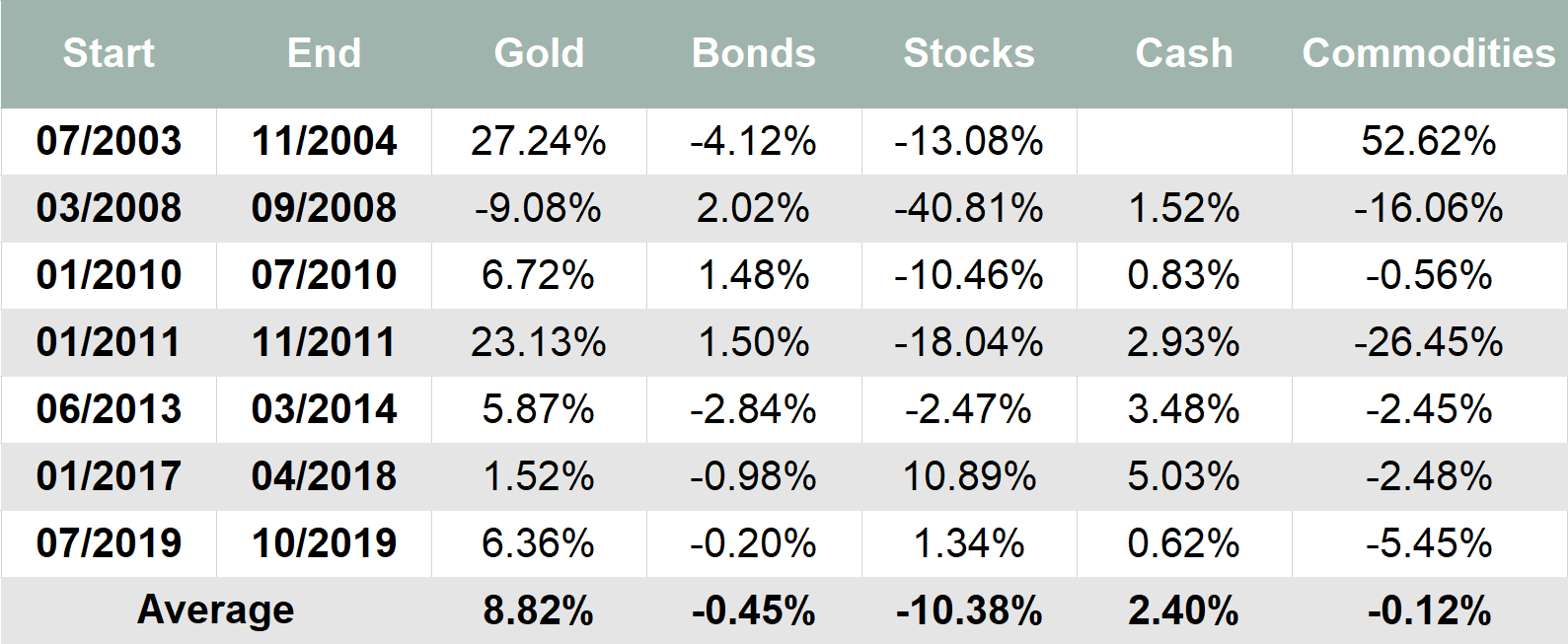

An economic slowdown and rising inflation are the two key ingredients for a stagflationary environment, or stagflation-like pressure. This could have serious implications for Chinese investors. Table 1 shows our analysis of performance of the main RMB asset classes during historical stagflation-like periods in China between 2004 and 2019. We found that:

- Risk assets experience higher volatility

During the seven stagflation-like periods we studied, stocks and commodities exhibited heightened volatilities and losses

- Bonds yield negative returns

On average, the ChinaBond New Composite Index yielded a -0.5% average return during the periods under analysis

- RMB gold outperforms other major asset classes

Gold, however, averaged a 9% return during China’s stagflation-like periods.

Table 1: Chinese investors tend to be risk-off during stagflation-like periods

Major RMB asset performance during stagflation-like periods in China*

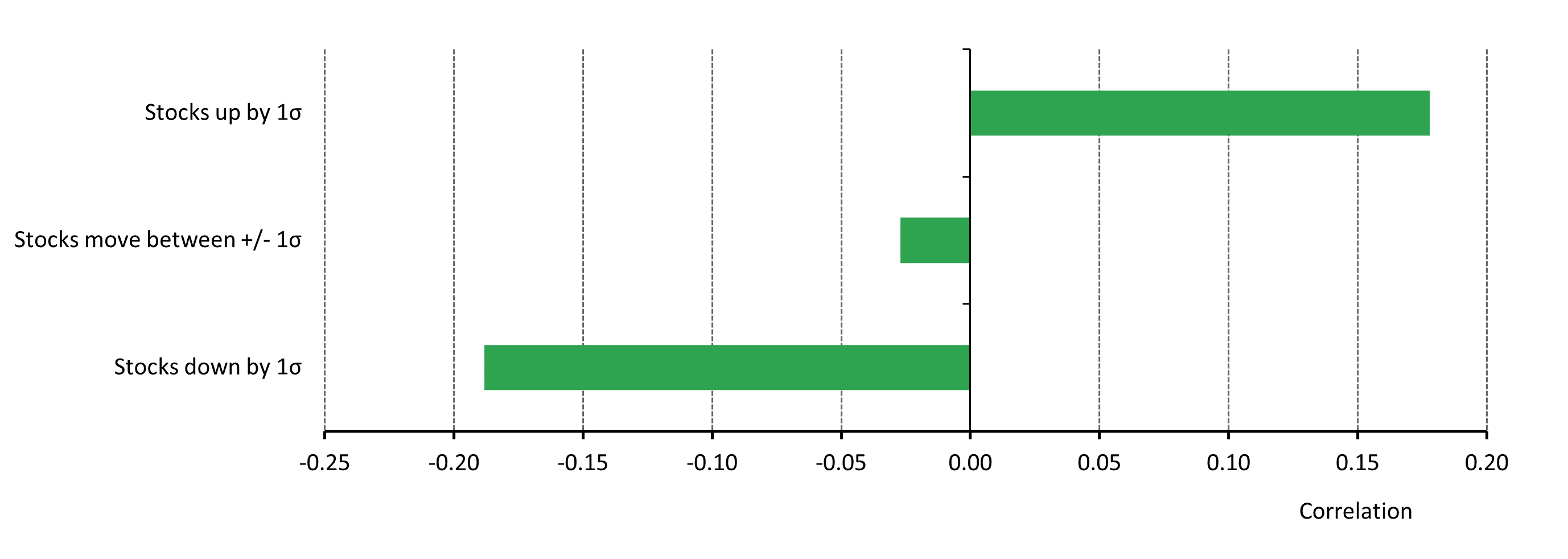

As a non-RMB based asset with a global market, gold can help Chinese investors navigate local equity market turbulence. Our analysis shows that when Chinese equities plunge, RMB gold exhibits a negative relationship with the local stock market. And this correlation turns positive when Chinese stocks rally. This is the diversifier every investor desires: protection during bad times and prosperity in good times.

But a question we frequently get asked is:

Can gold still function as a strategic part of my portfolio when the US enters a tightening cycle that could weigh on gold’s performance?

To answer this question, we examined RMB gold and Chinese equities between December 2008 and December 2018 – a time when the US Federal Reserve was hiking rates. And RMB gold maintained its effectiveness as a Chinese equity market risk diversifier.

In fact, in our 2022 Gold Outlook we mention that while rate hikes are likely approaching, real rates might remain low and lead to lower-than-expected gold price performance headwinds. Lingering inflationary concerns in many key markets could continue to be a key driver of gold. And with the possibility of tail events rising, global financial market volatility could increase, highlighting gold’s strategic role as an effective hedge against stock market turbulence.

Summary

In the Year of the Tiger China’s economy could face threats, such as a slowdown in growth and higher inflation. And to help cushion these shocks the PBoC has stepped up its efforts to ensure ample liquidity in the economy by cutting policy rates.3 China’s monetary policy stance in 2022 should remain supportive, potentially further reducing the opportunity cost of holding gold for local investors.

Going forward, RMB gold could be a valuable addition to Chinese investors’ portfolios if stagflationary pressure in China intensifies. And should the CNY weaken due to a mismatch between monetary policy in China and key Western markets, we believe that gold, a non-RMB asset, will be especially relevant for Chinese investors who wish to protect their wealth and purchasing power.

Footnotes

1For more information, please visit: 【深度】消费品上市公司涨价潮涌!这一次涨价逻辑有何不同?影响多大?_价格 (sohu.com)

2Please visit: 新一轮猪周期有望在今年第二季度开启?猪肉板块新年以来逆市上涨4.58%,这些潜力品种获北向资金加仓!-证券日报网 (zqrb.cn) and Pork prices in China are about to rise again, the risk of exploding consumer inflation - Tridge for more information

3For more information, please visit: Three takeaways from China's key conference for 2022 economic plan - CGTN and China’s cut of interest rates to spur economic growth - Global Times.